Feedback on Kane Trading products

I noticed on another forum that someone had asked if anyone had any feedback on Kane Trading products. One of my students posted an honest reply, and even though the thread was 'dormant' for about three months since the original request for feedback, it came alive, and people came out of the woodwork, saying things like 'go away spammer', Fibonacci is worthless, etc., etc. I checked back shortly after that and the moderator deleted the entire thread.

I won't go into my detailed thoughts here on the state of most forums, other than to mention some obvious conclusions I've drawn about them after this experience:

1. If you have a positive view on anything, don't post it, because you must be a spammer. No chance whatsoever you legitimately find the material useful.

2. If you hate the material, post away, essentially no limits. Don't worry about libel or slander, the sky's the limit. Blast away. It makes good copy.

3. If it can't be verified 100%, and hence easily coded, don't bother to say anything good, because it can't be substantiated, and is hence useless. Obviously, then, there is no merit or value in anything discretionary.

4. There is no place on any forum for anything that is ever sold, only free material. If it is ever sold, any mention is spam and you are part of the conspiracy. Besides, no one who is any kind of a good trader would ever sell anything, they would give it away, so it's an automatic 'open season' sign if anything positive is posted for anything that is sold, and that behavior is encouraged.

Now, the purpose of this thread is to have an area were those who have direct experience with Kane Trading products i.e. full book set buyers and mentor students, can post comments they feel may help others make informed decisions about the products, and whether the products may be of use to them in the development of their own 'Trading Plan'. Everyone should understand that people will be posting their opinion, and it is a forum for Kane Trading, so take it all with a grain of salt.

Please don't make a post here if you don't have direct experience with the methodology. If you've read a few free commentary on the website and have some inborn hatred of Fibonacci, or median lines, or any technique, don't post and say Fibonacci is useless, or whatever. This thread is for those that want feedback from people who have direct experience, not people who have preconceived notions and no direct experience with this specific methodology. Let's try to make this a useful resource, one of many a person should use, to attempt to make an informed decision. Thanks.

I won't go into my detailed thoughts here on the state of most forums, other than to mention some obvious conclusions I've drawn about them after this experience:

1. If you have a positive view on anything, don't post it, because you must be a spammer. No chance whatsoever you legitimately find the material useful.

2. If you hate the material, post away, essentially no limits. Don't worry about libel or slander, the sky's the limit. Blast away. It makes good copy.

3. If it can't be verified 100%, and hence easily coded, don't bother to say anything good, because it can't be substantiated, and is hence useless. Obviously, then, there is no merit or value in anything discretionary.

4. There is no place on any forum for anything that is ever sold, only free material. If it is ever sold, any mention is spam and you are part of the conspiracy. Besides, no one who is any kind of a good trader would ever sell anything, they would give it away, so it's an automatic 'open season' sign if anything positive is posted for anything that is sold, and that behavior is encouraged.

Now, the purpose of this thread is to have an area were those who have direct experience with Kane Trading products i.e. full book set buyers and mentor students, can post comments they feel may help others make informed decisions about the products, and whether the products may be of use to them in the development of their own 'Trading Plan'. Everyone should understand that people will be posting their opinion, and it is a forum for Kane Trading, so take it all with a grain of salt.

Please don't make a post here if you don't have direct experience with the methodology. If you've read a few free commentary on the website and have some inborn hatred of Fibonacci, or median lines, or any technique, don't post and say Fibonacci is useless, or whatever. This thread is for those that want feedback from people who have direct experience, not people who have preconceived notions and no direct experience with this specific methodology. Let's try to make this a useful resource, one of many a person should use, to attempt to make an informed decision. Thanks.

in the end,i do not matter. i will say it again; the .886 and 1.128 are the most powerful fib and their special characteristics were made clear to me in jim kane's work.members of jim's crew know that there are weeks on end that every trade i take is based on those numbers.all traders would benefit from an awareness of their presence.

Hello Jim,

Well put Jim Kane....sorry If I digressed. Will look at your info you posted and as always fee free to post more.

Roofer tks for the post and seems you know exactly what you doing.

We, especially I could use your enlightment from Trading-roofer.

So keep posting and maybe I missed it but where are your free posts located..on another free trading forum??

Tks.

Well put Jim Kane....sorry If I digressed. Will look at your info you posted and as always fee free to post more.

Roofer tks for the post and seems you know exactly what you doing.

We, especially I could use your enlightment from Trading-roofer.

So keep posting and maybe I missed it but where are your free posts located..on another free trading forum??

Tks.

