Week 10

quote:CL/CES - Week 10

This is the sixth weekly installment of my CL/CES journal I outlined in The Intro. Previous weeks:

Week 4

Week 5

Week 6

Weeks 7 & 8

Week 9

The course is based on material provided by DLC Profiles, as well as Jim's texts on Market Profile, MoM and MiP. Anyone needing more information should fill out this form and schedule some time with DLC to get a deeper overview of the course.

On with the journal ...

I was only marginally involved in the markets this week. It was spring break for my kids and we had a birthday, so we were able to do so many activities!

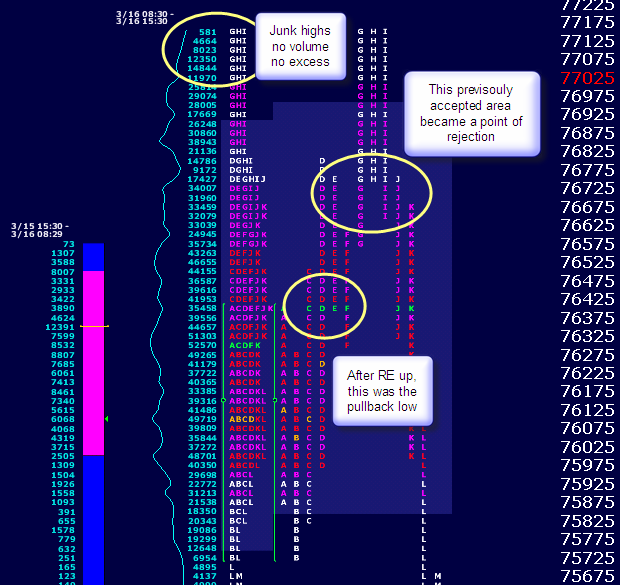

Monday, 03/16/2009

Pre-market

We got short in the overnight, but finished the Globex session very long. Open will be above: VAL, POC, VAH, PDC, and PDH. it should also be near ONH. looking to balance overnight long inventory.

EOD Notes

that G/H/I high does not look right. i don't think it will last through the week. especially with that 775-777 level above. judging by the volume, it doesn't look like sellers stepped in. shorter timeframe money stopped that rally, not deep pockets. pretty narrow base and RE to the upside doubled that range. we finished with a heavy afternoon sell-off and closed below the open. however. VA was higher, POC was higher, lows were higher, and highs were higher.

Trading Notes

struggling to stay out of the muck that was the first hour, i waited. when we tried higher, failed, then lower, and failed, i started looking for a good place to get long. i felt i found a spot when in F-period we retested that A/B/C-period cluster of highs. i did get some of that move, but it just wasn't a very big move, not much conviction. with that G/H/I top i wanted ot see a breakthrough. when we didn't get it, i was convinced of two things: 1) big money was absent and, 2) we would go lower before we went higher. in J-period, when we couldn't do much with the G/H/I-period lows, i went short. i was too precise on the K-preiod retest and did not reup.

