Cool Trading Eye-Opener

This is a fu@cking reality check ... good exposure and practice ... welcome to the real world of trading. Very nice exercise I think:

http://chartgame.com/

Interested in comments and feedback from any and every ones experience on this site!

http://chartgame.com/

Interested in comments and feedback from any and every ones experience on this site!

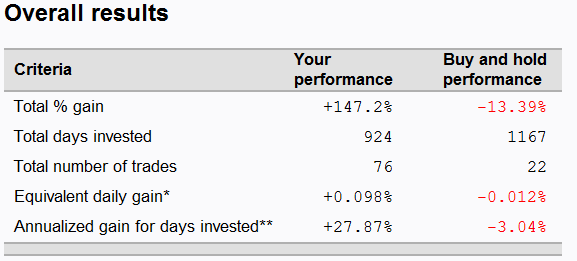

CharterJoe, I took this image from that link you posted. Was that your result? Very impressive.

Nice work, Joe.

Here's what I found while playing this. It's very easy to 'game the game'. Any posted track record from this doesn't do us much good (not saying anything specific to you here, Joe) without knowing things like stop placement, and how many times did one play the game. I'm sure this is all Joe did, and that's the entirety of his trades, but otherwise we wouldn't know that. For example, I just started playing, and figured out that instead of taking my usual stop out, when it went against me I'd just let it run. When I got a massive loser, I just restarted the game. After a short while I had a few outrageous track records built up, some doubling or tripling the account in ten or twenty trades, with no losers. The problem is, you can't tell I'm not taking stops or how many times I played when you see the incredible track record. In this way, it is similar to trading contests where you are encouraged to 'go for broke' and either you win or there's always next year.

I think it's great for some practice, but the thing I noticed most is how I hate to even play without my usual 'context', which doesn't mean just looking at the higher timeframe charts (so helpfully provided with this game), but the sector and market position and sentiment at that time. Without that, I'm almost trading blind. This game really showed that to me in spades.

All in all, though, even using a usual stop and 'playing fair' I was surprised how easy I found the game to 'beat' as compared to actual trading. Now I'm wondering why that is???

Here's what I found while playing this. It's very easy to 'game the game'. Any posted track record from this doesn't do us much good (not saying anything specific to you here, Joe) without knowing things like stop placement, and how many times did one play the game. I'm sure this is all Joe did, and that's the entirety of his trades, but otherwise we wouldn't know that. For example, I just started playing, and figured out that instead of taking my usual stop out, when it went against me I'd just let it run. When I got a massive loser, I just restarted the game. After a short while I had a few outrageous track records built up, some doubling or tripling the account in ten or twenty trades, with no losers. The problem is, you can't tell I'm not taking stops or how many times I played when you see the incredible track record. In this way, it is similar to trading contests where you are encouraged to 'go for broke' and either you win or there's always next year.

I think it's great for some practice, but the thing I noticed most is how I hate to even play without my usual 'context', which doesn't mean just looking at the higher timeframe charts (so helpfully provided with this game), but the sector and market position and sentiment at that time. Without that, I'm almost trading blind. This game really showed that to me in spades.

All in all, though, even using a usual stop and 'playing fair' I was surprised how easy I found the game to 'beat' as compared to actual trading. Now I'm wondering why that is???

If you look at the source of the web page (i.e. the HTML code behind it) it looks like all the prices are on the page already. I haven't tried this yet but I'd assume that you could dump all the prices into a text editor or spreadsheet and you'll be able to "see into the future." So that's the real way to game the game and get a perfect score each time.

Ah, here's something way cool. If you follow Joe's link you can click on the individual trades and go to the charts showing where he got in and out for each trade. This goes to what I was just saying. Look at INTC, for example. BOT at about 82, held through heat of under 68 (!), and closed out at 84, for a profit. That's basically what I was doing. But, would I ever buy a stock at 82 and hold to 68? Never, ever, under any circumstances, and I'm sure Joe wouldn't either. Or TIF, bought at over 43 and held to that low of 29 and change. All it takes is for one of those to keep going down and that's it, or to catch a streak of those. I'd be curious to hear form you, Joe, on your strategy and thinking as far as holding those with that much heat. I know you've made boatloads of real money in actual trading, but surely you haven't figured out a way to take that kind of heat in the real world, have you? If you have, please fill us in because that would be something I'd like to know. You just 'gamed the game' like I did, right?