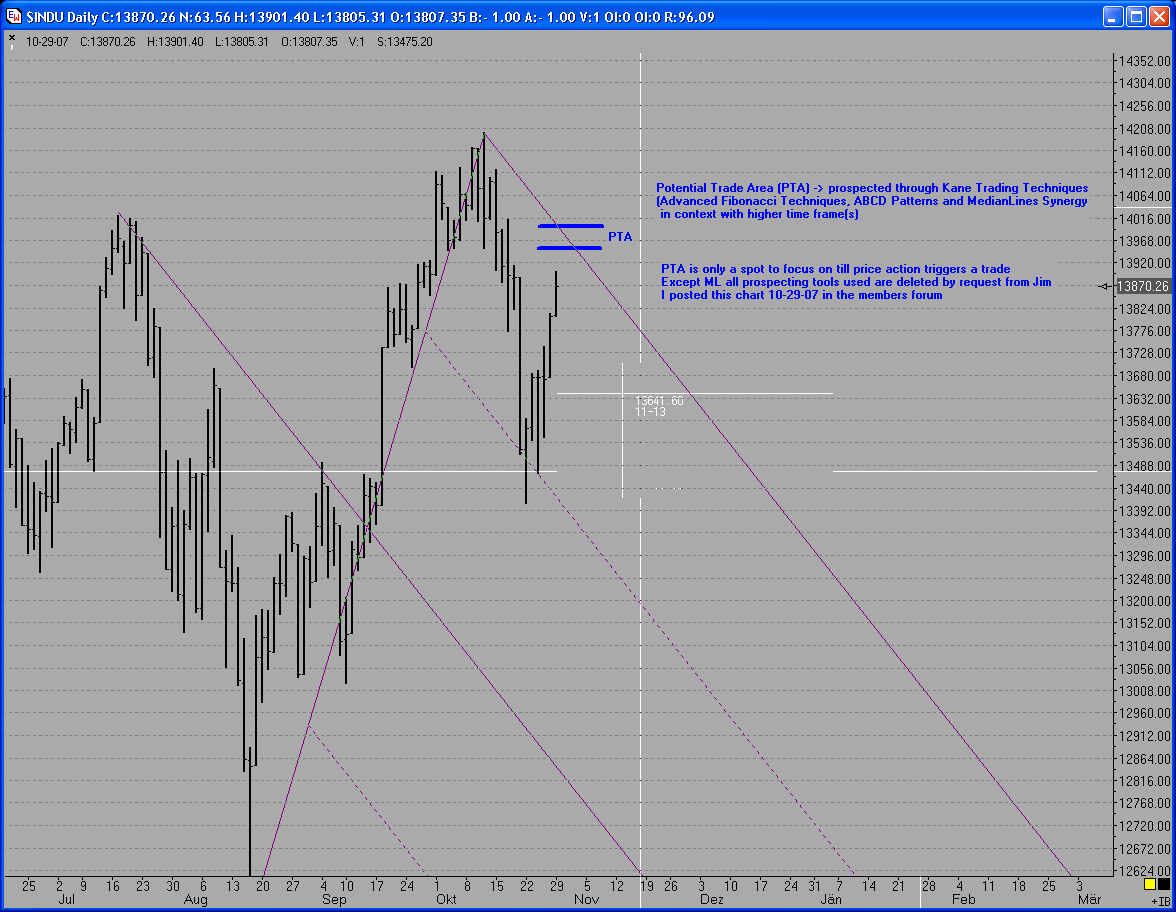

I asked the members of the private area to post two charts in here that had been posted in there well before today's sell off. I originally asked that someone post them, because they showed areas I was interested in watching, and it was going to make for some good potential educational discussion, regardless of what happened there. The charts that get posted here will only have one basic set on them. In the overall, this would be only the tiniest fraction of the methodology, in fact one of the least used concepts for sets that I myself use. My charts have a lot more on them, as one can see at my website, and even there, those, generally, are just frameworks of my actual 'working charts'. Nonetheless, I suggested these sets and charts because of how I was looking at the overall market layout and such, and saw some significance there.

Although the private area is strictly for education, the point of the methodology is to create areas of interest before price gets there, or it would not be of much use. Hence, many people practice the methodology and post charts there and ask for feedback. I do not want this thread to get off topic, and asking for these charts to be posted is going in the wrong direction, but to address the point pips2007 made, and finish that off, I wanted to show these and then back on topic we go.

Although the private area is strictly for education, the point of the methodology is to create areas of interest before price gets there, or it would not be of much use. Hence, many people practice the methodology and post charts there and ask for feedback. I do not want this thread to get off topic, and asking for these charts to be posted is going in the wrong direction, but to address the point pips2007 made, and finish that off, I wanted to show these and then back on topic we go.

As requested from Jim, I post 2 charts from the members forum ($SPX and $INDU) und 2 follow up charts.

