ES Friday 7-15-11

Good day everyone!

1312 1307 and 1301 are my S/R numbers for today.

Let's all do well! Please reply with comments, levels, and ideas!

1312 1307 and 1301 are my S/R numbers for today.

Let's all do well! Please reply with comments, levels, and ideas!

6.5 was a pitbull number and also a gap fill area.

i think the rebound from that are was exaggerated as right at 10am this news corssed the wire "House Plans Vote on $2.4 Trillion Debt Increase" obviously lifting the market

this vote would raise the debt ceiling by $2.4tn but would imply a matched budget amendment. It's being proposed by Republicans but i think it would be very difficult to get traction in the Senate.

just like yesterday, and the day before and the day before, this is a headline driven market, and the headline effects quickly fade away, just like now

i think the rebound from that are was exaggerated as right at 10am this news corssed the wire "House Plans Vote on $2.4 Trillion Debt Increase" obviously lifting the market

this vote would raise the debt ceiling by $2.4tn but would imply a matched budget amendment. It's being proposed by Republicans but i think it would be very difficult to get traction in the Senate.

just like yesterday, and the day before and the day before, this is a headline driven market, and the headline effects quickly fade away, just like now

Wow, I was checking around the house for a few minutes thinking an approach to 1301 was hours off, and look 1303.25!

I'm still waiting though. And I'm also curious to know how bad that 0955 report was.

I'm still waiting though. And I'm also curious to know how bad that 0955 report was.

i would expect the o/n lows to at least be tested today. I have some support penciled right above in the 301-302 area but would be cautious abt it, meaning i would wait for a failed break of the o/n

much bigger support lies below in the 94-96 area for me; we might not get there today but i think we are headed that way eventually

much bigger support lies below in the 94-96 area for me; we might not get there today but i think we are headed that way eventually

Hey Big Mike,

I too, would love to see a bit of discussion on the Fair Value topic. You may know me by now.... Sorry.... I've got little to offer. But until now, I wasn't sure it was a valid topic. Thanks for that!

I've posted a question a couple weeks ago on the topic. I had given up on it, because (while it was GOOD info!) I didn't get the response I was looking for. Now that you have shown interest, I will start researching more on the topic. Again, thanks for posting.

Here's the link to the Questions thread if your interested.

http://www.mypivots.com/board/topic/6794/1/value-of-the-market

I too, would love to see a bit of discussion on the Fair Value topic. You may know me by now.... Sorry.... I've got little to offer. But until now, I wasn't sure it was a valid topic. Thanks for that!

I've posted a question a couple weeks ago on the topic. I had given up on it, because (while it was GOOD info!) I didn't get the response I was looking for. Now that you have shown interest, I will start researching more on the topic. Again, thanks for posting.

Here's the link to the Questions thread if your interested.

http://www.mypivots.com/board/topic/6794/1/value-of-the-market

Originally posted by Big Mike

Is anyone incorporating Fair Value level into their decision making process?

Good luck to all!

apk,

interesting numbers, wild action

your numbers are interesting because yesterday, RTH price low was a small undercut of the 1.618 extension down of Monday's range.

Historically, odds about 8 in 10 that before the close on the following Monday, a full extension down will print.

1.618 extension down of Monday's RTH range was 1302.25 (undercut yesterday with a print of 1302.00, and BTW I have a friend tht immediately BUYS when the 1.618 extension (either direction) is printed for a 2 pt scalp))

2.00 extension down (Monday's RTH range subtracted from Monday's RTH L) = 1296.50

remember, 8 in 10 odds means that 2 out of 10 times the full extension does not print.

WHen market moves up to a positive 1.618, I have noticed retracements that find support at MOnday's H are good candidates for full extension up.

So, currently down 1.618 has been tagged, if MOnday's RTH L acts as resistance, would increase chances for full extension down? (I've never really paid attention to this for the down.

Monday's RTH Low was 1311.75.

interesting numbers, wild action

your numbers are interesting because yesterday, RTH price low was a small undercut of the 1.618 extension down of Monday's range.

Historically, odds about 8 in 10 that before the close on the following Monday, a full extension down will print.

1.618 extension down of Monday's RTH range was 1302.25 (undercut yesterday with a print of 1302.00, and BTW I have a friend tht immediately BUYS when the 1.618 extension (either direction) is printed for a 2 pt scalp))

2.00 extension down (Monday's RTH range subtracted from Monday's RTH L) = 1296.50

remember, 8 in 10 odds means that 2 out of 10 times the full extension does not print.

WHen market moves up to a positive 1.618, I have noticed retracements that find support at MOnday's H are good candidates for full extension up.

So, currently down 1.618 has been tagged, if MOnday's RTH L acts as resistance, would increase chances for full extension down? (I've never really paid attention to this for the down.

