ES Tuesday 8-29-17

Traders will be looking to see if they can get back above gap point at 2429.50 from trade of 8-21. This will also be a one standard deviation move down..( 15 points off the cash close).so I only plan on buys today under that point. If the world falls apart then I will miss it on the downside. I will also be using a key zone of 2433 - 2434.50 as a possible " turn em back down point" ( resistance). Further downside to try buys from are a zone from 2427.50 - 2425.....that is first real buy zone....then below that is 2420 - 2421.....hoping to get a long going and will edit with some charts

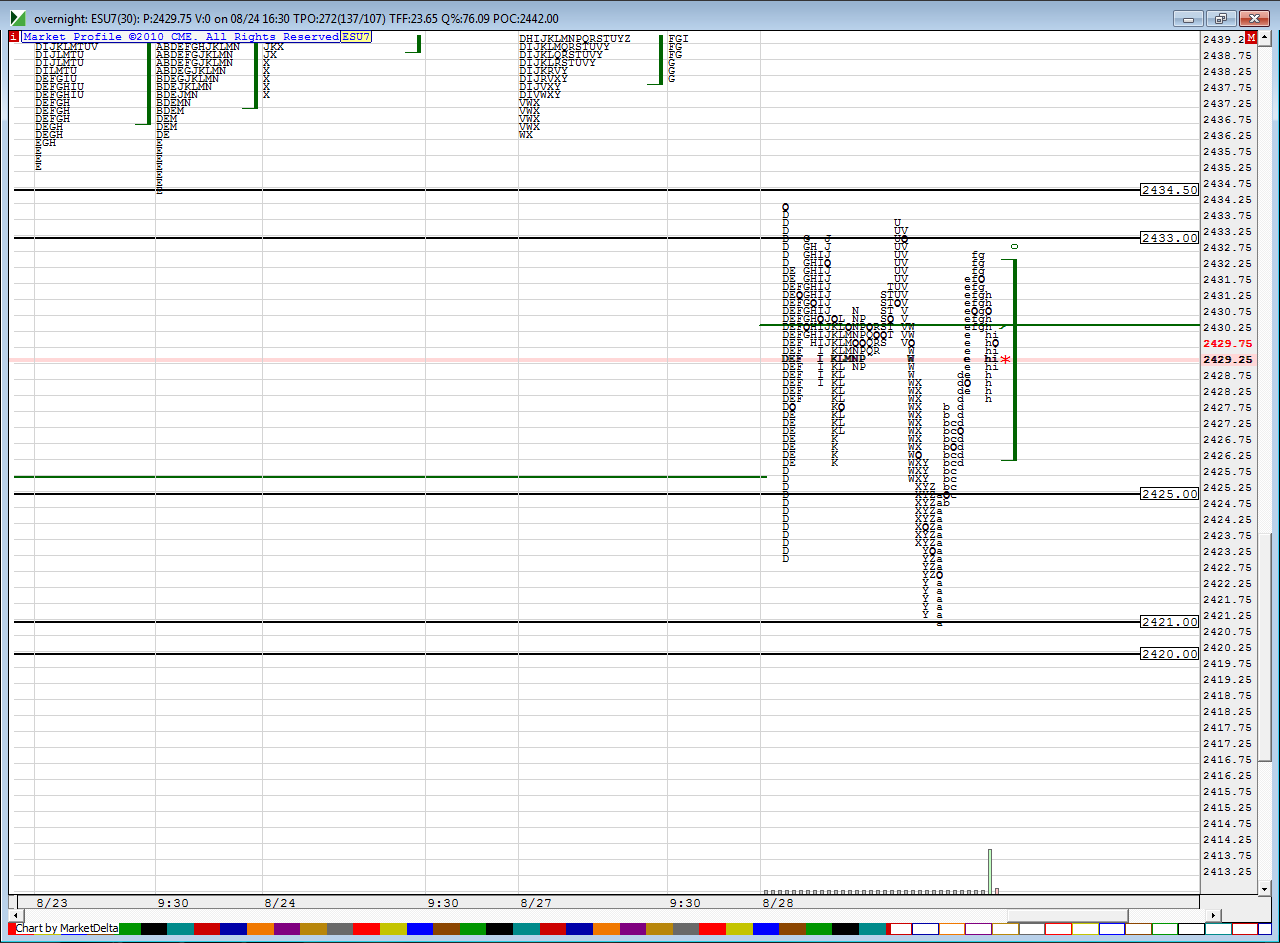

edit: First Mondays trade against last week.....Note the gap points at the 29.50 and up at 2432.75

edit: current overnight...Note POC of overnight is right at 30 area....proves traders are interested in that gap oint