Hawk

Hawk

I'm not sure if this is the correct place for this comment but could you guys post the current

PTA ( potential trade area ) for the S&P? I'm not doubting you post them somewhere on the Kane site but it

would be cool to see a few PTA's ahead of time posted here.I'm not looking to give you guys grief or anything

just want to see them in action. The problem I have had with Fibs and median lines in the past is that it seemed too subjective.

I'm curious if your course work has removed that problem and all members focus on the same areas and drawing techniques.

Thanks

Bruce

PTA ( potential trade area ) for the S&P? I'm not doubting you post them somewhere on the Kane site but it

would be cool to see a few PTA's ahead of time posted here.I'm not looking to give you guys grief or anything

just want to see them in action. The problem I have had with Fibs and median lines in the past is that it seemed too subjective.

I'm curious if your course work has removed that problem and all members focus on the same areas and drawing techniques.

Thanks

Bruce

Bruce,

It's a good question, but if it were to be addressed in the public KT forum, I'd rather someone start a new thread for it. This thread is so hard to keep on topic I feel like just deleting it. I shouldn't have asked for charts to be posted to address a point that didn't belong in this thread to start, but I thought I could wrap that up and get back on topic. This topic just gets so many people going, and on the attack, that it isn't even really worthwhile, it seems. I only decided to do it at all because someone from this forum asked over at another forum for feedback on my products, and in three months no one answered. I think it is important for people to have information, so I started this thread.

I'll get off topic again, and mention a few things, but it seems like it is going to be hard to have a thread just for my students and readers to post. A lot of what I am going to say is contained in the free articles on my website, in greater detail. First off, I have a discretionary methodology. Some judgement is part of the process. I chose this approach for myself because I feel nothing works better than the human brain, and I think my brain is well-suited to mathematical thinking. When I developed the methodology for me, I had less than zero intention of publishing, or even telling, anyone anything about it. All my work is nothing more than the things I have discovered that I think are of use to me. Nothing was designed to fit anyone else, or how other people like to do things, like coding.

Next, even though it is discretionary it is very detailed and specific. Ultimately, though, I make all sorts of decisions at every step. The books are designed to give many choices for each stage, so readers can decide what, if any variation they may want to incorporate into their own 'Trading Plan'. Probably the least subjective, in my opinion, is the PTA. For example, I may show ten different entry trigger techniques in the one book. I have my favorite let's say three I like. Maybe someone else likes other ones, or even one they brought to the table themselves. And, as I mentioned in a previous post with the free article I cited, predicting is not part of trading. My PTA i.e. setup is perhaps 10%-20% of my entire 'Trading Plan'. I'll come back to this in a minute.

Another thing is that I think it is impossible, at current technology levels, to code this. Maybe some parts, but the overall methodology, no way, not even close. Although I can imagine something so complex that a human brain could do it but no computer, it's not like that. It's the decision making process, based on logic and experience, that no computer could duplicate. Hence, the discretionary part. My background is in math, physics, chemistry, and computers, with graduate work, and I'm a former math teacher. Yet nothing turns my stomach more than the thought of system trading. I want to think at every step. That's why I devised my methodology, for me, as I did.

Now, will everyone see the exact same PTA every time? No. But the core of the entire methodology is the ABCD pattern, or the slew of variations that I published. When I mentor I start everyone out with the basic ABCD, and that becomes the hub of the wheel to start the process, which I show step by step. The ABCD determines the area I am willing to look at, period, end of story. From there, as each new phase unfolds in the PTA workup, I am looking for supporting i.e. synergistic things to hit the same spot. If they don't, on to the next possible setup.

If they come together within a level of tolerance I find acceptable (based on experience, such as how tight the groupings are, how close the key lines hit, etc.), then I have a PTA. Now 10%-20% of the entire trading process is ready. For simple ABCD's I would be quite disappointed if any student didn't find the same spot, as the Fib calculations are clearly outlined, the numbers I use clearly outlined, and the lines I use, although sometimes there is more than one choice, are usually pretty obvious. The geometry points to the spot, and if everyone is applying the same tools to the same points, I'd hope the same area is highlighted, or the universe is not as I learned in my physics class.

At this point, though, as I explained in detail in the free article about predicting, what entry trigger an individual may use is up to them, so some may trigger and some may not. My read on the action is a big factor for me, since I now have approximately 27,000 'screen hours'. No way I am going to take all that experience reading price action and not use it. I feel I generally have a good 'read' of price action, so if things don't behave the way I expect, that will alter my course of action. I may pass on the trade, I may close the trade before a lot of time has passed, I may add more on, whatever. That's part of being a discretionary trader. My management, my 'context' filtering of potential trades, it's all discretionary, as are all parts of the methodology. But I have very specific technical guidelines I use.

