Does anyone really make money trading futures?

Does anyone really make money trading futures?

I am just wondering.

I know I don't. I have tried all the indicators and the chat room gurus, and none of them make money.

I have a suspicion that a lot of the chat rooms for emini trading are just for hobbyists and market enthusiasts and not for serious traders trying to make a business out of trading.

For any new traders out there please be very cautious of paying anyone to mentor you or signing up for training or a chat room. From what I have seen the only people making money in these deals is the mentor, the chat room owner or the author of the training manual.

I would love to hear from you if you are a successful trader making 20% off your account or better over the past year. I know only 5 to 10 percent of traders are supposed to be successful, but I am beginning to think that zero percent of traders are successful over the long haul. Certainly anyone can have a streak of luck and rack up a few good months where they dramatically increase their account size, but these people are normally big risk takers and eventually they blow out their accounts by taking the exact same risks that help double their accounts in the first place.

Thanks in advance for any response.

I am just wondering.

I know I don't. I have tried all the indicators and the chat room gurus, and none of them make money.

I have a suspicion that a lot of the chat rooms for emini trading are just for hobbyists and market enthusiasts and not for serious traders trying to make a business out of trading.

For any new traders out there please be very cautious of paying anyone to mentor you or signing up for training or a chat room. From what I have seen the only people making money in these deals is the mentor, the chat room owner or the author of the training manual.

I would love to hear from you if you are a successful trader making 20% off your account or better over the past year. I know only 5 to 10 percent of traders are supposed to be successful, but I am beginning to think that zero percent of traders are successful over the long haul. Certainly anyone can have a streak of luck and rack up a few good months where they dramatically increase their account size, but these people are normally big risk takers and eventually they blow out their accounts by taking the exact same risks that help double their accounts in the first place.

Thanks in advance for any response.

When all is said and done, the only thing that matters is that when a trader's career is over, he or she

- is content with the end result

- understands how and why they got that result

I certainly hope that each trader or hopeful trader satisfies themselves as to the merits of trading, keeping self-delusion and misguidedness to a minimum. Be honest with yourself - do you really understand what you're doing?

Prior to beginning to trade, a person needs to demonstrate that their method will work. This is not something that should be done after you've started trading.

Many people who are much smarter and more talented than any of us, have failed at trading. I daresay these people had a much deeper understanding about financial markets than any of us do. You might be tempted to dismiss their failure with some explanation made in hindsight (or, more likely, regurgitating someone else's hindsight), but ask yourself - how much do you really know?

Human nature is to brag about winning and keep quiet the losses. But of everyone posting on these trading forums, the only person who is going to know with certainty the overall result at the end of his or her trading career - is the individual person himself. Be it a short lived career of three months or a span of several years.

The odds you find in a casino are exactly known because they are contrived. The casino designs the games with odds that are always in favor of the casino. Yet hundreds of thousands of people are addicted to placing money bets in casinos. There are two reasons:

(a) most of them don't understand the concept of odds

(b) a lot of them let expectation and hope guide their actions instead of being rational about (if they were rational they wouldn't gamble)

The situation with financial markets is more complicated because a big portion of the available odds are the result of natural processes beyond anybody's control. This is dangerous because people start inventing their own odds without the possibility of knowing whether they are accurate.

Again, for each of us posting and reading these forums, there are and have been many, many people substantially more intelligent and knowledgable who dedicated their waking hours to trading, and failed. This fact is something that should not be dismissed. Any aspiring trader needs to think twice about whether it's really something worth doing, and any existing trader should take pause.

Losing money through trading stings in an amount directly proportional to your desperation to win. If you are not desperate to win, and you realize that at the end of your 3-month, one year, or ten year trading career, you may have a negative P/L, then who can fault you for trading?

- is content with the end result

- understands how and why they got that result

I certainly hope that each trader or hopeful trader satisfies themselves as to the merits of trading, keeping self-delusion and misguidedness to a minimum. Be honest with yourself - do you really understand what you're doing?

Prior to beginning to trade, a person needs to demonstrate that their method will work. This is not something that should be done after you've started trading.

