ES short term trading 9-22-10

I think the O/N session sums up all the key areas which are

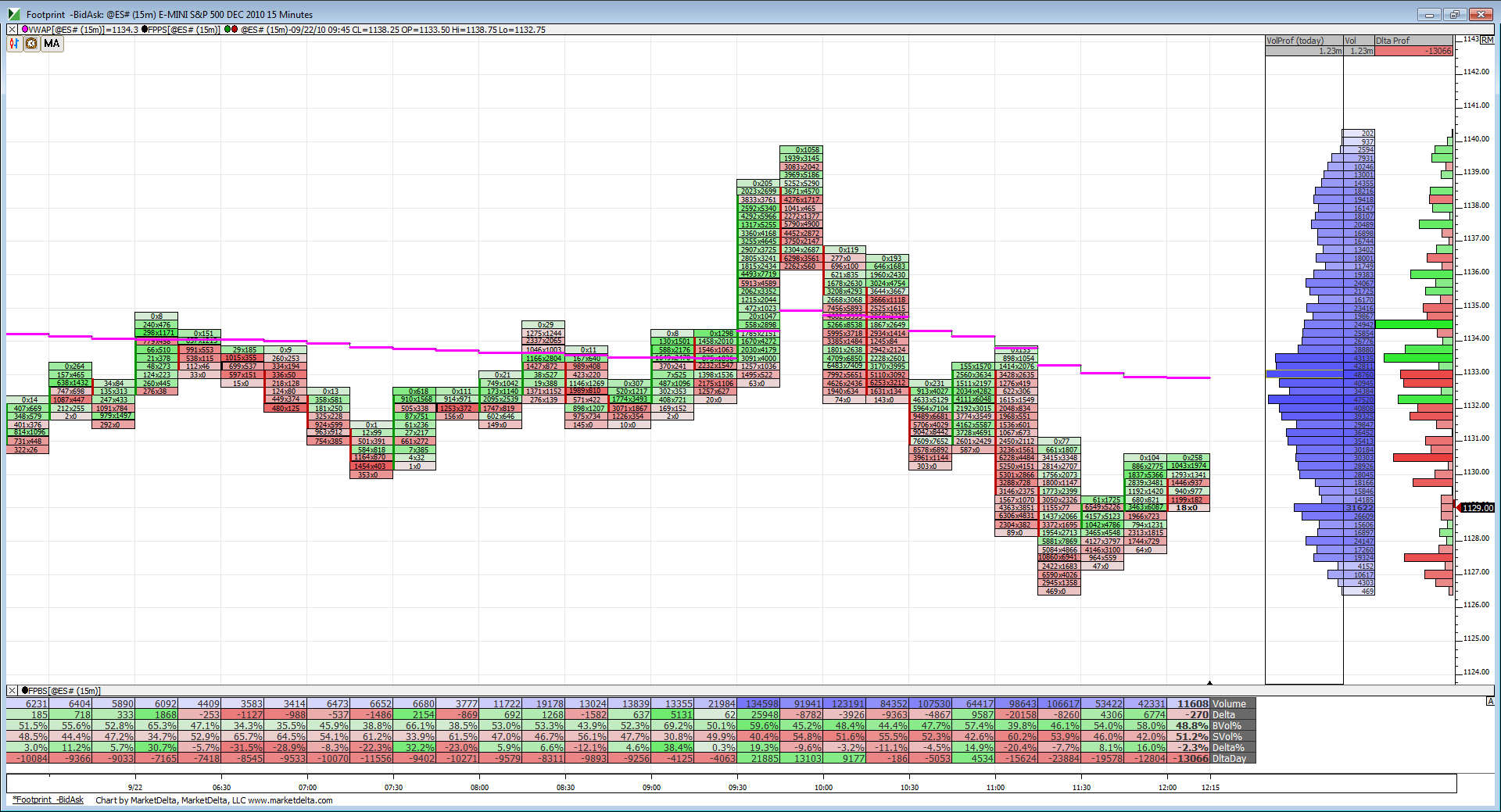

1127 - 1128.75 - Key volume from Mondays rally, breakout point and just under O/N low *******

1133.75 - 1136 - peak volume when Fed announced and magnet price from YD, gap fill and O/N midpoint

1140 - O/N high and near Mondays high

we know they like to break the Mon- Tuesday range!

we need to be aware of Pauls .62 concept and it's targets . From now on I'll call it the P-62. I like it !

