ES 3-31-2011

I'll TELL YOU SOMETHING ELSE! Tomorrow, we explode! 2 days now with contracting range!...ying-yang, look for a big move tomorrow gang!!!

I highlighted the most import part of this answer Lisa....I'm hoping people walk away with the concept of Volume areas.......those looking for an exact price will be in trouble as there is too much noise inthe market

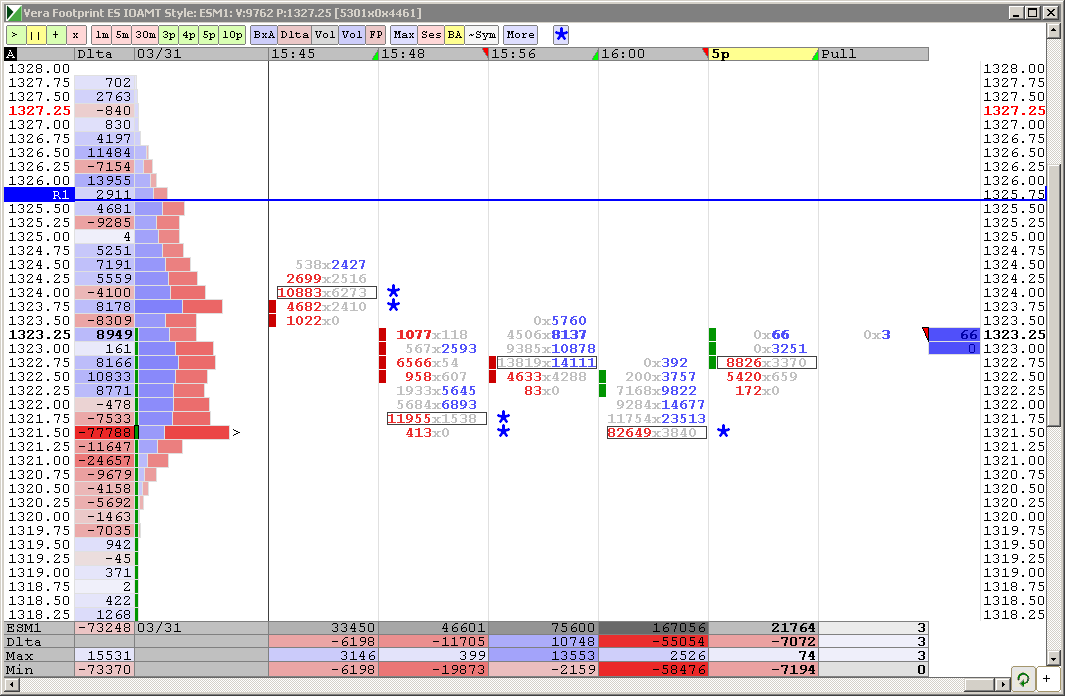

I donot find a precise level with just the time based bars .In my "lesson" I said I thought the volume was 25 - 26 but it was 24.50.....that was created by volume that made an air pocket....I'm not sure if you are familiar with that concept....it's really the same thing as "single prints" but on the much lower time frame.......but quite often you will see the air pocket....there is a thread somewhere...the fast push away....The volume is quite often a part of that or quite close to it.

In general though I donot trade off EXACT numbers...I'm working off areas........I knew today that the Value area high was 1325.75 and my number was 1324.50......so I am selling into an area.. not usually at an exact level.....My stops are usually geared to what is NOT suppose to happen with the profile...so they are not a fixed amount and that has it's advantages and drawbacks...probably wider than many and I will add into trades

I'm not good enough to pick tops or bottoms....The one minute bars are actually an older idea that I've used for a few years and it makes it easier to share with the forum as MY IRT charts are on another computer..My free and crappy IB charts don't go lower than one minute. I would encourage people to dial it down and get a more precise price.....but NEVER expect price to stop EXACTLY where you snap your lines..no matter what method you use.I think the big traders will buy or sell into an area in pieces....but there is always a one tic price that has the most volume....but that doesn't reflect their entire buy or sell order..so I am trading off areas...I also think over time I have become good at eyeballing the areas...Hopefully the concept will come across

I donot find a precise level with just the time based bars .In my "lesson" I said I thought the volume was 25 - 26 but it was 24.50.....that was created by volume that made an air pocket....I'm not sure if you are familiar with that concept....it's really the same thing as "single prints" but on the much lower time frame.......but quite often you will see the air pocket....there is a thread somewhere...the fast push away....The volume is quite often a part of that or quite close to it.

In general though I donot trade off EXACT numbers...I'm working off areas........I knew today that the Value area high was 1325.75 and my number was 1324.50......so I am selling into an area.. not usually at an exact level.....My stops are usually geared to what is NOT suppose to happen with the profile...so they are not a fixed amount and that has it's advantages and drawbacks...probably wider than many and I will add into trades

I'm not good enough to pick tops or bottoms....The one minute bars are actually an older idea that I've used for a few years and it makes it easier to share with the forum as MY IRT charts are on another computer..My free and crappy IB charts don't go lower than one minute. I would encourage people to dial it down and get a more precise price.....but NEVER expect price to stop EXACTLY where you snap your lines..no matter what method you use.I think the big traders will buy or sell into an area in pieces....but there is always a one tic price that has the most volume....but that doesn't reflect their entire buy or sell order..so I am trading off areas...I also think over time I have become good at eyeballing the areas...Hopefully the concept will come across

