HELP! How to use FIB Retracement lines?

How do I use Fibanocci retracement lines?...not the theory behind it but...where do I start drawing and to where and how many points away etc...anybody know a real good PRACTICAL tuturial on this...not theory..but practical...thanks in advance...IncreaseNow!

The experts here on using Fibonacci are the crowd at Kane Trading. I suggest asking your question in there and see what advice they come up with. It sounds like you're looking for a primer on Fibonacci retracements and extensions. They would probably be able to suggest something good.

thanks DAYTRADING...appreciate you and your site...thanks

You're very welcome.

i am simply trying to say what is..jim kane's work is not a place to go for a basic primer on fibonacci..it is only for serious students who are willing to do the work.

roofer: Where would you suggest someone get their feet wet with Fibonacci?

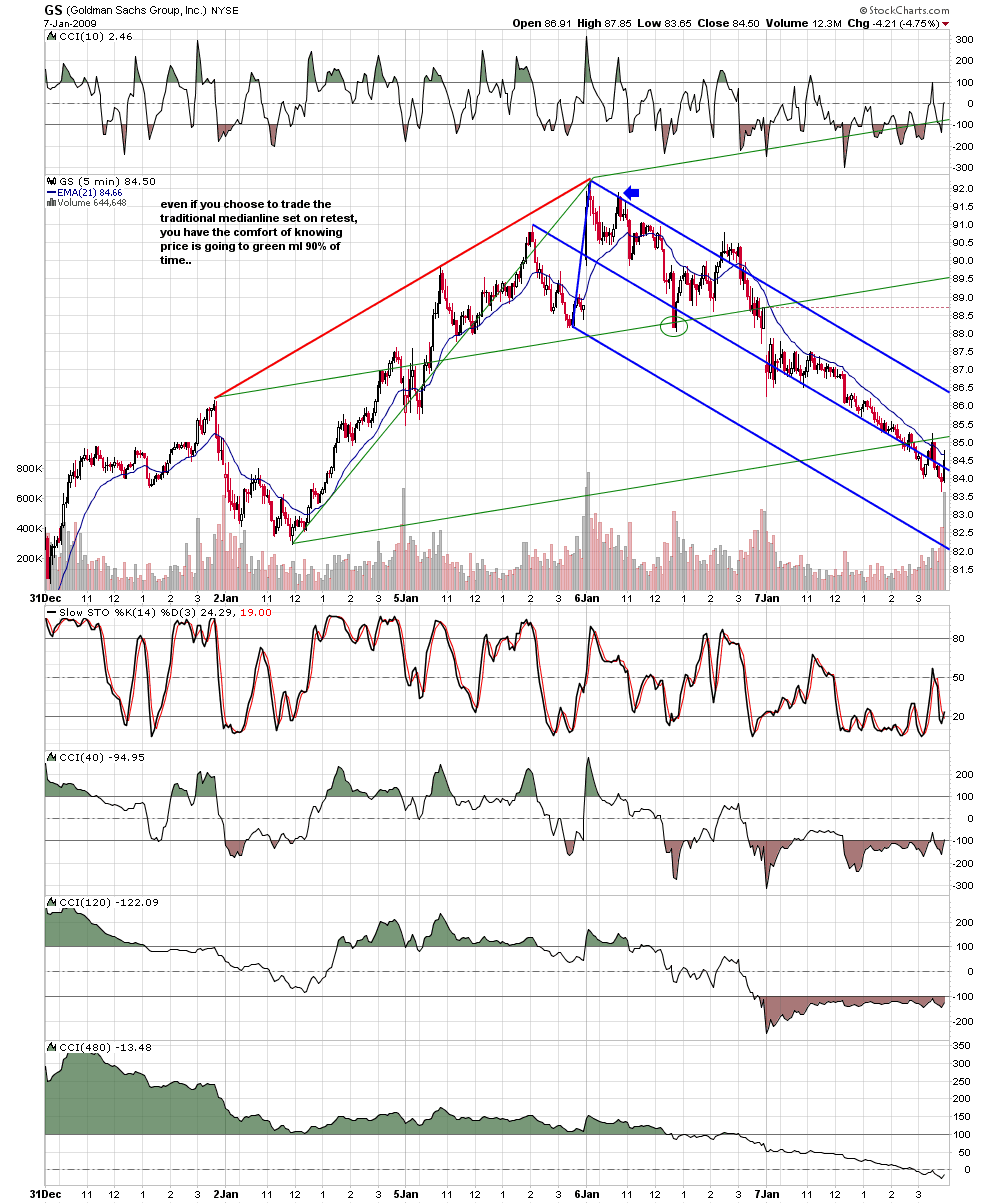

how do i answer that in a straight forward manner without doing what seems like a commercial?by speaking to my own experience and showing an example.i have traded fib for years. jim and i became friends because we both spend thousands of hours researching our tools.what he discovered stunned even me.at his forum we now use fib that jim derived that is in no other literature on fib combined with a set of tools that is shown no where else except in jim's writings.it is legitimate to ask for an example...at the forum i am known for my love of the .886 fib that i learned