ES 5-8-17

key areas and the reason I am more bearish then bullish up here..I want to get short on any push above 2395 now (9:18 EST)as we have good probabilities the pivot at 2393.50 will print in RTH today..

probability traders will be asking themselves if R1 or the Pivot will be first to print today....my money is on the pivot!

probability traders will be asking themselves if R1 or the Pivot will be first to print today....my money is on the pivot!

working the 96.25 short and will add above fridays high if needed...target is the pivot at 93.50

first clue for us shorts will be the reaction at the 94.75 high...we need to see weak pushes up from there if the bulls want to win this....we have opened inside fridays spike and we may see some back and forth trade before a direction is chosen.....I'm hoping we can push to the pivot number

scaling at overnight low print on runners....as much as I want to see further selling , ideally down in to the 2388 I have no clue if buyers are going to come in at the 91 - 92.75 zone ( base of the spike and VA high from friday)

current rth low matches the overnight low...so for those who aren't short you could probably look for shorts if we can rally 2 points or more up off that low near that 94.75 number might be a good spot

I had to make a new video as my account was showing on previous one.....we are balancing inside the spike so far and many would say that is bullish....they might be right...I have no real clue but I sure am curious to see what happens if/ when we take out that overnight low

the only thing I still like about the short side is that we are staying under that 94.75...that was a key level from friday that they blew through on friday...now they can't seem to get back above it.......but we can't deny that value is building higher and we seem to be creating the "b" pattern which is not really new selling just some longs liquidation...so we aren't out of the woods yet.....that was also a weak push outside the O/N low.......so even though this is some further selling I'm not convinced it will stay that way through the day ...I just pulled the plug at 91.25 print as I'm typing this in...that is time va high and one tic above my official 91 target and not leaving any last runner on...sellers who are really watching this and in my opinion shouldn't even be actively trading anymore will be looking to see how often and how far back UP into the overnight low and the spike base we can get...they don't want time to rebuild ABOVE that ...otherwise they may need to cover and we may get the rally up...I'm not interested in playing that way today and the 90 minute window has just closed! this seems as if it is a real struggle to go down today

bruce, wonderful update. Very helpful. so u use the composite profile to calculate vah/ VAL? when do you use the RTH val/vah separately?

thanks

thanks

I usually use just the daily vah and va low but in the back of my mind( which usually ends up on sticky notes) are the va high and low of the weekly bars....I like to see some confluence with those....like Friday having the POC of time on the daily at the 2388 and the weekly chart having a va high of time in the same area helps things out sometimes as we have two different time frames looking at the same area....hope that helps and thanks for the kind words....

I have spent lots of effort looking at composites of volume and time on hand picked "consolidation areas" and I just can't make them work. I prefer most of the simpler ideas taught by Dalton with a few of my own twists thrown in.

I have spent lots of effort looking at composites of volume and time on hand picked "consolidation areas" and I just can't make them work. I prefer most of the simpler ideas taught by Dalton with a few of my own twists thrown in.

bruce ur still bearish even though the developing POC is 95 even though there is enought time and did not take out the fridays POC? thanks and thanks for replying back it was very useful

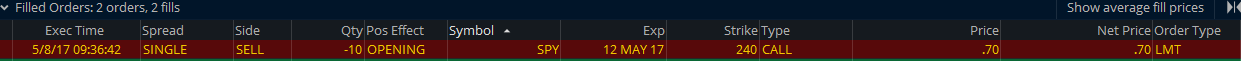

I am bearish but don't usually day trade much outside the first 90 minutes of the day. Here is a screen shot of the calls I sold this morning. My plan is to see if I can get price to test back down into the 2385 - 2387 area but that doesn't mean it will happen today If these go wrong, I will take the loss if I have to buy them back about 40 % above what I sold them for or else I will try to make about %50 on them if I'm a winner.... .

Originally posted by Padmaja

bruce ur still bearish even though the developing POC is 95 even though there is enought time and did not take out the fridays POC? thanks and thanks for replying back it was very useful

[quote]Originally posted by BruceM

I am bearish but don't usually day trade much outside the first 90 minutes of the day. Here is a screen shot of the calls I sold this morning. My plan is to see if I can get price to test back down into the 2385 - 2387 area but that doesn't mean it will happen today If these go wrong, I will take the loss if I have to buy them back about 40 % above what I sold them for or else I will try to make about %50 on them if I'm a winner.... .[quote]Originally posted by Padmaja

bruce ur still bearish even though the developing POC is 95 even though there is enought time and did not take out the fridays POC? thanks and thanks for replying back it was very useful

u had 2 bias. Long term (short calls) and the day trade. BTW great call. U make money both ways. ur call expire if the price point is never reached. GRT

I am bearish but don't usually day trade much outside the first 90 minutes of the day. Here is a screen shot of the calls I sold this morning. My plan is to see if I can get price to test back down into the 2385 - 2387 area but that doesn't mean it will happen today If these go wrong, I will take the loss if I have to buy them back about 40 % above what I sold them for or else I will try to make about %50 on them if I'm a winner.... .[quote]Originally posted by Padmaja

bruce ur still bearish even though the developing POC is 95 even though there is enought time and did not take out the fridays POC? thanks and thanks for replying back it was very useful

u had 2 bias. Long term (short calls) and the day trade. BTW great call. U make money both ways. ur call expire if the price point is never reached. GRT

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.