Collective2 - Six Sigma Trading

Original title for this thread: Zero losses year to date - eminis

Our trade system has produced only positive trades year to date with an estimated 14% return. Data guaranteed.

sixsigmatrading.com (site currently not available)

Our trade system has produced only positive trades year to date with an estimated 14% return. Data guaranteed.

sixsigmatrading.com (site currently not available)

all sounds pretty theoretical to me...anyone using real money on this ? would love to see those live trading results as compared to the hypothetical results being shown....

There is a difference between being right most of the time and successful trading. A vendor promoting themselves with a high win percentage, above 80%, is feeding our desire to be right. The problem here of course is that with these wide stops and large drawdowns, you will be spending a lot of time underwater waiting for these trades to turn around and let you out at a profit. Unless you can just walk away from the trades and let nature run it's course, this is a very stressful and unrealistic trading method and lifestyle.

To survive in trading you need to make more money than you lose, on average. Using the information provided by DT in this thread we have:

avg win $2894, avg loss $8240, win% = 86.5%

assuming no break-even trades, this hypothetical system produced a positive expectancy of $1,390, thus in theory the system could be profitable, assuming you can withstand the heat along the way...

(.865 * $2894) - ((1-.865) * $8240) = $2,503 - $1,112 = $1,390

...think I will stick with my boring old low win% + small loss + tiny drawdown method for the time being

There is a difference between being right most of the time and successful trading. A vendor promoting themselves with a high win percentage, above 80%, is feeding our desire to be right. The problem here of course is that with these wide stops and large drawdowns, you will be spending a lot of time underwater waiting for these trades to turn around and let you out at a profit. Unless you can just walk away from the trades and let nature run it's course, this is a very stressful and unrealistic trading method and lifestyle.

To survive in trading you need to make more money than you lose, on average. Using the information provided by DT in this thread we have:

avg win $2894, avg loss $8240, win% = 86.5%

assuming no break-even trades, this hypothetical system produced a positive expectancy of $1,390, thus in theory the system could be profitable, assuming you can withstand the heat along the way...

(.865 * $2894) - ((1-.865) * $8240) = $2,503 - $1,112 = $1,390

...think I will stick with my boring old low win% + small loss + tiny drawdown method for the time being

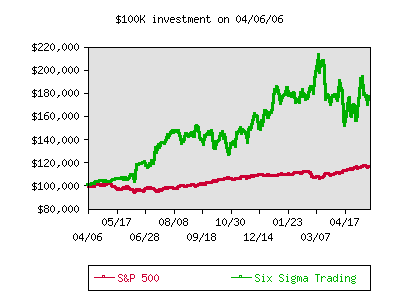

I've just checked Six Sigma on Collective2 and thought that I would update this topic. The current position reading on Collective2 states:

If I understand that correctly then the current position has an $86,660 draw down.

If you look at the last 10 trades that were taken you will see that 2 of them had a "drawdown & risk" of EXTREME and 3 with VERY HIGH. So 50% of the recent trades carried very high or worse risk.

My opinion of this system hasn't changed. I still think that with this type of risk it's a "shooting star" style system that will provide those spectacular results until it crashes and burns out. If my interpretation of the current position is correct then I believe that if you had to close out that loss of $86,660 today then the system would be back to its starting equity - but I'm not so sure that I've understood it correctly.

Started Buy Power Cash Long Eqty Margined Open P/L

$100,000 $145,313 $265,916 ($13,002) $107,600 ($86,660)

If I understand that correctly then the current position has an $86,660 draw down.

If you look at the last 10 trades that were taken you will see that 2 of them had a "drawdown & risk" of EXTREME and 3 with VERY HIGH. So 50% of the recent trades carried very high or worse risk.

My opinion of this system hasn't changed. I still think that with this type of risk it's a "shooting star" style system that will provide those spectacular results until it crashes and burns out. If my interpretation of the current position is correct then I believe that if you had to close out that loss of $86,660 today then the system would be back to its starting equity - but I'm not so sure that I've understood it correctly.

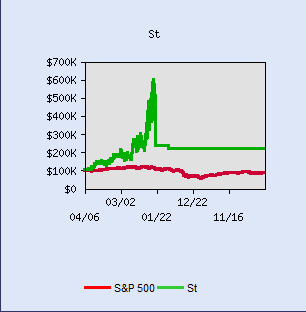

Portfolio current value is $146,203 (after typical commissions). On 8/17/07 he closed out a position that he'd been carrying for almost a month which lost $123,875. It looks like he opened a position in the ES long at 1492.50 on 7/20/07 at 1492.50 and continued to scale in until 8/17/07 and down to 1399.5 until he was loaded with 290 contracts and then finally stopped himself out losing 48.6% of his portfolio's value.

Maybe this system will work maybe it won't. Overall he's still showing a good profit but I think that this risk is exceptionally high and all you need is 2 back to back losing trades like that and bang goes 97.2% of your capital.

I wonder how many traders reading this have the capacity to scale up to 290 E-mini S&P500 contracts?

