ES Tuesday 10-4-11

I'm hoping to post these charts through the end of the week so we can see how these price distributions (bell curves) interact. The new user to this stuff should be concentrating on finding the key areas and drawing in the bell curves.

Today left us with two very distinct bell curves. A double distribution day separated by low volume in the middle. Viewers looking to get better should focus on the volume histogram and draw your high and low volume areas based on that without looking at the price bars.

Hopefully we will get an upmove overnight so we have something to work with in the RTH session tomorrow morning. We will formulate some trade ideas once we see which side of the bell curves price will be entering from in the morning.

It is my experience that highs and lows will form more often based off the low volume areas from previous days and not the high volume areas from previous days. This is opposite from what that Enthios site teaches and the natural true range method but as usual I encourage everyone to do their own research.

This chart below includes overnight data but only because my IB charts display the histograms better once the day is complete. So I am posting it this way only to present a better visual and no other reason. I do not think you need to incorporate the overnight volume because it is too low.

Today left us with two very distinct bell curves. A double distribution day separated by low volume in the middle. Viewers looking to get better should focus on the volume histogram and draw your high and low volume areas based on that without looking at the price bars.

Hopefully we will get an upmove overnight so we have something to work with in the RTH session tomorrow morning. We will formulate some trade ideas once we see which side of the bell curves price will be entering from in the morning.

It is my experience that highs and lows will form more often based off the low volume areas from previous days and not the high volume areas from previous days. This is opposite from what that Enthios site teaches and the natural true range method but as usual I encourage everyone to do their own research.

This chart below includes overnight data but only because my IB charts display the histograms better once the day is complete. So I am posting it this way only to present a better visual and no other reason. I do not think you need to incorporate the overnight volume because it is too low.

looking to get long near 72.75 as I think they will come back to 76.75 again

long 71.75 and light....hour range not up yet

low volume still at 76.75 and we have traded on both sides of the open today...read dalton

taking something at the 75.25 print and holding two

72.25 will take these last out otherwsie I will pull one at 76.76 and hold one for 85.50!

bruce you trade like 10 contracts??

how does it look for foot prints up here

that campaign was 5 contracts and that is why I was holding that last one for the bigger profit target at 85.50.. when I don't have a good low volume number then I am just trading with and like everyone else....Today I had the key 70 - 72 zone but didn't trade until after the 10 am reports...

Overall trading lighter...I wont trade now until I see the 94 - 95 area if it even comes but even up there we will have the value area low traders workingthat area too...so it is an obvious area...I don't like the obvious areas as much

Overall trading lighter...I wont trade now until I see the 94 - 95 area if it even comes but even up there we will have the value area low traders workingthat area too...so it is an obvious area...I don't like the obvious areas as much

I'm not in this but it will be interesting to see if they let them keep that low volume at 83.25 now

due to this back and fill up here if we combine today and yesterday then we now do have a low volume area that looks attractive at 89.75.....

