ES Friday 9-11-15

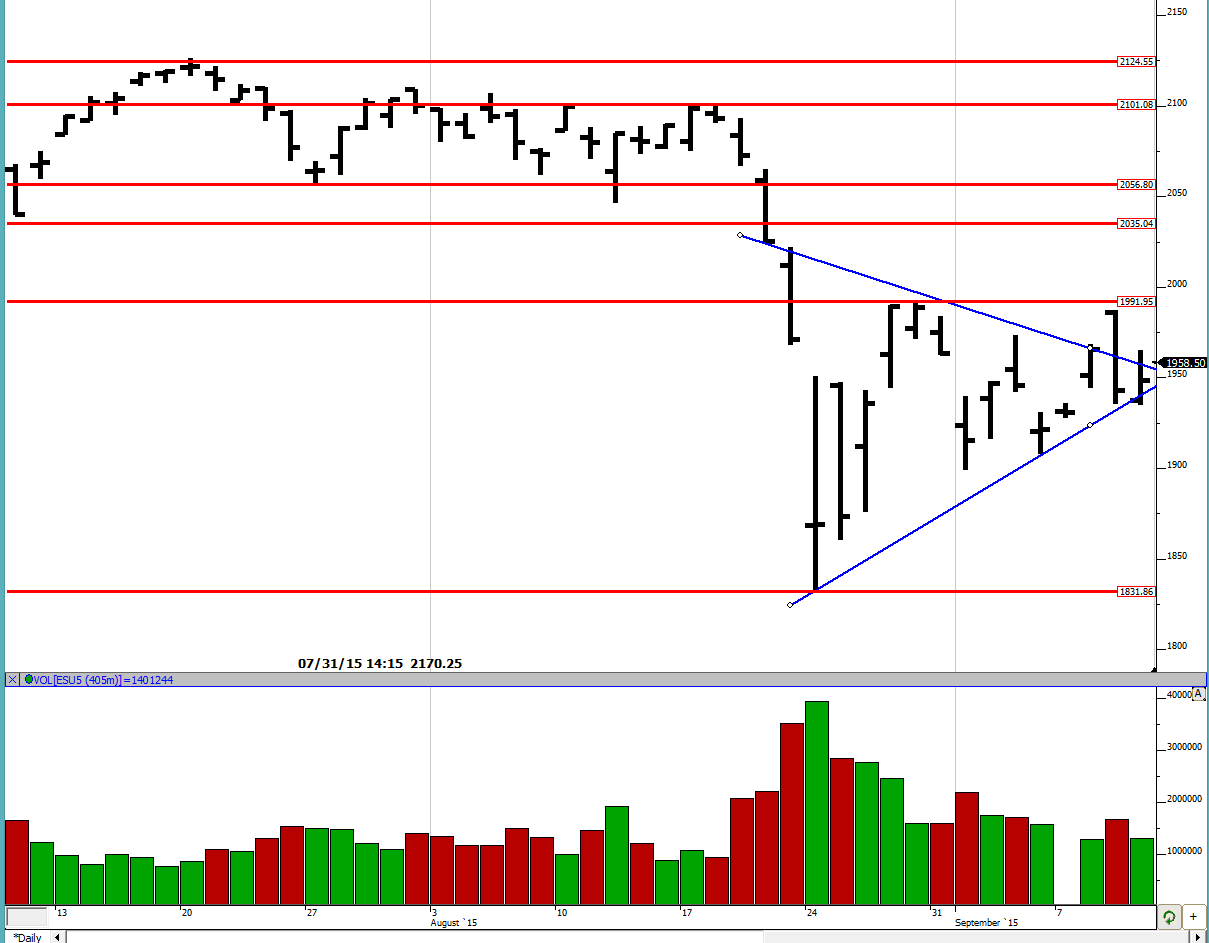

Good evening to all. I am still on the Sept contract and will roll over on Monday so that it is a clean break over the weekend. Today we stayed within the range with the markets looking outside Wednesday's lows and that was rejected swiftly. The buyers still have some juice left. Tomorrow could likely provide us some clear direction. We can see that today's close was within the triangle which is now quite compressed. It is either going to be 1900 (and then maybe 1831) or back up to 1991 (and then possibly more). Continue to be in balance. As a matter of fact, we can see that we are in a 2 day balance with today's and YD's lows being close to each other. Stay flexible.

