Mini I.B.

Set-up is VERY simple take the first 1/2 hour of RTH and if price trades above buy, and if it goes below sell short.

For mini Russell 2000 use targets of 2 points and a stop of 2 points.

For mini S&P500 use targets of 2.5 points and a stop of 2.5 points.

So far this March the ES has triggered 4 profits and 2 lossers or a gain of +$896.00 trading 4 contracts. It tends to perform better over a longer period. But the TF continues to outperform the ES month after month.

And trading 4 contracts in the past month would have yielded +$3150.00 on the ES

The TF on the other hand trading in the past month has yeilded +$6400.00 via trading 4 contracts

*these are actual results that counted my slippage but not comm.

For mini Russell 2000 use targets of 2 points and a stop of 2 points.

For mini S&P500 use targets of 2.5 points and a stop of 2.5 points.

So far this March the ES has triggered 4 profits and 2 lossers or a gain of +$896.00 trading 4 contracts. It tends to perform better over a longer period. But the TF continues to outperform the ES month after month.

And trading 4 contracts in the past month would have yielded +$3150.00 on the ES

The TF on the other hand trading in the past month has yeilded +$6400.00 via trading 4 contracts

*these are actual results that counted my slippage but not comm.

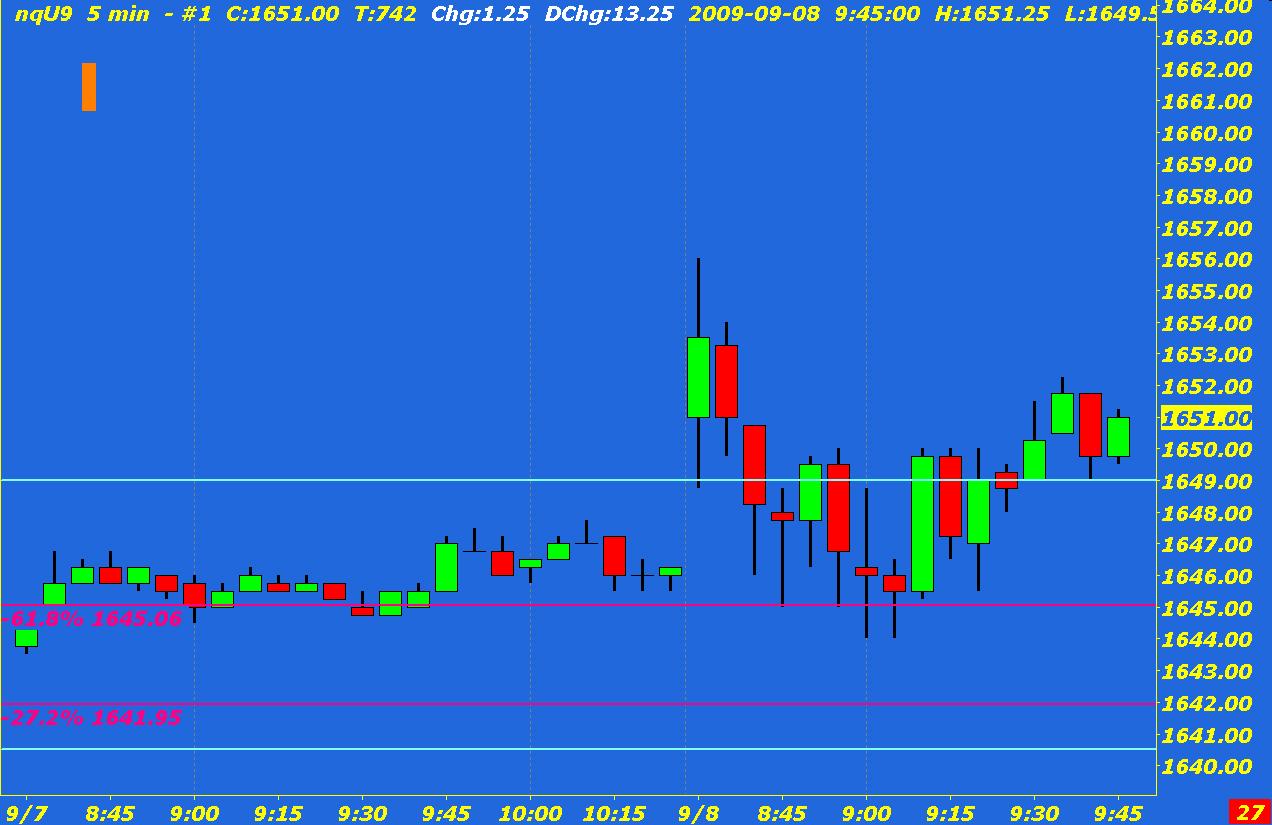

See the first bar of the day for 9/8 ?

