ES Tuesday 10-4-11

I'm hoping to post these charts through the end of the week so we can see how these price distributions (bell curves) interact. The new user to this stuff should be concentrating on finding the key areas and drawing in the bell curves.

Today left us with two very distinct bell curves. A double distribution day separated by low volume in the middle. Viewers looking to get better should focus on the volume histogram and draw your high and low volume areas based on that without looking at the price bars.

Hopefully we will get an upmove overnight so we have something to work with in the RTH session tomorrow morning. We will formulate some trade ideas once we see which side of the bell curves price will be entering from in the morning.

It is my experience that highs and lows will form more often based off the low volume areas from previous days and not the high volume areas from previous days. This is opposite from what that Enthios site teaches and the natural true range method but as usual I encourage everyone to do their own research.

This chart below includes overnight data but only because my IB charts display the histograms better once the day is complete. So I am posting it this way only to present a better visual and no other reason. I do not think you need to incorporate the overnight volume because it is too low.

Today left us with two very distinct bell curves. A double distribution day separated by low volume in the middle. Viewers looking to get better should focus on the volume histogram and draw your high and low volume areas based on that without looking at the price bars.

Hopefully we will get an upmove overnight so we have something to work with in the RTH session tomorrow morning. We will formulate some trade ideas once we see which side of the bell curves price will be entering from in the morning.

It is my experience that highs and lows will form more often based off the low volume areas from previous days and not the high volume areas from previous days. This is opposite from what that Enthios site teaches and the natural true range method but as usual I encourage everyone to do their own research.

This chart below includes overnight data but only because my IB charts display the histograms better once the day is complete. So I am posting it this way only to present a better visual and no other reason. I do not think you need to incorporate the overnight volume because it is too low.

bruce lets see what happens over night but if I was a betting man of witch i am 07.00 we will see tonight

http://screencast.com/t/YcvI7am2

Key levels:

1094-1095 VAL/PIV range low

1100-1102 PIV/3DRP

1110-1111 Daily PIV high/Local low

Key levels:

1094-1095 VAL/PIV range low

1100-1102 PIV/3DRP

1110-1111 Daily PIV high/Local low

http://screencast.com/t/A0qiQ9CeK

I shaded in the LVN onto the chart.. 94-95 is a key bias area, short below, long above.. 26-28 is also an area to fade.. Above is VPOC@42

I shaded in the LVN onto the chart.. 94-95 is a key bias area, short below, long above.. 26-28 is also an area to fade.. Above is VPOC@42

Hey Bruce,

Would you not consider ~1089.75 low volume? Seems to be surrounded by decent looking high volume areas. I've been doing my own low volume research and trying to match them up with your work. Been pretty dead on, but this one I am unsure about.

Thanks,

Sean

Would you not consider ~1089.75 low volume? Seems to be surrounded by decent looking high volume areas. I've been doing my own low volume research and trying to match them up with your work. Been pretty dead on, but this one I am unsure about.

Thanks,

Sean

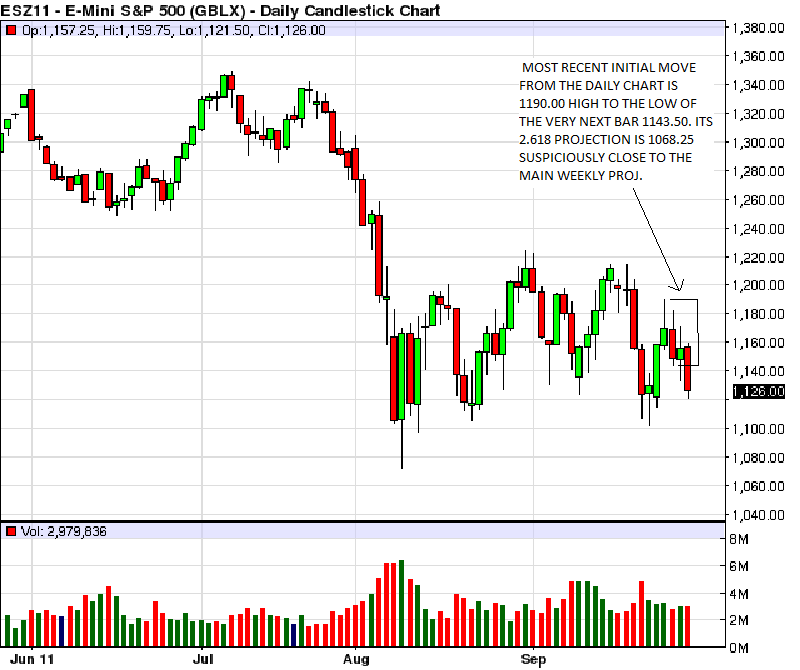

Whether or not we achieve or exceed the support area shown a LARGE rally is indicated once we find a bottom...for example, from sentimentrader..."the latest Hulbert Stock Newsletter Sentiment index dropped to -16.8%. That's the lowest reading since the first week in March 2009.

