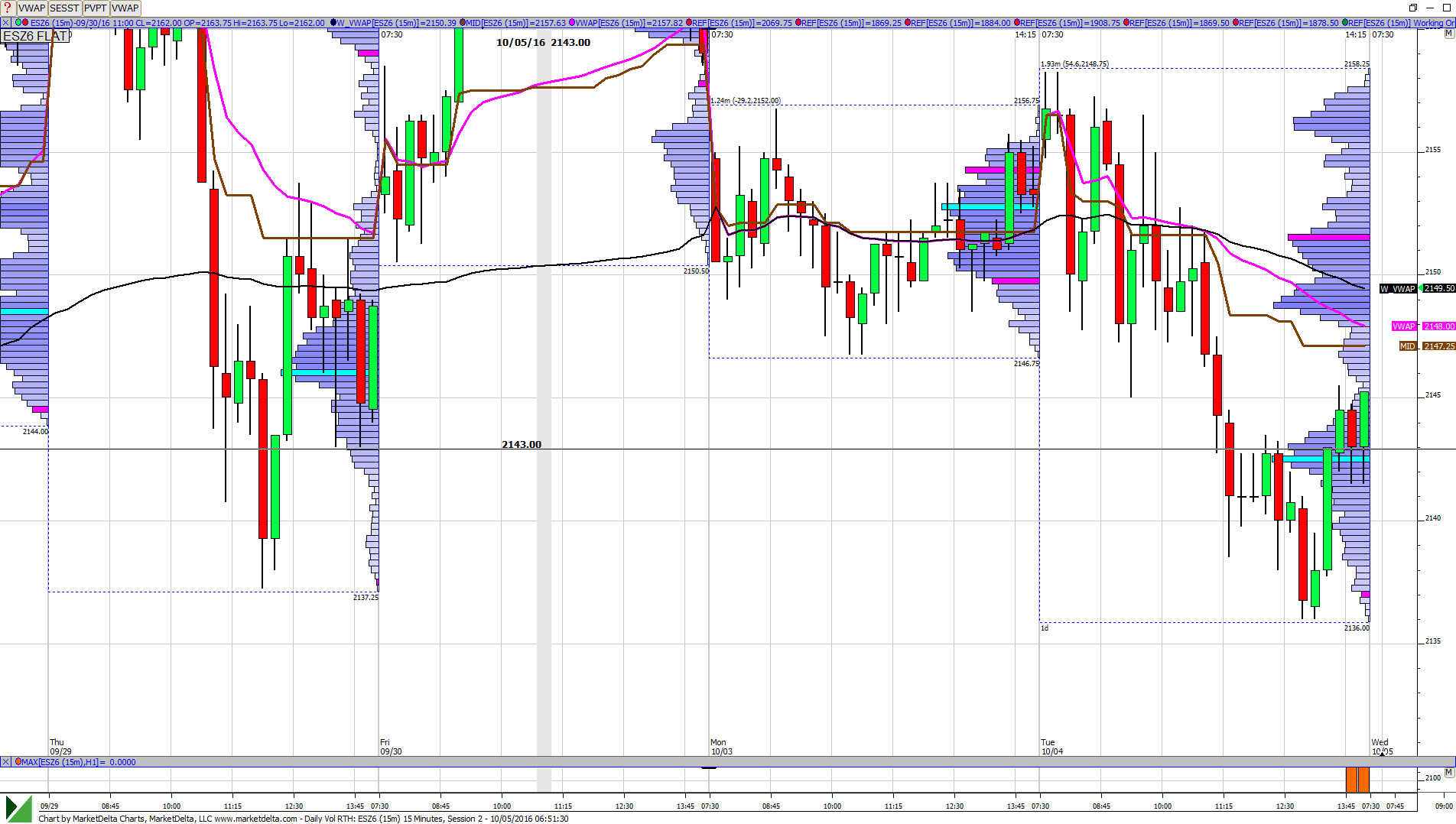

ES Wednesday 10-05-16

ON inventory is fairly balanced. If anything, it might be a little short even though we are currently above YD's close. There were almost 3 volume bells to YD's profile as can be seen in the picture with 42.5, 48.75 and 56 being the centers of those bells. We are currently trading around the center of the middle bell so I am going to be cautious at the open. Key LVN is at 45.5 which is also a couple of tics from the O/N mid. Also the current price is this week's VWAP so it is almost a coin toss on the direction for me at this time.

trying to get 2 point targets...not specific fill price but a price point from my entry so scaled at 51......and trying to hold again for that 49 and then pivot point...

yes, that is true...I'm hell bent today on getting the R1 or pivot...I thought the more times we popped into that low time spot at 54 then the greater odds it would give way onto the a high volume node and the R1 ..so that is why I took that failed breakout long.......see my chart...but you are correct...this is usually not my thing....but I'm trying for a probability and that is what happens when u trade for probabilities

Originally posted by NewKid

i have not seen you reverse so much in the past....

Originally posted by BruceM

I keep reversing at worse and worse prices.....was long 54.50, then went back sort at 53......original shorts where in at 54

It was just an observation, not a critique at all.... it has been a tough day so far for sure

Originally posted by BruceM

yes, that is true...I'm hell bent today on getting the R1 or pivot...I thought the more times we popped into that low time spot at 54 then the greater odds it would give way onto the a high volume node and the R1 ..so that is why I took that failed breakout long.......see my chart...but you are correct...this is usually not my thing....but I'm trying for a probability and that is what happens when u trade for probabilitiesOriginally posted by NewKid

i have not seen you reverse so much in the past....

Originally posted by BruceM

I keep reversing at worse and worse prices.....was long 54.50, then went back sort at 53......original shorts where in at 54

the split between the PV and r1 is helping bulls find support so far today

i'm glad u asked

Originally posted by NewKid

It was just an observation, not a critique at all.... it has been a tough day so far for sure

Originally posted by BruceM

yes, that is true...I'm hell bent today on getting the R1 or pivot...I thought the more times we popped into that low time spot at 54 then the greater odds it would give way onto the a high volume node and the R1 ..so that is why I took that failed breakout long.......see my chart...but you are correct...this is usually not my thing....but I'm trying for a probability and that is what happens when u trade for probabilitiesOriginally posted by NewKid

i have not seen you reverse so much in the past....

Originally posted by BruceM

I keep reversing at worse and worse prices.....was long 54.50, then went back sort at 53......original shorts where in at 54

i dont know if this is my bias, but i keep seeing signs of weak buying....

runners reversing to long at 53.75 and will go back to short at 52 even

reaction to the latest crude report?

yes...ad line has been dropping all day but that goes to show you internals can mess us up...especially in early trade...trying to get 56.50 to print

Originally posted by NewKid

i dont know if this is my bias, but i keep seeing signs of weak buying....

how many days fail to see a break from an IB high or low ? not many and especially when the range is so small

out at target.......last will go for the R1 or will be stopped at 52.50 and my day is done......whew....glad it's over.....

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.