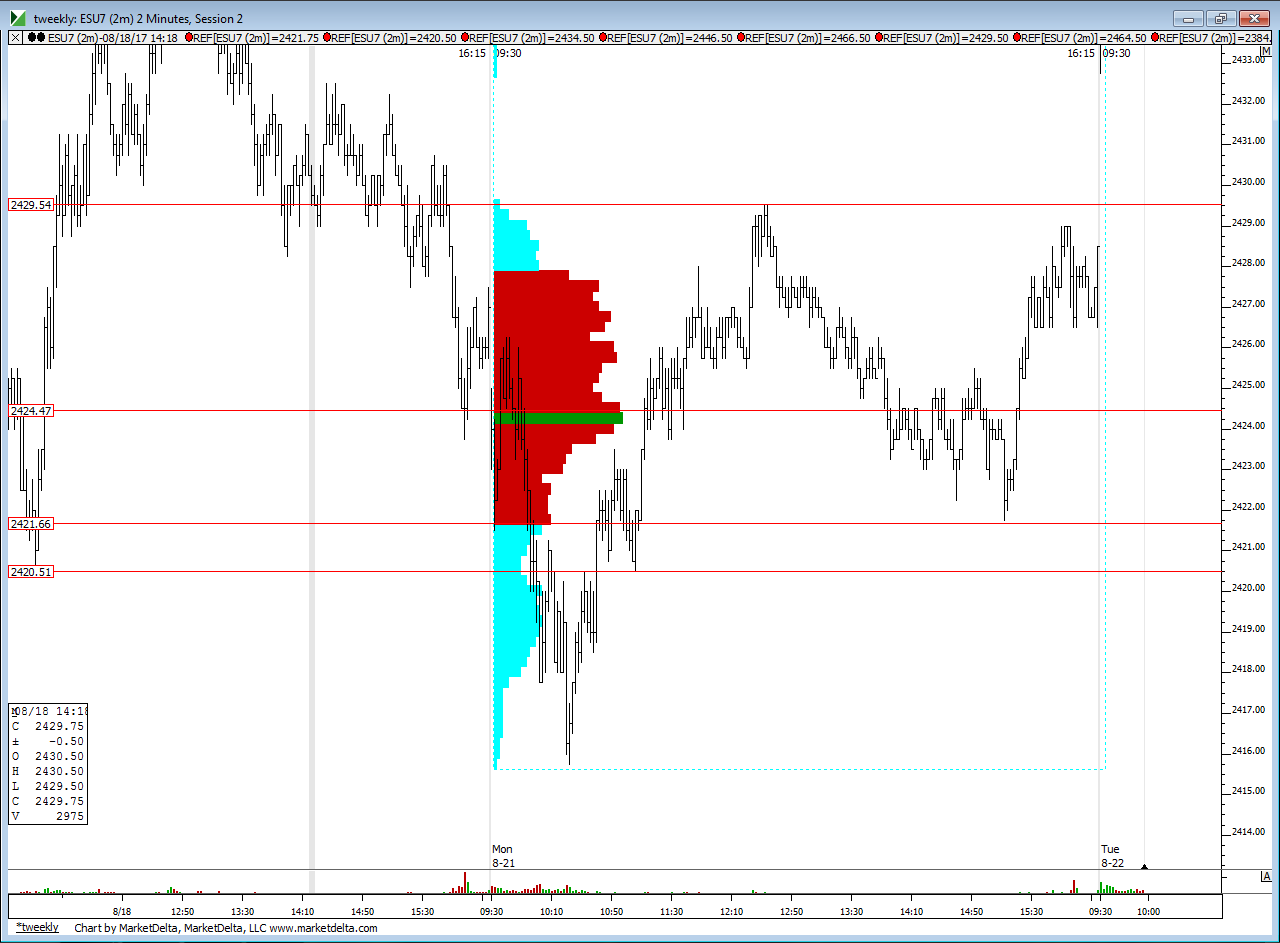

Edit: My favorite chart with a blow up of lines I'm using from 8-21 trade.......so I think we have some good lines and zones today

The big question will really be can we get above 8-21 high and hold above it...without that us long traders will have problems today

edit: First Mondays trade against last week.....Note the gap points at the 29.50 and up at 2432.75

edit: current overnight...Note POC of overnight is right at 30 area....proves traders are interested in that gap oint

Edit: My favorite chart with a blow up of lines I'm using from 8-21 trade.......so I think we have some good lines and zones today

The big question will really be can we get above 8-21 high and hold above it...without that us long traders will have problems today

made a bunch of edits to include charts...keep in mind we are still in last weeks range but today we will open below last weeks Value area...I plan to sell puts this morning and day trade to longside only from 25 - 27 area first....no add ons today...no averaging in....just winning trades or small losses and I am not afraid to try multiple times in my predefined zones

If cash goes to 2421 that will be 1.5 SD's to downside today....so if our 25 - 27 fails us then I think the 21 area will give us something

if you got the long it is best to take something near that 8 - 21 high as a firsttarget

going flat on all runners at 32.25 prints....just too close to that possible " Turn em back down point" and midpoint is one or two tics away

2444 cash close - so 15 point one SD down brought us to 2429....low so far today is 2428.20....very cool!

how my option trade did.....I find the hardest thing about making these trades is doing both at the same time.....so I am buying ES daytrades as I am selling puts....look at the time stamp....seems like the battle for today will be fought between our 33 - 34 zone and the 29.50.....so basically the gap zone ...and I want no part of this now

also notice that I wasn't willing to just sell "naked " puts today...so I did this as a credit spread so loss is limited in case we had the atomic flush down.......and kept it small.......most probably know how spreads work so I won't go into that......with Puts and fear in the market you can still collect good cash ( options players like to say "premium" for some reason) with spreads.....

keep in mind that we only had one TPO print at last weeks va low...so expecting the 37 area to be tested again at some point is wise....I would think that for today 42 - 45.50 might cap any up move ...anyway if you find a short u might keep that va low as a target in mind

I'm heading out for today but I think it's very suspicious that they blew through yesterdays low ( which happened to be to be the S1 level and have not yet REPRINTED that.....now if we put the weekly VA concept into play then I still think sells off the 42 - 45 area could still work today...I'll leave on that note today....hope it all play s out

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.