ES Wed 8-17-11

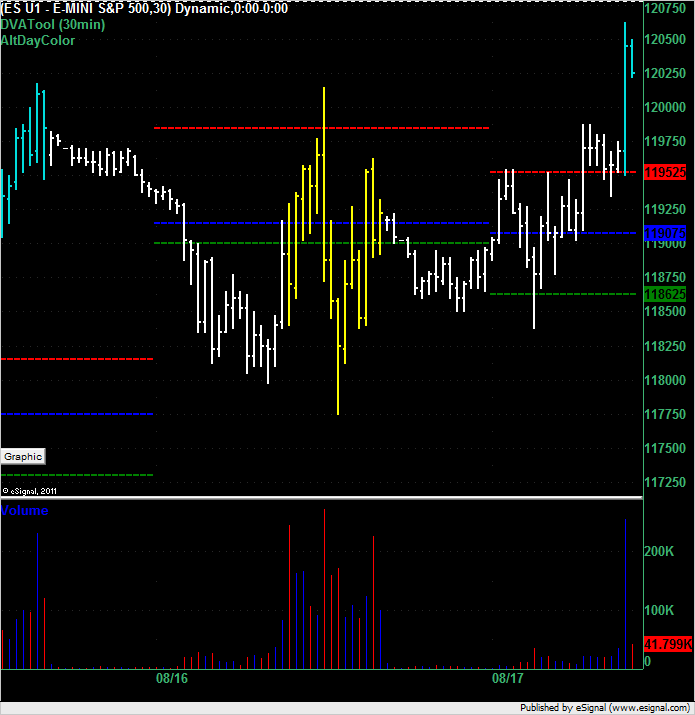

Looks like a classic Market Profile play this morning to the tick. The market opened above the value area at 1196.75 and then traded down to 1195 even which was 1 tick below the VAH (1195.25) which would have been a buy signal. Subsequent to that it has traded as high as 1206.25. So far:

Draw down: 0.25 points

Best run up: 11 points

Draw down: 0.25 points

Best run up: 11 points

I thought from 83.75...lol. 1190 still a low-volume node

I thought he said 86.50 any way that trade di good to hit 1190.00

Back up to the SD uphere higher low on 5m

no I didn't ...I exited at 86.50 and 88.75...

hopefully some will realize just exactly what happens at low volume zones.....I posted the 3 basic scenarios the other day...trade at low volume and get out near high volume

hopefully some will realize just exactly what happens at low volume zones.....I posted the 3 basic scenarios the other day...trade at low volume and get out near high volume

Originally posted by Lisa P

BRuce, hope you held that trade to 1190 - that was awsome!

Originally posted by BruceM

no I didn't ...I exited at 86.50 and 88.75...

Still excellent trade... still awsome!

Hi Bruce.

New user and new student to Market Profile. It really meshes well with my contrarian style of support and resistance trading. I was curious to know where I might find your post you were referring to just now about the low volume zones. I can't get enough of Market Profile and would like to soak in anything I can. Thanks Bruce.

New user and new student to Market Profile. It really meshes well with my contrarian style of support and resistance trading. I was curious to know where I might find your post you were referring to just now about the low volume zones. I can't get enough of Market Profile and would like to soak in anything I can. Thanks Bruce.

Originally posted by BruceM

no I didn't ...I exited at 86.50 and 88.75...

hopefully some will realize just exactly what happens at low volume zones.....I posted the 3 basic scenarios the other day...trade at low volume and get out near high volumeOriginally posted by Lisa P

BRuce, hope you held that trade to 1190 - that was awsome!

here it is for you and welcome to the forum:

http://www.mypivots.com/board/topic/6900/2/es-thu-8-11-11

so logically speaking I want to be taking longs below value and shorts above value. Most times we need to feel like we are getting a bargain so buying under value is a good deal if you can get it and selling to someone else when we are above value is good business for us. Especially in a market that does so much back and fill.I also work under the premise that low volume volume nodes from previous days especially like to get retested once they are busted through.

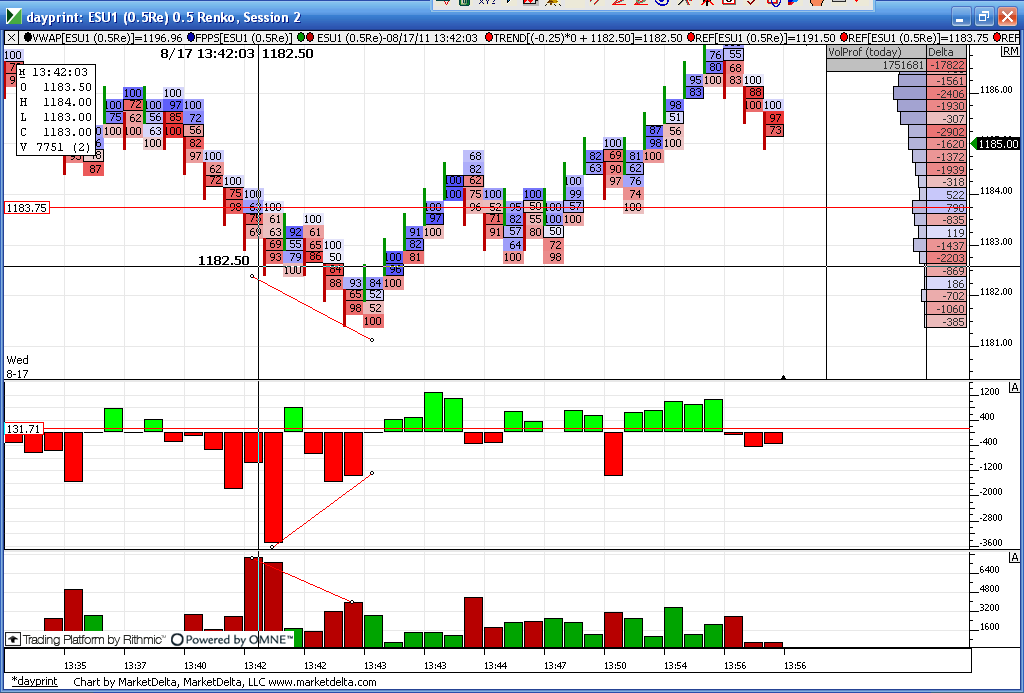

Buying under my low volume node of 1183.83 made logical sense to me as we were building value higher than Tuesdays trade at that time. Once again this took two tries on my part before I had it go my way.

On my chart below is the delta divergence in the middle pane ( lower price but delta is making higher lows) and volume in the lower pane also diverging with price.

http://www.mypivots.com/board/topic/6900/2/es-thu-8-11-11

so logically speaking I want to be taking longs below value and shorts above value. Most times we need to feel like we are getting a bargain so buying under value is a good deal if you can get it and selling to someone else when we are above value is good business for us. Especially in a market that does so much back and fill.I also work under the premise that low volume volume nodes from previous days especially like to get retested once they are busted through.

Buying under my low volume node of 1183.83 made logical sense to me as we were building value higher than Tuesdays trade at that time. Once again this took two tries on my part before I had it go my way.

On my chart below is the delta divergence in the middle pane ( lower price but delta is making higher lows) and volume in the lower pane also diverging with price.

Wow! Thank you Bruce for taking the time to answer my question with so much detail. I really appreciate it.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.