ES Monday 9-18-17

all the way short and will be selling the 2525 spx call spread this morning...no longs for me...u can have them all

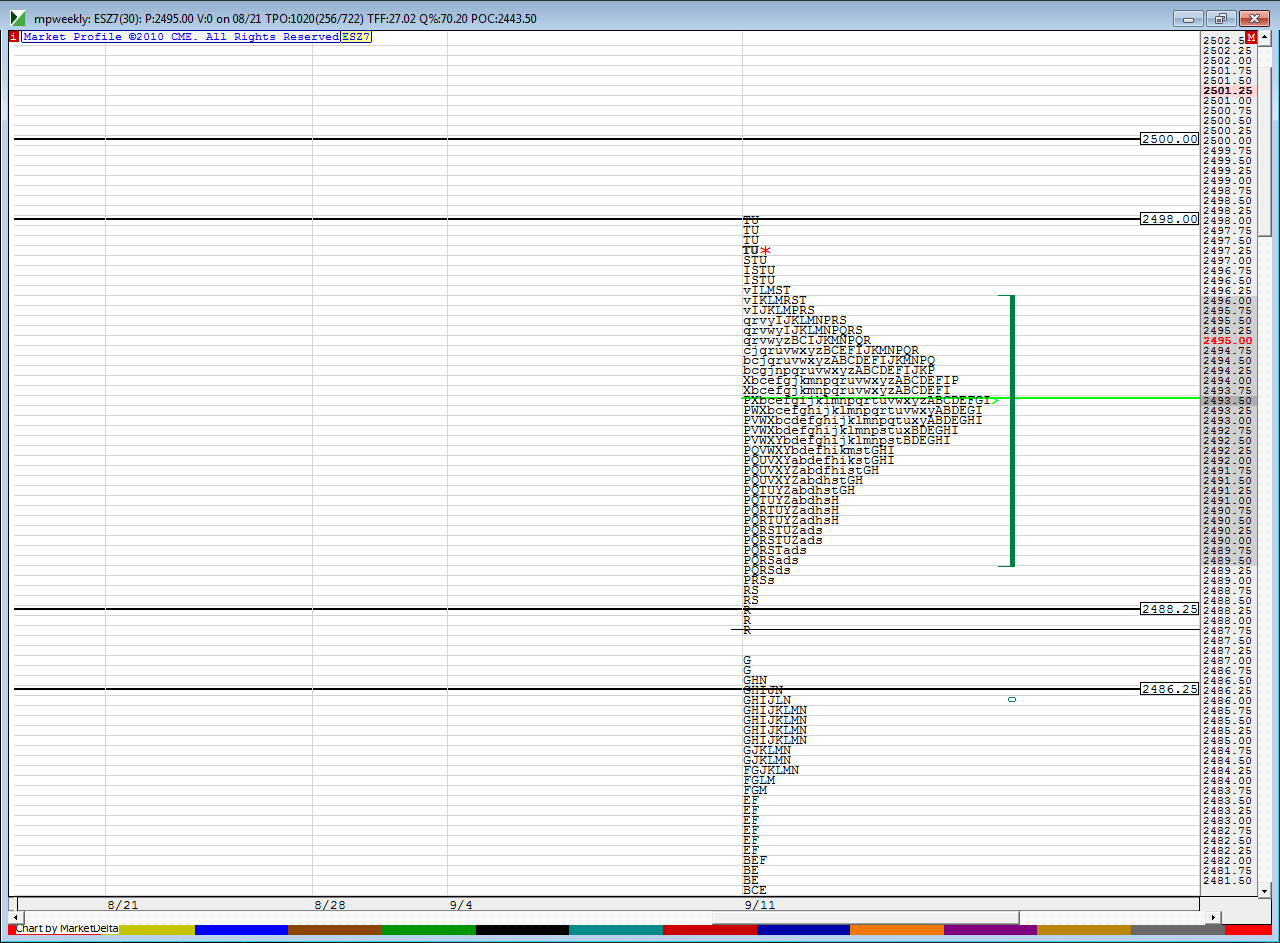

key weekly bracket / bell curve for me

ON SPX - 31 point one sd move for this week so 86 % chance we tag 2515 or drop down to 2485 before weeks end....one could use the opening 15 minutes of the week and use stop and reverse order until the 15 points is achieved...just an idea....today we have a 14 pt one sd move...so 86 % chance spx will print 2507 or 2493! one could use the opening 5 minute bar to try to go for that but you would need to think about gaps etc with these thoughts....these two ideas turns one into a breakout trader but that would be ok with proper risk management

magnet price for me is 98.25 today

key weekly bracket / bell curve for me

ON SPX - 31 point one sd move for this week so 86 % chance we tag 2515 or drop down to 2485 before weeks end....one could use the opening 15 minutes of the week and use stop and reverse order until the 15 points is achieved...just an idea....today we have a 14 pt one sd move...so 86 % chance spx will print 2507 or 2493! one could use the opening 5 minute bar to try to go for that but you would need to think about gaps etc with these thoughts....these two ideas turns one into a breakout trader but that would be ok with proper risk management

magnet price for me is 98.25 today

volume spiked at 2503.75 so I'd keep an eye on that if you still happen to be in this....that is the price now that many will be using as a magnet...so watch the high there on that one minute bar closely if looking for clues as to what the days close may bring...that also happen to be the 30 minute poc......cool stuff

here it comes

hey Bruce, good analysis this morning. i faded 2506 but covered before lunch. thought if it was going to sell off it would have before lunch CST time.... i should've sold calls, oh well...which spx month expiry did you sell? front month?

With no excess on today's high, this break could be just a gap filling exercise.

If this is the case, than the odds are high that the market might be aiming for that gap in data at 2506.00

And if today's session runs out of time, they might even try to reach that 2506.00 in tonight's overnight trading...

Just thinking out loud...

If this is the case, than the odds are high that the market might be aiming for that gap in data at 2506.00

And if today's session runs out of time, they might even try to reach that 2506.00 in tonight's overnight trading...

Just thinking out loud...

... and us hindsight-traders got long at 2498.00 (Friday's day high) with a target at 2506.00 (current day high)

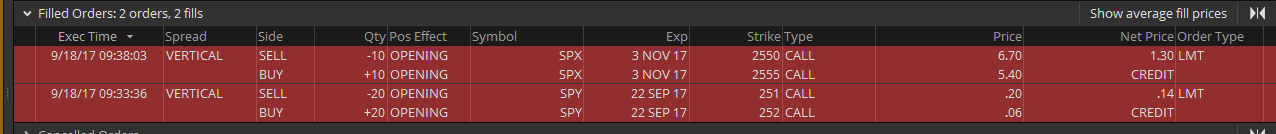

here are the options I initiated today....I also rolled my 249 calls from last week on Friday to Wednesdays expiry and will roll them again if needed.......but these are the ones I put on today

Originally posted by trader88

hey Bruce, good analysis this morning. i faded 2506 but covered before lunch. thought if it was going to sell off it would have before lunch CST time.... i should've sold calls, oh well...which spx month expiry did you sell? front month?

a video recap of the cash market and volume in ES and how our experiment with the 5 and 15 minute ranges would be doing

that seems quite logical....hope it goes that way for all who are long...the cash only closed about 3.5 pts higher today.....right in the center of the range....doji players may get sucked in short....no clue

Originally posted by Aladdin

With no excess on today's high, this break could be just a gap filling exercise.

If this is the case, than the odds are high that the market might be aiming for that gap in data at 2506.00

And if today's session runs out of time, they might even try to reach that 2506.00 in tonight's overnight trading...

Just thinking out loud...

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.