ES Thursday 8-13-15

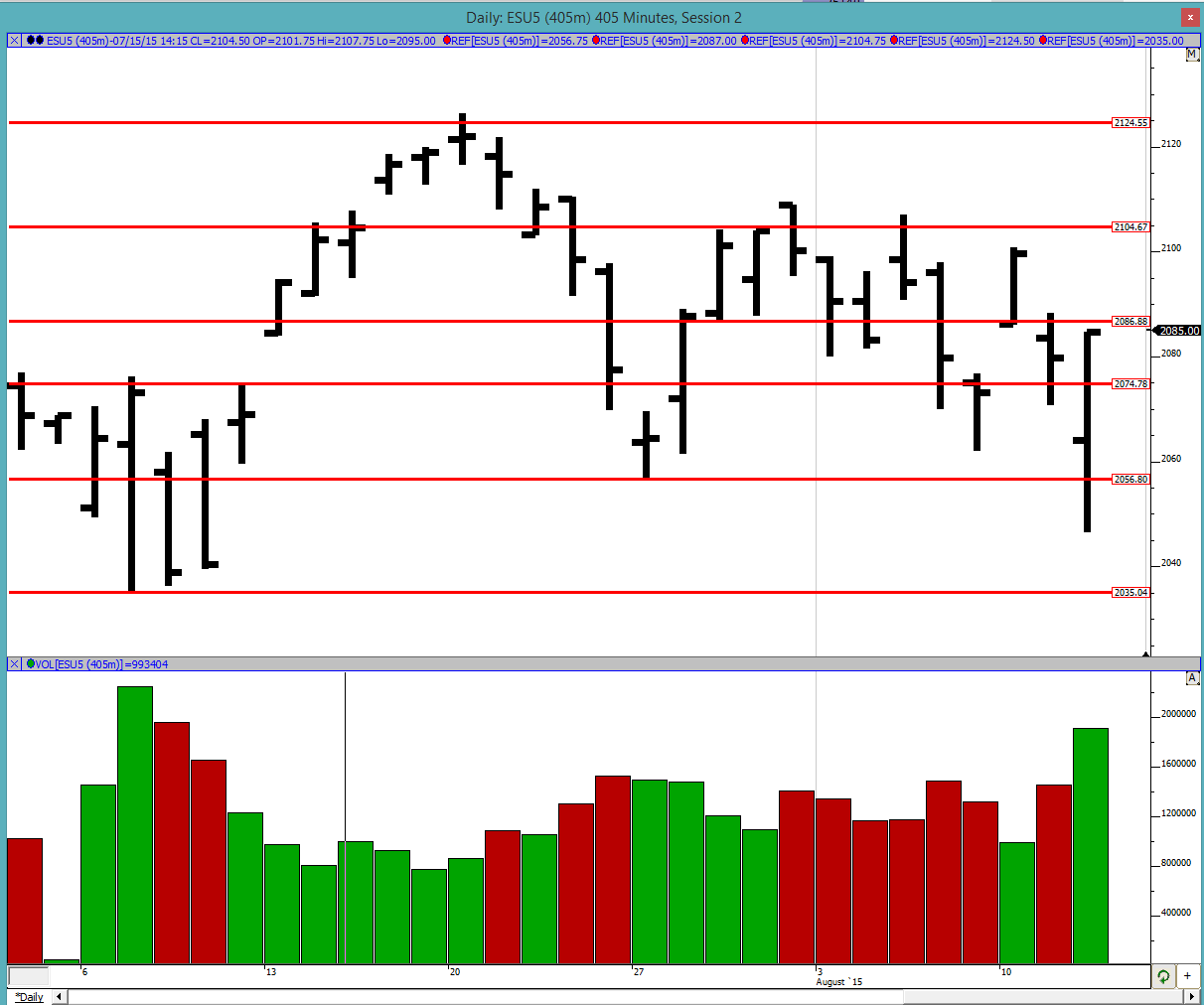

Good morning to all. Wednesday was quite a wild day with the massive swings. Hope everyone reading this came out of it unscathed. This daily chart seen below is all we need to know to see how cray this day was. After all of it we ended up closing within the balance area again. The buyers came in droves around the 2050 area and pushed the market back up. Somewhere I read that this was at the 200 day SMA so the buyers will definitely keep buying until they are proven wrong. I also read that it was Goldman Sachs doing the buying, not that it matters to us. We continue closing the balance area so we shall keep looking for a resolution outside of it for next direction.

