3 days of unclosed gaps in the ES

Does anybody know if the ES has seen 3 days of unclosed gaps in the past like we saw on Wednesday, Thursday, Friday last week?

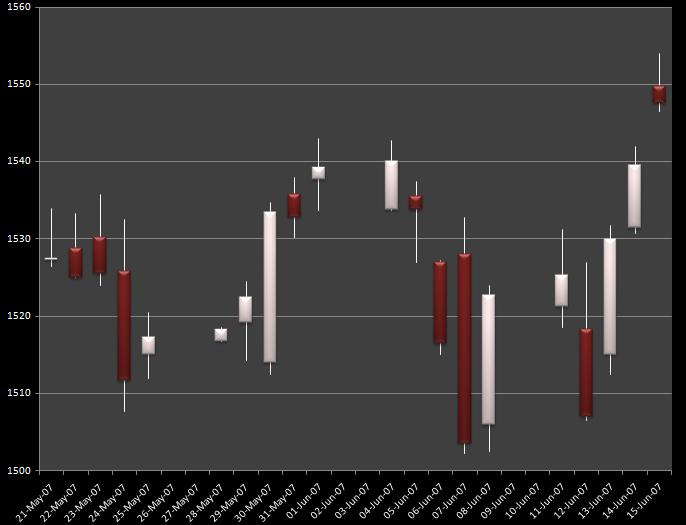

13, 14, and 15 June 2007 all had unclosed gaps.

13, 14, and 15 June 2007 all had unclosed gaps.

In order to come up with a sensible answer to this question I went off and did some research which included some programming to extract the relevant data and some analysis to select the appropriate days. You can read the article here: 3 Days of Unfilled Gaps in the ES

Interesting situation...looking at these charts, though -- in daily candle form -- it struck me that there are gaps, and then there are GAPS.

We have "gaps" when the when the day's range never revisits the previous day's close.

We have "GAPS" when the day's range never INTERSECTS the previous day's range.

So we have two gaps followed by one GAP.

Is this relevant???

We have "gaps" when the when the day's range never revisits the previous day's close.

We have "GAPS" when the day's range never INTERSECTS the previous day's range.

So we have two gaps followed by one GAP.

Is this relevant???

Also, one other thing...

I don't have my charts before me at the moment, so I don't have the relevent date.

But, on the ES, Friday's gap-up created a double-gap, I believe with a gap down at more-or-less than same level two or three weeks ago.

Again, I wish I had my charts here so I could bring a bit more specificity to this post, but a cursory glance will show what I'm talking about. How rare is that???

I've looked at this from a slightly different angle in the past when I discussed Extreme Gaps in a Gap Fade Study that I did. I defined an "extreme gap" as one opening outside of the previous day's range and a gap as an opening at least 1 tick from the previous close. However, I have never study what happens after there was no intersection between 2 days.

Blast...this is what I was afraid of...I need to get to my charts. I'll repost in an hour or so....thanks...

Ok, there it is...between the close of 6/05 and the open of 6/06...

And now I see the problem. I'm looking at TradeStation's continuous contract, which shows a close at 1549.75 followed by an open at 1543, which appears to fit rather perfectly with the overnight gap-up between this past Thursday and Friday....except, I suspect, I'm looking at an amalgam of the June and September contract.

Thing is, when I look at the M07, then U07, neither show a gap on this date. Woah, what the heck?

Clearly, I have some investigating to do...sorry for the confusion

And now I see the problem. I'm looking at TradeStation's continuous contract, which shows a close at 1549.75 followed by an open at 1543, which appears to fit rather perfectly with the overnight gap-up between this past Thursday and Friday....except, I suspect, I'm looking at an amalgam of the June and September contract.

Thing is, when I look at the M07, then U07, neither show a gap on this date. Woah, what the heck?

Clearly, I have some investigating to do...sorry for the confusion

That last chart I posted shows the continuous contract. Rollover was on 7 June I believe.

I can't figure out what the deal is for the life of me. What do you have for the close on 6/04 and the open on 6/05?

6/4 close (settlement) is 1540.25 and 6/5 open is 1536.00. I'm using the last traded price on 6/4 which I have as 1540.00.

BruceM, could you elaborate a bit on how you used the cash market with Monday morning's trade? Thnx...

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.