Many people who are much smarter and more talented than any of us, have failed at trading. I daresay these people had a much deeper understanding about financial markets than any of us do. You might be tempted to dismiss their failure with some explanation made in hindsight (or, more likely, regurgitating someone else's hindsight), but ask yourself - how much do you really know?

Human nature is to brag about winning and keep quiet the losses. But of everyone posting on these trading forums, the only person who is going to know with certainty the overall result at the end of his or her trading career - is the individual person himself. Be it a short lived career of three months or a span of several years.

The odds you find in a casino are exactly known because they are contrived. The casino designs the games with odds that are always in favor of the casino. Yet hundreds of thousands of people are addicted to placing money bets in casinos. There are two reasons:

(a) most of them don't understand the concept of odds

(b) a lot of them let expectation and hope guide their actions instead of being rational about (if they were rational they wouldn't gamble)

The situation with financial markets is more complicated because a big portion of the available odds are the result of natural processes beyond anybody's control. This is dangerous because people start inventing their own odds without the possibility of knowing whether they are accurate.

Again, for each of us posting and reading these forums, there are and have been many, many people substantially more intelligent and knowledgable who dedicated their waking hours to trading, and failed. This fact is something that should not be dismissed. Any aspiring trader needs to think twice about whether it's really something worth doing, and any existing trader should take pause.

Losing money through trading stings in an amount directly proportional to your desperation to win. If you are not desperate to win, and you realize that at the end of your 3-month, one year, or ten year trading career, you may have a negative P/L, then who can fault you for trading?

Bakrob,

Is it possible for you to send me a e-mail as a fellow Canadian and someone trying to get through the quagmire of info, lies and deception out there. I would appreciate any guidance you can offer.

c

Is it possible for you to send me a e-mail as a fellow Canadian and someone trying to get through the quagmire of info, lies and deception out there. I would appreciate any guidance you can offer.

c

cnSmith .. I don't see the option in your profile to email you? Send me a PM with your email address.

This past week was an interesting one performance wise for me. Friday, being US employment report day, I knew would be a tricky day of trading because often the day has high volume but can be very choppy (non-trending). And this Friday did not disappoint. I fell out of sync with the pace of trade during the protracted 4 hours of sideways chop which ran through the middle of the pit session. I had the directional bias right, but the higher level of choppiness mid-day was challenging for me. Also, Friday came on the heels of a two day win streak, where I had two trading days in a row without one losing trade, so I knew going into Friday the win streak was on borrowed time. I started the day with two nice winning trades, but things turned south on me during the directionless mid-day chop phase and I fell into a losing streak that lasted until the last hour of trading, where I pulled the nose of the plane up and finished the day with a couple of wins going into the close. This left me with what I will call a break-even day of trading. I ended with a net gain for the day, but just barely. If not for the last two trades of the day, it would have been a losing day.

Here are my basic stats for Friday alone, just to get a good feel for what a choppy day of trading looks like from my perspective:

Avg. Trade = $ 3.75

Avg. Win = $ 84

Avg. Loss = - 85

Avg. W/L ratio = 0.98

Profit factor = 1.09

Win% = 52 %

Max Win = $ 120

Max Loss = - 117

Avg MAE = - $ 72

OK so what can we take away from Friday. Note, by keeping the Max Loss per trade reasonably low, I avoided having a huge single loss from which it would have been impossible to recover. Also, note I kept the avg W/L ratio near 1, again making sure to protect from incurring a large single loss. This is defensive trading, and the lesson here is: control your risk at all times no matter what.

The summary for this week, four solid winning days in a row ending with Friday's soft performance:

Avg. Trade = $ 49

Avg. Win = $ 122

Avg. Loss = - 63

Avg. W/L ratio = 1.96

Profit factor = 3.0

Win% = 60%

Max Win = $ 596

Max Loss = - 117

Avg MAE = - $ 52

(all results per contract)

This week's results advanced the daily win streak to 18 positive winning days in a row ended with Friday's break-even day. Taking the last 5 weeks into account, introduces 1 losing day along with this week's 1 break-even day (out of 25 days total) for a daily win% of 92%.

