ES10-11-22

Seasonals and cycles have been doing there job thru bloody September, and scary October. Like Buffet says " buy when others are fearful. I dont think we`re there yet, but we`re getting close. Review past posts and you see the aggregate seasonals , midterm seasonals, and 4 year " sweet spot" are soon turning straight up for the November-December time period. Ive showed where one year from entering a bear mrkt. we are 20-22% higher. Heres another little tidbit to show that this late 2022 period could be a great buying oppurtunity. Light at the end of the tunnel? Anytime in the past 70 years when the market was down 25% (as we are now) , 3 years later we were ALWAYS much higher (somewhere north of 35%) and 5 years later the returns are stellar!

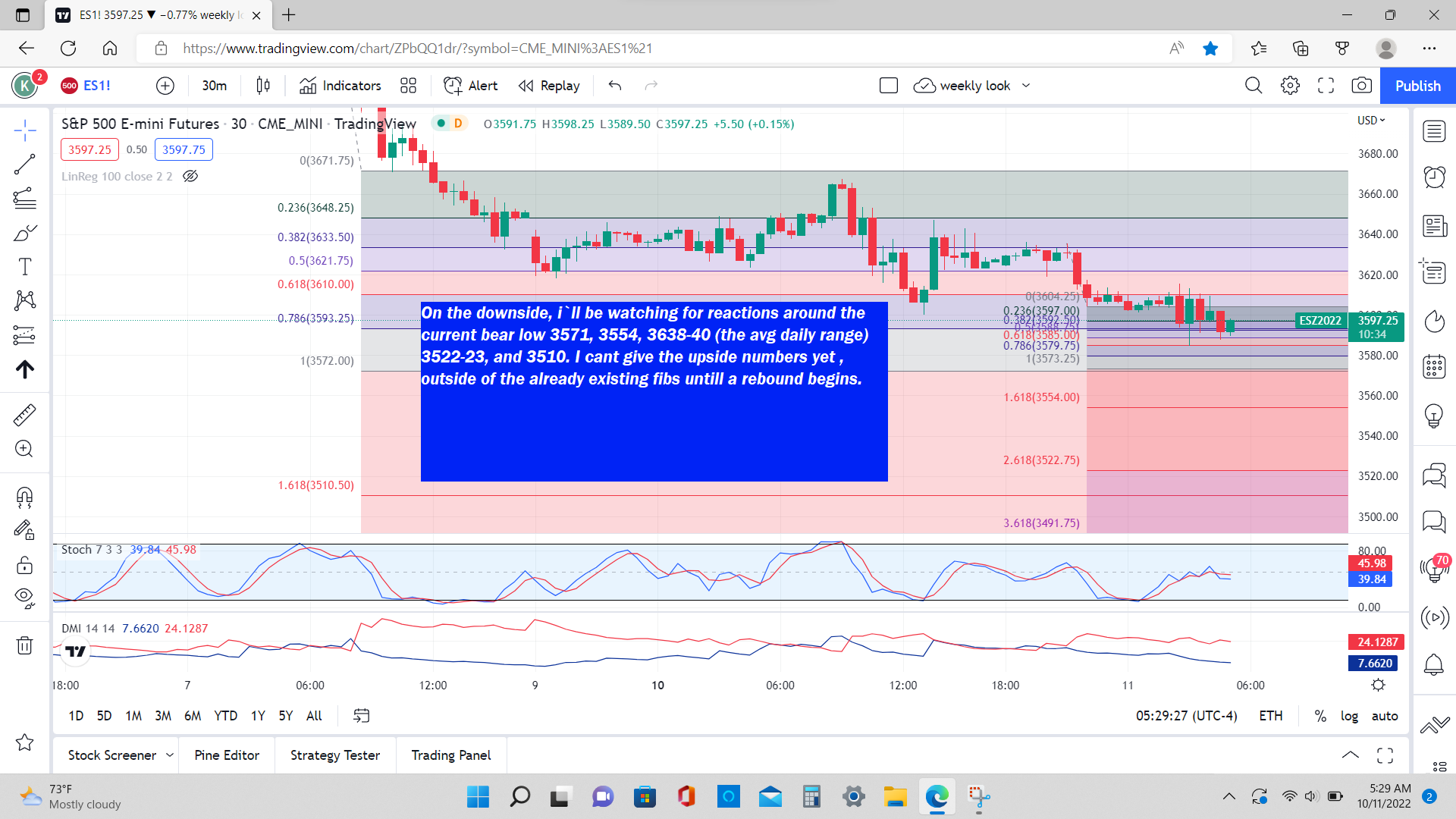

Who cares about the macro stuff , right? Traders want to know about the next few hours. Currently we are in a negative posture as we proceed to the open.

trying to sell 3610...probably too late

now on a sell (30 min).. and indicators have room to move! Black avg of cumulative ticks is around -600

i`ll be a seller at 3599.75

thats why i use an initial stop of 10 points... one tick away! Iguess i should bail out at breakeven or close but ive gone this far so i will hold short for now.

suopped and watching

I willt try again at 3622. if it gets there

From Stocktraders Almanac: Best Six Months Up 18-0 Midterm Years - Going back to 1950 the Best Six Months has is best performance from November of the Midterm year to April of the Pre-Election year, by a factor of three. And none of the other years of the 4-year cycle had zero losses.

