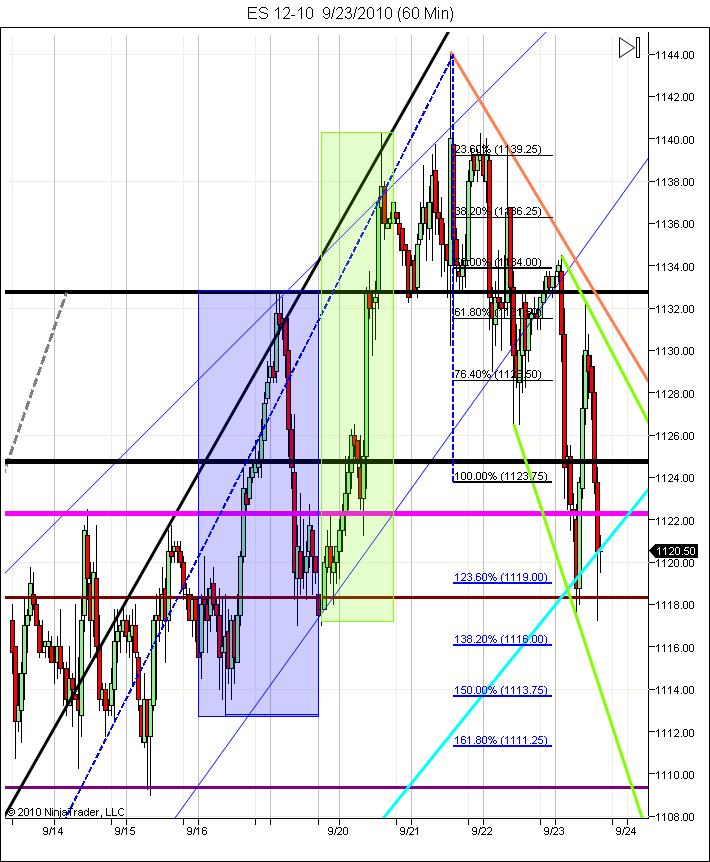

ES short term trading 9-23-10

Key area above is 25.50 - 27.75....that is a ledge and single prints from O/N session and part of key volume from Mondays breakout trade.....that becomes resitance now

Other area is 20.50 as that is midrange of volume spike from 8:30 report

ON low is also important today...currently at 17.50

we will open outside of YD range most likely so we need to think a bit differently...reports at 10 am.

Other area is 20.50 as that is midrange of volume spike from 8:30 report

ON low is also important today...currently at 17.50

we will open outside of YD range most likely so we need to think a bit differently...reports at 10 am.

A concept that Dalton throws around a lot is trading Value and not price. So even though we opened and rallied back to yesterdays close and the lows we have spent a lot of time building VALUE UNDER that close and now under the lows from YD.

I really enjoy the concept of market structure but sometimes it really is quite difficult to trade from...

They just cleaned up that one tick "air pocket" that my runners missed this morning...I point it out for reference only as I wasn't in on this decline. I'm putting core ideas that are repeatable in the "chart of the day thread".

That thread is not just a place for me so I hope others would post their key chart concepts that repeat. I think having the core ideas in one place is a better way to go as I don't think many enjoy having to scroll through our daily threads.....perhaps I'm wrong......

*&^&^%^& my freakin hand is sore and today has had me putting too many words down on the screen.....anybody have some Vicodin....?

I really enjoy the concept of market structure but sometimes it really is quite difficult to trade from...

They just cleaned up that one tick "air pocket" that my runners missed this morning...I point it out for reference only as I wasn't in on this decline. I'm putting core ideas that are repeatable in the "chart of the day thread".

That thread is not just a place for me so I hope others would post their key chart concepts that repeat. I think having the core ideas in one place is a better way to go as I don't think many enjoy having to scroll through our daily threads.....perhaps I'm wrong......

*&^&^%^& my freakin hand is sore and today has had me putting too many words down on the screen.....anybody have some Vicodin....?

1123.25 now the R level to break

17.50 was the O/N low..too funny!

I slapped that extension up there quick and was a little off in placement. No harm as 1123.25 did hold. Here's the corrected placement chart with 1123.75 as the 100% baseline.

BKX broke that 45.50 level and closed at 45.49

weird day

BKX broke that 45.50 level and closed at 45.49

weird day

50% of the RTH week = 32.50

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.