Monday 12-10-2007

Light news day today (home sales)

Fed announces interest rate policy tomorrow (Tuesday)

relatively flat open indicated so far...

Fed announces interest rate policy tomorrow (Tuesday)

relatively flat open indicated so far...

i'm in from 15.75..trying for 13.50 on short side..this could easily run away up...I have short goggles on though

so far we have filled the small gap open and are trading higher with the notable exception of the NQ which may be forming a lower high right here, if so we have a divergence

shorted the NQ's at resistance

covered short NQ +2.25

I wouldn't be surprised if they go back down to clear out the stops from all who bought the narrow range bar off the daily chart in the emini SP...they already smoked those who where buying the 60 minute breakout..trading in single prints down at this 16 area

given this narrow range since 11am, this could break in either direction... 60 minute chart points higher however.

i think if this up triangle breakout fails to acheieve target then they may go for the 1513..seems volume drying up on these pushes up....weekly pivot below at 1495...dow was leading that drive out..testing the triangle breakout point now....so buyers need to show themselves...

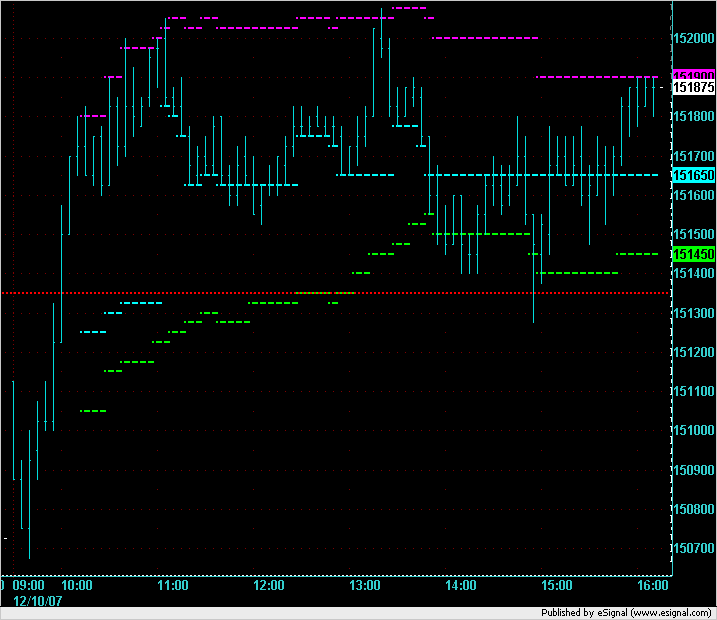

Today's action with the developing value areas and point of control for the ES on a 5 minute chart. Some Market Profile observations from today: Developing Value Area High caught a short later in the day and the Single Print caught a long with very small stops.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.