Greenies: 1894, 1923.25, 1938.5, 1950, 1970, 1981, 1986, 1995, 2014.25, 2053.25, 2077.75

Profile:

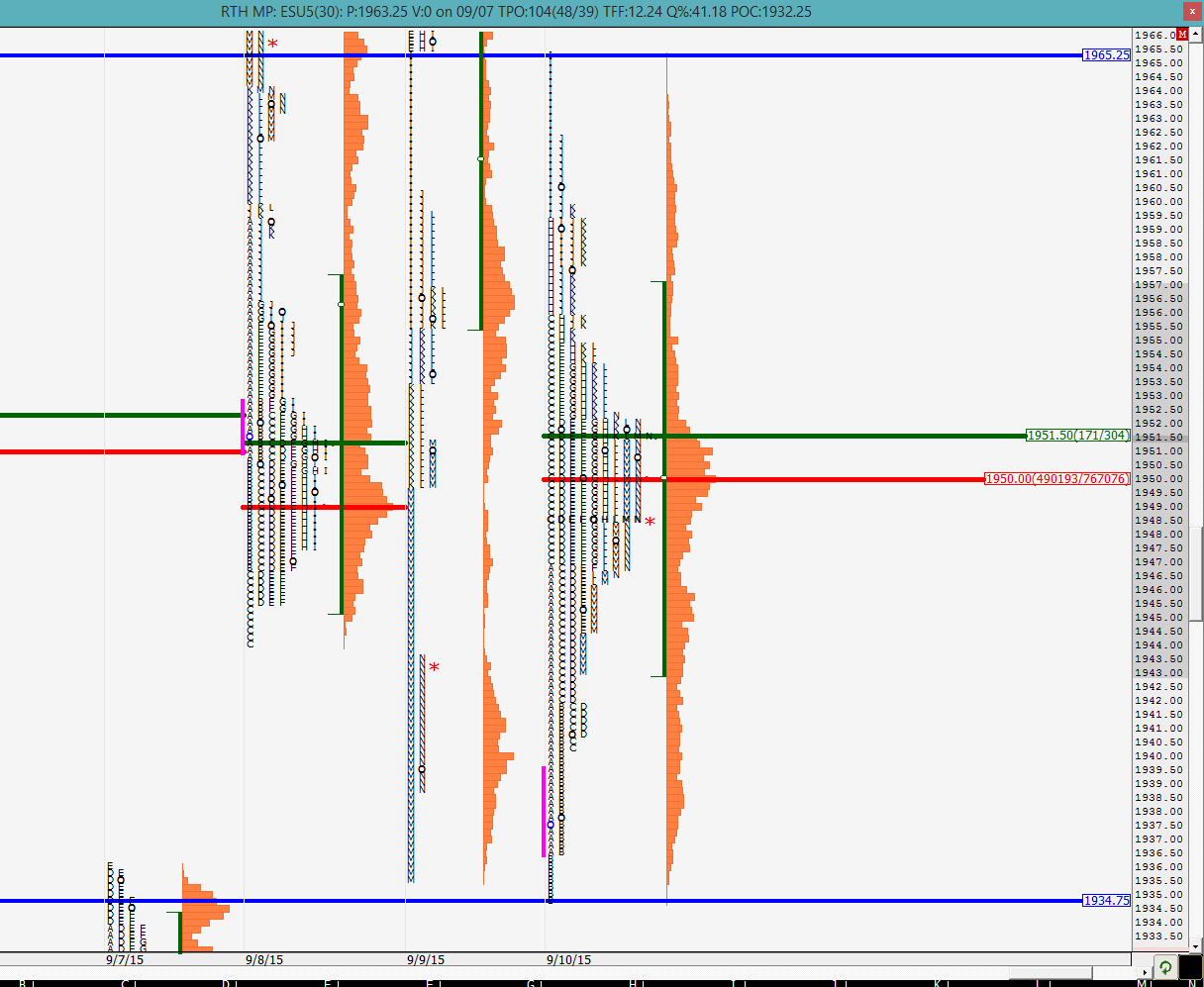

We can see how the high of the day at 1965.25 was right at the end of the single prints. We still have 2 more distributions on 9/9 that are unvisited. Also we see that today we had a fairly prominent POC and the VPOC right at the mid-pt of RTH range. Also we can see a nice bell shaped curve to the day which usually indicates a balancing day. The 2-day balance has a low of 1934.75 and a high of 1987.5, with the high also being close to the larger balance area high of 1991. Remember, we have seen rejection twice from 1991 which means that there are a lot of stops placed right above it. There could be some stop hunting coupled with buy stops (to initiate a position) there so the move could be rather dramatic. Be careful of trying to fade this area again because the membrane is much weaker now.

