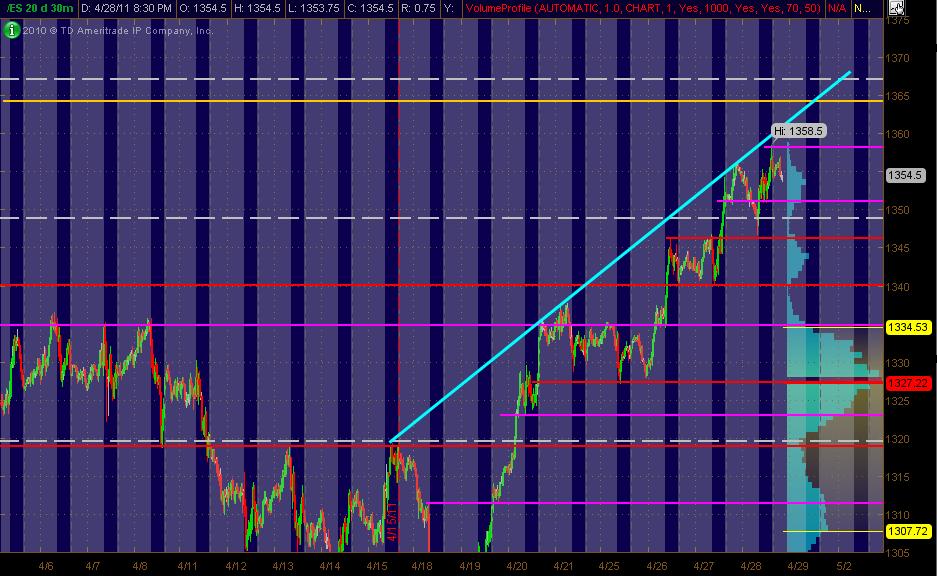

ES MAP for 4-29-11

Here's what I've got looking at the ES 30min chart of 20 days. The Gray background is the "overnight" trading. The right vertical axis shows the 20-days worth of Volume at Price in Light Blue. The Red lines are my PASR "zones" of potential S/R with the Magenta potential semi-significant. The White dashed lines are the Weekly Pivots.

Have a Yellow line above the current market that looks like a potential significant Fib cluster area to me. Also, I've drawn in a Cyan trendline across the top swings of prices. I've adjusted some of the lines/levels/zones since the last posting of my "map". Hope it's helpful to both ES and equity traders!

Have a Yellow line above the current market that looks like a potential significant Fib cluster area to me. Also, I've drawn in a Cyan trendline across the top swings of prices. I've adjusted some of the lines/levels/zones since the last posting of my "map". Hope it's helpful to both ES and equity traders!

I talked about 1 tick "fakeout" yesterday (or day before?).

Today, so far, "1 tick takeout" where H for today took out yesterday's H by 1 tick, as long as 58.75 is not exceeded, would play short-side scalps,

break point for something more to the downside would be 54.50, Pivot based on RTH only. If price tests there it is either support or it isn't and if it isn't, target 49.50 (plus 3 tick) = 50.25 (I always allow 3 ticks as close enough)

And I'm out of here, I have to go deliver my check for township taxes, oh the joy, the joy, the joy of home ownership.

good luck to all.

Today, so far, "1 tick takeout" where H for today took out yesterday's H by 1 tick, as long as 58.75 is not exceeded, would play short-side scalps,

break point for something more to the downside would be 54.50, Pivot based on RTH only. If price tests there it is either support or it isn't and if it isn't, target 49.50 (plus 3 tick) = 50.25 (I always allow 3 ticks as close enough)

And I'm out of here, I have to go deliver my check for township taxes, oh the joy, the joy, the joy of home ownership.

good luck to all.

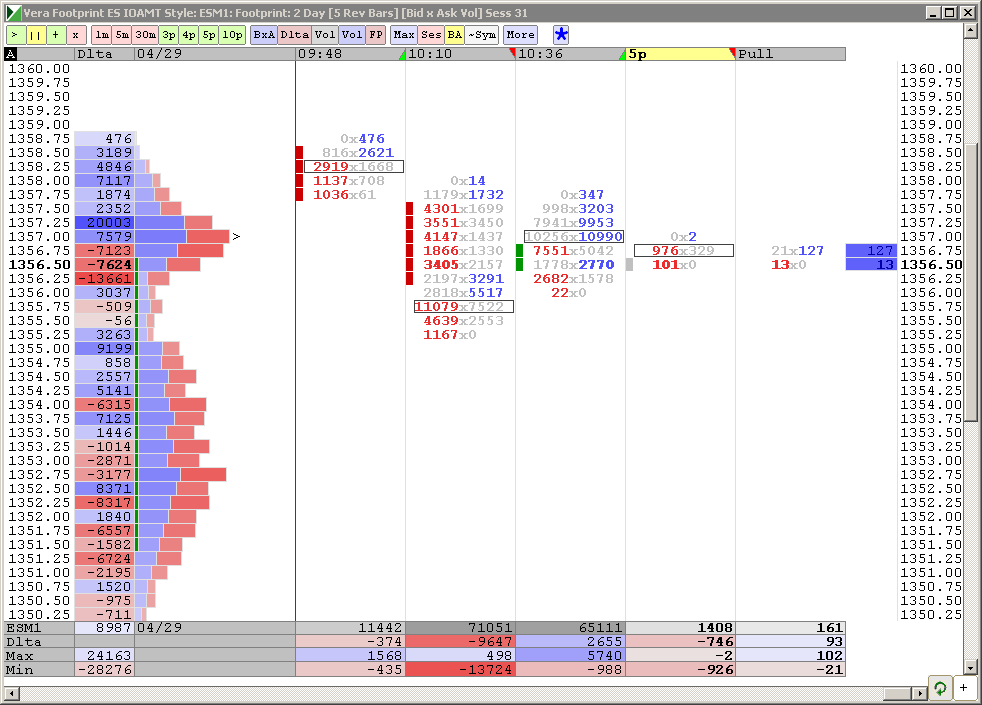

trying new sells at 58.25...will watch hour highs should they go for the breakout...56.75 is tightening point..so far symetric again..concern here is that they seem to be accepting price above the peak volume from YD and the ON

interesting that my CD is trending lower as price trends higher.....

TICK also trends lower as price rises - 3rd day same. Must be the Royal Wedding...

damn those royals !!

here is what I am watching...lets see what happens if buyers actually come in...how this changes and specifically what happens if we hit up into yesterdays highs of CD...still targeting lower based on internals ...we'll see

here is what I am watching...lets see what happens if buyers actually come in...how this changes and specifically what happens if we hit up into yesterdays highs of CD...still targeting lower based on internals ...we'll see

always fascinating to see what happens if negative sentiment CAN'T drive the market down...all us shorts get trapped....that afternoon surge from YD afternoon was a good example but that move fizzled

ideal add point will be up near 60 if it comes

Bruce, why 60, please?

wow, now that is what I call dumb luck as an exit...!! I guess they like that 57.50 !!

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.