ES Friday 3-9-12

OVB's use the entire range and engulfments work off the open to close relationship....I don't trade either as they form but like to trade 50% retracements to OVB's on bigger time frames and know which side SHOULD break first and which ones SHOULDN'T break to help filter shorter term trades

statistics are fun but they don't always come true obviously

statistics are fun but they don't always come true obviously

Bruce is there any trade you contemplate taking today or you done for the week?

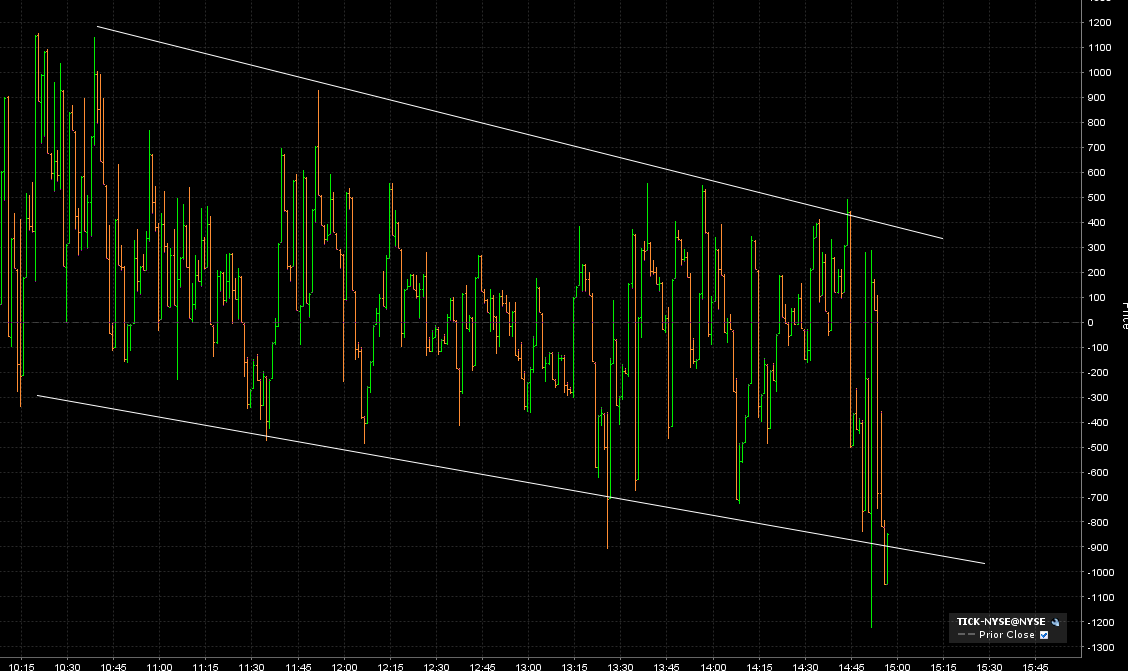

that is some huge $tick divergence up here

I just took a short but am only trading small as it is great to have wins late on Fridays but losses suck going into the weekend...so my advice is if you are playing up here then play small

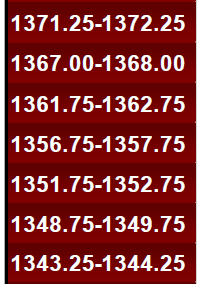

david i had a low volume area as per march at 73.50 so 5- 6 points below that is 67.50- 68.50 as per june. so a key area..

two things I am thinking about is this: 1)they are creating high volume today in a low volume price from another day and 2) we know they get 10 points of range lately so a projection may still come in up at 1370.50 which is close to having the OVB probability fail

just more reasons to be less agressive on fades...we normally want immediate rejection in low volume zones...not acceptance!

two things I am thinking about is this: 1)they are creating high volume today in a low volume price from another day and 2) we know they get 10 points of range lately so a projection may still come in up at 1370.50 which is close to having the OVB probability fail

just more reasons to be less agressive on fades...we normally want immediate rejection in low volume zones...not acceptance!

we just closed the "air" in the Russell

funny thing is even a small amount you make on friday makes the week end good!!!!!!!!!!!!!!!

Harry, if this the way you feel quit for the week as long as you are in the green

It seems to me that a slow friday on rollover week is a flip of the coin which side "they" screw.

David, had to learn this the hard way. now am not trading just watching done for the week. Have a nice weekend David and all

here was part of the internal picture I was watching and a good place to leave off on a friday...the market was grinding back and forth as the $ticks where channeling down..not pefect but what is ? we also had that air pocket below...just pointing out some of the context even if it is after the fact..

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.