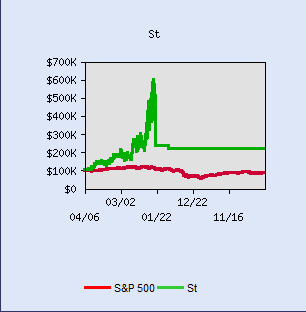

Collective2 - Six Sigma Trading

Original title for this thread: Zero losses year to date - eminis

Our trade system has produced only positive trades year to date with an estimated 14% return. Data guaranteed.

sixsigmatrading.com (site currently not available)

Our trade system has produced only positive trades year to date with an estimated 14% return. Data guaranteed.

sixsigmatrading.com (site currently not available)

Thanks for the info. Here are a couple of excerpts from you web site:

Perhaps you can tell us more about your product. Your web site only has 3 (?) pages and not much info about the product.

For example, do you produce trade signals to subscribers? Or managed other peoples money using this strategy?

quote:and

Six Sigma was invented by Motorola, and it is now a key component of the business model for many corporations. If you want to outrun your competitors by a mile, you will use Six Sigma. Through the use of powerful statistical tools and analysis, almost anything can be streamlined for success and efficiency. By definition, it is the final goal to achieve only 3.4 defects per 1 million opportunities. The bottom line is that the Six Sigma process reduces error and waste for the ultimate goal of perfection.

quote:

Hypothetical account balance below is an accounting result based on initial capital of $20,000 on Jan 1, 2006 and trading 1 contract per $20,000 using Six Sigma signaling data year to date.

Hypothetical balance is updated on the first of each month.

$22,850

Perhaps you can tell us more about your product. Your web site only has 3 (?) pages and not much info about the product.

For example, do you produce trade signals to subscribers? Or managed other peoples money using this strategy?

How many trades has your system traded to date? i.e. in the first quarter (3 months) of this year...

There is a little more information if you follow the link at the bottom of the services page. The system is available on a subscription basis. Daily e-mails are sent sometime after market close and before the next day open (overnight trading is irrelevent on the system) outlining any changes. Most days will see no changes as the system only generates about 4 signals on average per month. Thus we have had about 12 trades year to date, but none have shown losses on closing the trade. Almost 60 S&P index points have been gained year to date. On a basis of $20k capital and one contract per trade, that's a 14% return in 3 months on closed trades.

The system is designed for perfection, thus there are fewer trade signals. The ultimate goal in developing this system was in producing something which yielded 100% accuracy rather than getting 20 scalp signals a week and making profit on 70% of them. Perfection in timing provides for better long term growth and consistancy, especially when compounding results. It was also designed for the average person in mind and one does not have to sit in front of a computer all day waiting for signals that are only good for a few moments. Because these are based on higher time frame patterns, signals are slower to develop and thus trade signals and targets can be generated hours and in some cases days in advance. The key is in the filter technique which is very precise because entries are very specific and if not achieved, signals are canceled. Better to wait for a sure thing than work yourself to death trying to scalp a few points every day.

I do not currently manage funds, but will entertain the idea if requested. However, the most I will accept is $300k as I am not a registered advisor and will need to stay under NFA non advisor limits. The goal in the future is to turn this into a hedge fund of course, but that is still years down the road.

Additional questions can be posted here.

The system is designed for perfection, thus there are fewer trade signals. The ultimate goal in developing this system was in producing something which yielded 100% accuracy rather than getting 20 scalp signals a week and making profit on 70% of them. Perfection in timing provides for better long term growth and consistancy, especially when compounding results. It was also designed for the average person in mind and one does not have to sit in front of a computer all day waiting for signals that are only good for a few moments. Because these are based on higher time frame patterns, signals are slower to develop and thus trade signals and targets can be generated hours and in some cases days in advance. The key is in the filter technique which is very precise because entries are very specific and if not achieved, signals are canceled. Better to wait for a sure thing than work yourself to death trying to scalp a few points every day.

I do not currently manage funds, but will entertain the idea if requested. However, the most I will accept is $300k as I am not a registered advisor and will need to stay under NFA non advisor limits. The goal in the future is to turn this into a hedge fund of course, but that is still years down the road.

Additional questions can be posted here.

quote:

Originally posted by daytrader

How many trades has your system traded to date? i.e. in the first quarter (3 months) of this year...

That certainly sounds like an interesting swing trade system - especially your approach to ultra-filtering.

You might want to get your results audited in real time. There are a number of ways that you can do that. There is a web site called Collective2 that ranks and audits trading systems but from personal use and what I've seen of 3rd party systems run on there the software has too many bugs and can't be trusted. Once they've sorted out the bugs and improved their user interface then their system might be usable.

Another way to audit your system is to post the trades to a forum such as this before they are taken and then have someone like myself confirm the trades and keep a tally for a month or so. I'll do that for you if you want.