Maybe this system will work maybe it won't. Overall he's still showing a good profit but I think that this risk is exceptionally high and all you need is 2 back to back losing trades like that and bang goes 97.2% of your capital.

I wonder how many traders reading this have the capacity to scale up to 290 E-mini S&P500 contracts?

Here's what I'd worry about. There is some exogeneous market shock event like 9/11, and you have an instantaneous drop of say 150 points, instead of the several days it took for a drop of that amount after the reopening in '01. Don't think that couldn't happen. With 290 contracts on that would be an instant loss of $2,175,000 if my math is correct. Think 1987 if you think things can't happen quick. 9/11 was fairly mild in that the open was barely down, and there was time to react. Next time it may not be so nice. Lately we've seen the ES move 50 points like it was nothing. 150 on a major event would likely be way too conservative. Even a tiny 50 point market shock event would be $725,000. In fact, if the portfolio was at $146,000, the $ per point at 290 contracts is $14,500, so it was 10 points from being busted anyway, a move which the ES can do lately before you blink.

And speaking of that, something just came to mind. What is the margin on 290 contracts? I have no idea who the person in this thread is, in fact, I just read this tonight and thought it had some interesting concepts to discuss, but does he have an exchange membership and better margin rates? If you hold overnight you can't get those nice $500 (or even $300) way overleveraged daytrading rates. The exchange minimum right now is $2,800 for overnight. To do 290 contracts you'd need $812,000. With $146,000 one could only do 52 contracts and a margin call would be a tick away (figuratively).

So, anyone attempting to duplicate this (how not recommended is that?) would have to have a membership, as this isn't even remotely possible with regular margins. I'd like to know a bit more about how someone was getting $500 margin for overnight holds? Hang on, I just went and checked the Merc website and it says that members get the same $2,800, they just don't have to have the $3,500 initial that non-members do, it's the same $2,800 to open. So, unless there is something here I am missing, can anyone explain how this position was even possible? Am I missing something obvious? This just gets more curious by the minute.

And speaking of that, something just came to mind. What is the margin on 290 contracts? I have no idea who the person in this thread is, in fact, I just read this tonight and thought it had some interesting concepts to discuss, but does he have an exchange membership and better margin rates? If you hold overnight you can't get those nice $500 (or even $300) way overleveraged daytrading rates. The exchange minimum right now is $2,800 for overnight. To do 290 contracts you'd need $812,000. With $146,000 one could only do 52 contracts and a margin call would be a tick away (figuratively).

So, anyone attempting to duplicate this (how not recommended is that?) would have to have a membership, as this isn't even remotely possible with regular margins. I'd like to know a bit more about how someone was getting $500 margin for overnight holds? Hang on, I just went and checked the Merc website and it says that members get the same $2,800, they just don't have to have the $3,500 initial that non-members do, it's the same $2,800 to open. So, unless there is something here I am missing, can anyone explain how this position was even possible? Am I missing something obvious? This just gets more curious by the minute.

Some good points Jim. I think that the system is designed with a starting capital of $100,000 and when he hit that loss it would have been sitting at about $290,000 so his ratio would have been $1,000/contract held over the month (at the end of his scale ins) so this doesn't seem very realistic and way over-leveraged anyway.

Still, I want to know how anyone could get $1,000 overnight margin, as I can't find that available anywhere. I just checked the main places with $500 and even $300 daytrading margin, and they require full exchange minimum for overnight. I did a Google search and couldn't find any place not following the exchange minimum for overnight. So, my point is, it would not be possible in the real world to construct the stated position? Is this a hypothetical system, in that it wasn't actually done, and hence real world margins and margin calls could be ignored? Does whatever that 'tests' these systems also keep an eye on real world things like margin and margin calls? Excuse my ignorance, since I have not been following any of this, being 100% discretionary myself.

It must be hypothetical. I haven't spent enough time at Collective2 to work out how this aspect of it works.

I'm just wondering what good it is to ponder a system and its results if they can't actually be done based on the actual margin. I've never been to Collective2, and I have no idea what they do or how it works, but if any process that follows a system doesn't filter out parameters that aren't actually physically possible it doesn't seem like it is a useful tool. I'm wondering now how many systems have been tested, by any process, and shown to be profitable, and weren't actually possible based on margin? I wonder if anyone has 'caught' this concept before?

There are many errors on the Collective2 system and I'm not sure if they're really that interested in correcting them. For example, one of the vendors argued that a trade signal that he issued was issued by mistake and asked them (Collective2) to remove it (it obviously lost) and they did. I pointed out that if the vendor had a winning trade by mistake they wouldn't have ask for it to be removed from the system but they weren't really interested in my comment. I think that the site relies on many "performing" systems so they are not as concerned about it being accurate.

There's another site called Covestor that's run along similar lines but that's more of an auditing system for traders who want to be fund managers while Collective2 is aimed at futures traders.

There's another site called Covestor that's run along similar lines but that's more of an auditing system for traders who want to be fund managers while Collective2 is aimed at futures traders.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.