Homework

webinar

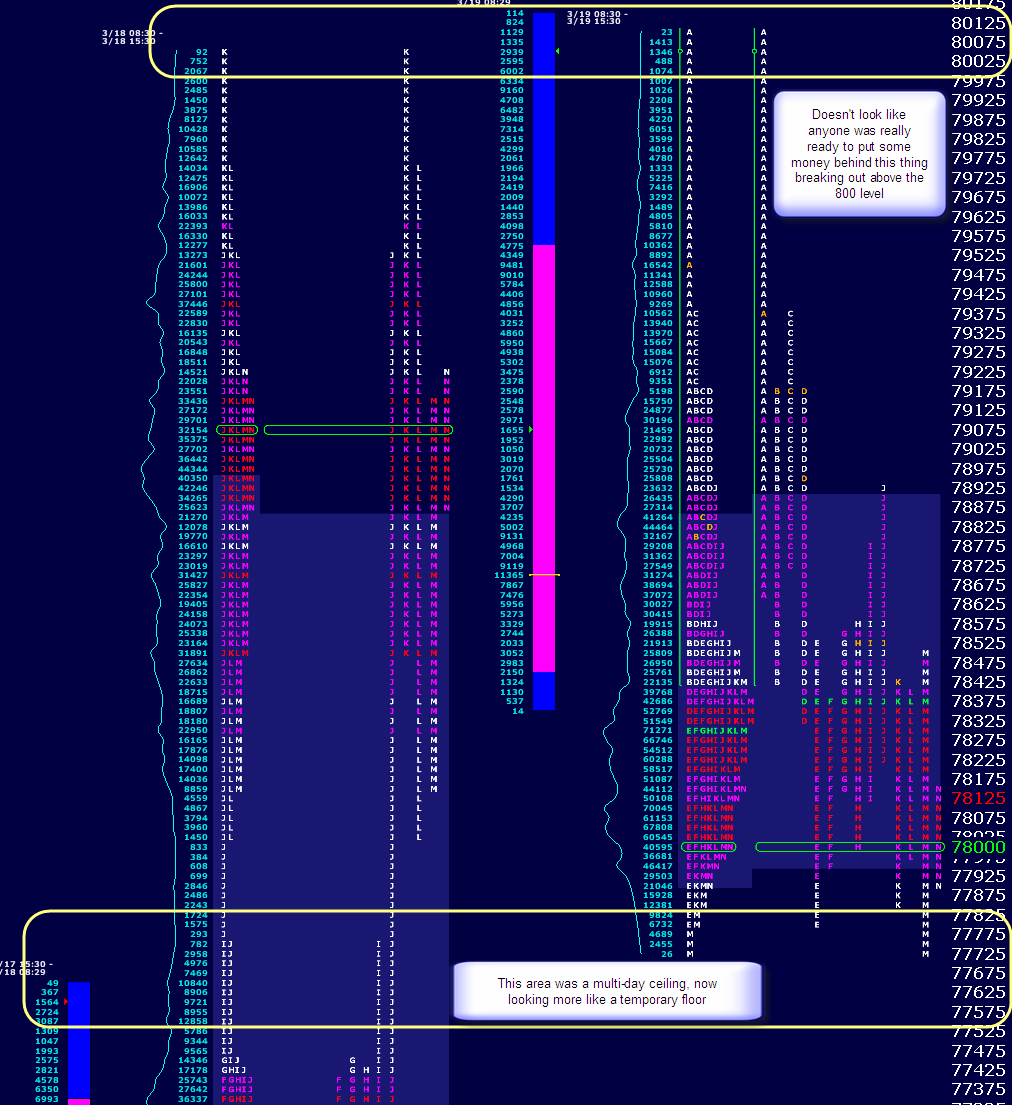

Tuesday, 03/17/2009

Pre-market

open will be below close, VAL, POC, VAH, but likely withing PDR. overnight peeked into VA and A/B/C-period lows. L-period single still relevant (disregarding the Globex fill).

EOD Notes

A-period tail, average-ish base, one-timeframe through I-period, pullback low at 758.50 area, continued one-timeframing from K-period to the clsoe. outside day. close near highs. conflicting VAs: vol = overlapping H/L vs. TPO = overplapping lower

Trading Notes

after we took out ONL and PDL, i took a long. i got shaken out. right before it tiptoed through PD-ONL. right idea, wrong time/place. i wasn't composed enough to re-up, so i had to wait. a probe through IBH and no additional downward extension, so i took a long on the pullback. bordered on max heat. held for a while and jumped off. nothing else materialized for me.

Homework

review webinar

Wednesday, 03/18/2009

Pre-market

open will be several points down from PDC but up from ONL. within range and probably within balance area. overnight predominately short. look to balance overnight inventory.

EOD Notes

weak initial effort to balance inventory and small base. one-timeframed down in A/B/C-periods. created excess and a tail when we reached POC in C-period. POC tested, but price was rejected, not accepted. one-timeframed up C- through K-period. hit the big 800 today. on crap volume. and sold off 20pts from the highs, closing about 10pts off the highs.

Trading Notes

took a trade on the POC probe / excess. low heat and quick, solid payoff. yay! only other thing that looked promising was the G-period pullback, but i was not on it. or anything else.

