ES Friday 10-14-2011

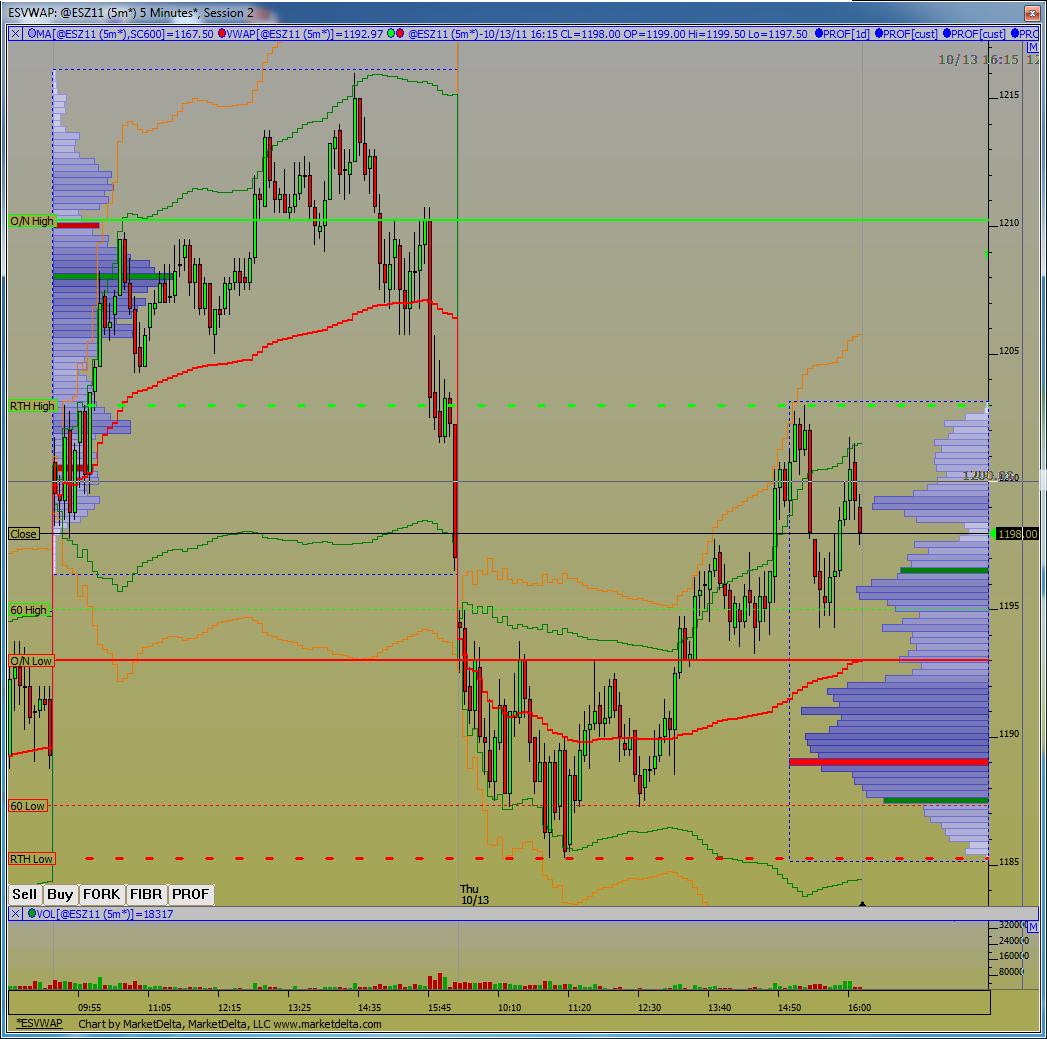

Big Low Volume support at 1198.

Current O/N high traded to the LVN from Wed. of 1210.50. Above that is 1214-1216.

Current O/N high traded to the LVN from Wed. of 1210.50. Above that is 1214-1216.

10.25 was LV from wed to 3675 contracts

Right now, on a 24hour chart, is what I used to call a hammock formation.

1) a High

2) a belly

3) a test of the H of 2 days ago.

I am hoping Bruce, Lorn, anyone might be able to see something in the V profiles, or some other observation that would help ID the formation as a sell (DT H today testing H of 2 days ago) or not.