Sold @ 1648.50.

Bought @ 1648.50.

Got a point.

Rinse and repeat daily.

Meant to say I Bought it back at 1647.50.

This 1 minute editing window doesn't work well for us fumble-fingered Texans.

This 1 minute editing window doesn't work well for us fumble-fingered Texans.

Thanks for the chart PIp. Why didn't you take the 2 points at 1646.50? I thought that's what your usual target was? Were you looking for something bigger and got stopped out with the point?

Just curious how you play it. I think managing the trade is lots more important than the4 entry. At least that's where I need to improve. That's why I always ask about that end of things. Nice work Pip. Thanks again.

Just curious how you play it. I think managing the trade is lots more important than the4 entry. At least that's where I need to improve. That's why I always ask about that end of things. Nice work Pip. Thanks again.

I didn't take 2pts cuz I'm a paranoid goof.

(I'm really trying not to be!)

(I'm really trying not to be!)

This reminds me of Gary Smith's first book in mid-1990's. He traded using the MSNBC ticker. Gary also published his broker statements and called out hucksters and wanabees to do the same. Brokers used variations of this trade as a carrot for their clients. I'll have to dig his book up and see how well I remember. I traded it with the NYFE, which was so thinly traded that I knew if I was filled it would be a loss and if I didn't get in on a limit that's when the market took off--even with phone access to the pit.

Any recent result for 5b? Thanks.

Jimmy, I've heard of using a 1pt, not tick, 1 whole point above/below the first 5min bar to get you into the mkt, and then just trading it the best you can.

I've given up on my 1 tick method tho. Got a better method.

Google Malcolm Robinson's Simple System.It's free, it works, and, to me anyways, it makes sense.

I've given up on my 1 tick method tho. Got a better method.

Google Malcolm Robinson's Simple System.It's free, it works, and, to me anyways, it makes sense.

Thanks. I will give it a try.

Looks like a lot bad comments about this guy. Piperan, what result you got from this system?

Download the freebie and get after it. Pull up a 5min chart of the ES and see how many opportunities lie in store for you.

The entire cosmos could be plotting to help you if you'll let it.

Here's a link. Enjoy.

http://s3.amazonaws.com/FDT/SalesVids/SimpleSystem/SimpleSystem.html

The entire cosmos could be plotting to help you if you'll let it.

Here's a link. Enjoy.

http://s3.amazonaws.com/FDT/SalesVids/SimpleSystem/SimpleSystem.html

(duplicate post in "Mini I.B. vs 7am-9am Breakout" thread)

I have been a member of mypivots for a little over a year now, using the posts as a springboard for learning about the futures and currency markets – I’ve really appreciated the research and insight of so many of the contributors.

I’m now at the point where I’d like to begin systematically back testing one or two strategies for potential trading. I like the concept of breakouts (just finished Fisher, currently reading Crabel) – this thread and Charter Joe's 7am-9am GBP/USD Breakout thread are especially interesting in this regard.

I’d appreciate some advice from the folks here. The IB and 7-9 threads are now over a year old: do both concepts still perform reasonably well in live trading? If so, which of these would you recommend that I begin my back testing with:

1. The 30B

2. The 5B

3. The 7-9 currency breakout

I have a full time job so I need a scheduled window of time to trade in. I plan to trade single lots, primarily intraday. I am methodical by nature and prefer smaller, steady gains to wild gains… and wild losses.

Any thoughts gratefully received! Thanks.

Isaac

I have been a member of mypivots for a little over a year now, using the posts as a springboard for learning about the futures and currency markets – I’ve really appreciated the research and insight of so many of the contributors.

I’m now at the point where I’d like to begin systematically back testing one or two strategies for potential trading. I like the concept of breakouts (just finished Fisher, currently reading Crabel) – this thread and Charter Joe's 7am-9am GBP/USD Breakout thread are especially interesting in this regard.

I’d appreciate some advice from the folks here. The IB and 7-9 threads are now over a year old: do both concepts still perform reasonably well in live trading? If so, which of these would you recommend that I begin my back testing with:

1. The 30B

2. The 5B

3. The 7-9 currency breakout

I have a full time job so I need a scheduled window of time to trade in. I plan to trade single lots, primarily intraday. I am methodical by nature and prefer smaller, steady gains to wild gains… and wild losses.

Any thoughts gratefully received! Thanks.

Isaac

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.