Part of the point here, and perhaps what you are leaning towards, is to make the point that if everyone wouldn't find the same exact spot, and manage the same exact way, and wind up in the same exact spot, the methodology is worthless/useless. I agree it may not be for specific people, like those who want system trading methodologies, but I think discretionary trading, albeit with a clear, well-defined methodology, is very useful. I think of it like this. Would a team of doctors, say diagnosticians and/or surgeons, diagnose a patient in the exact same way, from start to finish, every time? No way. The process each did would vary a bit, based on their experience and such, but ultimately they should all reach the same end point. No two surgeons will perform the surgery exactly the same, every cut, every stitch, but that doesn't mean their techniques are useless.

I try to teach people how to create their own 'Trading Plan', to think on their own, and to find what works for them. I believe I have some very solid starting points for the various areas of the plan, and people can test and try them and see if they fit into their vision for their plan. I have many different ABCD variations to start the PTA hub with. Some like them all, like me, some like only a few. These two traders may then be looking at totally different areas on different issues as a result.

Finally, as far as posting charts in advance. Ah, I could do a thousand pages on this, and it gets to the core of the entire philosophy. What is the reason for wanting to see charts in advance? To have the validity of the methodology 'proved' before any money is spent on the books? What would 'prove' it? This will vary from person to person. For some, if 100% of a statistically valid number of chart setups 'worked' they still wouldn't think the methodology had validity. For others, it would be a different criteria. Read the free article on predicting. If only 2.5% (as I jokingly showed in the article) 'worked' but you made money, would that be good enough? People put way, way too much emphasis on the PTA and way, way too little on the rest of the 'Trading Plan'.

Next, unless one understands the concept of reading price action, of entry triggers, of 'context' filtering, of management, as designed to go along with these PTA's, they are pretty much useless. Again, I have to refer back to the article. If we all come up with the same PTA, and price just sails through it, that means nothing to me, on to the next PTA, to wait and see what price thinks of it. If someone posts 20 PTA's for you, and say several people all posted, and had the same areas, and only one reacted and took off like a rocket, and the other 19 price sailed through, what would that tell you? In the article, although exaggerated, you see it says nothing negative about the methodology, because watching for certain price reactions is an integral part of the methodology. Without that, there is no methodology. And without every aspect, there is no methodology, at least for me. Each piece of the puzzle is a necessary part.

When I ran the paid member service at my website, I posted in advance charts all the time. I didn't do this as 'picks', I did it so the members could watch as things unfolded, and see and study things as they happened, and then I'd discuss my thoughts on it all. I did this daily for a year, and it's now all part of the time stamped member archive. I have over 250 free commentary on my website, and I frequently posted in advance charts, as I have at the Median Line forum (now Market Geometry), and at other forums. I post my chart of the month at my site, and it was the chart of the week when the commentary was weekly, in advance. I usually went into detail on the next commentary on what happened, and that is all in the archive, for those that want to dig into that.

All in all this is a very comprehensive methodology that takes years of hard work to even begin to get competency with, and I am very clear about that. I make endless analogies about what it takes to become a professional trader, just like being a doctor, architect, commercial airline pilot, etc. To show a few charts to evaluate an entire comprehensive methodology to me is like evaluating a medical school by asking to see the stitches on a few patients a few doctors from there did after some surgeries. If I recall correctly roofer was trying to show some of this at a paid forum elsewhere where he had been a member and posted for years. All people wanted was setups, in advance. Nothing about what to do with them, nothing about how to form them, just post setups for us free, every day. I believe he posted a lot of setups in advance, only to finally get frustrated and stop because no one wanted to learn anything, they just wanted free setups in advance.

I have found that posting setups is a losing game. Those that read the over 250 free commentary and articles can make a reasonably informed decision if they like the style and if they want to study it more, and those that can't decide after all that work I've shown, well, I advise they find something else that speaks to them better. Again, back to the article. People want setups that 'work' like 80% of the time, without regard to price action, market and sector action at the time, and so on. That's why the 'guru's' use those numbers all the time. My PTA's are useless without entry triggers, price action, market and sector observations, and so on. To post them, without any of that understanding, and without the understanding that the 80% the guru's say is totally from fantasyland, would serve no useful purpose.

If people feel that without that they can't make a decision, or feel there isn't enough evidence of the usefulness of the methodology to them, even after reading the over 250 free commentary and the free articles, what I suggest is, be conservative and look elsewhere. Don't buy the books. Don't do it unless it speaks to you and what you have seen looks potentially useful to you. I've done what I can to present what my work is about, to help people make an informed decision. If that's not enough, I am not going to try to 'talk you into it', I'm going to do the opposite, and suggest it isn't calling out to you as a potentially good fit for you, and you should move on.

