MP Stocks & Bonds finally trending

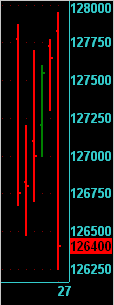

This must be fairly rare that the range on Monday exceeds the range for the previous week? Have you ever done any testing or analysis on how this type of week usually pans out after that type of range? Basically we have what I would call an "Extreme Outside Day" or an "Extreme Monday" because the high and low are outside the high/low for the previous week.

Anybody know when this last happened?

Anybody know when this last happened?

4th oct. and yes I know it was a Tuesday. but probably statistically more often than you realise if you allow it to be any day of the week rather than specifically the most bullish day of the week ie Monday

4th october doesn't engulf the previous day or day(-3) but it does engulf day(-2).

There may however be something here. Look at 19 Oct. It engulfs the previous 3 days and almost the previous 6 trading days (with 1 exception on the low). The following day was an inside day.

Now look at today. Yesterday an extreme outside day and today an inside day.

So if we apply this casual observation to Market Profile then we can expect a rotating market and sell the VAH and buy the VAL.

So my question (to myself) that I want to ask and test is: Does a rotational trading style improve in profitability on days after these extreme outside days?

I'm sure you can see where I'm going here... Classify each pattern of days and adjust trading style for subsequent days to improve profitability.

There may however be something here. Look at 19 Oct. It engulfs the previous 3 days and almost the previous 6 trading days (with 1 exception on the low). The following day was an inside day.

Now look at today. Yesterday an extreme outside day and today an inside day.

So if we apply this casual observation to Market Profile then we can expect a rotating market and sell the VAH and buy the VAL.

So my question (to myself) that I want to ask and test is: Does a rotational trading style improve in profitability on days after these extreme outside days?

I'm sure you can see where I'm going here... Classify each pattern of days and adjust trading style for subsequent days to improve profitability.

You can take it a lot further than just that but yes you are on the right track. How about thinking along the lines of say we have a neutral day what is the probability of it being followed by another neutral day or say a trend day or say a NVD etc. SO how did you do on Thursday ? Did you test your theory and did it work. The answer was yes until it broke late in the day changing the day structure.

Well the theory applied to Wednesday because that was the expected rotational day because Tuesday was the Extreme Outside Day. I didn't classify today (Thursday).

On Wednesday the buying of the VAL worked to the tick as that turned out to the be Low of Day.

On Wednesday the buying of the VAL worked to the tick as that turned out to the be Low of Day.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.