ES short term trading 6-28-10

I just created a Market Profile using the RTH sessions for ES from last week, Monday through Friday. So the 1 week Value Areas are:

VAH=1102.00

POC=1075.50

VAL=1063.50

This week's Economic Events.

VAH=1102.00

POC=1075.50

VAL=1063.50

This week's Economic Events.

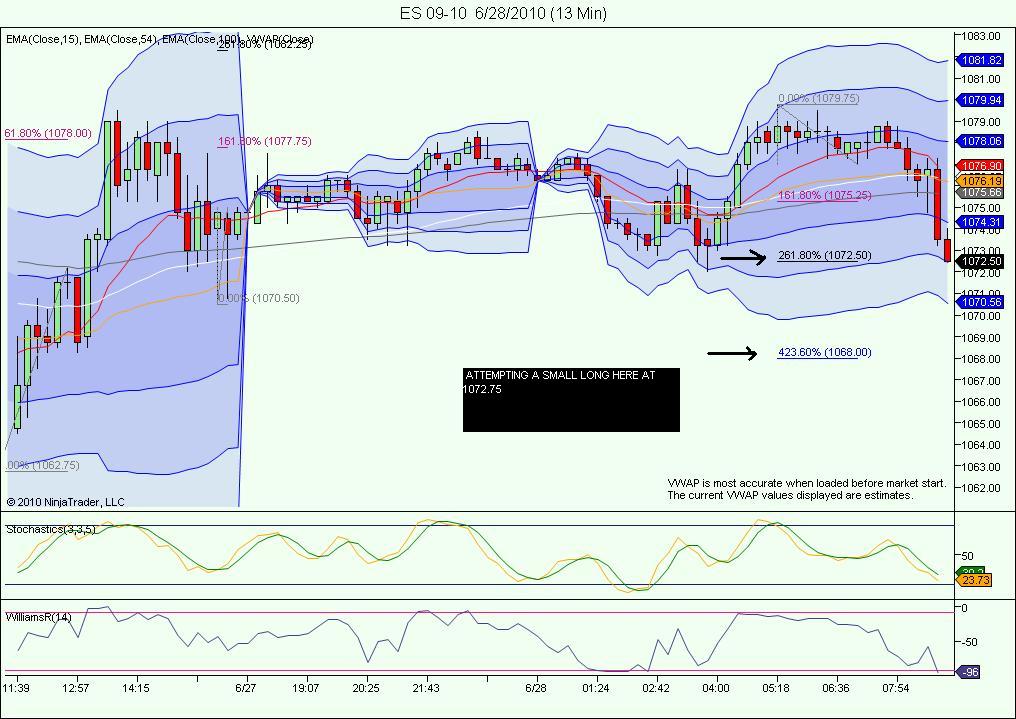

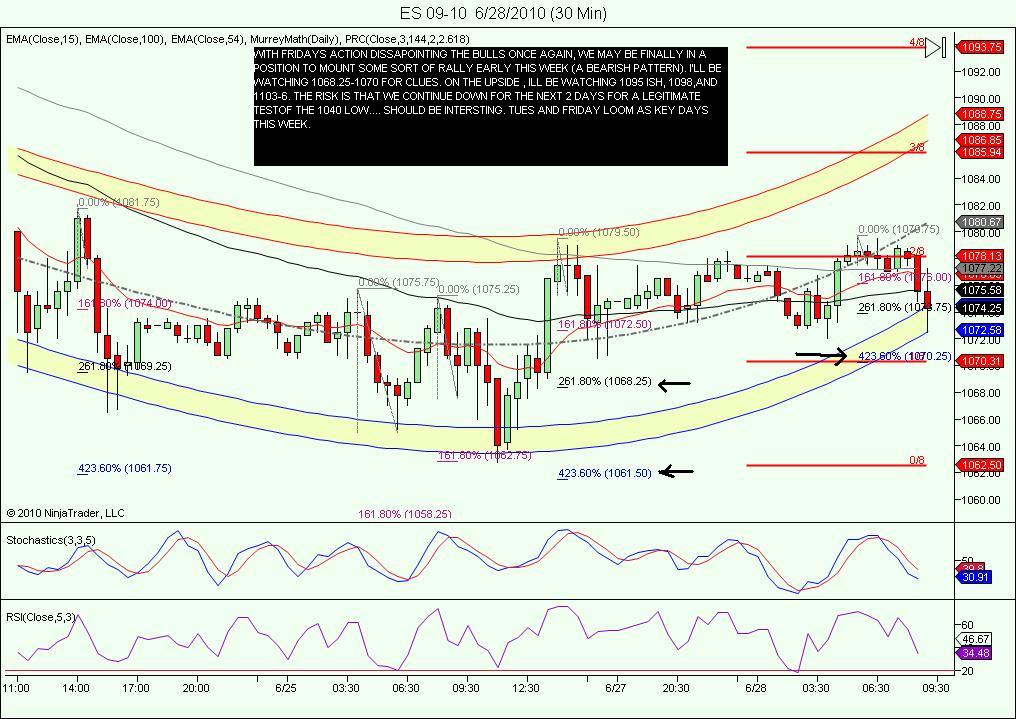

I see three key zones in early trade....the 78 - 81, the 72.50 and 61.50 - 63....these also frame out Fridays trade quite well

further above will be the 87.50 and below we have the 54 area

I think there is a very high probability of testing Fridays high and the O/N high up near 77.75 in the RTH session....so starting very small longs at 73.75 in O/N....

further above will be the 87.50 and below we have the 54 area

I think there is a very high probability of testing Fridays high and the O/N high up near 77.75 in the RTH session....so starting very small longs at 73.75 in O/N....

OUT THE SECOND HALF AT 1075.75 (DUE TO THE 1076.25 PROJECTION)...if we surpass that, a real possibility, 1078.50-1079.25 would be next. Going out for breakfast, back soon...

if we get lucky and they run out the O/N high and Friday high first today then I'll be on the lookout for short signals to get back to 72.50.....hopefully we will see some air pockets outside Friday's range for that to happen or at least try for it

last week with all sessions the most time at any price was 72.50

peak volume changes so need to cover at 76...there gonna run out those 71 lows I think

long 71.50....may need to add below 70

nice Kool!...

Yes, the front month unless there are only a few days to expiration. And I'm looking for immediacy in the move, up or down, of decent magnitude ... preferably within 1 to 2 (sometimes 3)days. And that's if I don't have a strong directional bias ... which I don't currently ... just a mild bias to the down side which comes primarily from how individual stocks have performed in the past couple of days and how their charts currently look "heavy" for lack of a better term.

Originally posted by Piker

Originally posted by MonkeyMeat

Just an observation guys. Yeah, there's the cycle of expansion and contraction of daily bar ranges (and the same on other time frames as well) ... but, look at the SPY chart and also the ES chart that includes all trading hours. The market is likely to have a decent magnitude move out of the current range ... my hope being that tonight's trading stays narrow and that Tuesday opens inside of this range bound activity. Then it's a matter of how ya play it ... directionally or tossing on straddle or strangle option contracts ... and even potentially legging out of them. Here's hoping for continued range constriction tonight and opening into tomorrow!!

Just curious MM,

Do you use front-month contracts when you put on straddles/strangles?

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.