from jim. i rarely take a trade anymore that does not include that number.yet that number is NOT EVEN MENTIONED in the books by the well knon fib writers. so i do not know how i can suggest a primer when they don't even mention the dozens of powerful tools in jim's work that make fib trading clear.here is an example.... to most traders this price action was un tradeable slop in GS...but to a kane trader this was crystal clear... each vertical line represents a turn at the .886 with a stop 10 cents beyond the swing measured off of when sto above 78 or below 22...OBVIOUSLY the GS traders are aware of the .886...but they are not writing books and letting you in to what's going on as jim kane has..

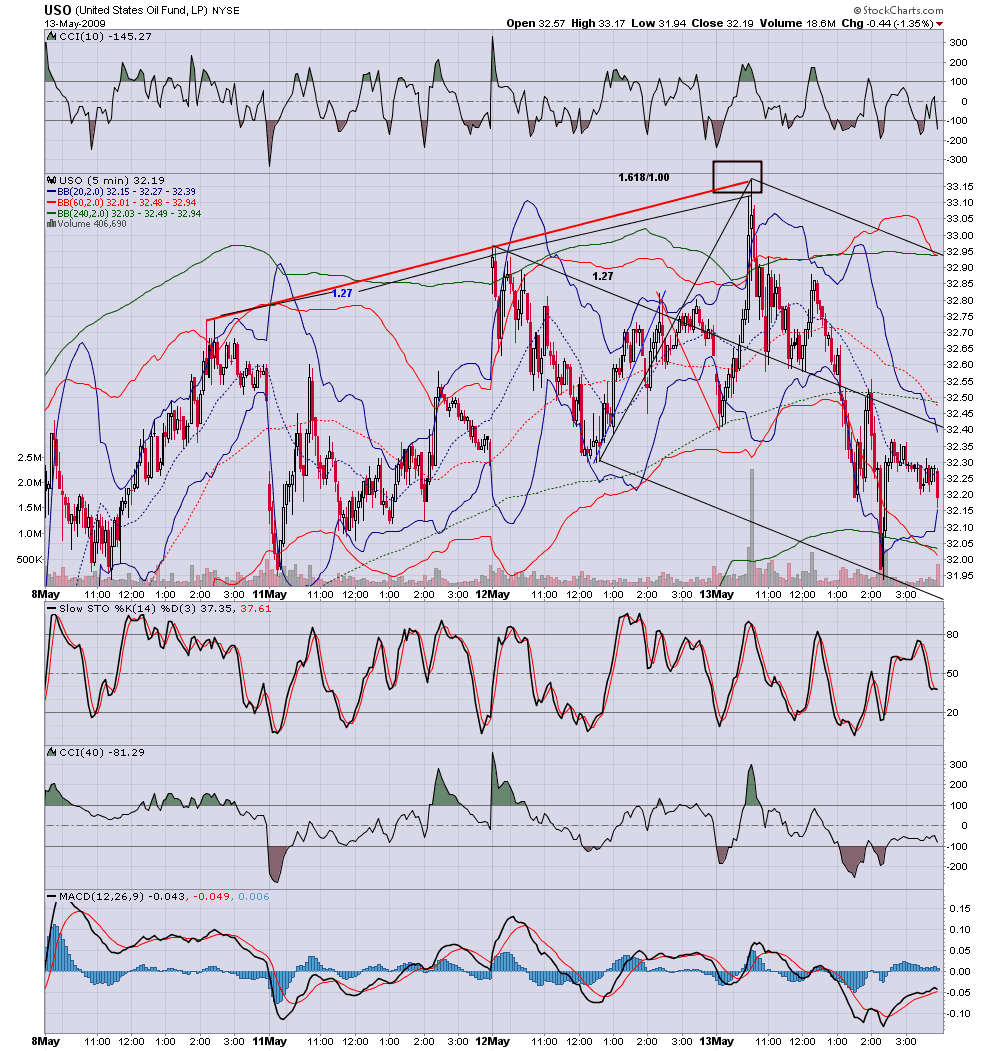

it is legitimate to ask for another example.using the tools of the forum has allowed us to capture 13 dollars of swings in USO this past month..even if you had traded only 100 shares the profits would have paid for 2 complete sets of jim's books and gain you entry into jim's forum where charts of this quality are shown every day.every trader at the forum could explain to me the meaning of everything on this chart based on what is in jim's books and concepts used every day at the forum,, for example ''gap fib'', which is not in any written work on fib, including jim's, yet is crucial to trading this chart. so how can i suggest another source when they don't even mention all of this?this is not just theory. all of this is PREDEFINED tools applied to charts every day.