That's cool, DT. Now if we could only all do that in real life, like it appears the vampire squid is doing, and we'd be making some real coin!

Ah, and it gets worse for all you cheaters out there :-) If you look at the source code you can just see what chart it is and what time period, and then just pull it up and trade from that, cranking up a slew of 5,000% track records for a handful of trades. I know, it's still a good tool for practicing, but any posted track records aren't going to tell us much...

Yeah, the TIF is an even bigger drawdown, like one-third. That hold no matter what game works until it doesn't, and then you blow out. I'm waiting to hear what Joe has to say on all this, keeping in mind, of course, that we all know it's a game, and that we already know he doesn't actually trade like this :-)

Jim Kane,

So why would you every bother to 'break' your own trading rules in a simulation game? Cause it's not real money. REAL money (of your own) completely changes everything. Those without a hard stop that is based on an INITIAL better than 1.5 to 1.0 reward to risk ratio is useless--or simply a game.

No offense to you and those that traded this game--but unless one treated this properly it has no predictive value in the real world where you have $$ thousands on the line each week--week after week.

Cool concept but our 'nature' and the brevity of the exercise coupled with NO real $$$ involved (in my humble opinion) makes the exercise useless.

Moreover--I would go so far as to say PAPER trading is completely and utterly usesless--as your net worth is not involved.

Proper psychology, trade management (100% rule-based adherence) and then METHOD are the keys in this speculative game. In that order. If you had told me that 25 years ago I would not have believed you.

peace

researcher247

So why would you every bother to 'break' your own trading rules in a simulation game? Cause it's not real money. REAL money (of your own) completely changes everything. Those without a hard stop that is based on an INITIAL better than 1.5 to 1.0 reward to risk ratio is useless--or simply a game.

No offense to you and those that traded this game--but unless one treated this properly it has no predictive value in the real world where you have $$ thousands on the line each week--week after week.

Cool concept but our 'nature' and the brevity of the exercise coupled with NO real $$$ involved (in my humble opinion) makes the exercise useless.

Moreover--I would go so far as to say PAPER trading is completely and utterly usesless--as your net worth is not involved.

Proper psychology, trade management (100% rule-based adherence) and then METHOD are the keys in this speculative game. In that order. If you had told me that 25 years ago I would not have believed you.

peace

researcher247

I spent about 3 hours trying out the trading simulator yesterday.

I actually surprised myself with reasonably decent account performance. I ended up somewhere around +175% net. I posted significant gains (above 50%) on several stocks.

I managed to quickly break every rule in my trading book however. It's amazing how freeing it is to trade in a simulated account !

On one trade, I did not exit when it went against me. I held on and waited to exit on the next bounce. The trade went straight down until the time ran out on it, and it wiped out 75% of my trading account in one trade ! I fought back however and reclaimed almost all the loss, bringing the account back to a little over $8K (down 20% net). I was proud of my single minded recovery effort. Amazing how well a 75% single loss will focus your attention on your trading !

With my new found freedom, I also managed to consistently overtrade. After the first 10 or so stocks I got this out of my system and settled down enough to actually wait for a valid trade setup to form.

Thankfully the simulator did not allow me to add to a losing position, the thought did enter my mind more than once.

Overall, a reasonably good example of how not to trade ...

I actually surprised myself with reasonably decent account performance. I ended up somewhere around +175% net. I posted significant gains (above 50%) on several stocks.

I managed to quickly break every rule in my trading book however. It's amazing how freeing it is to trade in a simulated account !

On one trade, I did not exit when it went against me. I held on and waited to exit on the next bounce. The trade went straight down until the time ran out on it, and it wiped out 75% of my trading account in one trade ! I fought back however and reclaimed almost all the loss, bringing the account back to a little over $8K (down 20% net). I was proud of my single minded recovery effort. Amazing how well a 75% single loss will focus your attention on your trading !

With my new found freedom, I also managed to consistently overtrade. After the first 10 or so stocks I got this out of my system and settled down enough to actually wait for a valid trade setup to form.

Thankfully the simulator did not allow me to add to a losing position, the thought did enter my mind more than once.

Overall, a reasonably good example of how not to trade ...

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.