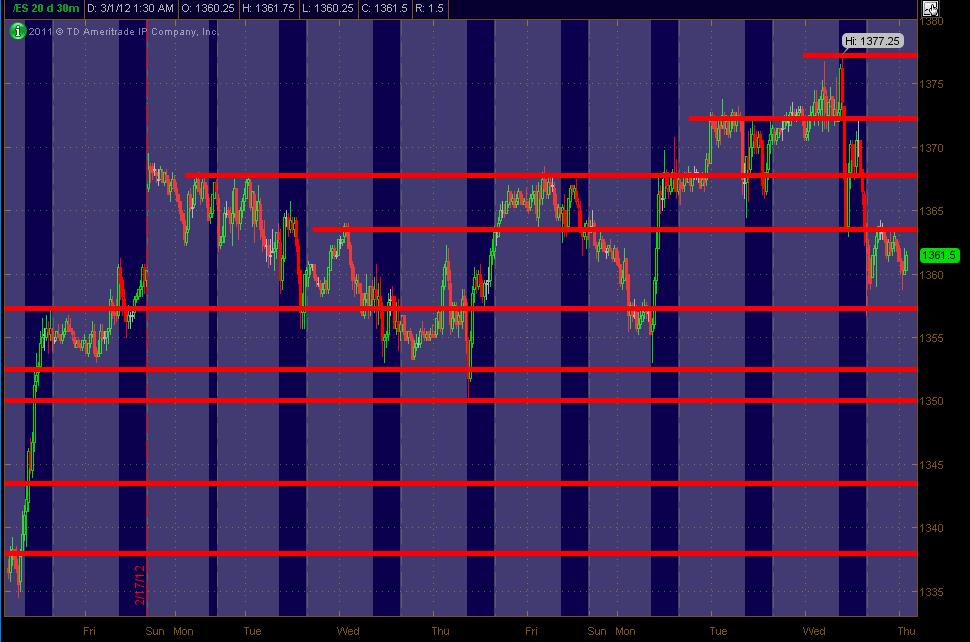

ES Thursday 3-1-12

Here's what I'm seeing as PASR (Support/Resistance) ZONES for the ES using a 30min chart as a "map" coming into Thursday's trading. The Gray background shows the trading outside of the RTH session, with the Blue background being the RTH activity. Hope some find this helpful as they incorporate their own strategeries throughout the trading day!

hard to predict a break from bell curves that is why we shouldn't trade from the middle...I'm hoping for a downside break as long as we stay away from the O/N highs now but I only have two runners so I am not initiating anything in here...

Originally posted by khamore1

To Bruce, will you consider the statistic for the IB (95% chance of a break) if so to which direction this 95% going to happen?

I heard it through the grapevine that market will continue the initial direction it took after a good or bad economic report. ….so today we had a down move…. Will it continue down?

Originally posted by khamore1

I heard it through the grapevine that market will continue the initial direction it took after a good or bad economic report. ….so today we had a down move…. Will it continue down?

How good is the grapevine?

not sure what the market will do but I am just working off the "bell curve as a magnet theory " until proven wrong by big volume

many times when you see a one minute bar that encompasses so much of the days range we end up with some great bell curve trades...so I assume we will still go back to 68 AGAIN soon

many times when you see a one minute bar that encompasses so much of the days range we end up with some great bell curve trades...so I assume we will still go back to 68 AGAIN soon

Originally posted by G Runt

Originally posted by khamore1

I heard it through the grapevine that market will continue the initial direction it took after a good or bad economic report. ….so today we had a down move…. Will it continue down?

How good is the grapevine?

We will find out soon...I never tasted their wine before

Originally posted by khamore1

I heard it through the grapevine that market will continue the initial direction it took after a good or bad economic report. ….so today we had a down move…. Will it continue down?

This was a an old floor trader "trick". Immediate reaction to news type info occurred in a 3 impulse wave. Locals would try to catch the 3rd leg for a quick profit. It has lost its effectiveness with the electronic markets taking precedence.

Originally posted by beyondMP

Originally posted by khamore1

I heard it through the grapevine that market will continue the initial direction it took after a good or bad economic report. ….so today we had a down move…. Will it continue down?

This was a an old floor trader "trick". Immediate reaction to news type info occurred in a 3 impulse wave. Locals would try to catch the 3rd leg for a quick profit. It has lost its effectiveness with the electronic markets taking precedence.

Thank you

these slow grinds up can be brutal and difficult...2 pm so I am starting to look for shorts to get a previous bracket low and that ledge at 72....

two day volume hasn't shifted as per Nicks chart so we are at the edge of the bell up here

if we are wrong they will get new weekly highs where I think better shorts sit up above 77.50...trade small for me as this is a more difficult time to trade

two day volume hasn't shifted as per Nicks chart so we are at the edge of the bell up here

if we are wrong they will get new weekly highs where I think better shorts sit up above 77.50...trade small for me as this is a more difficult time to trade

gap in data @ 73.25 (1m chart)

looking to target 71.25 on last contract just for fun...no great place for stop but don't care right now..71.25 is the low volume price from JUST todays session

look at that..right back to our 68...without me but who cares ? Hopefully anyone new or struggling should study Nicks chart and think more about CONTEXT...read the work of Bret Steenbarger here http://www.traderfeed.blogspot.com/

if you doubt what anyone says here than maybe after much review you may realize that many good trades start with the TARGET in mind FIRST. It isn't always easy to trade for final targets but often you will be able to take a piece out of the journey back down ( or up) to magnet prices

if you doubt what anyone says here than maybe after much review you may realize that many good trades start with the TARGET in mind FIRST. It isn't always easy to trade for final targets but often you will be able to take a piece out of the journey back down ( or up) to magnet prices

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.