I have gone through this sharing process primarily to challenge the absolute claims made by the random walk theorists. Also, with Jim Kane's insightful commentary I hope this has been an instructive example for traders interested in advancing their trading success. Please keep in mind, trading futures involves substantial risk of loss and is not suitable for all investors. As always, past performance is NOT indicative of future results.

Here are my basic stats for Friday alone, just to get a good feel for what a choppy day of trading looks like from my perspective:

Avg. Trade = $ 3.75

Avg. Win = $ 84

Avg. Loss = - 85

Avg. W/L ratio = 0.98

Profit factor = 1.09

Win% = 52 %

Max Win = $ 120

Max Loss = - 117

Avg MAE = - $ 72

OK so what can we take away from Friday. Note, by keeping the Max Loss per trade reasonably low, I avoided having a huge single loss from which it would have been impossible to recover. Also, note I kept the avg W/L ratio near 1, again making sure to protect from incurring a large single loss. This is defensive trading, and the lesson here is: control your risk at all times no matter what.

The summary for this week, four solid winning days in a row ending with Friday's soft performance:

Avg. Trade = $ 49

Avg. Win = $ 122

Avg. Loss = - 63

Avg. W/L ratio = 1.96

Profit factor = 3.0

Win% = 60%

Max Win = $ 596

Max Loss = - 117

Avg MAE = - $ 52

(all results per contract)

This week's results advanced the daily win streak to 18 positive winning days in a row ended with Friday's break-even day. Taking the last 5 weeks into account, introduces 1 losing day along with this week's 1 break-even day (out of 25 days total) for a daily win% of 92%.

I have gone through this sharing process primarily to challenge the absolute claims made by the random walk theorists. Also, with Jim Kane's insightful commentary I hope this has been an instructive example for traders interested in advancing their trading success. Please keep in mind, trading futures involves substantial risk of loss and is not suitable for all investors. As always, past performance is NOT indicative of future results.

Thanks for posting all that, PT. I think it is really helpful for the readers to see the numbers so well laid out. As I've said in many of my writings, if one goes into a pizza business, it's fairly easy to find stats on what other similar pizza places in the area might be making. If you open up a convenience store, same thing, and so on. But for small, independent traders, it's very, very hard to get any reliable numbers, and hence very hard to create a plan that is based on any accurate data. You are providing such data here, and I hope everyone struggling to create a business plan for trading realizes this. And as I said before, it is amazing how closely your numbers reflect my own research and data.

As some may recall, PT and I started this conversation in another thread that I started trying to point out what I thought realistic numbers looked like, and that they weren't the 20 or 30 point average winners some were claiming (and saying you must be an idiot if you don't get). And I'll mention again, what PT has shown here, in my opinion, is a slow and steady, consistent approach that will tend to have a very low variability. As discussed by both PT and myself, management (risk and trade) are a key factor in this. The odds of this kind of style 'blowing up' are very low in my opinion.

As a closing remark, I have a 'test' I joke to beginners about. I call it the 'vendor test'. If you look at the potential stats for your plan and then imagine if you were a vendor trying to promote your 'Learn to trade in a weekend' seminar with those stats, if you think you'll fill the room, the plan is worthless. If you think you'll make a good amount of money doing the seminar, the plan is still likely useless, and if you are positive you won't have a single person show up at the seminar, your stats are in the ballpark of being something actually realistic. Just something to think about.

Great job, PT, I never get tired of looking at your stats.

As some may recall, PT and I started this conversation in another thread that I started trying to point out what I thought realistic numbers looked like, and that they weren't the 20 or 30 point average winners some were claiming (and saying you must be an idiot if you don't get). And I'll mention again, what PT has shown here, in my opinion, is a slow and steady, consistent approach that will tend to have a very low variability. As discussed by both PT and myself, management (risk and trade) are a key factor in this. The odds of this kind of style 'blowing up' are very low in my opinion.

