Trading ER2

For those of you who regularly trade the ER2 - what do you currently use as leading indicators for price movement?

YM, NQ, ES, IWM, INDU, COMP, SPX, TICK/TRIN, etc. etc.

I have been experimenting with combinations of some of the above and seem to get mixed results which are different every day depending on the market leader (DJIA, NAS, S&P).

I do keep an eye on the three major individual sector indices for ER2 weighting (fin. svcs., industr. materials, and healthcare) as well as the ten largest equities in the index itself - and of course the overall market action.

My question is: what are the best indicators to monitor for price action (outside of Stoch & MACD) for the ER2?

YM, NQ, ES, IWM, INDU, COMP, SPX, TICK/TRIN, etc. etc.

I have been experimenting with combinations of some of the above and seem to get mixed results which are different every day depending on the market leader (DJIA, NAS, S&P).

I do keep an eye on the three major individual sector indices for ER2 weighting (fin. svcs., industr. materials, and healthcare) as well as the ten largest equities in the index itself - and of course the overall market action.

My question is: what are the best indicators to monitor for price action (outside of Stoch & MACD) for the ER2?

nova -

my primary trading is structured in Market Profile. however, i often use $TICK, $TICKI, $TRIN for scalp moves (.5 to 1.5pts typically). as for which index leads, it seems to me to depend on the day. some days the NQ seems to lead, others it's the ER2 or YM or ES or Stoxx etc. if trying to use an index-based leader indicator, the keys seem to me to be:

1. identify the leader early

2. regardless of perceived leader, trade each market independently

the second point sounds both obvious and contradictory to using indices as indicators but all i mean is don't get wrapped up in "Well, the ES is tanking so the ER2 will follow." today was a pretty good example, when the er2 really seemed to be puking and the ES held its own, dipping a bit but nothing for shorts to salivate over.

anyway, hope this helps. good luck in your pursuits.

take care

omni

my primary trading is structured in Market Profile. however, i often use $TICK, $TICKI, $TRIN for scalp moves (.5 to 1.5pts typically). as for which index leads, it seems to me to depend on the day. some days the NQ seems to lead, others it's the ER2 or YM or ES or Stoxx etc. if trying to use an index-based leader indicator, the keys seem to me to be:

1. identify the leader early

2. regardless of perceived leader, trade each market independently

the second point sounds both obvious and contradictory to using indices as indicators but all i mean is don't get wrapped up in "Well, the ES is tanking so the ER2 will follow." today was a pretty good example, when the er2 really seemed to be puking and the ES held its own, dipping a bit but nothing for shorts to salivate over.

anyway, hope this helps. good luck in your pursuits.

take care

omni

Novistar,

2 things:

1. Try using (TradeStation) $ER2IUX, which is the ER2 premium. All stock indexes roughly track, but this is the best premium indicator (more clear and better than the spinx, esinx, nqiqx, or ym premium - months of study). 4 period moving avg on 1 min chart. Trade the turns.

2. Inter-Index indications. Cash market charts. $IUX, $INX, $NDX.X.

5 MIN. When 5 period moving avg of one index breaks a low and the other two do not, BIG buy when 5 period ma turns up. Opposite applies.

I want to promote more ER2 LIQUIDITY. Love trading ER2'S vs. ES's. Smoother, less choppy, consistantly more profit potential on the downside.

Can't believe I gave this away for free. When you make money on this you owe me some Omaha steaks and Maine lobsters - both !!! And anyone else that reads this !!!!

2 things:

1. Try using (TradeStation) $ER2IUX, which is the ER2 premium. All stock indexes roughly track, but this is the best premium indicator (more clear and better than the spinx, esinx, nqiqx, or ym premium - months of study). 4 period moving avg on 1 min chart. Trade the turns.

2. Inter-Index indications. Cash market charts. $IUX, $INX, $NDX.X.

5 MIN. When 5 period moving avg of one index breaks a low and the other two do not, BIG buy when 5 period ma turns up. Opposite applies.

I want to promote more ER2 LIQUIDITY. Love trading ER2'S vs. ES's. Smoother, less choppy, consistantly more profit potential on the downside.

Can't believe I gave this away for free. When you make money on this you owe me some Omaha steaks and Maine lobsters - both !!! And anyone else that reads this !!!!

Thanks guys!! Those are really useful comments. I will try them out and report back here.

Hello All ER2 traders.

