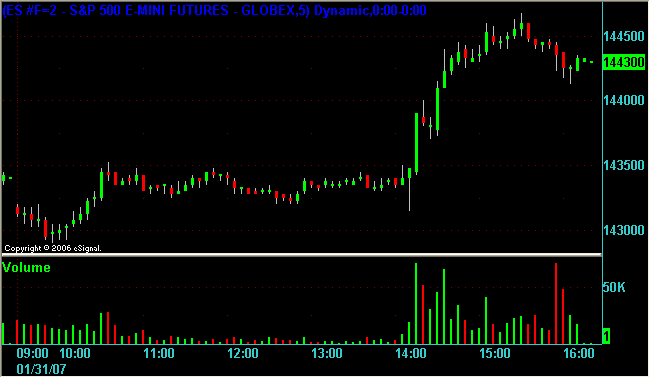

FOMC Fed Day 31 Jan 2007

quote:

Fed vice chairman Donald Kohn warned yesterday that it is too soon to become sanguine about inflation, notwithstanding an easing of price pressures. At a speech at the Atlanta Rotary Club, Kohn stated the recent drop in core inflation could reflect merely "one-time influences." His remarks indicate that the Fed retains its December outlook, when it labeled inflation its greatest concern and held short-term interest rates at 5.25%. Since December, manufacturing and business investment have weakened and inflation has been unexpectedly low, fueling speculation that in January, the Fed might announce that a rate increase is as likely as a cut. Kohn's comments suggest that such a neutral statement is unlikely. He expects the economy to accelerate this year, though the housing decline could deepen further. Kohn dismissed the concern that the inverted yield curve, which traditionally presages recessions, bodes ill for the economy. Overall, his prognosis is positive: "Conditions appear to be in place for a good year for the U.S. economy, one marked by growth that is moderate and sustainable and by inflation that will be lower than last year's."

From CBOT's Fed watch, 98% probability of no change so far.

quote:

Based upon the January 26 market close, the CBOT 30-Day Federal Funds futures contract for the February 2007 expiration is currently pricing in a 2 percent probability that the FOMC will decrease the target rate by at least 25 basis points from 5-1/4 percent to 5 percent at the FOMC meeting on January 31 (versus a 98 percent probability of no rate change).

Summary Table

January 24: 96% for No Change versus 4% for -25 bps.

January 25: 98% for No Change versus 2% for -25 bps.

January 26: 98% for No Change versus 2% for -25 bps.

January 29:

January 30:

January 31: FOMC decision on federal funds target rate.

Summary Table

January 24: 96% for No Change versus 4% for -25 bps.

January 25: 98% for No Change versus 2% for -25 bps.

January 26: 98% for No Change versus 2% for -25 bps.

January 29: 98% for No Change versus 2% for -25 bps.

January 30: 98% for No Change versus 2% for -25 bps.

January 31: FOMC decision on federal funds target rate.

January 24: 96% for No Change versus 4% for -25 bps.

January 25: 98% for No Change versus 2% for -25 bps.

January 26: 98% for No Change versus 2% for -25 bps.

January 29: 98% for No Change versus 2% for -25 bps.

January 30: 98% for No Change versus 2% for -25 bps.

January 31: FOMC decision on federal funds target rate.

The Federal Open Market Committee decided today to keep its target for the federal funds rate at 5-1/4 percent.

Recent indicators have suggested somewhat firmer economic growth, and some tentative signs of stabilization have appeared in the housing market. Overall, the economy seems likely to expand at a moderate pace over coming quarters.

Readings on core inflation have improved modestly in recent months, and inflation pressures seem likely to moderate over time. However, the high level of resource utilization has the potential to sustain inflation pressures.

The Committee judges that some inflation risks remain. The extent and timing of any additional firming that may be needed to address these risks will depend on the evolution of the outlook for both inflation and economic growth, as implied by incoming information.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; Timothy F. Geithner, Vice Chairman; Susan S. Bies; Thomas M. Hoenig; Donald L. Kohn; Randall S. Kroszner; Cathy E. Minehan; Frederic S. Mishkin; Michael H. Moskow; William Poole; and Kevin M. Warsh.

Recent indicators have suggested somewhat firmer economic growth, and some tentative signs of stabilization have appeared in the housing market. Overall, the economy seems likely to expand at a moderate pace over coming quarters.

Readings on core inflation have improved modestly in recent months, and inflation pressures seem likely to moderate over time. However, the high level of resource utilization has the potential to sustain inflation pressures.

The Committee judges that some inflation risks remain. The extent and timing of any additional firming that may be needed to address these risks will depend on the evolution of the outlook for both inflation and economic growth, as implied by incoming information.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; Timothy F. Geithner, Vice Chairman; Susan S. Bies; Thomas M. Hoenig; Donald L. Kohn; Randall S. Kroszner; Cathy E. Minehan; Frederic S. Mishkin; Michael H. Moskow; William Poole; and Kevin M. Warsh.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.