As a closing remark, I have a 'test' I joke to beginners about. I call it the 'vendor test'. If you look at the potential stats for your plan and then imagine if you were a vendor trying to promote your 'Learn to trade in a weekend' seminar with those stats, if you think you'll fill the room, the plan is worthless. If you think you'll make a good amount of money doing the seminar, the plan is still likely useless, and if you are positive you won't have a single person show up at the seminar, your stats are in the ballpark of being something actually realistic. Just something to think about.

Great job, PT, I never get tired of looking at your stats.

Since I stepped off the 'random walk is nonsense' bandwagon I will not comment on that, but I did find a good read for those that want to hear what a highly respected long-term trader has to say on the subject. I came across this a little while ago, and thought I'd list the reference. If you've ever traded or heard of the '2B' setup, then you likely know who 'Trader Vic' is. He has a recent book out Trader Vic on Commodities. Chapter 6 is entitiled 'A Challenge to the Random Walk Theory', pages 45-66. It is worth looking at if you happen to have access to the book.

Along these same lines, here is something interesting, too. Go to this page:

http://www.investorsinsight.com/blogs/thoughts_from_the_frontline/archive/2009/04/24/back-to-the-future-recession.aspx

Scroll down to the area under the heading 'How Did We Get It So Wrong?' and read the first paragraph and the first two lines of the second paragraph. Trader Vic also addresses this concept in the second paragraph on page 45 in his book, this concept that an idea can get accepted, and then it is set in stone, no matter what future evidence is presented. And it is taught on and on, even by people who feel it is absurd. I mean, ponder what is in the above lines from that link. About two hundred academic professors from economics schools, and like two or three believed in the efficient market hypothesis, yet all two hundred taught it. If that doesn't sum it all up for once and for all, nothing ever will...

Along these same lines, here is something interesting, too. Go to this page:

http://www.investorsinsight.com/blogs/thoughts_from_the_frontline/archive/2009/04/24/back-to-the-future-recession.aspx

Scroll down to the area under the heading 'How Did We Get It So Wrong?' and read the first paragraph and the first two lines of the second paragraph. Trader Vic also addresses this concept in the second paragraph on page 45 in his book, this concept that an idea can get accepted, and then it is set in stone, no matter what future evidence is presented. And it is taught on and on, even by people who feel it is absurd. I mean, ponder what is in the above lines from that link. About two hundred academic professors from economics schools, and like two or three believed in the efficient market hypothesis, yet all two hundred taught it. If that doesn't sum it all up for once and for all, nothing ever will...

So many great comments in this thread...

If it is one thing I have learned after 12 years of trading is the bottom line: you need to have a proven and reliable system to trade the futures.

The system removes the emotion and will be the key to your long-term success.

If it is one thing I have learned after 12 years of trading is the bottom line: you need to have a proven and reliable system to trade the futures.

The system removes the emotion and will be the key to your long-term success.

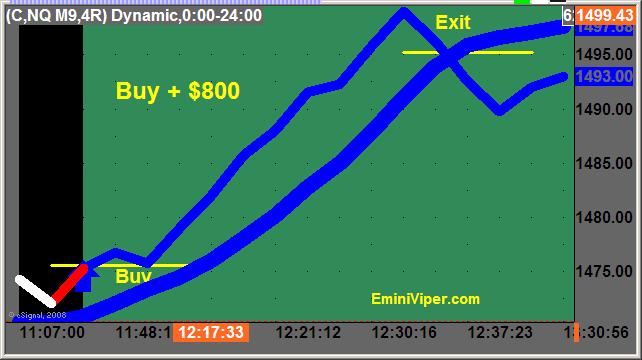

Hey, cba. I checked out that EminiViper.com page. Very impressive. Seems like they don't have any losing days, or even losing trades (or do they not post those?). Is that so? If not, how many stop outs or false signals are you seeing on an average day? It doesn't mean much to me to see winners, I am more interested in the losers I have to take to get those winners. Also, are you the owner of EminiViper.com, or do you work for them? If not, what is your association? If I don't ask, that will likely be the first question from everyone else. Thanks.

Hey Jim -

Thanks for visiting the Web site and offering your constructive questions and feedback...