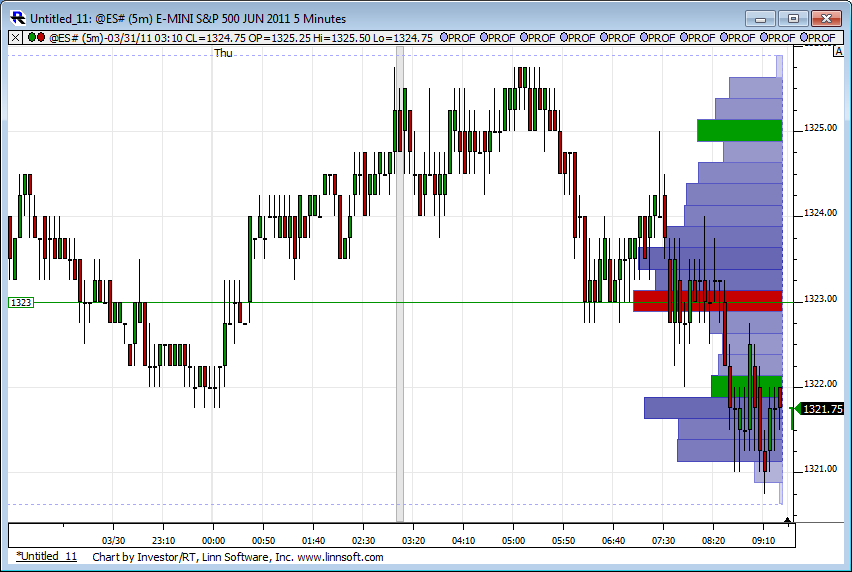

If you look at the first chart I posted the spike bar was followed by a few downward drifting bars.....that found support....Now incorporate the air pocket concept and you will have a very good idea of where people entered agressively....

A spike bar that creates an air pocket that isn't filled in will usually have the volume at or near the air pocket..

Here is a key..In market profile terms they will look at these areas as LOW VOLUME because not much TIME was spent there...but the reality is that the low volume area is created by a HIGH VOLUME VERTICAL PUSH in VERTICAL VOLUME ( The histogram) ...IT is high volume that usually breaks away prices...

So you need to reconcile that.....it's actually confusing yet simple..

High volume on the Vertical scale pushes price away so no time is spent at those prices......the market is very efficient and likes to test and fill in those prices....

Hopefully I'm not confusing the issue here

A spike bar that creates an air pocket that isn't filled in will usually have the volume at or near the air pocket..

Here is a key..In market profile terms they will look at these areas as LOW VOLUME because not much TIME was spent there...but the reality is that the low volume area is created by a HIGH VOLUME VERTICAL PUSH in VERTICAL VOLUME ( The histogram) ...IT is high volume that usually breaks away prices...

So you need to reconcile that.....it's actually confusing yet simple..

High volume on the Vertical scale pushes price away so no time is spent at those prices......the market is very efficient and likes to test and fill in those prices....

Hopefully I'm not confusing the issue here

thanks all for the kind words.....I had a volume attractors thread or something which this would go good in but even I can't find it.....so I know what you mean KOOL.......a place for background stuff on the core ideas.....the hyper text is a great addition and hopefully helpfull

Originally posted by koolblue

BACK... very nice concise explanation of your methods ,Bruce.. sometimes i wish we had D.T. gather up these posts and put them somewhere for all newer traders who want to learn our methods!...well done!

somehow,pal, we really need to consolidate all of our 'teaching' dialogues... and other folks also. P.T.'s had a few , Paul,Lorns,etc and put them all in one easy place to find! Im pretty good at finding stuff and would be willing to spend a weekend doing it, if D.T. agrees, but i fear if we dont, in a couple months,or a year it'll be hard to find(in effect lost!). Another good example is Charter Joes mini ib method... I feel it would be invaluable to newer traders!... thx again!

To all people looking for the "Holy Grail" in day trading,

it's in this thread

it's in this thread

Originally posted by koolblue

BACK... very nice concise explanation of your methods ,Bruce.. sometimes i wish we had D.T. gather up these posts and put them somewhere for all newer traders who want to learn our methods!...well done!

I wonder if we just use the voting and have a reference page for the top voted for posts?

Originally posted by koolblue

somehow,pal, we really need to consolidate all of our 'teaching' dialogues... and other folks also. P.T.'s had a few , Paul,Lorns,etc and put them all in one easy place to find! Im pretty good at finding stuff and would be willing to spend a weekend doing it, if D.T. agrees, but i fear if we dont, in a couple months,or a year it'll be hard to find(in effect lost!). Another good example is Charter Joes mini ib method... I feel it would be invaluable to newer traders!... thx again!

I can certainly help with that. I wonder if the dictionary would be the right place to put it? The site is setup so that I can auto-link certain words to the dictionary - as most of you already know. So if we came up with names for the strategies, setups, methods and techniques then we could add each one of them to the dictionary as a distinct item and then auto-link them from here. For example, we could call one "Bruce's Air" and that would link to something like this:

http://www.mypivots.com/dictionary/definition/407/air-pocket

which was taken from something that Bruce wrote.

It seems to be the most obvious place to collect the information. Also the dictionary also has a fast lookup search bar.

If you want to experiment with this idea try and add one from here:

http://www.mypivots.com/dictionary/create

and I'll help clean it up and then add the auto-link words.

Good idea and great stuff guys!

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.