ES 05-09

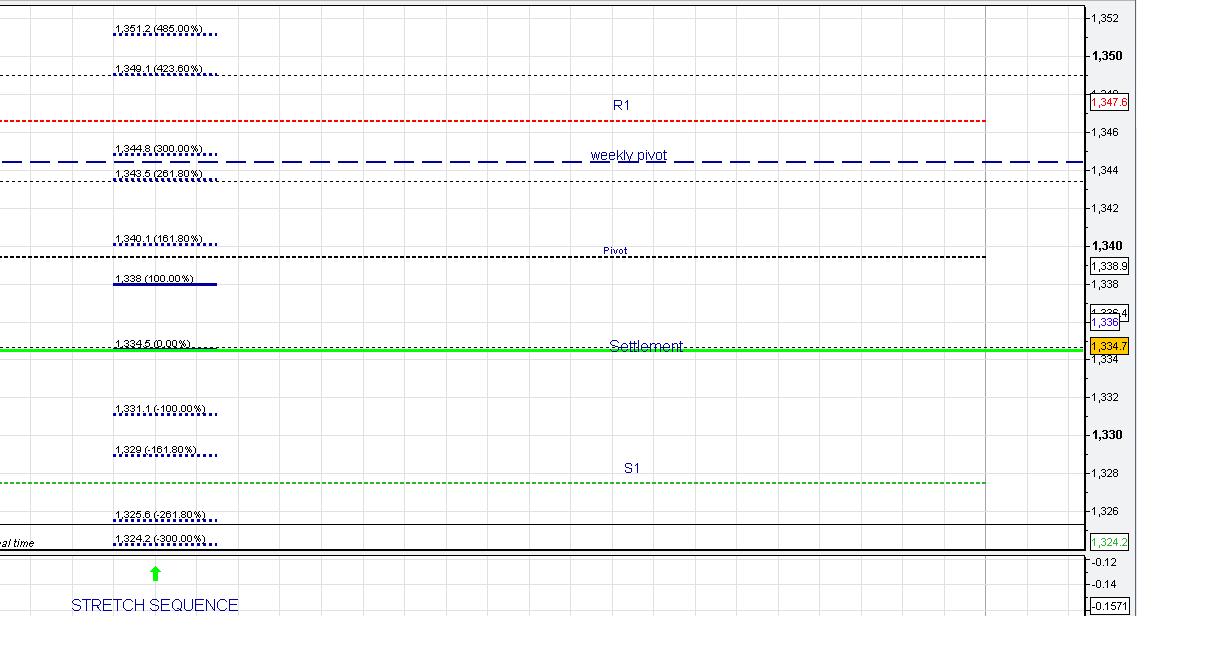

Some numbers for Monday. I expect the bulls won last week, if commodities can drop 10% and stocks dont sell off big time then you have to be with the bulls. Any moves down to 1329 and 1326 should be counter trend to be bought, no bias though intra day assume anything can happen

I just used standard pivots from chart software, I notice they are a little different from the ones posted on the daily notes here. Interested in anyones thoughts on the various pivot/R1/S1 calcs that people use?

I have added the stretch sequence on the left. All the numbers are fibs off the stretch and stretch 161 , so 423 and 485 are (stretchX161) X 2.61 and 3. I thought it was better to put them in one sequence as some of the numbers overlap.

I just used standard pivots from chart software, I notice they are a little different from the ones posted on the daily notes here. Interested in anyones thoughts on the various pivot/R1/S1 calcs that people use?

I have added the stretch sequence on the left. All the numbers are fibs off the stretch and stretch 161 , so 423 and 485 are (stretchX161) X 2.61 and 3. I thought it was better to put them in one sequence as some of the numbers overlap.

how do you come up with the stretch? i am not really familiar with the stretch calculation technique and although i have seen many of hunter's posts, the stretch number always appears as given. thanks for you help

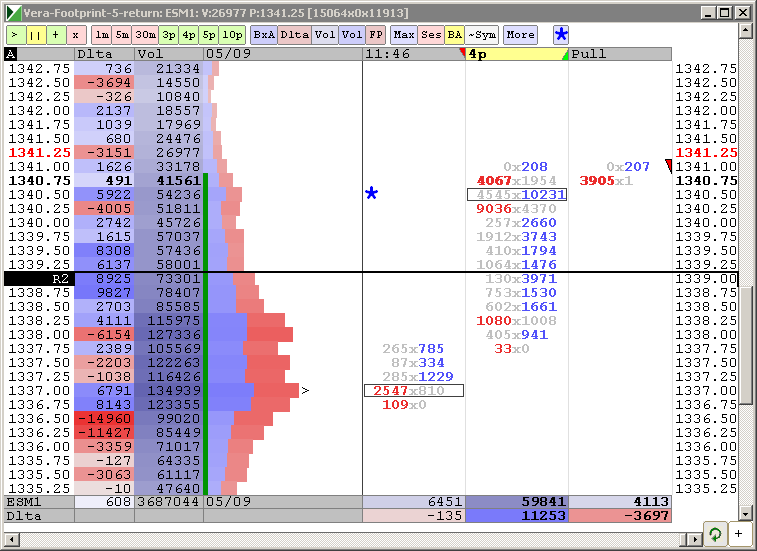

Last weeks RTH Volume Profile. 1343 is POC, should be interesting how/if prices react in that zone this week.

never mind, i found it in the mypivots dictionary...thanks

Originally posted by ayn

how do you come up with the stretch? i am not really familiar with the stretch calculation technique and although i have seen many of hunter's posts, the stretch number always appears as given. thanks for you help

just for info I have the high of the morning as 1344.8 exactly the x3 number on my chart, just above the weekly pivot. Hard to trade those V tops though

the low was settlement from Friday, on the upsaide now 1340 & 1344 look interesting

sold into O/N midpoint.....low volume drive up....no reports so not expecting any great trends..internals at even steven!!

taking something at OR high...trying to hold for O/N low run out! Market will try to break O/N low or high a very high % of the time.....not convinced it will be the lows yet...but hopeing weakness of Friday will carry over today..

These daytrading threads are more dead than Bin Laden !!

These daytrading threads are more dead than Bin Laden !!

they are working on trying to keep it symetric and 37.75 is the low volume they will probably need to fill in unless some REAL volume comes in to keep driving down...not looking like that yet

Sorry that was Thursday's VAH and Wednesday's VAL.

Busy talking to insurance - they make me angry and I make mistakes

Busy talking to insurance - they make me angry and I make mistakes

That one was just for you Bruce.

Originally posted by BruceM

it will be interesting to see what happens once LORN stops buying the 42.50 area....

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.