Ultimately, if you want to take no risk at all, then the reward you should expect is zero. Imagine a trading 'system' that 'works', you can 100% verify it before you do it, and it is free, since you aren't taking any risk to try it. Zero risk, guaranteed reward. That's what people want. If it was out there, I'd be trading it, I'll tell you that. At some point a decision has to be made to risk the cost of the books, based on perceived reward/risk, based on available information. If you don't like the reward/risk, do what we all do in trading: pass the trade. I can't do any more than I have to show the methodology than what is on the website. I thought this thread would be helpful, but at this point I think it is probably going to turn out to be a waste of time...

It's a good question, but if it were to be addressed in the public KT forum, I'd rather someone start a new thread for it. This thread is so hard to keep on topic I feel like just deleting it. I shouldn't have asked for charts to be posted to address a point that didn't belong in this thread to start, but I thought I could wrap that up and get back on topic. This topic just gets so many people going, and on the attack, that it isn't even really worthwhile, it seems. I only decided to do it at all because someone from this forum asked over at another forum for feedback on my products, and in three months no one answered. I think it is important for people to have information, so I started this thread.

I'll get off topic again, and mention a few things, but it seems like it is going to be hard to have a thread just for my students and readers to post. A lot of what I am going to say is contained in the free articles on my website, in greater detail. First off, I have a discretionary methodology. Some judgement is part of the process. I chose this approach for myself because I feel nothing works better than the human brain, and I think my brain is well-suited to mathematical thinking. When I developed the methodology for me, I had less than zero intention of publishing, or even telling, anyone anything about it. All my work is nothing more than the things I have discovered that I think are of use to me. Nothing was designed to fit anyone else, or how other people like to do things, like coding.

Next, even though it is discretionary it is very detailed and specific. Ultimately, though, I make all sorts of decisions at every step. The books are designed to give many choices for each stage, so readers can decide what, if any variation they may want to incorporate into their own 'Trading Plan'. Probably the least subjective, in my opinion, is the PTA. For example, I may show ten different entry trigger techniques in the one book. I have my favorite let's say three I like. Maybe someone else likes other ones, or even one they brought to the table themselves. And, as I mentioned in a previous post with the free article I cited, predicting is not part of trading. My PTA i.e. setup is perhaps 10%-20% of my entire 'Trading Plan'. I'll come back to this in a minute.

Another thing is that I think it is impossible, at current technology levels, to code this. Maybe some parts, but the overall methodology, no way, not even close. Although I can imagine something so complex that a human brain could do it but no computer, it's not like that. It's the decision making process, based on logic and experience, that no computer could duplicate. Hence, the discretionary part. My background is in math, physics, chemistry, and computers, with graduate work, and I'm a former math teacher. Yet nothing turns my stomach more than the thought of system trading. I want to think at every step. That's why I devised my methodology, for me, as I did.

Now, will everyone see the exact same PTA every time? No. But the core of the entire methodology is the ABCD pattern, or the slew of variations that I published. When I mentor I start everyone out with the basic ABCD, and that becomes the hub of the wheel to start the process, which I show step by step. The ABCD determines the area I am willing to look at, period, end of story. From there, as each new phase unfolds in the PTA workup, I am looking for supporting i.e. synergistic things to hit the same spot. If they don't, on to the next possible setup.

If they come together within a level of tolerance I find acceptable (based on experience, such as how tight the groupings are, how close the key lines hit, etc.), then I have a PTA. Now 10%-20% of the entire trading process is ready. For simple ABCD's I would be quite disappointed if any student didn't find the same spot, as the Fib calculations are clearly outlined, the numbers I use clearly outlined, and the lines I use, although sometimes there is more than one choice, are usually pretty obvious. The geometry points to the spot, and if everyone is applying the same tools to the same points, I'd hope the same area is highlighted, or the universe is not as I learned in my physics class.

At this point, though, as I explained in detail in the free article about predicting, what entry trigger an individual may use is up to them, so some may trigger and some may not. My read on the action is a big factor for me, since I now have approximately 27,000 'screen hours'. No way I am going to take all that experience reading price action and not use it. I feel I generally have a good 'read' of price action, so if things don't behave the way I expect, that will alter my course of action. I may pass on the trade, I may close the trade before a lot of time has passed, I may add more on, whatever. That's part of being a discretionary trader. My management, my 'context' filtering of potential trades, it's all discretionary, as are all parts of the methodology. But I have very specific technical guidelines I use.

Part of the point here, and perhaps what you are leaning towards, is to make the point that if everyone wouldn't find the same exact spot, and manage the same exact way, and wind up in the same exact spot, the methodology is worthless/useless. I agree it may not be for specific people, like those who want system trading methodologies, but I think discretionary trading, albeit with a clear, well-defined methodology, is very useful. I think of it like this. Would a team of doctors, say diagnosticians and/or surgeons, diagnose a patient in the exact same way, from start to finish, every time? No way. The process each did would vary a bit, based on their experience and such, but ultimately they should all reach the same end point. No two surgeons will perform the surgery exactly the same, every cut, every stitch, but that doesn't mean their techniques are useless.