Greenies (past naked developing VPOCs): 2051.5, 2053.75, 2090.25, 2092.75, 2096.75, 2098, 2104.25, 2112.75, 2118.75 and 2123.5

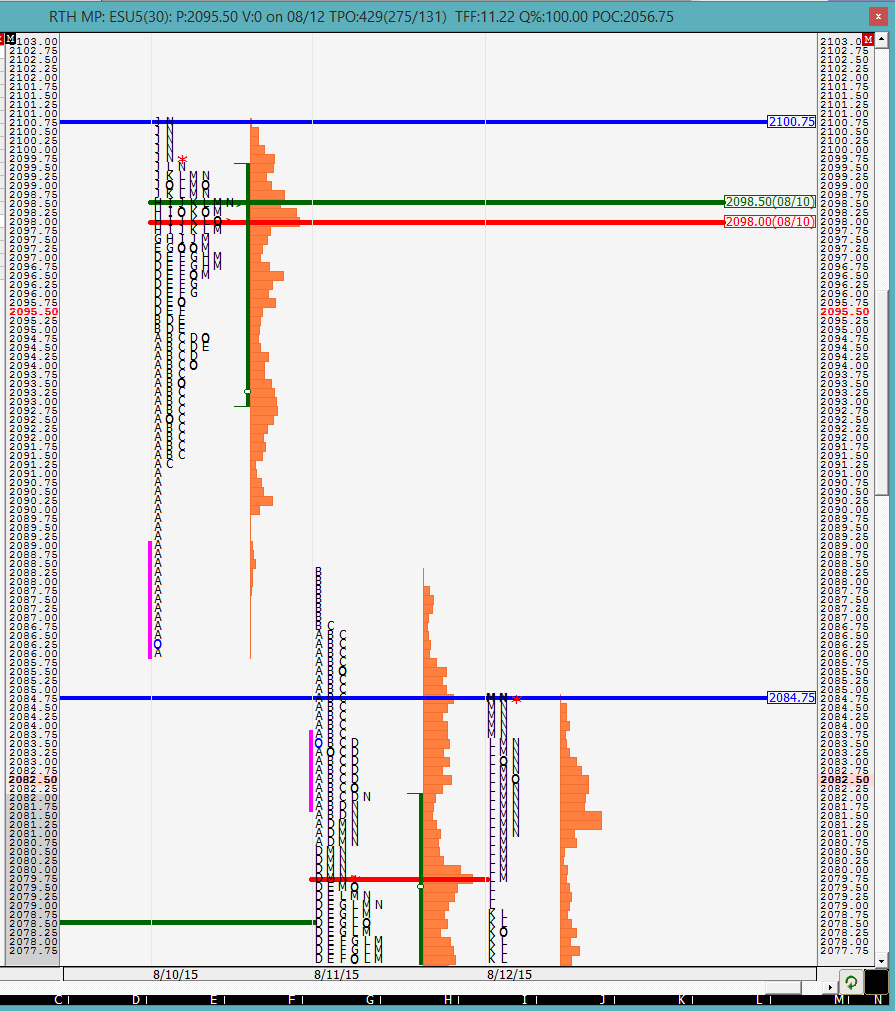

Profile: I am not going to try fitting the profile in one picture but we can see that there were multiple distributions (3 to be exact) separated by single prints. Keep that on the radar as we forward as the lines in sand. For the market to continue moving up we need to see these single prints defended. Eventually of course we expect it to get cleaned up but for the near term the reaction of the market around them will give us the clues. Interestingly the VPOC on the day was at 2053.75 which means that it did not move up in the day.

