ES Friday 2-3-12

32.50 - 35 is my sell zone post report..beyond that I would only look above the 40 area for fades.

I do not know why the market is up so much. Perhaps they KNOW there GOT to be QE3.

Mkt is up 20% from the bottom, is economy?

As for the VIX (option traders' opinion) it is still moving up

it's moving up because they want to seLL S&P......so fear is in there...we've only gone 2 points above the IB high.....we'll see

Remember Lehman? Solid Friday night (according to CEO), gone Monday morning

Speaking of devil. Just now on the business news: Canadian stocks are to get a new "circuit breaker"

oh, the regulators will hold a quick-moving stock just for 5 min, to assess...lol

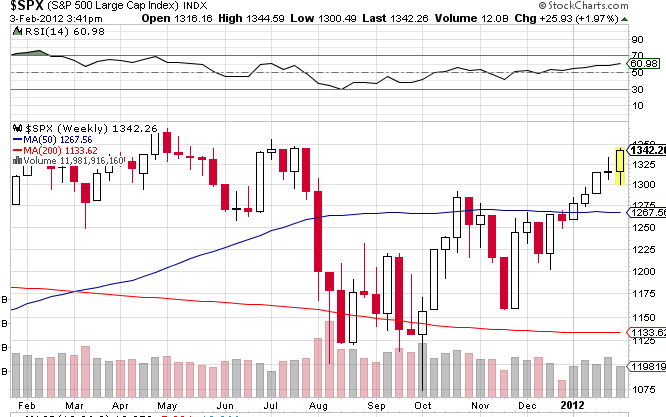

here is the cash...look at those July highs....like a big freakin ledge.....it's safer to expect resistance to form there so sell out ahead of that big ledge....then get back in if/when it breaks out and price holds above there...just my opinion of course

naturally nobody REALLY knows but we all like to think we know...

what I do know is that the S&P % bullish is very close to levels that cause the market to correct downward...as is percent of NYSE stocks above 50 day MA...when they get close to 90% then market needs to sell off to let buyers in....it is there now....so I think we are two weeks or less...much less from a good top..

naturally nobody REALLY knows but we all like to think we know...

what I do know is that the S&P % bullish is very close to levels that cause the market to correct downward...as is percent of NYSE stocks above 50 day MA...when they get close to 90% then market needs to sell off to let buyers in....it is there now....so I think we are two weeks or less...much less from a good top..

weekly R2 was 1342.75 this week without using the settlement close....I didn't trade since this morning and wouldn't have been long for that...just pointing that out as part of the reasons I had the 40 - 42 zone....

The weekly pivots make a nice addition to confluence numbers and If I had to pick any other static set of numbers outside of the RATS I would use those pivots and the split areas of them.

The weekly pivots make a nice addition to confluence numbers and If I had to pick any other static set of numbers outside of the RATS I would use those pivots and the split areas of them.

Lisa...we can never have too many posts here...so please post often

Originally posted by Lisa P

have a good weekend everyone. do not eat too much junk food.

sorry for many small posts

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.