I try to teach people how to create their own 'Trading Plan', to think on their own, and to find what works for them. I believe I have some very solid starting points for the various areas of the plan, and people can test and try them and see if they fit into their vision for their plan. I have many different ABCD variations to start the PTA hub with. Some like them all, like me, some like only a few. These two traders may then be looking at totally different areas on different issues as a result.

Finally, as far as posting charts in advance. Ah, I could do a thousand pages on this, and it gets to the core of the entire philosophy. What is the reason for wanting to see charts in advance? To have the validity of the methodology 'proved' before any money is spent on the books? What would 'prove' it? This will vary from person to person. For some, if 100% of a statistically valid number of chart setups 'worked' they still wouldn't think the methodology had validity. For others, it would be a different criteria. Read the free article on predicting. If only 2.5% (as I jokingly showed in the article) 'worked' but you made money, would that be good enough? People put way, way too much emphasis on the PTA and way, way too little on the rest of the 'Trading Plan'.

Next, unless one understands the concept of reading price action, of entry triggers, of 'context' filtering, of management, as designed to go along with these PTA's, they are pretty much useless. Again, I have to refer back to the article. If we all come up with the same PTA, and price just sails through it, that means nothing to me, on to the next PTA, to wait and see what price thinks of it. If someone posts 20 PTA's for you, and say several people all posted, and had the same areas, and only one reacted and took off like a rocket, and the other 19 price sailed through, what would that tell you? In the article, although exaggerated, you see it says nothing negative about the methodology, because watching for certain price reactions is an integral part of the methodology. Without that, there is no methodology. And without every aspect, there is no methodology, at least for me. Each piece of the puzzle is a necessary part.

When I ran the paid member service at my website, I posted in advance charts all the time. I didn't do this as 'picks', I did it so the members could watch as things unfolded, and see and study things as they happened, and then I'd discuss my thoughts on it all. I did this daily for a year, and it's now all part of the time stamped member archive. I have over 250 free commentary on my website, and I frequently posted in advance charts, as I have at the Median Line forum (now Market Geometry), and at other forums. I post my chart of the month at my site, and it was the chart of the week when the commentary was weekly, in advance. I usually went into detail on the next commentary on what happened, and that is all in the archive, for those that want to dig into that.

All in all this is a very comprehensive methodology that takes years of hard work to even begin to get competency with, and I am very clear about that. I make endless analogies about what it takes to become a professional trader, just like being a doctor, architect, commercial airline pilot, etc. To show a few charts to evaluate an entire comprehensive methodology to me is like evaluating a medical school by asking to see the stitches on a few patients a few doctors from there did after some surgeries. If I recall correctly roofer was trying to show some of this at a paid forum elsewhere where he had been a member and posted for years. All people wanted was setups, in advance. Nothing about what to do with them, nothing about how to form them, just post setups for us free, every day. I believe he posted a lot of setups in advance, only to finally get frustrated and stop because no one wanted to learn anything, they just wanted free setups in advance.

I have found that posting setups is a losing game. Those that read the over 250 free commentary and articles can make a reasonably informed decision if they like the style and if they want to study it more, and those that can't decide after all that work I've shown, well, I advise they find something else that speaks to them better. Again, back to the article. People want setups that 'work' like 80% of the time, without regard to price action, market and sector action at the time, and so on. That's why the 'guru's' use those numbers all the time. My PTA's are useless without entry triggers, price action, market and sector observations, and so on. To post them, without any of that understanding, and without the understanding that the 80% the guru's say is totally from fantasyland, would serve no useful purpose.

If people feel that without that they can't make a decision, or feel there isn't enough evidence of the usefulness of the methodology to them, even after reading the over 250 free commentary and the free articles, what I suggest is, be conservative and look elsewhere. Don't buy the books. Don't do it unless it speaks to you and what you have seen looks potentially useful to you. I've done what I can to present what my work is about, to help people make an informed decision. If that's not enough, I am not going to try to 'talk you into it', I'm going to do the opposite, and suggest it isn't calling out to you as a potentially good fit for you, and you should move on.

Ultimately, if you want to take no risk at all, then the reward you should expect is zero. Imagine a trading 'system' that 'works', you can 100% verify it before you do it, and it is free, since you aren't taking any risk to try it. Zero risk, guaranteed reward. That's what people want. If it was out there, I'd be trading it, I'll tell you that. At some point a decision has to be made to risk the cost of the books, based on perceived reward/risk, based on available information. If you don't like the reward/risk, do what we all do in trading: pass the trade. I can't do any more than I have to show the methodology than what is on the website. I thought this thread would be helpful, but at this point I think it is probably going to turn out to be a waste of time...

