ES 3-31-2011

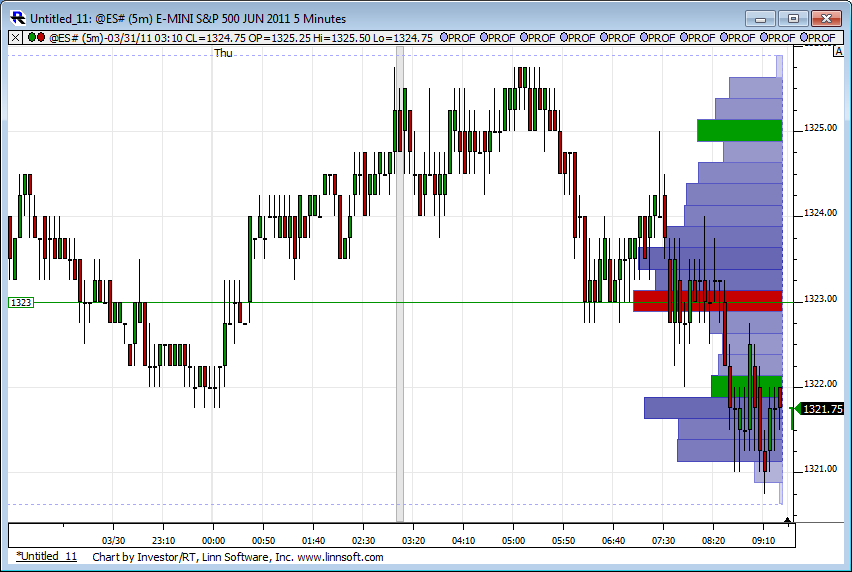

gm all...was looking to buy 20.5 for a small scalp but that trade is gone...looking to buy 318 instead (1.618 proj of the move from 27.75 down to 21.75), and will try a short scalp at 324-324.25 (2.618 proj of the 20.75-22 move which will likely coincide with the 300 level or so in ym and hence show decent resistance)...good luck today

selling into 24.50.....peak volume from Wednesday

short from 24.25 as indicated above...forgot completely abt the 9:42-45 data release (i try not to carry positions thorugh announcements) but anyway it did not seem to hurt much...took half off at 22.75 and holding the other half down to 21.75

flat now....i apologize if responses come late but every time i try to post my google chrome takes ages to go through with it...may be i should try a different browser when on the mypivots website...

ok, i am seriously frustrated, how is it everyone seems to know the direction of the market today or any day but me? what is it on a an intraday level everyone looks at to determine levels to buy and sell for scalping? I understand the fib ext and pulling both sides... what else is it that is used to to determine levels?

Huge question OP.

First, answer this question for yourself. Are you a trend trader or a fade trader? This answer is huge to how you pull the trigger in relation to all these levels being bantered about on a daily basis.

Ok. Now the most important levels/prices on an intra-day basis for both types of traders are the following:

Yesterdays RTH High and Low. (Mark these on your chart)

Overnight High and Low (Mark these on your chart)

1st hour (10:30 EST) High and Low (Mark these on your chart)

Prior session close.

Midpoint from O/N and prior RTH session.

A trader can keep it real simple if he/she likes and just trade off these levels. So if you are a fader, when price approaches one of these levels you are looking to trade in the opposite direction price is currently moving.