The videos are intended to show the NQ Emini trades that are triggered by the system each day. Currently the system is designed to issue trade signals only the Nasdaq Emini. In addition to the Viper indicator, the system uses a combination of guidance charts and a trading chart that very rarely has a losing trade. With all of these constraints, it should be noted however, that there are not many signals that trigger in any given trading day. Depending on the volatility - usually one or two trades may trigger - a busy day would be 3 trades.

The entire trading system is not shown in the videos; however, all of the details regarding these trade signals are shown in an eBook and training videos. The actual trade signals themselves are analyzed in real-time in the live Webinars. The entire goal of this system was accuracy - not catching every trade.

In answer to your other question, I have been a trader for a little over 12 years now, I am a partner in the firm; and was involved extensively in developing, actively trading and back-testing the Viper system over the past year and a half.

Once again, thank you for your input, and I look forward to opportunity of respectfully participating in your Forum...

Thanks for visiting the Web site and offering your constructive questions and feedback...

The videos are intended to show the NQ Emini trades that are triggered by the system each day. Currently the system is designed to issue trade signals only the Nasdaq Emini. In addition to the Viper indicator, the system uses a combination of guidance charts and a trading chart that very rarely has a losing trade. With all of these constraints, it should be noted however, that there are not many signals that trigger in any given trading day. Depending on the volatility - usually one or two trades may trigger - a busy day would be 3 trades.

The entire trading system is not shown in the videos; however, all of the details regarding these trade signals are shown in an eBook and training videos. The actual trade signals themselves are analyzed in real-time in the live Webinars. The entire goal of this system was accuracy - not catching every trade.

In answer to your other question, I have been a trader for a little over 12 years now, I am a partner in the firm; and was involved extensively in developing, actively trading and back-testing the Viper system over the past year and a half.

Once again, thank you for your input, and I look forward to opportunity of respectfully participating in your Forum...

Thanks for the response, cba. Wow, those are some incredibly impressive stats. Given these are intraday trend trades, it's almost incomprehensible to me. My style is intraday trend trading, and with the 3 to 5 to 1 or sometimes higher reward/risk profiles I'm happy anywhere in the 30% to 50% winners range.

I have a few more questions. Is there a way to follow along and see live trade signals the moment they develop, on a trial basis? The web site mentions visiting a live webinar for a day. Would one see live signals in time to act, or only after they have started? What if no signals are generated that day, can someone try another day? It's very hard to evaluate a system with a one-day trial, especially one that generates only a few signals.

Next, what is the difference between live webinars and live trading room, as far as signals given in real-time? Also, if one signs on to your room and gets all that training, does that do any good without the software? What is the cost of the license, since the website doesn't specify this? I'd love to follow along real-time for a period and evaluate your system, but I'm not sure you have any provisions where I could do that without laying out money first. Again, if I don't ask all these questions, someone else will. Since I'm probably the longest-winded character at this forum, I figured I'd just get the ball rolling. It's not often I hear about a system that has almost no losers at all.

Lastly, if we go much further with this discussion it may be appropriate to move it from this thread to one you or someone else could create in Trading Advisory Services.

I have a few more questions. Is there a way to follow along and see live trade signals the moment they develop, on a trial basis? The web site mentions visiting a live webinar for a day. Would one see live signals in time to act, or only after they have started? What if no signals are generated that day, can someone try another day? It's very hard to evaluate a system with a one-day trial, especially one that generates only a few signals.

Next, what is the difference between live webinars and live trading room, as far as signals given in real-time? Also, if one signs on to your room and gets all that training, does that do any good without the software? What is the cost of the license, since the website doesn't specify this? I'd love to follow along real-time for a period and evaluate your system, but I'm not sure you have any provisions where I could do that without laying out money first. Again, if I don't ask all these questions, someone else will. Since I'm probably the longest-winded character at this forum, I figured I'd just get the ball rolling. It's not often I hear about a system that has almost no losers at all.

Lastly, if we go much further with this discussion it may be appropriate to move it from this thread to one you or someone else could create in Trading Advisory Services.