Thanks for the detailed response Jim. I merely wanted to see

some Pta's for the S&P only because that is what I trade and haven't had much luck with Fibs or medians lines. It seems like you have a very comprehensive training program and one would benefit from poking around your site to see if it is "right" for them.

I agree with your comments about entry setups. As one who does post setups I will freely admit that those are only a small piece of the trading puzzle and everyone will trade or manage positions differently ( the real key!!).

It's great to hear that you have removed most of the subjectivity to Fibs and median lines. That's a big step but not the whole package as you mentioned. I guess I just would have liked to see a few of your members post here in advance ( or somewhere for my market)just out of curiosity..probably nothing more....

Sorry this thread isn't turning out as you like. I'm sure it's not easy being an educator who sincerely believes in their course work. It only takes a few "bad" ones to make it harder on those who are legit.

Perhaps if you feel high motivated at some point in the future you could send me some S&P charts or post them here. I enjoy your writing and the content I have found time to read on your site.

Bruce

some Pta's for the S&P only because that is what I trade and haven't had much luck with Fibs or medians lines. It seems like you have a very comprehensive training program and one would benefit from poking around your site to see if it is "right" for them.

I agree with your comments about entry setups. As one who does post setups I will freely admit that those are only a small piece of the trading puzzle and everyone will trade or manage positions differently ( the real key!!).

It's great to hear that you have removed most of the subjectivity to Fibs and median lines. That's a big step but not the whole package as you mentioned. I guess I just would have liked to see a few of your members post here in advance ( or somewhere for my market)just out of curiosity..probably nothing more....

Sorry this thread isn't turning out as you like. I'm sure it's not easy being an educator who sincerely believes in their course work. It only takes a few "bad" ones to make it harder on those who are legit.

Perhaps if you feel high motivated at some point in the future you could send me some S&P charts or post them here. I enjoy your writing and the content I have found time to read on your site.

Bruce

for those who struggle with trading medianlines and thinking through their entries, there is a wonderful teaching post by tim morge at www.medianline.com

I have been reading the 'show me' posts with some smile on my face. Why? I was there about 4 months ago. I talked to one of Jim's mentoring students who was so gracious to spend his time and experiences with trading and Jim's work. After talking to him, and sitting on my hands a few days longer, I decided to purchase Kane's entire set of material. And as suggested by the above trader that I talked to, I also purchased the 4 hours of one on one with Jim.

I read the books..the basics several times, because I would have a better understanding of what Jim was trying to convey everytime I would reread the material. Then, when I felt I knew enough to be dangerous, I setup the time to start the 4 hours of personal Q&A's with Jim. Those 4 hours were the true turning point for me. I knew then, that I wanted to delve deeper into his methodolgy. Jim showed me some medium line work that made total sense. I had used them in the past, but not effectively. After his intro into the lines, I knew then that I could not and would not trade without the lines. The confluence of the lines and the fibs just stuck out like a sore thumb on the charts..here I am, now trade me with 'your' plan.

The subjectivity of the medium lines is maybe only 3% once you know what you are looking for and what you are trying to do with them.

I immediately chose to sign up for my first 10 hours of mentorship with Jim. We do this work from each others computer. No travel. He takes control of my computer to explain what he wants me to see and learn. Then, I will drive for a while. It's a back and forth course of instruction. I have completed 7 hours with him at this writing. After we finish the remaining 3, I will sign up for another 10 lot.

After a session with Jim, I go back and read the applicable material in his books. I see things that were 'never there' before. The light bulb gets brighter each week.

If your question now is, what can I do with what I have learned so far. Well, I could write a plan to trade today...no question about it. His entry(s) are better than mine, but work from the very same principal. I will not completely abandon my entries that I have used.

But rather, will compare mine to his at the time of pulling the trigger. My entry will fade his at times. That is part of the subjectivity and fun of trading. It's an art that one fine tunes his or hers entire lifetime of trading. From the traders I talk to, 95% of their fine tuning is management of the trades, not entries, not stops, not direction, etc.

Hope this helps with some of the questions one might have about studying with Jim Kane.

I read the books..the basics several times, because I would have a better understanding of what Jim was trying to convey everytime I would reread the material. Then, when I felt I knew enough to be dangerous, I setup the time to start the 4 hours of personal Q&A's with Jim. Those 4 hours were the true turning point for me. I knew then, that I wanted to delve deeper into his methodolgy. Jim showed me some medium line work that made total sense. I had used them in the past, but not effectively. After his intro into the lines, I knew then that I could not and would not trade without the lines. The confluence of the lines and the fibs just stuck out like a sore thumb on the charts..here I am, now trade me with 'your' plan.