Since 2000, anytime it dropped this low, the S&P was positive a month later only 56% of the time, but all of the negative weeks occurred in 2008. If we except that time period (big exception, granted), then a month later the S&P was up 13 out of 13 weeks, with a median return of +4.1%.

Price pattern: This was the 2nd day in a row the S&P lost more than -2.5%, with the S&P closing at a new one-year low as well.

This has happened 24 times since 1928. The next day was positive 50% of the time, the next week 71% and the next month 58%.

As far as the next week goes, the S&P was perfect since 1940, rising 11 out of 11 times with a median return of +4.7%.

Since 1928, if the 2nd down day was a Monday (as it is this time), then the next week was positive all 5 times, averaging +11.1% (yes, 11.1%).

If we relax the parameters and look for back-to-back -2% down days ending on a Monday with the S&P at least at a six-month low, all occurrences within the past 50 years were at or within days of a large and/or multi-week rally - 8/29/66, 9/30/74, 10/19/87, 3/12/01, 7/22/02, 10/27/08 and 3/2/09." thats just some of the evidence, believe me there is more. Also i think most wave riders would have 5 waves down completing an Elliot pattern.If a rebound should materialize ,i would not be surprised to see the 1280 to 1300 level hit ,possibly by yearend or early 2012.

Since 2000, anytime it dropped this low, the S&P was positive a month later only 56% of the time, but all of the negative weeks occurred in 2008. If we except that time period (big exception, granted), then a month later the S&P was up 13 out of 13 weeks, with a median return of +4.1%.

Price pattern: This was the 2nd day in a row the S&P lost more than -2.5%, with the S&P closing at a new one-year low as well.

This has happened 24 times since 1928. The next day was positive 50% of the time, the next week 71% and the next month 58%.

As far as the next week goes, the S&P was perfect since 1940, rising 11 out of 11 times with a median return of +4.7%.

Since 1928, if the 2nd down day was a Monday (as it is this time), then the next week was positive all 5 times, averaging +11.1% (yes, 11.1%).

If we relax the parameters and look for back-to-back -2% down days ending on a Monday with the S&P at least at a six-month low, all occurrences within the past 50 years were at or within days of a large and/or multi-week rally - 8/29/66, 9/30/74, 10/19/87, 3/12/01, 7/22/02, 10/27/08 and 3/2/09." thats just some of the evidence, believe me there is more. Also i think most wave riders would have 5 waves down completing an Elliot pattern.If a rebound should materialize ,i would not be surprised to see the 1280 to 1300 level hit ,possibly by yearend or early 2012.

Sean,

The best low volume areas will come at a "transition point". This is the place where the market has gone from consolidation to trend or from trend to consolidation. The consolidation points can be thought of as the fat part of the bell curve. Then we break away from from those and this break away forms the low volume areas on the chart. Then we go back to consolidation.

The area you mentioned doesn't really have any back and forth price action that preceeds it so I don't use it. There is no consolidation point that preceeds it in the day session. This isn't to say that you are wrong though it's just that I want to be trading as close to the transition points as possible.

We basically want to be asking the question:

Where is the point that we went from consolidation to trend or from trend to consolidation? Then when we get back to those areas ( the retest- like we have up at the 94 area in the overnight)we want to see if the players that caused the breakouts are willing to trade there again.

No wrong answers though and glad you are doing your own research.

The best low volume areas will come at a "transition point". This is the place where the market has gone from consolidation to trend or from trend to consolidation. The consolidation points can be thought of as the fat part of the bell curve. Then we break away from from those and this break away forms the low volume areas on the chart. Then we go back to consolidation.

The area you mentioned doesn't really have any back and forth price action that preceeds it so I don't use it. There is no consolidation point that preceeds it in the day session. This isn't to say that you are wrong though it's just that I want to be trading as close to the transition points as possible.

We basically want to be asking the question:

Where is the point that we went from consolidation to trend or from trend to consolidation? Then when we get back to those areas ( the retest- like we have up at the 94 area in the overnight)we want to see if the players that caused the breakouts are willing to trade there again.

No wrong answers though and glad you are doing your own research.

Originally posted by Capitalista

Hey Bruce,

Would you not consider ~1089.75 low volume? Seems to be surrounded by decent looking high volume areas. I've been doing my own low volume research and trying to match them up with your work. Been pretty dead on, but this one I am unsure about.

Thanks,

Sean

thanks for the stats Koolio!!

Since we are into new lows for 2011, I looked back to 8/24/2010 (last time we were down here). If that is the correct thing to do, I see a low volume area from 68-67 and around 1072.

Does this jive with the more experienced MP traders?

Does this jive with the more experienced MP traders?

The difficulty here is that back then a different contract was being traded, so the price levels aren't completely transferable to the current contract due to the premium/discount differences within each contract.

So they are less reliable in a specific sense.

So they are less reliable in a specific sense.

Originally posted by Big Mike

Since we are into new lows for 2011, I looked back to 8/24/2010 (last time we were down here). If that is the correct thing to do, I see a low volume area from 68-67 and around 1072.

Does this jive with the more experienced MP traders?

