ES Thursday 7-20-17

2474 - 2475 is first key number on upside to try and target back to yesterdays highs. Keep in mind we have an 8:30 report today if you play this early. Yesterdays profile is sloppy to me but I have a bearish mindset which can be trouble.....I will update before market opens and after that 8:30 report. No midpoint test yesterday. Very difficult to trade in low volatility where we don't see much two sided trade.

edit one: I sold 75 even on the way back down post report ...going for current midpoint of 72.75...R1 is 75 today and weekly R1 is 75 !

edit two: Biggest number to watch is 2469 today. I will explain on video

Edit three...the Video

edit one: I sold 75 even on the way back down post report ...going for current midpoint of 72.75...R1 is 75 today and weekly R1 is 75 !

edit two: Biggest number to watch is 2469 today. I will explain on video

Edit three...the Video

reselling 74 and not afraid to add above current On highs....midpoint will be target again....

no gap and go's two days in a row so they should go back to YD's close in RTH today...so 71.25 is a target...anything above 74 is sell to me and will be agressive this morning......faders got burned yesterday and they usually don't get burned two days in a row...of course in this volatility and lack of sellers then anything seems to be happeneing

I added my video to post number one above...being very aggressive this morning....calls sold YD are naturally in the hole and losing...don't want anyone to think I forgot to update the forum on those.....this isn't a post and boast thread...we need to own it when we are wrong or losing !!

adding to my 74's at 75.25 and last add point will be above overnight high if / when it prints......Midpoint has not printed ....YET !!

scaling heavy at midpoint........will try for YD's highs and close gap now...I will still work the overnight highs if that comes first

scaling once again at YD highs.....

a critical mental point for me....even though yesterday was frustrating for trading I have learned over time to condition myself to get excited about days following frustrating days. If you define yourself as a fader then you will notice over time that days following days that don't do what you think they will ( in other words us faders lose) end up being fantastic days. It's almost as if all the faders who got burned come back for revenge the following day

70.25 is final on day trades for me...this was a second RTH short campaign and we hit into overnight POC and very close to that close gap fill....this goes with my get out in front of key areas theory and they know many will try for gap fills and an overnight high or low range....I simply do not want to give anything back today and I want to feel like I took over the world trading today ...LOL...be careful if and when Ym hits 21551...the ES may be at the key 68 - 69 at the same time today......

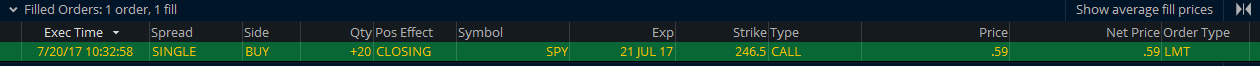

I bought back my options for a loss of commissions but I still have the 247 spy's with a week to go....I wanted to get clean on these as they had only one day left and although I want that 2461.25 retest in ES I thought it would be better to do that with the further dated options just in case......funny how I was filled at exact price of what I sold them for

Thanks Big Mike....it may come down to that and I appreciate the help....I'll have to run some sim trades on your calendar spreads....I'm not a huge fan of debit spreads but in low volatility it would make sense

Originally posted by Big Mike

Bruce, Good luck with the brakes, if you run into an issue holler. I have done quite a bit of my own work over the years and actually was poised to have a certified mechanic career-40 years ago. OUCH that hurt my ears.

Regarding the option decay, with volatlity so low the premiums just aren't there so I'm buying SPX calendar spreads. Sell 8 days out buy 22 days out every Wed/Thursday ATM. Ties up 6-700 per trade and today's trade is already of for .55 per contract profit. The nice part is if/when vol expands the trade will really zoom into profit quickly. Your naked calls might be tough to buy back of vol jumps while you're in.

I am just waiting for pop in vol >20 to put on a volatility structure trade my son and I have noodled out.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.