The subjectivity of the medium lines is maybe only 3% once you know what you are looking for and what you are trying to do with them.

I immediately chose to sign up for my first 10 hours of mentorship with Jim. We do this work from each others computer. No travel. He takes control of my computer to explain what he wants me to see and learn. Then, I will drive for a while. It's a back and forth course of instruction. I have completed 7 hours with him at this writing. After we finish the remaining 3, I will sign up for another 10 lot.

After a session with Jim, I go back and read the applicable material in his books. I see things that were 'never there' before. The light bulb gets brighter each week.

If your question now is, what can I do with what I have learned so far. Well, I could write a plan to trade today...no question about it. His entry(s) are better than mine, but work from the very same principal. I will not completely abandon my entries that I have used.

But rather, will compare mine to his at the time of pulling the trigger. My entry will fade his at times. That is part of the subjectivity and fun of trading. It's an art that one fine tunes his or hers entire lifetime of trading. From the traders I talk to, 95% of their fine tuning is management of the trades, not entries, not stops, not direction, etc.

Hope this helps with some of the questions one might have about studying with Jim Kane.

I also want to add on that when you are a book set buyer you get free access to the member forum here which is stacked with incredible information. I've learned so much in that forum and it's really special to be able to communicate with other Kane Trading students and getting input from Jim and Roofer. What a bonus! Did I mention it was free?!

Hey, Bruce. I'm still around, I just haven't been posting in the public area much. I'll send you an e-mail with some details. I mostly post in my private area, where I'm posting many times on an average day. I'll use the same e-mail address I have for you. If that one isn't still good, let me know.

As for the above post, all I can say is that writing style is just how Nick writes, and I don't think he meant anything strange by it. I 'met' Nick a long time ago over in Scott Carney's Harmonic Trader chat room when he had that and I was active over there. He follows my work, too, and shows up from time to time, as his schedule allows. He sends me charts here and there, showing things he is looking at. I consider him fully 'legit'.

I may consider just deleting off this section, so no one will wonder anything about anything. I don't need any new 'business', and don't need to advertise looking for any. There is enough on my website for those that are interested to make a decision if they want to study my work. It's just something that 'runs in the background'. If someone finds the website by doing a targeted search (the only kind of buyer I'd want anyway), great. Otherwise, no problem, it's there waiting.

As I've said before, the mypivots audience are not the kind of traders who would be interested in my work anyway. I only have forums here because Guy offered them to me way back. And I only started this thread because someone over at Elite asked, legitimately, if anyone had any experience with my work, and I stumbled on that and it had gone unanswered. I asked a few of my students to make honest comments there. The firestorm that started within minutes was beyond comprehension. The entire thread was pulled shortly after that.

So, I figured if someone was doing a search for comments on my work, at least they could find this thread where I wouldn't allow that kind of shredding. Not because I have an interest in the postings, but because I would never allow that kind of behavior in any thread in a forum section I had. At least people can post their opinions as they see fit here. But, even that looks to perhaps be an issue. Like I said, I know what I have found, I know what I present in the books, I know what I show to one-on-one students, and I know I have presented more than enough for people to make a highly informed decision on all that. I don't need to do anything here to 'hawk for business'.

As for the above post, all I can say is that writing style is just how Nick writes, and I don't think he meant anything strange by it. I 'met' Nick a long time ago over in Scott Carney's Harmonic Trader chat room when he had that and I was active over there. He follows my work, too, and shows up from time to time, as his schedule allows. He sends me charts here and there, showing things he is looking at. I consider him fully 'legit'.

I may consider just deleting off this section, so no one will wonder anything about anything. I don't need any new 'business', and don't need to advertise looking for any. There is enough on my website for those that are interested to make a decision if they want to study my work. It's just something that 'runs in the background'. If someone finds the website by doing a targeted search (the only kind of buyer I'd want anyway), great. Otherwise, no problem, it's there waiting.

As I've said before, the mypivots audience are not the kind of traders who would be interested in my work anyway. I only have forums here because Guy offered them to me way back. And I only started this thread because someone over at Elite asked, legitimately, if anyone had any experience with my work, and I stumbled on that and it had gone unanswered. I asked a few of my students to make honest comments there. The firestorm that started within minutes was beyond comprehension. The entire thread was pulled shortly after that.

So, I figured if someone was doing a search for comments on my work, at least they could find this thread where I wouldn't allow that kind of shredding. Not because I have an interest in the postings, but because I would never allow that kind of behavior in any thread in a forum section I had. At least people can post their opinions as they see fit here. But, even that looks to perhaps be an issue. Like I said, I know what I have found, I know what I present in the books, I know what I show to one-on-one students, and I know I have presented more than enough for people to make a highly informed decision on all that. I don't need to do anything here to 'hawk for business'.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.