I've never had any way to figure out whether this style DT is a sell or not. I know 50% of the RTH range (as it unfolds can sometime help in bolstering confiidence in (selling) the formation.,

1) a High

2) a belly

3) a test of the H of 2 days ago.

I am hoping Bruce, Lorn, anyone might be able to see something in the V profiles, or some other observation that would help ID the formation as a sell (DT H today testing H of 2 days ago) or not.

I've never had any way to figure out whether this style DT is a sell or not. I know 50% of the RTH range (as it unfolds can sometime help in bolstering confiidence in (selling) the formation.,

do some tricky stuff now

BTW,

my normal MO was to wait for a swing H failure, or if the first 2 5min bars were down, sell for a test of the previous swing L.

previous swing Low I see on the chart is the 1206 handle.

my normal MO was to wait for a swing H failure, or if the first 2 5min bars were down, sell for a test of the previous swing L.

previous swing Low I see on the chart is the 1206 handle.

all of that is just checking the upper edge of a bigger bell curve richard...no diofferent except failed trades go much further when we get the fade wrong...we are't wrong yet..reports at 9:55 and 10 am

low volume at 1214!!

seeing any foot prints up here

I have no vol up here they all went awy

reports at 10. not the best time to get ambitious

10:07 or so is usually good time

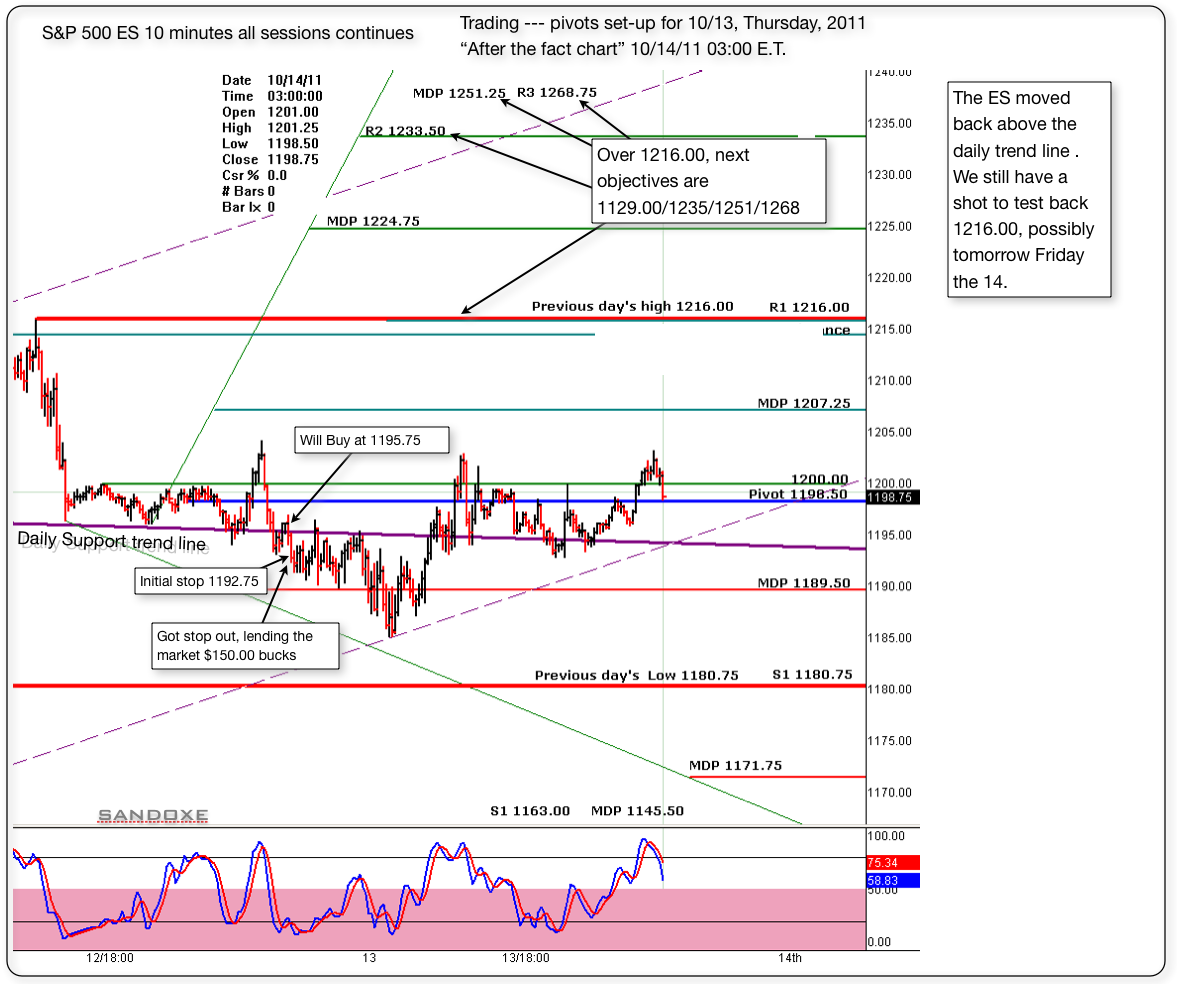

Below are some copied, pasted comments from yesterday's posts, and below that, today's chart with the same pivots from yesterday. In that chart you will see that, some of yesterday's pivotal levels worked well today too. This chart was also posted this morning at 03:00 (copy below) in Thursday's thread indicating we got another shot at 1216.00, today Friday the 14.

Some times you got to keep trying and trying, and if it's mean to be, it will be....

_________________________

sandoxe | 13-Oct-2011 at 5:18 AM

If the bulls still want to give it one more test to 1216, and possibly 1229 with good spike after that I'm Ok with it. Maybe today and tomorrow.

Below is the "before the fact chart" with the pivots set up for today. I'm buying at 1195.75, just above the daily trend line.

Initial stop at 1192.75.

__________________________

sandoxe | 13-Oct-2011 at 5:48 AM | Rep: 245 | Posts: 200 | mail

That was fast. I 'm lending the market $150.00 bucks. This is getting a bit bearish now that it has moved down below the support trend line. I gonna have to have my bear hat near by.