Not sure if you are here Sean but it could be a good one

Not sure if you are here Sean but it could be a good one

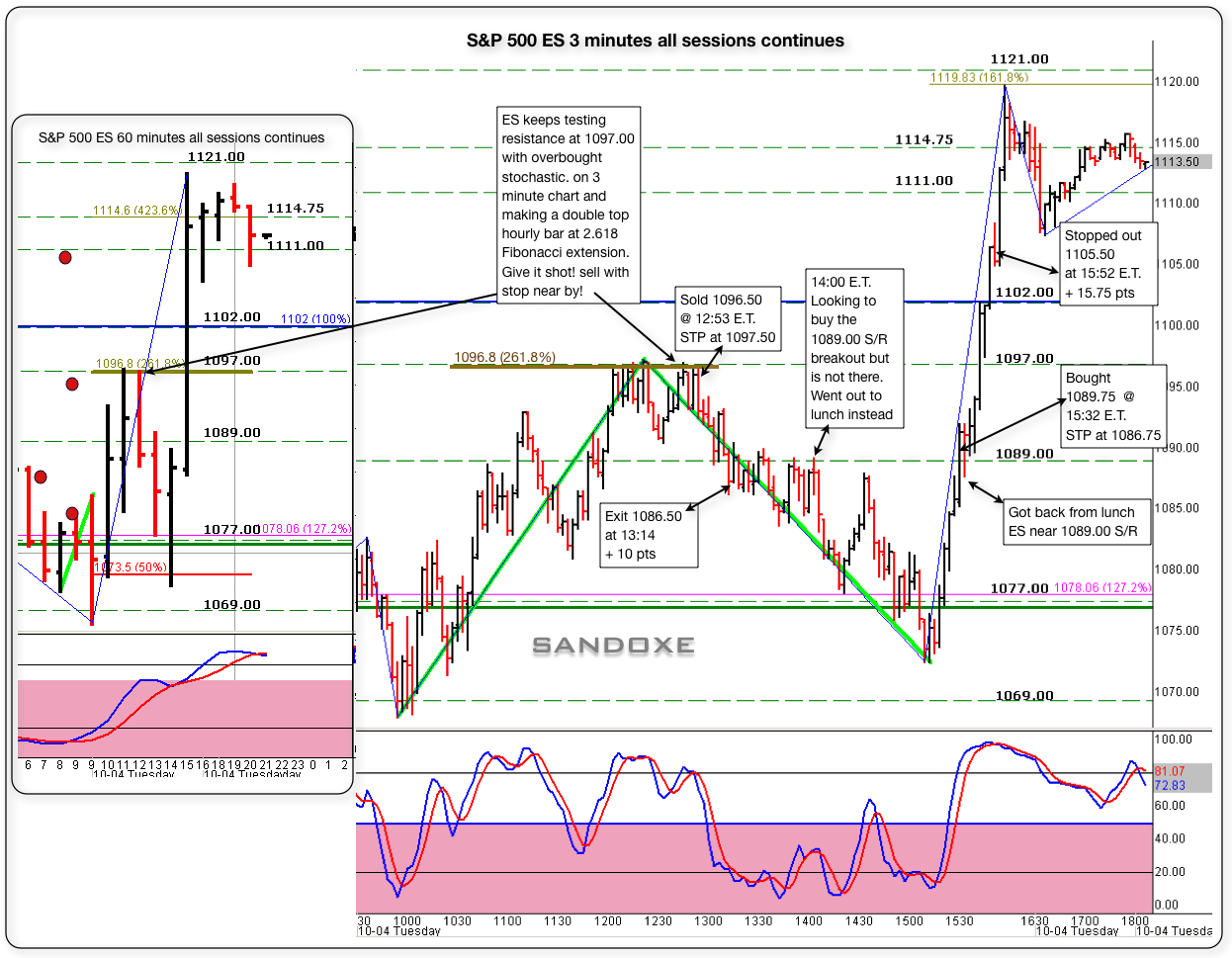

Here's a 3 minute self explanatory chart for my posts here at the forum.

Lisa, I don't know what you are referring to when asking about second level. But, we can talk about numbers and S/Rs and that's what I was looking at 12:53 as seeing in the chart below.

I hope this helps in some way. Seeing and playing S/Rs in conjunction with your system.

Lisa, I don't know what you are referring to when asking about second level. But, we can talk about numbers and S/Rs and that's what I was looking at 12:53 as seeing in the chart below.

I hope this helps in some way. Seeing and playing S/Rs in conjunction with your system.

Originally posted by sandoxe

Got back from lunch and ES was moving with good momo and true my 1089.00 and here we are, just hit the objective at 1102.00

ES now trading 1105.75 @ 15:48Originally posted by sandoxe

ES keeps testing 1089 but fail to move above it with some momo. Will wait.

ES now trading 1087.50 @ 13:56 E.T

Time for some delicious lunch hmmmmm.

Originally posted by sandoxe

I'm looking to buy from 1089.00 S/R. will let it test a bit and see if sets up for me.

Objective 1097/ 1102.

ES now trading 1088.75 @ 13:34

In due time will show us the way.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.