ES Tuesday 2-7-12

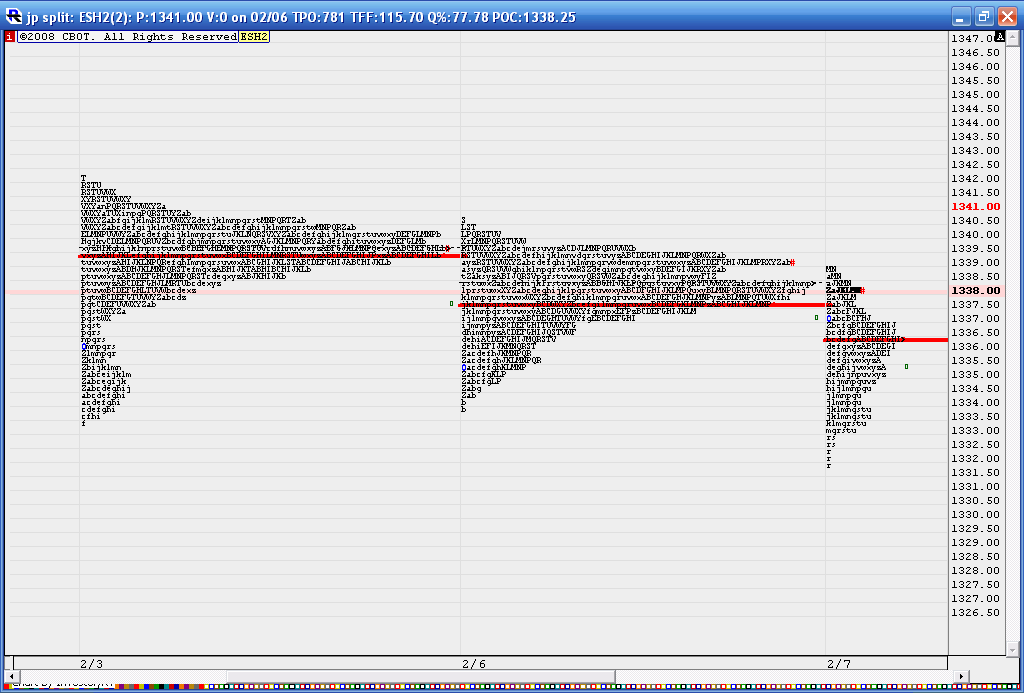

a look at what I'm using this morning...35 - 33 is important support ... a break and hold below there targets 29.75 and then the 25 area with 22.50 as a bigger volume magnet...

above I have 38.75 - 1340...then will use Fridays highs and overnight highs

yesterday was inside Friday so we need to monitor for potential breakout trade more than usual

basically we have the same levels as yesterday..small ranges still in play so numbers are close by!!

above I have 38.75 - 1340...then will use Fridays highs and overnight highs

yesterday was inside Friday so we need to monitor for potential breakout trade more than usual

basically we have the same levels as yesterday..small ranges still in play so numbers are close by!!

you'd have to naturally watch that 34.75 as time is building there and peak volume today.....but we also have that weekly open...so I don't like trading in the middle....this is still a congested market...lots of numbers in the way....

sorry I can't be more help in here

sorry I can't be more help in here

Originally posted by khamore1

Bruce, I just shorted the es @37 based on a low volume profile of 2 days ago, is it the same way you enter the market? if yes where is going to be your exit,? I know I'm asking to much, but you're a good guy

Lokk at market profile the way Bruce use it (one minute) you will see a low volume 2 day ago

part of the problem with a low volume zone on a bigger time frame ( which I think u r referring to ) is we never know when they will just spend time filling all that in and chop it back and forth....so I like the extremes of a bigger low volume zone if I was focusing on those...right now those extremes seem to be up above 38.50 and below 34.75.....in between is a lower volume spot IF u combine profiles

yes but we spent lots of time filling in that spot yesterday...

Originally posted by khamore1

Lokk at market profile the way Bruce use it (one minute) you will see a low volume 2 day ago

My one minute incorporating overnight shows some volume 38.75 - 40.50 then thin above that.

This also gets near the +4.00 and yesterday's singles.

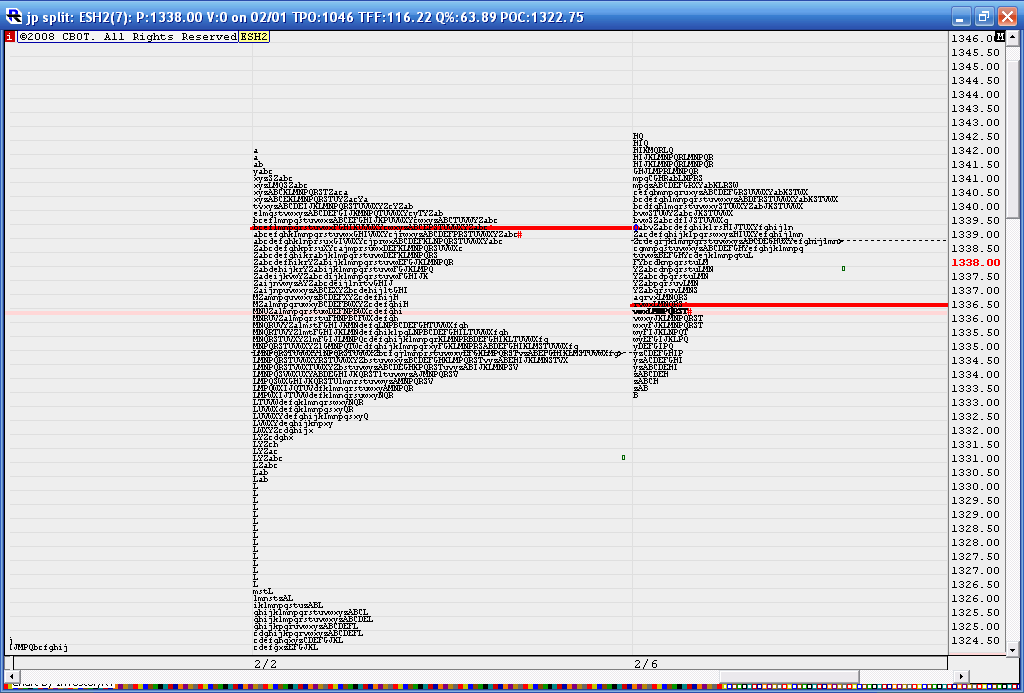

remember that my primary use of any data outside of the real time session is just to CONFIRM areas...with that said here is today and Monday and friday...RTH only...I don't see low volume there but it does begin to define a wall of time and volume from yesterday...so prefered sells are up here now but we would need to be careful because that 34 .75 node has held again...

we are still just in a bigger consolidation so we need to play at extremes and use the centers for targets

we are still just in a bigger consolidation so we need to play at extremes and use the centers for targets

quite often when you see one range extreme fail they will target the other side...so if that holds true then they may still want to push out highs of the last two days...

just something to keep in mind if you are nibbling on the short side

just something to keep in mind if you are nibbling on the short side

I'm nibbling at 41.25 short but I know that other extreme is close buy so keeping it small..air pockets below at 38.75

gap in data as well at 39.5

the biggest surprise for me was when they blew through the 38 - 39 area the second time...on that rally up...was SURE they would have stopped it there again......another reason I watch the order flow

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.