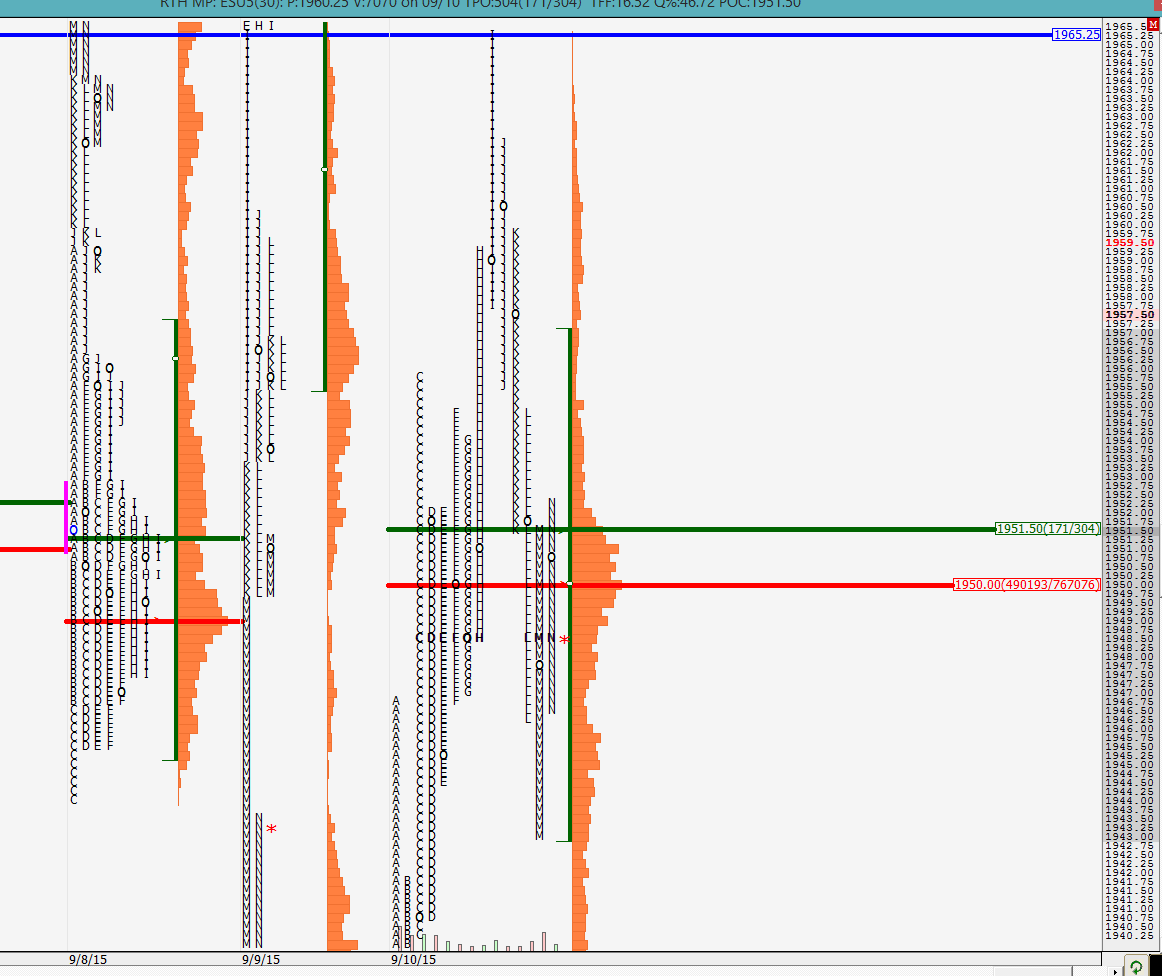

The split profile simply shows the balancing day playing out. We went down, then back up, down and up again. We can kind of see the "oscillations" getting smaller. I find this very fascinating mainly due to my engineering background.

We shall see how the O/N plays out and try gauging the RTH session tomorrow. PPI report at 8:30 am ET time. Good luck to all.

Greenies: 1894, 1923.25, 1938.5, 1950, 1970, 1981, 1986, 1995, 2014.25, 2053.25, 2077.75

Profile:

We can see how the high of the day at 1965.25 was right at the end of the single prints. We still have 2 more distributions on 9/9 that are unvisited. Also we see that today we had a fairly prominent POC and the VPOC right at the mid-pt of RTH range. Also we can see a nice bell shaped curve to the day which usually indicates a balancing day. The 2-day balance has a low of 1934.75 and a high of 1987.5, with the high also being close to the larger balance area high of 1991. Remember, we have seen rejection twice from 1991 which means that there are a lot of stops placed right above it. There could be some stop hunting coupled with buy stops (to initiate a position) there so the move could be rather dramatic. Be careful of trying to fade this area again because the membrane is much weaker now.

The split profile simply shows the balancing day playing out. We went down, then back up, down and up again. We can kind of see the "oscillations" getting smaller. I find this very fascinating mainly due to my engineering background.

We shall see how the O/N plays out and try gauging the RTH session tomorrow. PPI report at 8:30 am ET time. Good luck to all.

Good morning to all. My MarketDelta setup was acting up and I was forced to switch over to the Dec contract. I think the historical DTN data feed switches automatically but the real time does not until I do so. Therefore I get this weird mix up of things. Anyways, sorry for any confusion that I might cause. The O/N inventory is fairly balanced and I think we are going to keep chopping until the Fed meeting next week. I do not think there are going to be any big moves before then. Good luck to all.

we opened below the center of YD's bell and now attempting to get back to the center of it. that would provide resistance.

also the close is a tick below the VPOC/mid-pt of RTH

also the close is a tick below the VPOC/mid-pt of RTH

I have a suspicion that we are going to stay in this trading range until next Thursday's Fed meeting unless something dramatic happens

30 min VPOC at 1932.75 on the Dec contract

approaching the balance area low of the 2 day balance area. if there is no bounce here, there could be a sell off coming. 30-min VPOC not yet tested

through the center of YD's bell and now on the upper side. Since the bottom of the 2-day balance has been rejected so far, the destination trade is to the other end of the balance area.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.