quote:

Originally posted by IncreaseNow

How do I use Fibanocci retracement lines?...not the theory behind it but...where do I start drawing and to where and how many points away etc...anybody know a real good PRACTICAL tuturial on this...not theory..but practical...thanks in advance...IncreaseNow!

Increase, There is an excellent free seminar archived by the CBOT website called " Trading Using Fibonacci Tools, Analytics & Technicals" hosted by Carolyn Boroden. Go to http://www.hotcomm.com/virmeetCID_EVENTARCHIVE.asp?CID=YMDZYQ and the events are listed by date. Look for 7/6/06.

I want to add a little bit on to what roofer said about the free KT private forum, and hopefully it won't be too off topic (I'll throw in some info at the end to hopefully balance it off). This forum is free, I don't charge for it. It is open only to full book set buyers, and that is what roofer refers to as 'the price of admission'. The forum was created by request from my book set buyers and students because they wanted a place to post all the techniques unrestricted. I ask that people not post the more 'proprietary' material publically, and so far, as far as I know, everyone has honored that request. I feel that is partly because they have a vested interest in the material at that point.

The forum allows them to go wild and post all the techniques, with their own twists and improvements. Many new variations and some totally unique material has been posted. I post occasionally, but it is a forum for the students, and any post, no matter how beginner, is acceptable, as long as it relates to the KT methodology in some way. I do agree with roofer, though, my work is 'hard-core', and among the very highest level that anyone has published with these tools, in my opinion. There is some review in a few of the books, but they assume some serious background knowledge.

Here are some additional resources for Fib. Unfortunately, it is hard to find 'basic' info.

My website has over 250 free archived commentary, and although they are advanced, they have a lot of Fib work to study there.

Carolyn Boroden is, as mwald posted, a great resource.

Robert Miner is a great resource, but his work is also very advanced.

If you go to Traders Press there is a small booklet called 'Understanding Fibonacci Numbers' for like $5. I have no idea what it is like, but it sounds like what was asked for, in terms of simplicity. There is also a video called 'Simple Fibonacci Trading', but I also have not seen it, so I can't say first-hand how simple it is, or if that may be of any use to you. He also has the book 'New Frontiers in Fibonacci Trading', but it may be more complex. You can do a search there for 'Fibonacci'.

Scott Carney's books are a great resource, and his first book, The Harmonic Trader, has a fair amount of basic Fib explanation.

I hope this helps. The resources are very limited, and that was part of my motivation in writing up my work.

[admin edit: links added to books]

The forum allows them to go wild and post all the techniques, with their own twists and improvements. Many new variations and some totally unique material has been posted. I post occasionally, but it is a forum for the students, and any post, no matter how beginner, is acceptable, as long as it relates to the KT methodology in some way. I do agree with roofer, though, my work is 'hard-core', and among the very highest level that anyone has published with these tools, in my opinion. There is some review in a few of the books, but they assume some serious background knowledge.

Here are some additional resources for Fib. Unfortunately, it is hard to find 'basic' info.

My website has over 250 free archived commentary, and although they are advanced, they have a lot of Fib work to study there.

Carolyn Boroden is, as mwald posted, a great resource.

Robert Miner is a great resource, but his work is also very advanced.

If you go to Traders Press there is a small booklet called 'Understanding Fibonacci Numbers' for like $5. I have no idea what it is like, but it sounds like what was asked for, in terms of simplicity. There is also a video called 'Simple Fibonacci Trading', but I also have not seen it, so I can't say first-hand how simple it is, or if that may be of any use to you. He also has the book 'New Frontiers in Fibonacci Trading', but it may be more complex. You can do a search there for 'Fibonacci'.

Scott Carney's books are a great resource, and his first book, The Harmonic Trader, has a fair amount of basic Fib explanation.

I hope this helps. The resources are very limited, and that was part of my motivation in writing up my work.

[admin edit: links added to books]

Thanks Jim. I've added links to the books. It looks like The Harmonic Trader is out of print and unavailable.

Thanks Jim. I've edited your original post and added the link.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.