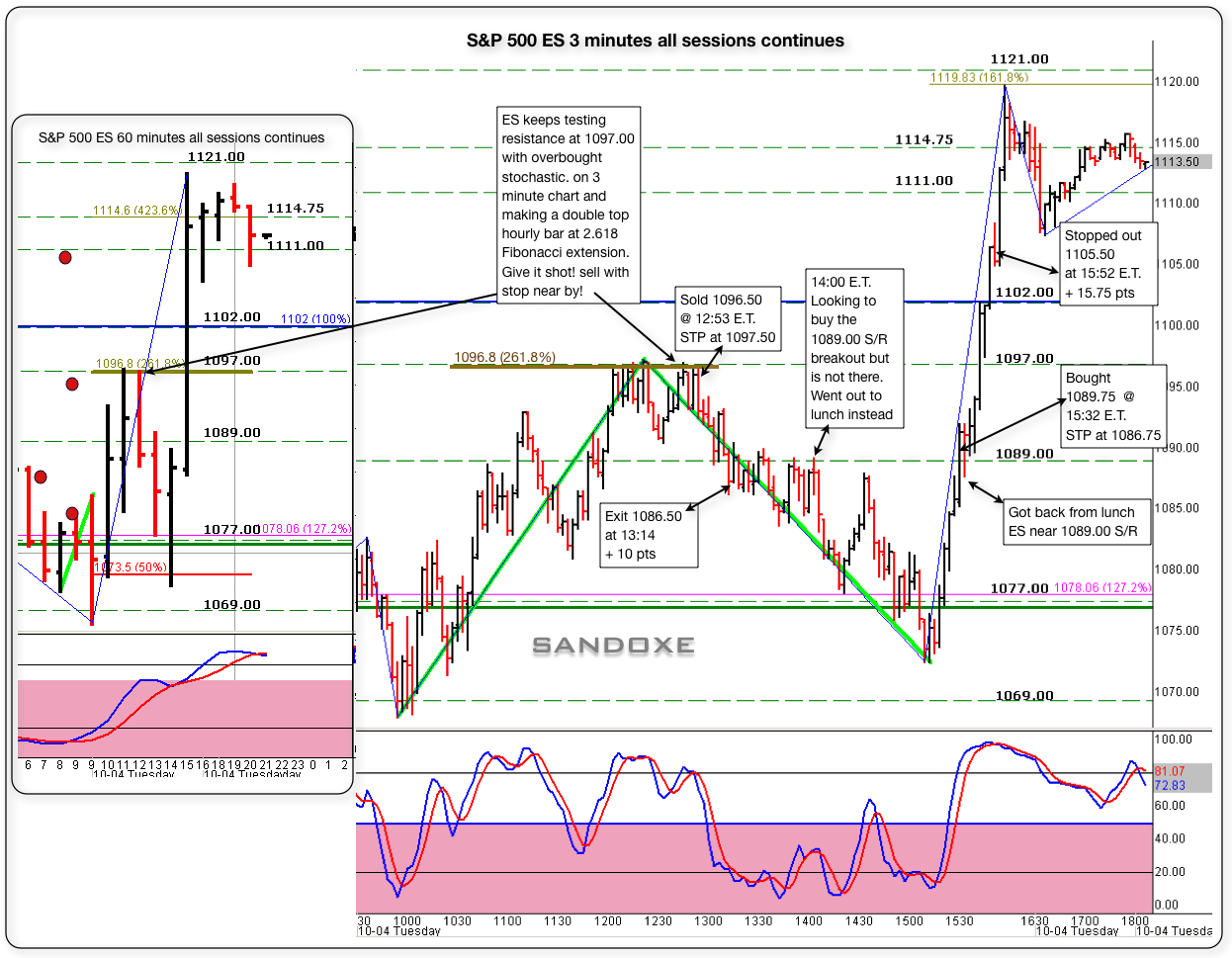

Here's a 3 minute self explanatory chart for my posts here at the forum.

Lisa, I don't know what you are referring to when asking about second level. But, we can talk about numbers and S/Rs and that's what I was looking at 12:53 as seeing in the chart below.

I hope this helps in some way. Seeing and playing S/Rs in conjunction with your system.

Lisa, I don't know what you are referring to when asking about second level. But, we can talk about numbers and S/Rs and that's what I was looking at 12:53 as seeing in the chart below.

I hope this helps in some way. Seeing and playing S/Rs in conjunction with your system.

Originally posted by sandoxe

Got back from lunch and ES was moving with good momo and true my 1089.00 and here we are, just hit the objective at 1102.00

ES now trading 1105.75 @ 15:48Originally posted by sandoxe

ES keeps testing 1089 but fail to move above it with some momo. Will wait.

ES now trading 1087.50 @ 13:56 E.T

Time for some delicious lunch hmmmmm.

Originally posted by sandoxe

I'm looking to buy from 1089.00 S/R. will let it test a bit and see if sets up for me.

Objective 1097/ 1102.

ES now trading 1088.75 @ 13:34

In due time will show us the way.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.