If your system generates trades for any instrument then you can pick an obscure instrument such as the MC which hardly anyone trades and thereby not giving away info that your subscribers are already paying for.

Yet another idea: Email me the signals for 1 month and I will post each closed trade after it has closed and confirm the return on your system.

Good luck getting it audited.

You might want to get your results audited in real time. There are a number of ways that you can do that. There is a web site called Collective2 that ranks and audits trading systems but from personal use and what I've seen of 3rd party systems run on there the software has too many bugs and can't be trusted. Once they've sorted out the bugs and improved their user interface then their system might be usable.

Another way to audit your system is to post the trades to a forum such as this before they are taken and then have someone like myself confirm the trades and keep a tally for a month or so. I'll do that for you if you want.

If your system generates trades for any instrument then you can pick an obscure instrument such as the MC which hardly anyone trades and thereby not giving away info that your subscribers are already paying for.

Yet another idea: Email me the signals for 1 month and I will post each closed trade after it has closed and confirm the return on your system.

Good luck getting it audited.

If I understand correctly, your system generates about 4 trades per month.

Now how much is profit target on each trade and what is the draw down ?

Each trade is held for how many days?

THANK YOU

Now how much is profit target on each trade and what is the draw down ?

Each trade is held for how many days?

THANK YOU

Thanks...I'll consider some sort of audit solution for validation without giving away too much. The signals are enhanced specifically for S&P index futures, so best to stick with the optimum derivative.

Pakeez

To date, 57 S&P index points were taken going into the end of March on closed trades. Another opened late in Mar was just closed today for another 11 points for 68 total so far. With roughyl 4 trades per month, figure about 12 trades this year so far. On 1 contract at a $1 a side, you're only looking at about $25 in trade expenses on 68 index points which is $3800 profit. The long term average is about a 5% gain per month and trading only 1 contract per $20k in capital. Drawdown is minimal for the most part because of the high filter standards. Generally, entry is made within a few index points of an optimum turn about 90% of the time but I have seen it go as far as 10-15 points drawdown to entry. Turning points in the market are like rubber bands and the further you stretch a turn past optimum entry, the faster it springs back. Thus, even on the rare occasion when it may go 10-15 points against you, it always springs back to a gain within the next day or so. The system filters can detect this as the market will sometimes attempt to shake out players with rare extreme moves only to leave them behind soon after. Anyway, extreme situations are usually not the norm.

Gains per trade depends on the strength of the signal and market conditions...it can be as little as an even trade because the turn is weak and you end up getting stopped out for zero or it can be as much as 20-30 index points. Length of time held also varies from a day to as much as 2 weeks. The goal is consistancy in positive or neutral gains. How long it takes and how much those gains are at any given time is irrelevant as long as the success rate stay at or near 100%.

To date, 57 S&P index points were taken going into the end of March on closed trades. Another opened late in Mar was just closed today for another 11 points for 68 total so far. With roughyl 4 trades per month, figure about 12 trades this year so far. On 1 contract at a $1 a side, you're only looking at about $25 in trade expenses on 68 index points which is $3800 profit. The long term average is about a 5% gain per month and trading only 1 contract per $20k in capital. Drawdown is minimal for the most part because of the high filter standards. Generally, entry is made within a few index points of an optimum turn about 90% of the time but I have seen it go as far as 10-15 points drawdown to entry. Turning points in the market are like rubber bands and the further you stretch a turn past optimum entry, the faster it springs back. Thus, even on the rare occasion when it may go 10-15 points against you, it always springs back to a gain within the next day or so. The system filters can detect this as the market will sometimes attempt to shake out players with rare extreme moves only to leave them behind soon after. Anyway, extreme situations are usually not the norm.

Gains per trade depends on the strength of the signal and market conditions...it can be as little as an even trade because the turn is weak and you end up getting stopped out for zero or it can be as much as 20-30 index points. Length of time held also varies from a day to as much as 2 weeks. The goal is consistancy in positive or neutral gains. How long it takes and how much those gains are at any given time is irrelevant as long as the success rate stay at or near 100%.

quote:

Originally posted by pakeez

If I understand correctly, your system generates about 4 trades per month.

Now how much is profit target on each trade and what is the draw down ?

Each trade is held for how many days?

THANK YOU

Thanks sst. What is the size of the stop loss used?

I hate to keep using this line, but once again, it depends on the market conditions, signal strength, size of the pattern, etc. Any good system needs to be adjustable to changing market conditions. A specific stop cannot be defined until the trade itself is defined.

quote:

Originally posted by daytrader

Thanks sst. What is the size of the stop loss used?

Okay - on the ES - what is the largest and smallest stop that you've seen/used so far in the last 3 months?

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.