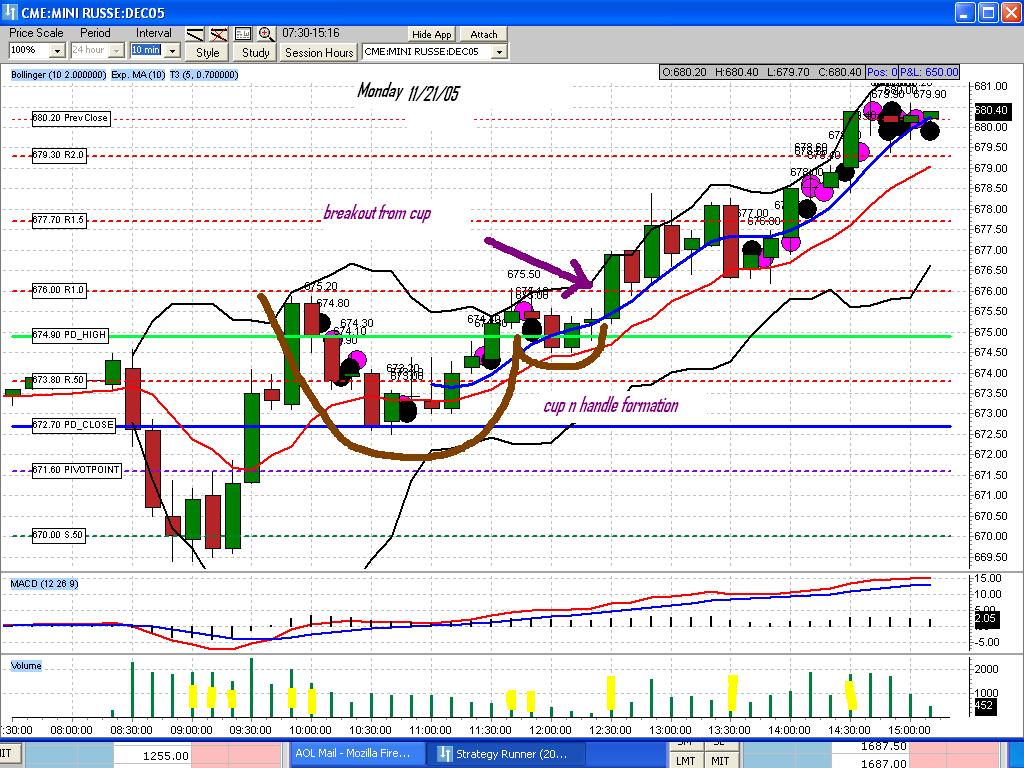

One of the things that I see happen often with the Russ Mini is how well the " Woodie" Pivot's work.

One thing that I did add to my pivot numbers was to add a pivot in between each level. For example, I have added R.50 in between the pivot and R1, as well as R1.5 and R2.5 in between R1 & R2, as well as S.50, S1.5 and S2.5 and it has been working very well over the last 2 1/2 months.

To do this, round up all Woodie Pivot Numbers up to the nearest dime 1st. Then find the range or spread between the Pivot and R1 and divide by 2, take the sum and add it to the lower number.

Todays ER Pivot = 677.20 R1 = 682.50 Spread = 5.30 /2 = 2.65

Add Pivot to the spread = 677.20 + 2.65 = 679.85 then rounded up to the nearest dime = 679.90, 679.90 = R.50

The same thing is done for all Support and Resistance numbers from the Pivot up to R3 and down to S3 thus adding S.50, S1.5, S2.5 AND R.50, R1.5, R 2.5

I have an excel spreadsheet calculate all of my PSR #'s every morning.

All I do is enter the High, Low and Close and it calculates the rest.

If anyone would be interested in this excel spreadsheet, just ask.

The Spreadsheet calculates all PSR for the SP, NAZ and Russel

You be surprised how many times you think that the market is heading to R1 or down to S1 only to see it stall at the 1/2 way mark and then continue or totally reverse from there.

Happy Trading...

One of the things that I see happen often with the Russ Mini is how well the " Woodie" Pivot's work.

One thing that I did add to my pivot numbers was to add a pivot in between each level. For example, I have added R.50 in between the pivot and R1, as well as R1.5 and R2.5 in between R1 & R2, as well as S.50, S1.5 and S2.5 and it has been working very well over the last 2 1/2 months.

To do this, round up all Woodie Pivot Numbers up to the nearest dime 1st. Then find the range or spread between the Pivot and R1 and divide by 2, take the sum and add it to the lower number.

Todays ER Pivot = 677.20 R1 = 682.50 Spread = 5.30 /2 = 2.65

Add Pivot to the spread = 677.20 + 2.65 = 679.85 then rounded up to the nearest dime = 679.90, 679.90 = R.50

The same thing is done for all Support and Resistance numbers from the Pivot up to R3 and down to S3 thus adding S.50, S1.5, S2.5 AND R.50, R1.5, R 2.5

I have an excel spreadsheet calculate all of my PSR #'s every morning.

All I do is enter the High, Low and Close and it calculates the rest.

If anyone would be interested in this excel spreadsheet, just ask.

The Spreadsheet calculates all PSR for the SP, NAZ and Russel

You be surprised how many times you think that the market is heading to R1 or down to S1 only to see it stall at the 1/2 way mark and then continue or totally reverse from there.

Happy Trading...

Thanks for all the info russel2k!

I was trying to reproduce your woodie pivots by hand but couldn't. What input values did you use for OHLC?

You can upload your spreadsheet to the forum here so we can try in out.

I was trying to reproduce your woodie pivots by hand but couldn't. What input values did you use for OHLC?

You can upload your spreadsheet to the forum here so we can try in out.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.