ES short term trading weekly preview 7-31-10

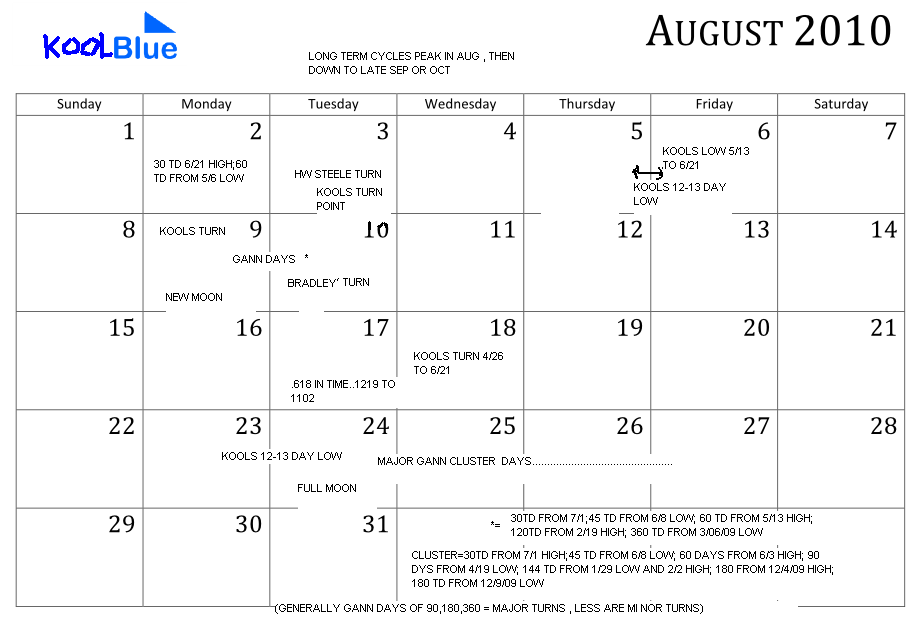

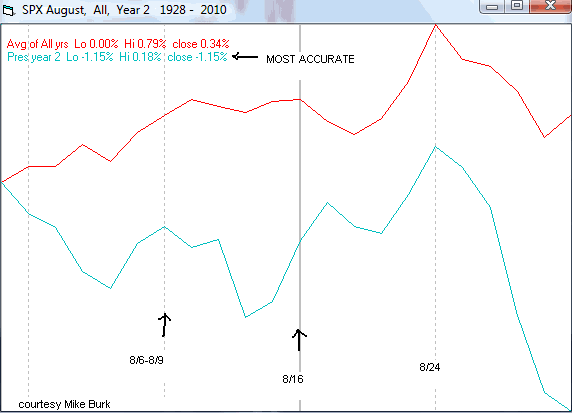

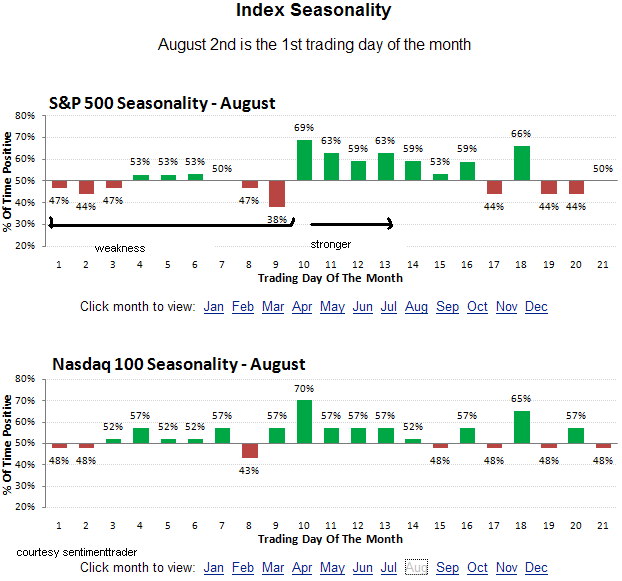

This is likely to be a key month of the year. Although long term patterns allow for a major bear market top in spring of 2011, Aug has the makings of a decent cycle top heading down into the obligatory late Sep ,early Oct low. There are several possible timeframes for this to occur this month. Watch for Tues 8/3 to be a turn point of some sort , but more importantly the 9th-10th and the period around the 24th look to be critical! Be advised that for the past 9 months or so the high comes very early in the month and low around mid-month. At least thats been the general pattern.Next week is the infamous Kools 12-13 day low at the end of the week heading in to the critical 8/9 date, so my short term bias would be for an high early in the week (perhaps by Tues?), and then lower into the weekend.I would expect the second week of the month to be strongly up after the 9th-10th is out of the way.....

There were a couple of mentions and questions over the last week about when the most likely time of the day was for a high or low. This should help:

Timing the High/Low of the Day

Timing the High/Low of the Day

Thanks for linking to this article.

Hari

Hari

Originally posted by day trading

There were a couple of mentions and questions over the last week about when the most likely time of the day was for a high or low. This should help:

Timing the High/Low of the Day

kool,

Very interesting info....Mind if I asked where you got this from? Do they have stats on forex or currency futures?

Very interesting info....Mind if I asked where you got this from? Do they have stats on forex or currency futures?

Originally posted by CharterJoe..unfortunatey no, they dont... same with crude oil ,which i have been concentrating on lately.. fwiw, the stock market almanac points out Mon should be a down day! One seasonal chart is from a blogger named Mike Burk who posts at safehaven.com ... the other is a pay service called sentimenttrader.

kool,

Very interesting info....Mind if I asked where you got this from? Do they have stats on forex or currency futures?

SUMMARY AND CONCLUSIONS: I expect this month to break the pattern of the last 8 or nine months where we had the high near the beginning of the month and low mid-month.. in fact i would expect the high mid -month or later. Seasonals seem to support this. I would also expect this month to be a key month in the sense that the high this month should lead to a decent retracement (retest of 1002?) by late OCT. Most likely timeframe for the top might be around the 9th or the 24th.These are all long term guesses of course, but based on historical sentiment and cycles.... good trading!

Cheers KB for the seasonality reports!

Hey Kool,

Sure you didn't mean to say the low's have been coming near the beginning of the month and high's, or at least higher numbers, mid-month?

Sure you didn't mean to say the low's have been coming near the beginning of the month and high's, or at least higher numbers, mid-month?

Originally posted by koolblue

SUMMARY AND CONCLUSIONS: I expect this month to break the pattern of the last 8 or nine months where we had the high near the beginning of the month and low mid-month..

Great Study DT. Have you updated it with recent data by any chance?

Originally posted by day trading

There were a couple of mentions and questions over the last week about when the most likely time of the day was for a high or low. This should help:

Timing the High/Low of the Day

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.