Short term trading weekend preview

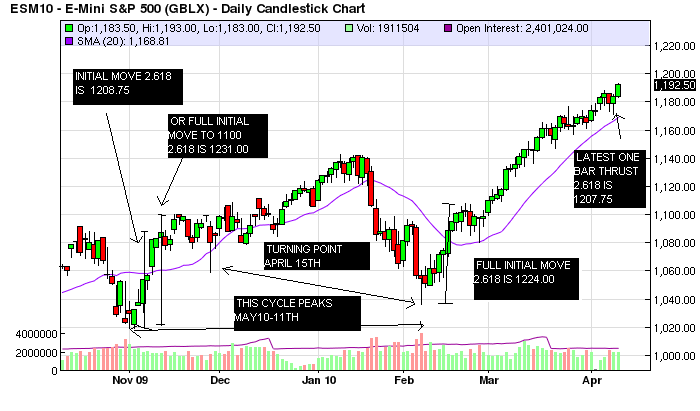

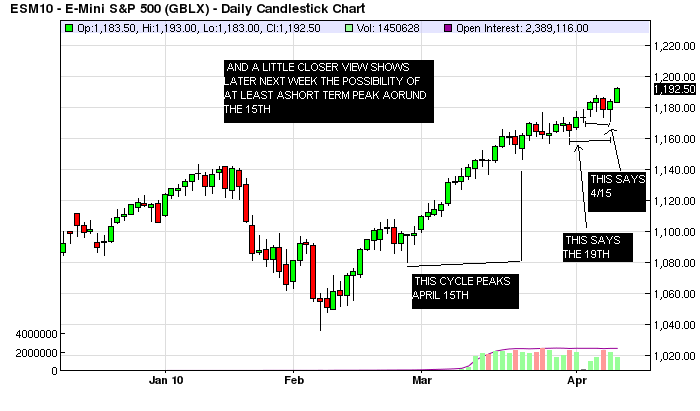

Earnings silly season begins. And it wont be the earnings , but how people perceive the news that will determine the trend. We continue marching upward, due for a decent 5-6% pullback that daily indicator divergencies say could now happen anytime. Not just the garden variety 2% pullbacks we have seen since the current rally began Feb 5th.Just having fun with kools tools indicates a good probability of good reactions off of some key price zones just ahead! And 2 possible time frames to keep an eye on....

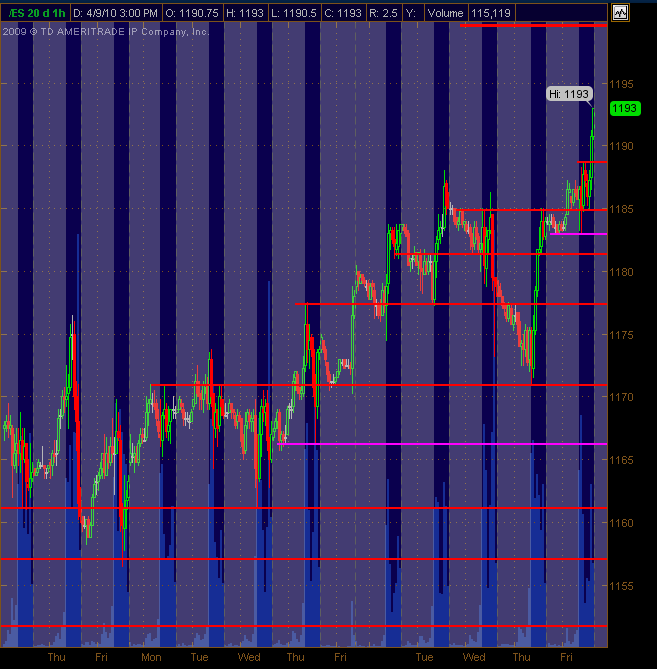

Note how price spent the most time around 1182-1183. This was the accepted value area for the week. Prior week's fair value was around 1168.5 - 1169.5. Fair value keeps going up, so, the Wed/Thurs pullback did not threaten, but actually confirmed that the uptrend is intact.

Note also the market reaction to April's NFP report (Good Friday, when futures mkt were open only for an hour). Breakout monday, test of breakout wed/thurs, and closed at new weekly and contract highs - again.

The weekly pp for last week was 1170.75. We have a "naked" weekly pp, as price was 2ticks away from tagging it.

All this reinforces the prevailing sentiment. I thought sellers might have something to work with on the Wed. pullback (also because ATR was increasing up to that point), but their control has been completely obliterated, and the sellers will have to start from scratch again this coming week.

This coming week's weekly pp= 1185.5. I will be looking to buy at those levels, unless the sellers show us something new that we have not seen this week (or last, or the week prior).

courtesy ew trends and charts

Here's what I'm seeing with Price Action S/R levels/zones for Monday (used a variety of time frames and both RTH and 24hr data).

out of context so I removed my post

Just some musings:

I know we're in an upmove, grinding higher with the majority of days closing above the open. And yeah, we're entering the wildcard of earnings. Any hint lately of a rollover/selloff has quickly been met with buying spiking price up hard and quick ... but with overall talk of low volume.

There's no look of a parabolic move on the daily ES ... but I'm thinking perhaps this may be a potential non-conventional "blow-off" topping pattern/action. I've only hit the high points of internals and they're not offering a decent "tell."

With trendlines and trend channels ... as well as signif resistance in the 1200-1210 area (and the obligatory Dow 11,000 ... which are just the round numbers) ... I'm looking for input/feedback from the great minds here as I'm considering positioning myself short for a multi-day/week pullback/selloff.

Would be playing it with options on the SPY while still trading the ES long or short intraday, fyi.

Anyway, just looking for some additional feedback beyond the PASR levels I've posted and trade with intraday ... and wanting more of an input for what I see as a potential decent swing type of trade. And I only have to go back just a couple months or so for a short term top that offered a decent magnitude move down ... thinking we may be in a similar situation shortly.

Any and all ... lemme and the rest of mypivots folks know whatcha think!

Thanks ... The Funky Monkey

I know we're in an upmove, grinding higher with the majority of days closing above the open. And yeah, we're entering the wildcard of earnings. Any hint lately of a rollover/selloff has quickly been met with buying spiking price up hard and quick ... but with overall talk of low volume.

There's no look of a parabolic move on the daily ES ... but I'm thinking perhaps this may be a potential non-conventional "blow-off" topping pattern/action. I've only hit the high points of internals and they're not offering a decent "tell."

With trendlines and trend channels ... as well as signif resistance in the 1200-1210 area (and the obligatory Dow 11,000 ... which are just the round numbers) ... I'm looking for input/feedback from the great minds here as I'm considering positioning myself short for a multi-day/week pullback/selloff.

Would be playing it with options on the SPY while still trading the ES long or short intraday, fyi.

Anyway, just looking for some additional feedback beyond the PASR levels I've posted and trade with intraday ... and wanting more of an input for what I see as a potential decent swing type of trade. And I only have to go back just a couple months or so for a short term top that offered a decent magnitude move down ... thinking we may be in a similar situation shortly.

Any and all ... lemme and the rest of mypivots folks know whatcha think!

Thanks ... The Funky Monkey

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.