Singles from 2079 to 2079.75 and 2074.75 to 2076.25

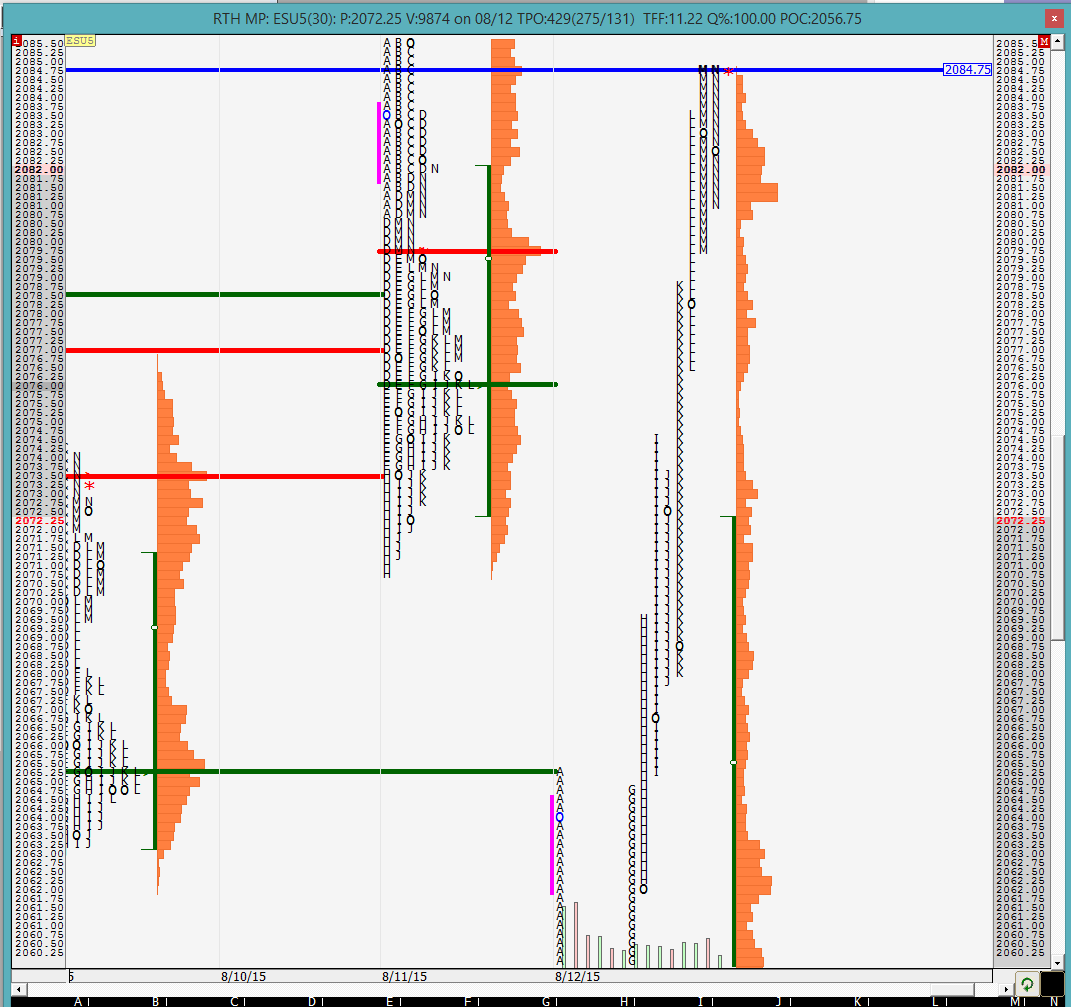

The picture below shows that there are poor highs on 8/10 and 8/12. This is an exponential effect which means that the likelihood of these getting cleaned up are now higher. We just do not know when.

The split profile does not say much due to the market being so stretched out but those who were reading my comments YD would have seen how the market acted in the D and E periods, coming right to the low of the A period and selling off. That was a pretty classic setup to go long. The only problem with that is the question on where do you enter. Going by the poor high it again seems that the auction does not feel complete so we shall see how the day shapes up.

Good luck trading to all.

Greenies (past naked developing VPOCs): 2051.5, 2053.75, 2090.25, 2092.75, 2096.75, 2098, 2104.25, 2112.75, 2118.75 and 2123.5

Profile: I am not going to try fitting the profile in one picture but we can see that there were multiple distributions (3 to be exact) separated by single prints. Keep that on the radar as we forward as the lines in sand. For the market to continue moving up we need to see these single prints defended. Eventually of course we expect it to get cleaned up but for the near term the reaction of the market around them will give us the clues. Interestingly the VPOC on the day was at 2053.75 which means that it did not move up in the day.