Homework

review webinar/charts

Thursday, 03/19/2009

Pre-market

none. birthday party. so here's a chart with some post-market thoughts.

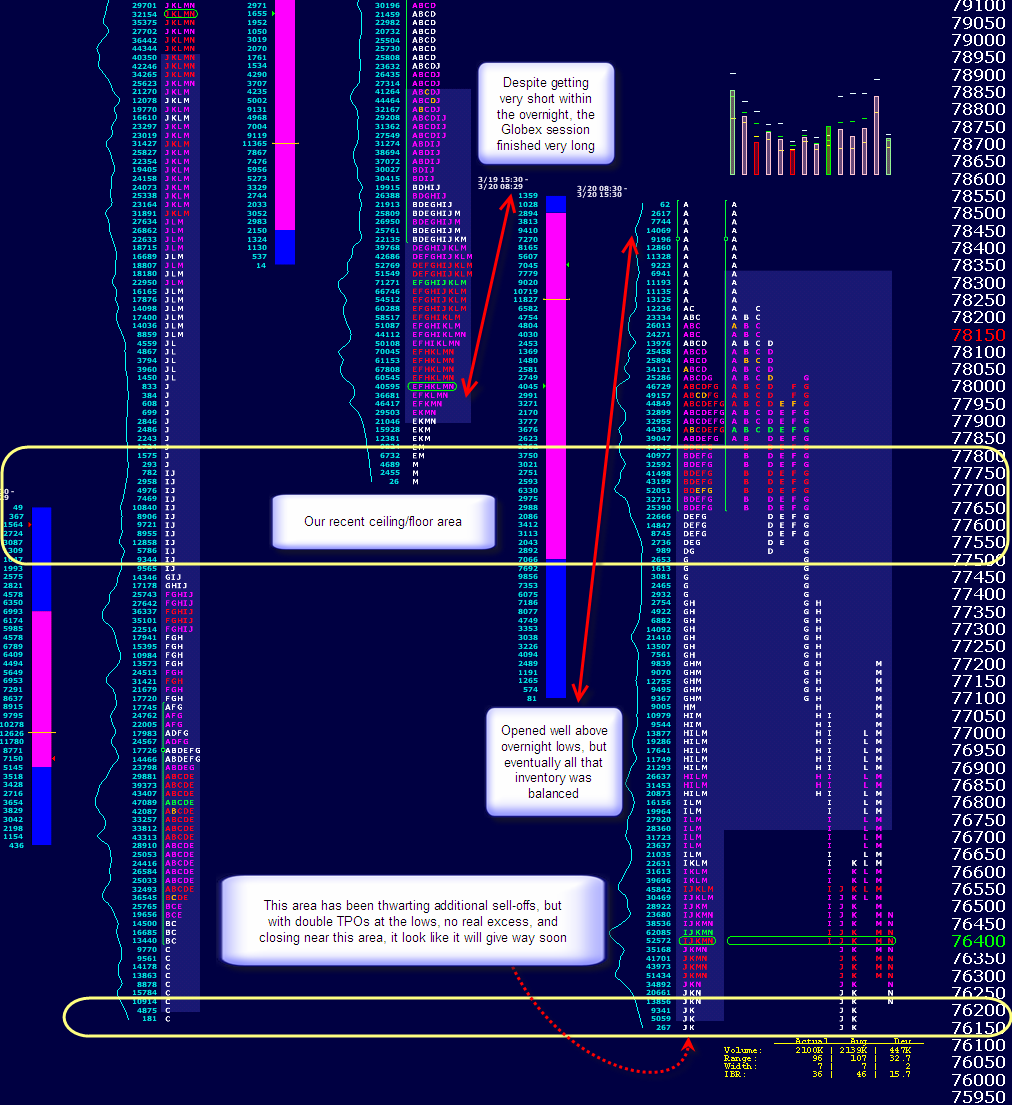

Friday, 03/20/2009

Pre-market

none. spent day at the zoo. so here's a chart with some post-market thoughts.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.