ES Short Term Trading 10-7-10

What I said yesterday still applies (yesterday's RTH was an exact to the tic match of the 40 day high print)

GapGuy study looked at Gap Up openings where the Open was a new 40 trading day H. Incredibly, historically, 82% of these gaps fill on the same day.

This happened on Thursday, 9-30-10 and that gap filled.

If today, Thurs, 10-07-10 opens above 1158.75, that would be a gap open at a new 40 trade day High.

GapGuy study looked at Gap Up openings where the Open was a new 40 trading day H. Incredibly, historically, 82% of these gaps fill on the same day.

This happened on Thursday, 9-30-10 and that gap filled.

If today, Thurs, 10-07-10 opens above 1158.75, that would be a gap open at a new 40 trade day High.

cool stuff paul...that's my plan for today ...shorts up here in the 61 - 63 zone I mentioned the other day.....that is also your .62 projection area....watching O/N high close just in case the buyers will try to front run TOMORROWS reports today

years ago (before HFT and individual electronic access to the markets through the internet), day before employment report used to be quiet relatively small range, now it can be a bucking bronco.

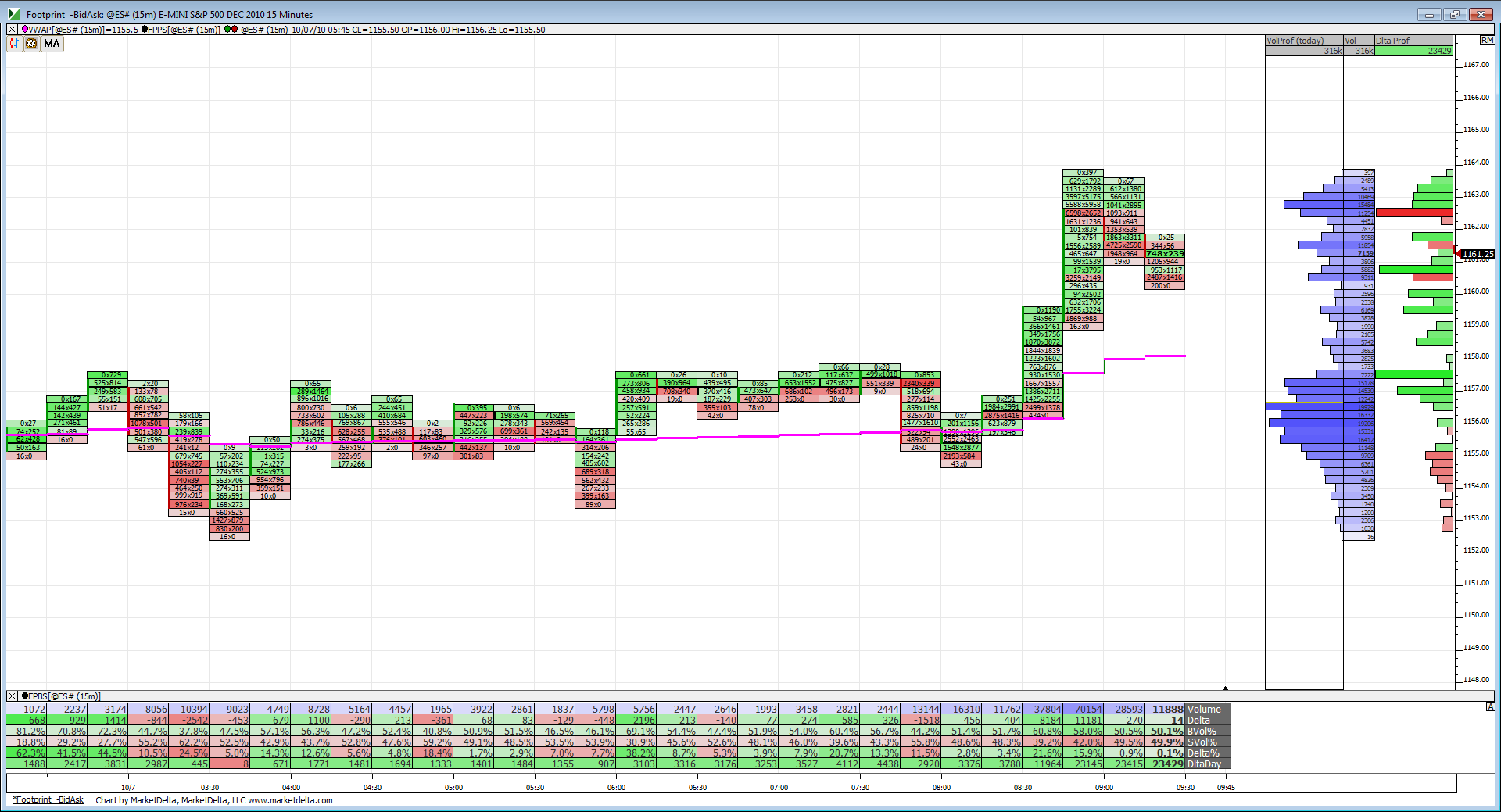

Here is a look at the footprint coming into the open. The question is, looking at the volume profile on the right, will new volume come in at these levels to support the move or do prices trade back to all that volume between 57-55?

Lorn,

I noticed (your chart) that volume is bulging right near yesterday's close, 1156.00

if the 82% odds come in, a print there would be the fill.

there is something else that might allow a little lift: The DJ-30 is very close to printing big round 11,000.

could be a magnet and a rejection price.

I noticed (your chart) that volume is bulging right near yesterday's close, 1156.00

if the 82% odds come in, a print there would be the fill.

there is something else that might allow a little lift: The DJ-30 is very close to printing big round 11,000.

could be a magnet and a rejection price.

And interesting to note the DOW has been the strongest of the three big indexes of late...

Originally posted by PAUL9

Lorn,

I noticed (your chart) that volume is bulging right near yesterday's close, 1156.00

if the 82% odds come in, a print there would be the fill.

there is something else that might allow a little lift: The DJ-30 is very close to printing big round 11,000.

could be a magnet and a rejection price.

I pulled at 56.25..that was key from yesterday...trying to hold two for complete gap fill...no reports to inspire them against us..!!

Bruce,

what's complete gap fill, 1 tic under 56.25

or are you going for the 4:00C at 55.50?

what's "complete"

what's complete gap fill, 1 tic under 56.25

or are you going for the 4:00C at 55.50?

what's "complete"

Done at 53.75 but for anyone holding there is a ledge at 52 area

yes paul the 4pm...some like to watch the cash go to even from the previous but 4 pm is close enough

Something I've learned from reviewing all my "scramble" trades, you know, those trades that I've put on in O/N session and thenI have to scramble to protect in day session....painful

The point is this......my crappy O/N trades and bad trades early on happen a HUGE percent of the time when 10 am reports are due...this makes sense as some trend traders position in O/N session and early day session in hopes that the 10 am report will treat them well...and when they do work well it is much harder for us faders....the market needs inspiration to keep trending...and the reports sometimes give them that inspiration

Something I've learned from reviewing all my "scramble" trades, you know, those trades that I've put on in O/N session and thenI have to scramble to protect in day session....painful

The point is this......my crappy O/N trades and bad trades early on happen a HUGE percent of the time when 10 am reports are due...this makes sense as some trend traders position in O/N session and early day session in hopes that the 10 am report will treat them well...and when they do work well it is much harder for us faders....the market needs inspiration to keep trending...and the reports sometimes give them that inspiration

gap at 55.50

sellers will try to sell above the 50% back so above the 54 area is ideal sell point

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.