Singles from 2079 to 2079.75 and 2074.75 to 2076.25

The picture below shows that there are poor highs on 8/10 and 8/12. This is an exponential effect which means that the likelihood of these getting cleaned up are now higher. We just do not know when.

The split profile does not say much due to the market being so stretched out but those who were reading my comments YD would have seen how the market acted in the D and E periods, coming right to the low of the A period and selling off. That was a pretty classic setup to go long. The only problem with that is the question on where do you enter. Going by the poor high it again seems that the auction does not feel complete so we shall see how the day shapes up.

Good luck trading to all.

The O/N inventory looks long but not by much. As of now we would open within YD's range but outside of value.

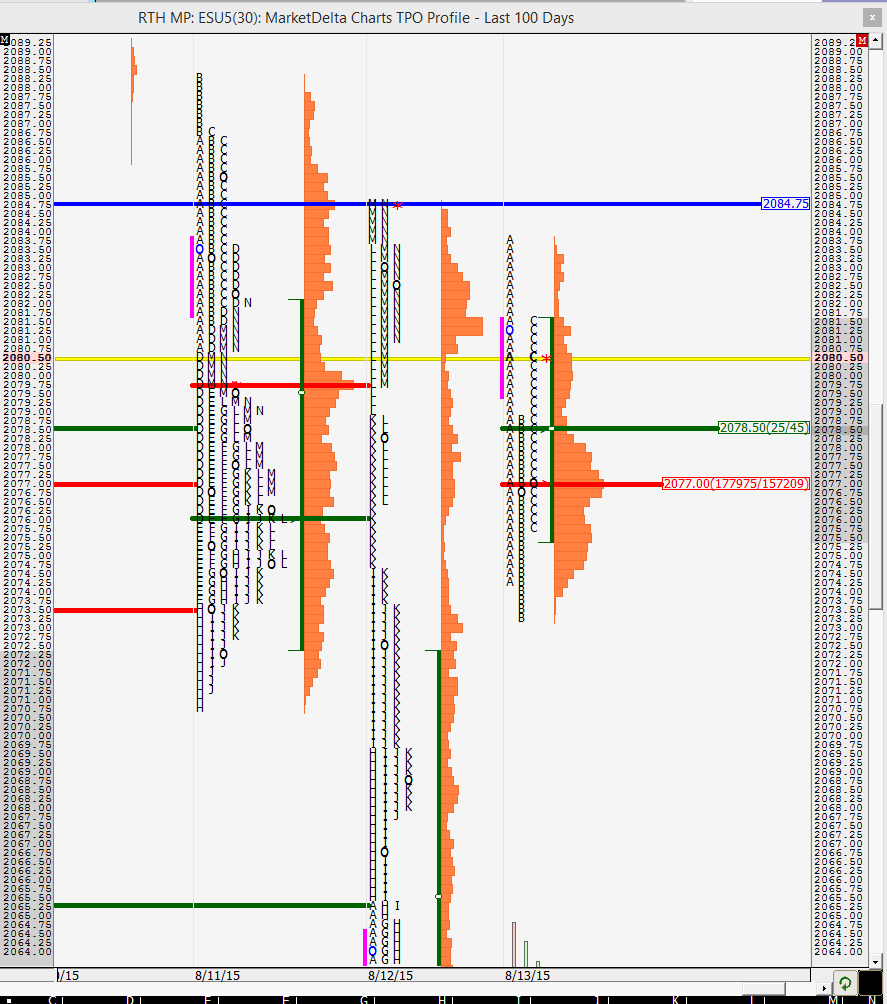

Singles from 2079 to 2079.75 covered

second set of singles being defended right now.

second set of singles covered. multiple distributions from YD are now closed. now the question is whether buyers will defend this or are we going to see a liquidation break?

large range so far in the first 25 mins... lots of single prints. we know what that means

coming to the OR high and backing off is not a sign of strong selling.... looks like we are getting ready for new highs

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.