ES short term trading 4-1-11

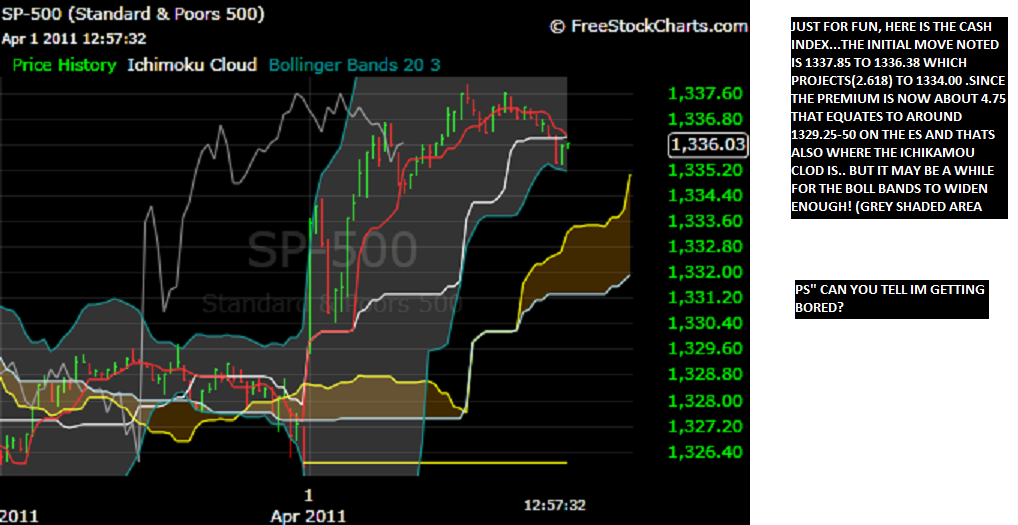

Good morning! Set for a wild open, eh! I thought i'd briefly touch on the thought process i have going into a typical trading session. First, as you may know i have a longer term bullish bias, thinking that 1241 was a supreme buying opportunity to an expected move up to 1426 at a minimum, probably by June. I am much more cautious shorter term however,feeling that a short term top may be overdue. So that the set up! Now for today! Yesterday i pointed out 2 days with a very tiny daily range in the es, would likely yield a big range (strong move) day very soon. The fact that today is unemployment day made that a no-brainer. lol. Anyway, being jobs day, remember ive shown in the past that , historically, its best to 'fade' the opening move! That means if we open down, you would want to buy! Conversely ,if we have a strong move up opening, that would be bearish!... i know thats hard to believe ,but thats just history! It certainly appears so far that the bearish scenerio,may be taking hold... in other words i'll likely be looking for shorts! And heres what im looking at as we come to the opening of the rth session...

Last time we had a gap up day with this set up we went north all day with only a couple 2 handle corrections, until right before the close! Remember? any way, check this out...

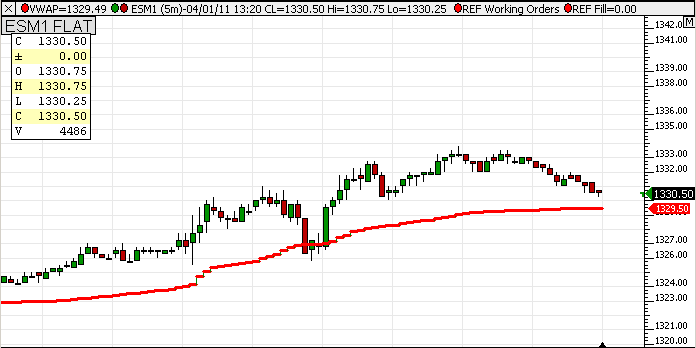

went flat at 30.75...that is OR high......and we will need volume to break away from the HV price....so there is no reason that we won't go back to 31.75......but I'll pass...I'm terrible buyer in general and especially on up days

Originally posted by koolbluemy order is currently at 1329.25 tho i will adjust up or down 1-2ticks if i have too!

Placing my long order at 1328.75, the 30 min median line and one min proj

for those who like volume nodes and vwap there is a thread on Traders Laboratory by someone named jpearl....trading with market statistics or something like that.....He'll give ya lots of cool things to think about...let me know if you can't find it and I'll dig it up for ya....

he talks about market skews etc,,,interesting stuff...

some believe that a HV node that rests above VWAP is implying that buyers are stronger...they may be right but I still prefer to sell above them as they form...I'm just a better seller .....but look up that thread...he has some videos for explainations too

he talks about market skews etc,,,interesting stuff...

some believe that a HV node that rests above VWAP is implying that buyers are stronger...they may be right but I still prefer to sell above them as they form...I'm just a better seller .....but look up that thread...he has some videos for explainations too

Just for info only: the actual 5 min projection is 1329.00, the vwap is currently at 1329.46, P.T.'S 100 ema average on the 5 min chart is at 1329.08, and the high volume earlier started around 1329.75... all of which may mean nothing but we'll see.

well, the boyz in da hood... i mean pits, should be getting back from their three matini lunches any time now! Lets hope something happens!..lol

I doubt it, they probably left for the day =)

Originally posted by koolblue

well, the boyz in da hood... i mean pits, should be getting back from their three matini lunches any time now! Lets hope something happens!..lol

i'm at the office so i can't post a chart but if you look at early to mid Feb the market did the same thing when they hit the 1330 levels. There seems to be a brick wall at the 1333-1335 levels. Maybe someone could look into this and confirm?

My guess is there is balance between sellers and buyers at these levels and with no significant news or reports we will stay stagnate until that changes with earnings reports or other news.

with recent flar ups of trouble in jordan and the middle east,our own senate not able to agree on a budget, i would suspect the market is approaching higher levels a little cautiously to see what happnes over the weekend.

My guess is there is balance between sellers and buyers at these levels and with no significant news or reports we will stay stagnate until that changes with earnings reports or other news.

with recent flar ups of trouble in jordan and the middle east,our own senate not able to agree on a budget, i would suspect the market is approaching higher levels a little cautiously to see what happnes over the weekend.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.