ES Wednesday 5-25-16

I'll get to a video in the morning after we can get a handle on Overnight action. I was only able to make up a bit less then 1/2 my losses from trading on Tuesday. An important point: It is very hard to mentally switch gears from a fader to a trend trader or a trend trader back to a fader. So pick one and get good at it and if you have clues that it may be the other type of day ( the kind you don't do well at ) then scale down or don't trade. I thought we had some difficult days the last two weeks. The only good thing about trend days for me is that they usually don't do it like that two days in a row...especially right off the opening like Tuesdays trade.

Here is my main bell curve from Tuesdays Trade:

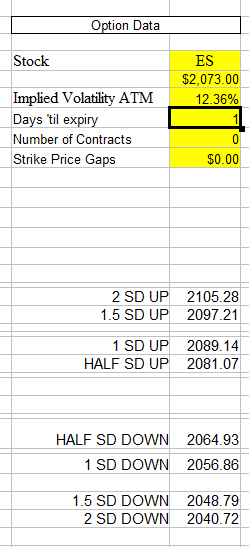

here are the bands:

Here is the main bell curve I am watching from 4-28 that sits above Tuesdays highs should we open above in Wednesdays session:

lets see how the overnight plays out. In general I will be looking for signs that we might have a shot at revisiting the 69 area and even possibly the 58 area by weeks end.....now the big conflict as far as this kind of longer term prediction is that the SITYS for the month of May has not hit yet and if it does then they might drive to 2098 to get that. As a short term trader I find these "predictions" interesting but not very profitable ! Planning to ramble in the morning for anyone interested. Was way off the mark on Tuesday and hoping to perform much better in Wednesdays trade.

EDIT : Added some video babble

Here is my main bell curve from Tuesdays Trade:

here are the bands:

Here is the main bell curve I am watching from 4-28 that sits above Tuesdays highs should we open above in Wednesdays session:

lets see how the overnight plays out. In general I will be looking for signs that we might have a shot at revisiting the 69 area and even possibly the 58 area by weeks end.....now the big conflict as far as this kind of longer term prediction is that the SITYS for the month of May has not hit yet and if it does then they might drive to 2098 to get that. As a short term trader I find these "predictions" interesting but not very profitable ! Planning to ramble in the morning for anyone interested. Was way off the mark on Tuesday and hoping to perform much better in Wednesdays trade.

EDIT : Added some video babble

with no reports I will be selling in the overnight from two areas...the 83.75 and I am using a zone from 86.75 - 89...I'll explain later on video...2080.50 will be targets on shorts from the first area...the 83.75...we had no overnight midpoint test yesterday so we won't know that price obviously until that session closes....we have the potential to see MATD activity so be careful of holding for too long

I added some video babble to first post...I think 80 is going to hold the key today as that is a weekly poor high....midpoint is at 79.50....many will be using first one minute as a filter and aggressive traders will be selling the OR low and buying the OR high...they will take multiple tries and stop and reverse in order to try and catch a move........so a viable option for some...my concern with that method today is that we opened and drove yesterday and then trended...so we might not expect that on a morning after a trend day...we may need to consolidate....

In first post on the chart at 74.55 I wrote " see video" but then forgot to explain why I am keeping that area on my chart...this explains why

this market is giving us two chances on short side today...one happened in On and one is happening in day session...so many will be selling as close to 83 again as possible or looking for a price action entry on any pushes up that try to suck in buyers

selling above On high is a good trade idea with plan to come back to 83.75 ( that trade failed so far)...the 83.75 short failed ...

low odds that On midpoint fails two days in a row....we want trade to stay inside O/N highs now

hmmm...interesting open and drive two days in a row ? outside of range and value...they were suppose to make RTh a bit easier on us today..I'm looking to sell 2 points and more above upper edge of 89.50 ( see video of bulk of time area) so I can target that number...so 91.50 and higher ..we have swing highs in the 93 - 94 area to add at if needed...oil report in 11 minutes so beware...frustrating to be "off" again and really thought we would get this over with earlier today

FWIW r2 is 90.75 !!

runners trying for singles at 87.75

it's funny I actually feel bad and that I let folks down for being so WRONG recently...but I take responsibility and always stress how we all need to be the owners of our own work.......on the plus side it gives a good representation of how difficult trading can be from the technical and mental side

thanks...i appreciate the comments

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.