CHART-EX WEEK VS DAY CHART 181

CHART-EX WEEK VS DAY CHART

MAY 10-16, 2005 VS. MAY 17, 2005

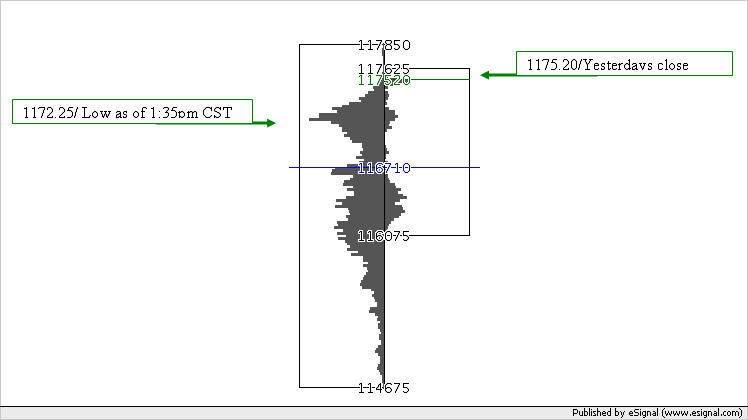

The above Chart-Ex chart displays the trading ranges and cumulative volume at price for the time frame;

Week = May 10-16, 2005

Day = May 17, 2005

- As of 1:35 pm CST, May 18, 2005, the delayed quote for the E-MINI S&P 500 05JUN is HIGH=1189.50, LOW= 1172.25, LAST=1185.50

- As you can see from the chart, the EMINI S&P 500 used the first high volume area below 1175.20 (yesterday’s close) for its support.

- The CHART-EX WEEK VS DAY java chart displays weekly high volume area at 1172.25 (today’s low as of 1:35 pm CST).

- As the market was approaching it’s daily low today, traders were able to use the weekly high volume accumulation as a support/buy signal area.

I've also just noticed that yesterday's range was 55% of the previous month's range and that it was 125% of the previous week's range - in the ES that is. I don't think that your charts are designed to show that but it's a very good visual representation of the previous trading session's size in comparison to the day before, week and month.

I do like 1217.00 as resistance. I would alco look at 1211.00. From a bar chart you can guage the area but using chart-ex with the volume at price you can "zero" in.

I like how you are comparing time frames. When I comare time frame, I compare the previous days high/low to its close and yesterdays high/low it the previous days close. This gives me a comparsion/relative strength of the high/lows to the close.

I like how you are comparing time frames. When I comare time frame, I compare the previous days high/low to its close and yesterdays high/low it the previous days close. This gives me a comparsion/relative strength of the high/lows to the close.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.