__________________________

sandoxe | 13-Oct-2011 at 3:02 PM

I gave it an other shot above the support trend line same price 1195.75 I'm at B.E. and will seat here till it gives me 1216 LOL

__________________________

sandoxe | 13-Oct-2011 at 3:43 PMl

What did you guys do? The market was doing well. now my stop got hit at B.E. -- Had and awesome day yesterday, and today I suck!

The market still owes me $ 150.00 bucks from this morning. hmmmm I need to see my self doing better, much better.........

Here's the chart posted this morning at 03:00. I was a bit tire and did not put all the stuff in it and did not made a new one with the pivots for today. Just use the same. At the long run is the same thing all over again, as you saw in the above chart. The pivots worked just as good.

I see for you the same I see for my self: Having an awesome, incredible, fun, weekend, best ever!!!

Some times you got to keep trying and trying, and if it's mean to be, it will be....

_________________________

sandoxe | 13-Oct-2011 at 5:18 AM

If the bulls still want to give it one more test to 1216, and possibly 1229 with good spike after that I'm Ok with it. Maybe today and tomorrow.

Below is the "before the fact chart" with the pivots set up for today. I'm buying at 1195.75, just above the daily trend line.

Initial stop at 1192.75.

__________________________

sandoxe | 13-Oct-2011 at 5:48 AM | Rep: 245 | Posts: 200 | mail

That was fast. I 'm lending the market $150.00 bucks. This is getting a bit bearish now that it has moved down below the support trend line. I gonna have to have my bear hat near by.

__________________________

sandoxe | 13-Oct-2011 at 3:02 PM

I gave it an other shot above the support trend line same price 1195.75 I'm at B.E. and will seat here till it gives me 1216 LOL

__________________________

sandoxe | 13-Oct-2011 at 3:43 PMl

What did you guys do? The market was doing well. now my stop got hit at B.E. -- Had and awesome day yesterday, and today I suck!

The market still owes me $ 150.00 bucks from this morning. hmmmm I need to see my self doing better, much better.........

Here's the chart posted this morning at 03:00. I was a bit tire and did not put all the stuff in it and did not made a new one with the pivots for today. Just use the same. At the long run is the same thing all over again, as you saw in the above chart. The pivots worked just as good.

I see for you the same I see for my self: Having an awesome, incredible, fun, weekend, best ever!!!

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.