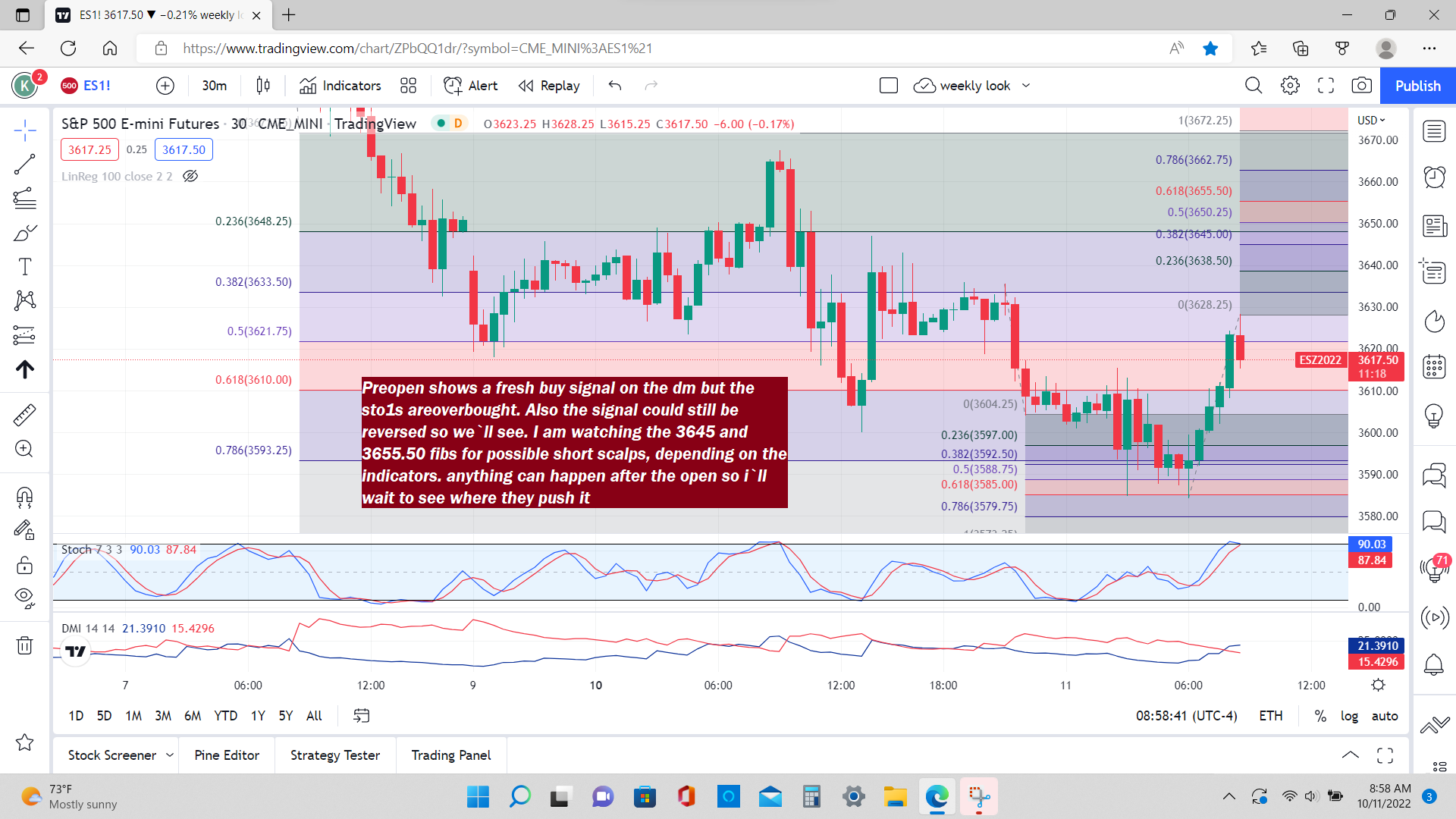

stopped out for a 7 point loss. The es just broke a small trendline and ticks remain strong here so bulls have more power than i thought.And of course the Mon-Tues low could already be in.

Imust say the rebound from the Mon-Tues low has been impressive, but we`ll see if ppi affects it tomorrow. In the meantime im content to watch although any move down to 3617 gets me long.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.