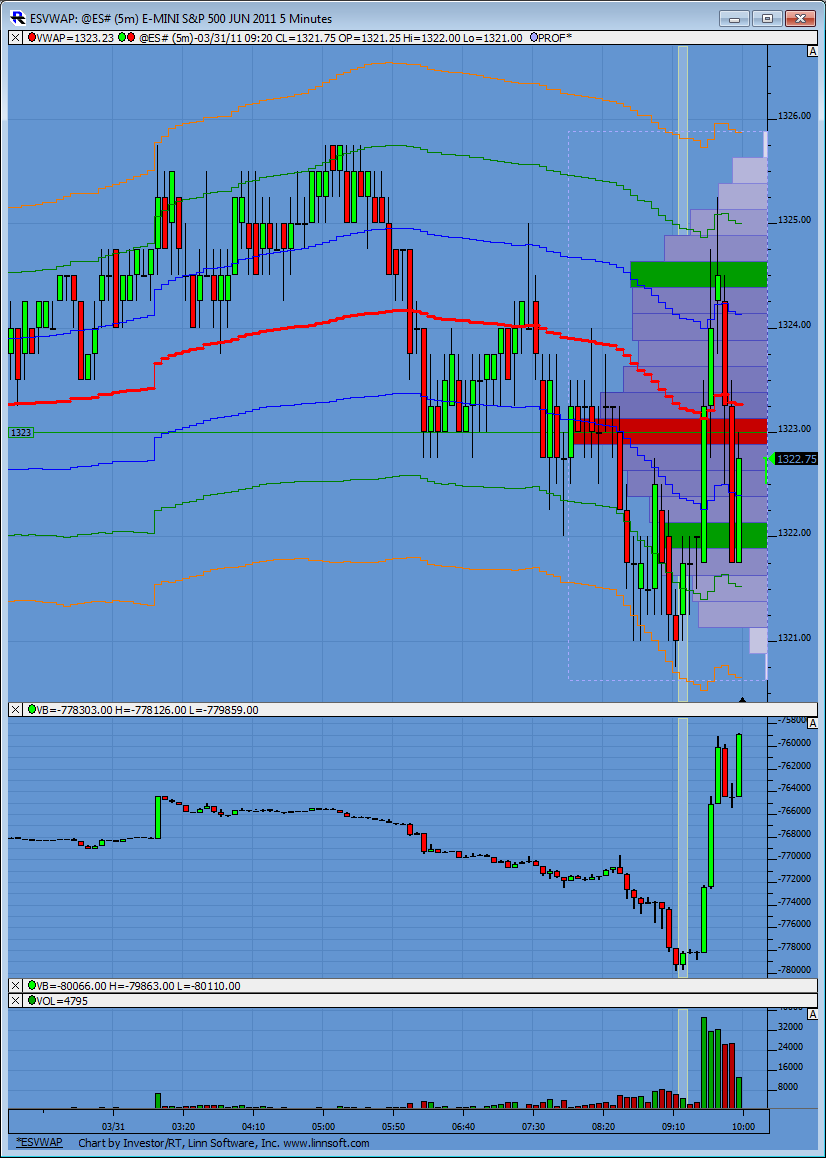

Today's example. Low of O/N is 1320.75.

Price just hit this level and reversed. A fader would have gone long here within a tick or two most likely.

Now after experience and such you can start including volume in determining levels as well as fib/proportion projections.

Hope that helps.

First, answer this question for yourself. Are you a trend trader or a fade trader? This answer is huge to how you pull the trigger in relation to all these levels being bantered about on a daily basis.

Ok. Now the most important levels/prices on an intra-day basis for both types of traders are the following:

Yesterdays RTH High and Low. (Mark these on your chart)

Overnight High and Low (Mark these on your chart)

1st hour (10:30 EST) High and Low (Mark these on your chart)

Prior session close.

Midpoint from O/N and prior RTH session.

A trader can keep it real simple if he/she likes and just trade off these levels. So if you are a fader, when price approaches one of these levels you are looking to trade in the opposite direction price is currently moving.

Today's example. Low of O/N is 1320.75.

Price just hit this level and reversed. A fader would have gone long here within a tick or two most likely.

Now after experience and such you can start including volume in determining levels as well as fib/proportion projections.

Hope that helps.

Originally posted by optimusprime

ok, i am seriously frustrated, how is it everyone seems to know the direction of the market today or any day but me? what is it on a an intraday level everyone looks at to determine levels to buy and sell for scalping? I understand the fib ext and pulling both sides... what else is it that is used to to determine levels?

Hello, New to the room. Been trading the ES for about 2 years with moderate success. Looking to get to the next level of profitable trading. Looking forward to learning more and if I can contribute I will.

selling agin into the 24.50....much smaller as we are approaching hour finish soon....optimus I have some good babble later...at least I think it's important

thank lorn for your explanation. i have something to build my intraday trades with along with kools fibs. Type of trader is the easy part. Long term swing...i buy and hold hence why i post longer term charts 60 min- 240 etc... been trying to find a way to take 3 to 4 pts per day out of the market which i have met with some success but not as much as i would like and find my self really getting killed on an intraday level. It seems the longer term strategies don't really translate in to the faster time frames for day trading. this brings me to my frustration i guess. thank you again for your respo0nse.. i learnso much from here, i hope i can get it put together for shorter term profits! good luck today everyone.. time for me to hit the office.

Originally posted by koolblue

somehow,pal, we really need to consolidate all of our 'teaching' dialogues... and other folks also. P.T.'s had a few , Paul,Lorns,etc and put them all in one easy place to find! Im pretty good at finding stuff and would be willing to spend a weekend doing it, if D.T. agrees, but i fear if we dont, in a couple months,or a year it'll be hard to find(in effect lost!). Another good example is Charter Joes mini ib method... I feel it would be invaluable to newer traders!... thx again!

I can certainly help with that. I wonder if the dictionary would be the right place to put it? The site is setup so that I can auto-link certain words to the dictionary - as most of you already know. So if we came up with names for the strategies, setups, methods and techniques then we could add each one of them to the dictionary as a distinct item and then auto-link them from here. For example, we could call one "Bruce's Air" and that would link to something like this:

http://www.mypivots.com/dictionary/definition/407/air-pocket

which was taken from something that Bruce wrote.

It seems to be the most obvious place to collect the information. Also the dictionary also has a fast lookup search bar.

If you want to experiment with this idea try and add one from here:

http://www.mypivots.com/dictionary/create

and I'll help clean it up and then add the auto-link words.

Good idea and great stuff guys!

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.