Monday's RTH Low was 1311.75.

Fair Value is a hypothetical fundamental analysis calculation. It is used, most commonly, by institutional investors to justify the values of their portfolios.

As in most cases, hypothetical calculations have little to no value in the real world. And, even much less in the world of intraday trading.

As in most cases, hypothetical calculations have little to no value in the real world. And, even much less in the world of intraday trading.

Originally posted by TradeQueen

Hey Big Mike,

I too, would love to see a bit of discussion on the Fair Value topic. You may know me by now.... Sorry.... I've got little to offer. But until now, I wasn't sure it was a valid topic. Thanks for that!

I've posted a question a couple weeks ago on the topic. I had given up on it, because (while it was GOOD info!) I didn't get the response I was looking for. Now that you have shown interest, I will start researching more on the topic. Again, thanks for posting.

Here's the link to the Questions thread if your interested.

http://www.mypivots.com/board/topic/6794/1/value-of-the-market

Originally posted by Big Mike

Is anyone incorporating Fair Value level into their decision making process?

Good luck to all!

TQ - I, too, would love to see some discussion on "fair value". And, would very much be interested in whatever research you might be willing to pass along. Thanks.

Originally posted by PAUL9

apk,

interesting numbers, wild action

your numbers are interesting because yesterday, RTH price low was a small undercut of the 1.618 extension down of Monday's range.

Historically, odds about 8 in 10 that before the close on the following Monday, a full extension down will print.

1.618 extension down of Monday's RTH range was 1302.25 (undercut yesterday with a print of 1302.00, and BTW I have a friend tht immediately BUYS when the 1.618 extension (either direction) is printed for a 2 pt scalp))

2.00 extension down (Monday's RTH range subtracted from Monday's RTH L) = 1296.50

remember, 8 in 10 odds means that 2 out of 10 times the full extension does not print.

WHen market moves up to a positive 1.618, I have noticed retracements that find support at MOnday's H are good candidates for full extension up.

So, currently down 1.618 has been tagged, if MOnday's RTH L acts as resistance, would increase chances for full extension down? (I've never really paid attention to this for the down.

Monday's RTH Low was 1311.75.

Very interesting. Thanks for sharing. However it looks like the full extension already occurred during the early Tuesday morning O/N session.

The .618 extension would've worked as a 2 point scalp and so far the 1.0 has been the low of the week. I'm not sure if you'd disregard that since it didn't happen during RTH but it's something to be aware of.

Zien;

Do the 618 #s act as a magnets

TIA

Do the 618 #s act as a magnets

TIA

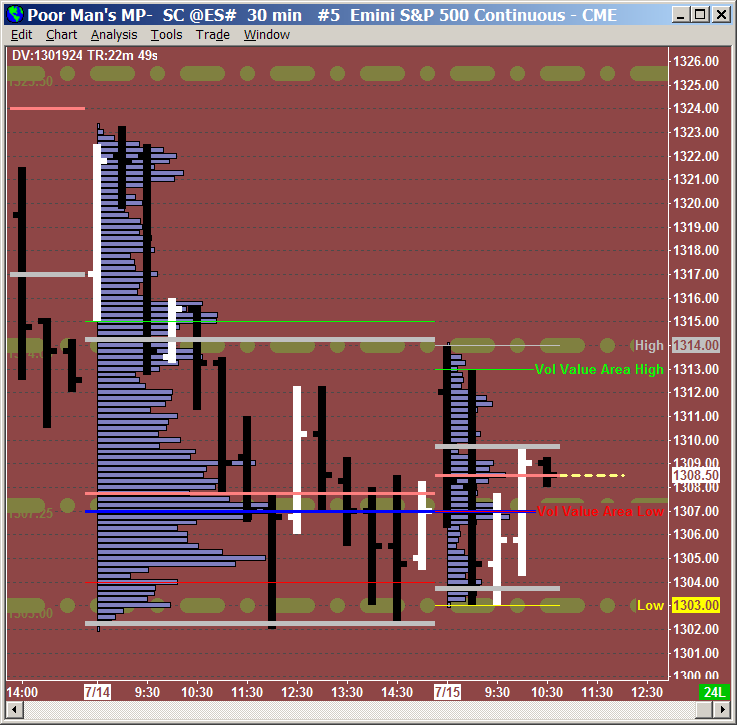

Here is my Poor Man's MP chart. Previous hi vol nodes(represented by those fat lines in background) can offer important info.

Originally posted by redsixspeed

http://ori.cnbc.com/id/17689937

cnbc fair value link

That is what I use, thanks. It appears that the cash index reacts directional to whether the futures are above or below fair value at the open.

Has anyone observed some directional "tell" related to the futures contract(s)?

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.