Expiry Fridays - Bullish or Bearish?

I wrote this Expiry Fridays article about weeks with Expiry Fridays which shows that if measured by the DJIA then those weeks are generally more bullish than your average week.

The average gain per week in the DJIA from 1986 to 2005 is 0.205% but if you only look at weeks with expiry Friday's then that gain is 0.326% and if you exclude weeks with expiry Fridays then the gain is 0.195%.

If you want a copy of the spreadsheet that I used for calculating this then just reply to this topic and I'll email it to you in a ZIP file. (You do NOT need to include your email address in the reply.)

The average gain per week in the DJIA from 1986 to 2005 is 0.205% but if you only look at weeks with expiry Friday's then that gain is 0.326% and if you exclude weeks with expiry Fridays then the gain is 0.195%.

If you want a copy of the spreadsheet that I used for calculating this then just reply to this topic and I'll email it to you in a ZIP file. (You do NOT need to include your email address in the reply.)

Story of Interest

http://biz.yahoo.com/tm/050616/12674.html

[edit]We have de-linked the yahoo article above because it has expired and is no longer available - Forum Admin[/edit]

TradingMarkets.com

Random Expiration Price Movement Is Daytrading Opportunity

Thursday June 16, 9:32 am ET

By Kevin Haggerty

The market action around a major option expiration like June usually means lots of random price movement which oftentimes is out of context of what you might expect. This makes the daytrader a pawn in the game, but still enables you to react and capitalize on any extended intraday price movement, just as you should have done yesterday. For example, the

http://biz.yahoo.com/tm/050616/12674.html

[edit]We have de-linked the yahoo article above because it has expired and is no longer available - Forum Admin[/edit]

TradingMarkets.com

Random Expiration Price Movement Is Daytrading Opportunity

Thursday June 16, 9:32 am ET

By Kevin Haggerty

The market action around a major option expiration like June usually means lots of random price movement which oftentimes is out of context of what you might expect. This makes the daytrader a pawn in the game, but still enables you to react and capitalize on any extended intraday price movement, just as you should have done yesterday. For example, the

Thanks proedge_joe - pity there wasn't more info about how day traders react and capitalize on those movements - a bit empty on strategy and full of historic facts and figures.

Could you please send me the study.

Thanks

Thanks

I would be interested in seeing your spreadsheet.Your site is invaluable,fantastic,a great help.Thanka

Hi Gila,

I've just updated the web site and the spreadsheet is now available for download at the bottom of the article. Here's the web page again: Expiry Fridays article

Refresh the page (F5) if the link isn't there.

Regards,

Guy

I've just updated the web site and the spreadsheet is now available for download at the bottom of the article. Here's the web page again: Expiry Fridays article

Refresh the page (F5) if the link isn't there.

Regards,

Guy

This next week has in the past shown a higher tendency to be bullish because it's a week with an Expiry Friday. Will this next week live up to expectations or let us "down" ?

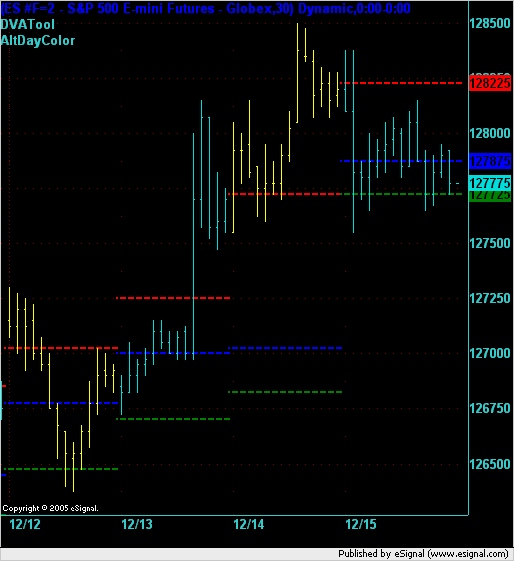

Another bullish expiry week - the pattern looked very similar to the one that I posted last quarter.

The ES saw a low this week on Monday of 1292.25 and then put in a high on 1321.5 on Thursday (which was almost taken out today - Friday) giving us a range of 29.25 points and a change on the week from open to close of +21.75 points or +1.68%

Anybody play the swing long from Monday through to Thursday or Friday?

The ES saw a low this week on Monday of 1292.25 and then put in a high on 1321.5 on Thursday (which was almost taken out today - Friday) giving us a range of 29.25 points and a change on the week from open to close of +21.75 points or +1.68%

Anybody play the swing long from Monday through to Thursday or Friday?

Next week, 12 - 16 June 2006, is expiry week for the E-mini Futures. This week is traditionally bullish. Anybody have any reasons why next week might be an exception to the rule? Share them with us ahead of time and let's see how the theories pan out.

Good luck with your trading next week.

Good luck with your trading next week.

I have managed to find a cached version of the article mentioned above by proedge_joe. It is written by Kevin Haggerty (former head of trading at Fidelity Capital Markets) now at www.kevinhaggerty.com

The article is year old when I posted this. I will quote the important bits. Emphasis is mine.

So you "should have" capitalized on the extended intraday price movements. Keep an eye out for this concept in the coming week which is expiration week.

The article is year old when I posted this. I will quote the important bits. Emphasis is mine.

quote:

Random Expiration Price Movement Is Daytrading Opportunity

Thursday June 16, 2005 9:32 am ET

By Kevin Haggerty

The market action around a major option expiration like June usually means lots of random price movement which oftentimes is out of context of what you might expect. This makes the daytrader a pawn in the game, but still enables you to react and capitalize on any extended intraday price movement, just as you should have done yesterday. For example, the QQQQ closed at 37.70, +0.3%, and a daytrader had a 1,2,3 HB entry above 37.31, which was a +1.1% move from entry catching the afternoon trend up from 1:45 p.m. ET into the close...

On the day, the SPX was +0.2% to 1206.58 with an intraday high of 1208.08 and back to the rally high range. The Dow was also +0.2% to 10,556, with the Nasdaq +0.3% to 2075. NYSE volume was 1.39 billion shares, the volume ratio 60 and breadth +598...

So you "should have" capitalized on the extended intraday price movements. Keep an eye out for this concept in the coming week which is expiration week.

Triple expiration this week.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.