My early bias is long at 31.75 to get above 34.50 but if we start spending time near 27 ( when day session opens) and buyers don't show up then the bias needs to shift.

At 9 am we are set to open inside YD range. So be careful if they drive it right out of that range lower with volume at the open. Then I will be long and wrong and will need to cover. Will watch volume closely and a report at 10 a.m.

1127 - 1128.75 - Key volume from Mondays rally, breakout point and just under O/N low *******

1133.75 - 1136 - peak volume when Fed announced and magnet price from YD, gap fill and O/N midpoint

1140 - O/N high and near Mondays high

we know they like to break the Mon- Tuesday range!

we need to be aware of Pauls .62 concept and it's targets . From now on I'll call it the P-62. I like it !

My early bias is long at 31.75 to get above 34.50 but if we start spending time near 27 ( when day session opens) and buyers don't show up then the bias needs to shift.

At 9 am we are set to open inside YD range. So be careful if they drive it right out of that range lower with volume at the open. Then I will be long and wrong and will need to cover. Will watch volume closely and a report at 10 a.m.

about matches that 1122 level

I learn a lot from you Paul

thanks for your posts!

I learn a lot from you Paul

thanks for your posts!

Originally posted by DavidS

about matches that 1122 level

I learn a lot from you Paul

thanks for your posts!

Learn a lot... about what? critical decision making process to determine start of cocktail hour?...LOL

thx

and by the way, I mentioned that if price reaches 618 extension of Monday's range usually goes to one full extension, that remains in effect from Monday Close to the next Monday's Close.

signing off to go kill weeds

Any advice on when to start cocktail hour is always worthy information.

Originally posted by PAUL9

Originally posted by DavidS

about matches that 1122 level

I learn a lot from you Paul

thanks for your posts!

Learn a lot... about what? critical decision making process to determine start of cocktail hour?...LOL

thx

and by the way, I mentioned that if price reaches 618 extension of Monday's range usually goes to one full extension, that remains in effect from Monday Close to the next Monday's Close.

signing off to go kill weeds

So here we are at noon time. As you can see a convincing close at 10:30 under VWAP and test of the O/N lows unfolded. Something which gives me a hint that prices might not continue much lower is the look of the distribution of volume. Its looking like the typical volume bulge of a range day. Will be very telling if/when prices challenge VWAP again.

On possible targets if prices decide to break down, I'm showing a couple of naked VPOC at 1120 and 1116.75 from last week.

On possible targets if prices decide to break down, I'm showing a couple of naked VPOC at 1120 and 1116.75 from last week.

lol,

I really like that quote,"Yesterday I could undrstand today, I might as well start drinking early."

No, I was referring to the different way from mine that you look at the markets.

Goes for most of the regulars here.

I'm more of a visual mathemetician that uses patterns,charts and indicators.

Anyway, I had never thought about a lot of the things you point out from your research before.

I really like that quote,"Yesterday I could undrstand today, I might as well start drinking early."

No, I was referring to the different way from mine that you look at the markets.

Goes for most of the regulars here.

I'm more of a visual mathemetician that uses patterns,charts and indicators.

Anyway, I had never thought about a lot of the things you point out from your research before.

Yesterday's low has held prices in check it seems.

no fades on lows for me....I would have thought that bigger buying would protect the breakout but nobody on it...point is that I'd rather look short and miss any surprise up move from buyesr

Bruce, was there a high volume node between 38 and 40? BEFORE today's early RTH

if you look at the time 12:10 EST ...you will see the other volume spike and why I started shorts at that 31 print....it's all about volume...the rest is just silly lines on our charts

They ALWAYS like to TRY and test volume....it doesn't mean they will actually be able to push it far enough for a complete test though...we capitalize on them TRYING to make the test.....and make more money when they get a complete test...just try and pick pieces off along the way.....the greedy get what they deserve....you know the old saying!!!

They ALWAYS like to TRY and test volume....it doesn't mean they will actually be able to push it far enough for a complete test though...we capitalize on them TRYING to make the test.....and make more money when they get a complete test...just try and pick pieces off along the way.....the greedy get what they deserve....you know the old saying!!!

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.