ES 10-18-22

.... 2 more days and we hit the avg bear market in terms of length, but not quite to the avg % decline yet. Of course this doesnt reflect whether we enter a recession or not, just the avg of all bears.

All of thiis data and a ton more i have posted the last few weeks , doesnt assure the bear market has ended but simply indicates it could be time for a substantial rebound imho

exiting my long at 3640 cause i got stuff to do soon... interesting tid bit here..." Through trading day #195 of the year, the S&P 500 is down more than 20%. There have been five other years with this large of a decline through this much of the year. Three of those didn't see a lower close, another a short and modest decline. All showed gains over the next year. " Coutesy Quantifiable Edges

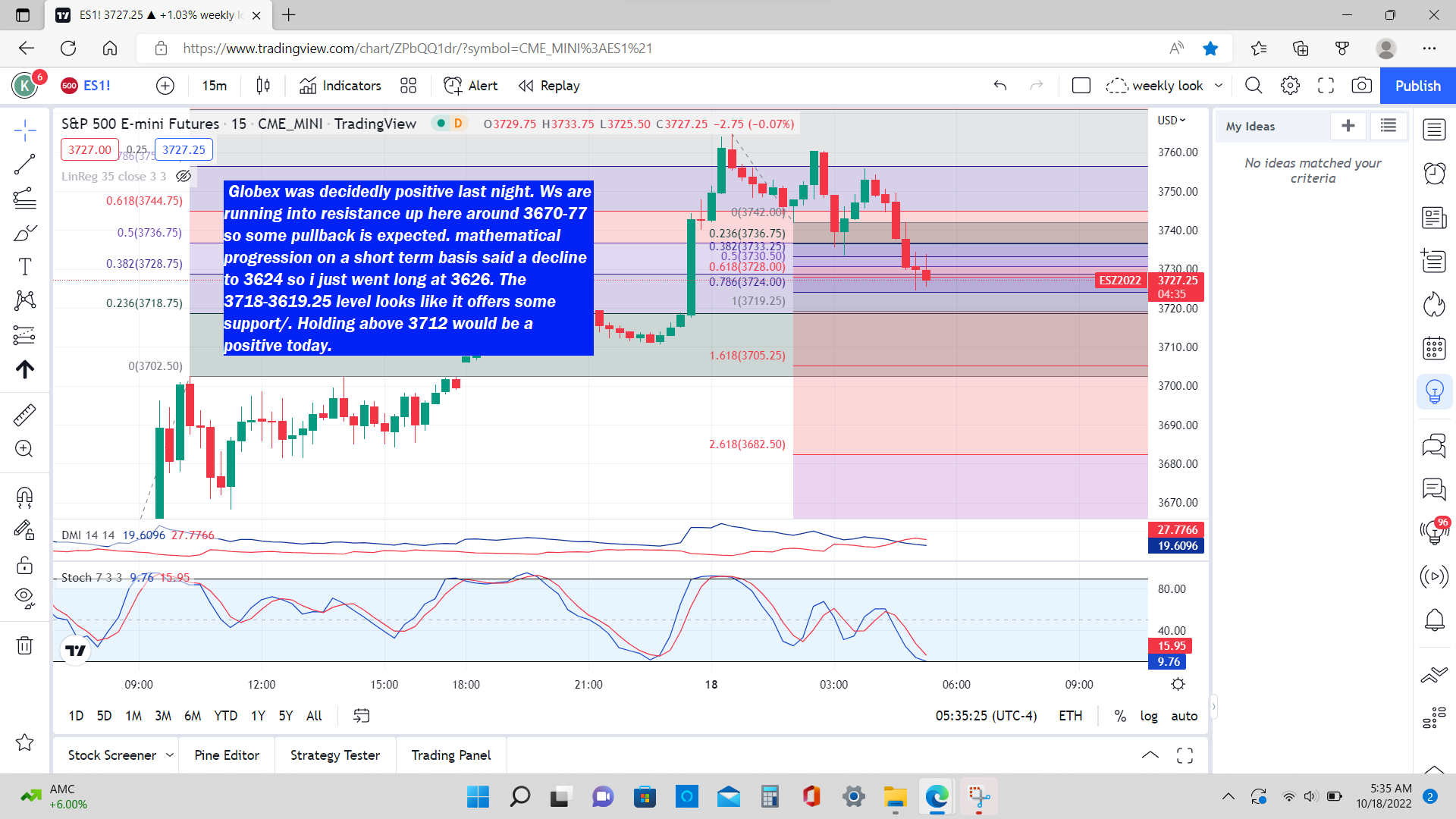

This resistance area above 3770 might be a good short scalp but i`ll wait for the avg daily range before i sell again (3813 or higher) A good decline and i`ll be a buyer

ill try a long scalp at 3757

I `m out. minus 7 points there .

Where or where to get long ...here? 3745 3728, or wait for 3715?

Guess i`ll try 3728

i really wish i had a runner! Gotta go...C Ya!

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.