I consistently profit from futures/futures options, but it took me a long time to figure out the best way for me to do so.

While a set of trading rules is very important, I have found that it is just as, maybe even MORE important, to develop "trading callouses" from getting your butt handed to you repeatedly along the way.

Here's the thing: Any set of rules will only work until they don't. It is normal human psychology that there will come a time (again and again) where you deviate from the rules because A) you have had a string of losses, B) you have had a string of wins and now you have a loss and can't believe you're really supposed to "lose this one," C) you get greedy, D) you get scared for whatever reason, or E) any one of a thousand other things that will cause you to screw up.

I had ups and downs for many years until I thought I had it figured out and had a couple of years of really solid profits. I had my own private island picked out :) (not really, but I did have a condo in mind O/N an island). Then came the financial crisis of 2008 and I learned that while I had a generally good strategy, because times were good I had not developed an appropriate risk control system.

Hundreds of thousands of dollars later... (and that didn't take long at all!) I learned the hard way that my strategy was woefully inadequate when the unexpected happened. It took me a while to brush myself off, but eventually I did.

Since sometime in 2009 my cumulative returns are somewhere around 450%. Over the past 9 years I've found that proper risk control continues to be where I tend to fall short, so I've had some choppiness during this time. About two years ago I tightened things up some more to try to make for a smoother equity curve... this mean that, theoretically, my losing months should NOT be as large as in the past, but my winning months will also not be as large as they were in the past.

That's okay though -- even my cumulative success over the past 9-10 years, when averaged out by month, comes to < 2% a month. I suspect that 2% a month, long term, is about where I'll stay, but the ride should just be smoother along the way.

A return like that may or may not be enough for a particular person--it is for me--but keep in mind if you want to shoot for the stars there's a really good chance you're going to eventually crash land back on earth. It really does come down to being adequately capitalized and having a reasonable return be "enough" for you. By all means, trade even with a small account, because you need that experience to get to the point where you'll know what you're doing when you have the larger account. Just don't expect to turn a tiny account into a massive one along the way or you will probably be disappointed.

-PDG

While a set of trading rules is very important, I have found that it is just as, maybe even MORE important, to develop "trading callouses" from getting your butt handed to you repeatedly along the way.

Here's the thing: Any set of rules will only work until they don't. It is normal human psychology that there will come a time (again and again) where you deviate from the rules because A) you have had a string of losses, B) you have had a string of wins and now you have a loss and can't believe you're really supposed to "lose this one," C) you get greedy, D) you get scared for whatever reason, or E) any one of a thousand other things that will cause you to screw up.

I had ups and downs for many years until I thought I had it figured out and had a couple of years of really solid profits. I had my own private island picked out :) (not really, but I did have a condo in mind O/N an island). Then came the financial crisis of 2008 and I learned that while I had a generally good strategy, because times were good I had not developed an appropriate risk control system.

Hundreds of thousands of dollars later... (and that didn't take long at all!) I learned the hard way that my strategy was woefully inadequate when the unexpected happened. It took me a while to brush myself off, but eventually I did.

Since sometime in 2009 my cumulative returns are somewhere around 450%. Over the past 9 years I've found that proper risk control continues to be where I tend to fall short, so I've had some choppiness during this time. About two years ago I tightened things up some more to try to make for a smoother equity curve... this mean that, theoretically, my losing months should NOT be as large as in the past, but my winning months will also not be as large as they were in the past.

That's okay though -- even my cumulative success over the past 9-10 years, when averaged out by month, comes to < 2% a month. I suspect that 2% a month, long term, is about where I'll stay, but the ride should just be smoother along the way.

A return like that may or may not be enough for a particular person--it is for me--but keep in mind if you want to shoot for the stars there's a really good chance you're going to eventually crash land back on earth. It really does come down to being adequately capitalized and having a reasonable return be "enough" for you. By all means, trade even with a small account, because you need that experience to get to the point where you'll know what you're doing when you have the larger account. Just don't expect to turn a tiny account into a massive one along the way or you will probably be disappointed.

-PDG

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.