ES Wed 9-21-11

Don't forget that today is a Fed Day. Resources for today:

All fed rates over last 21 years:

http://www.mypivots.com/trading/fedrates

The ES on the previous 113 Fed Days:

http://www.mypivots.com/trading/feddays

All fed rates over last 21 years:

http://www.mypivots.com/trading/fedrates

The ES on the previous 113 Fed Days:

http://www.mypivots.com/trading/feddays

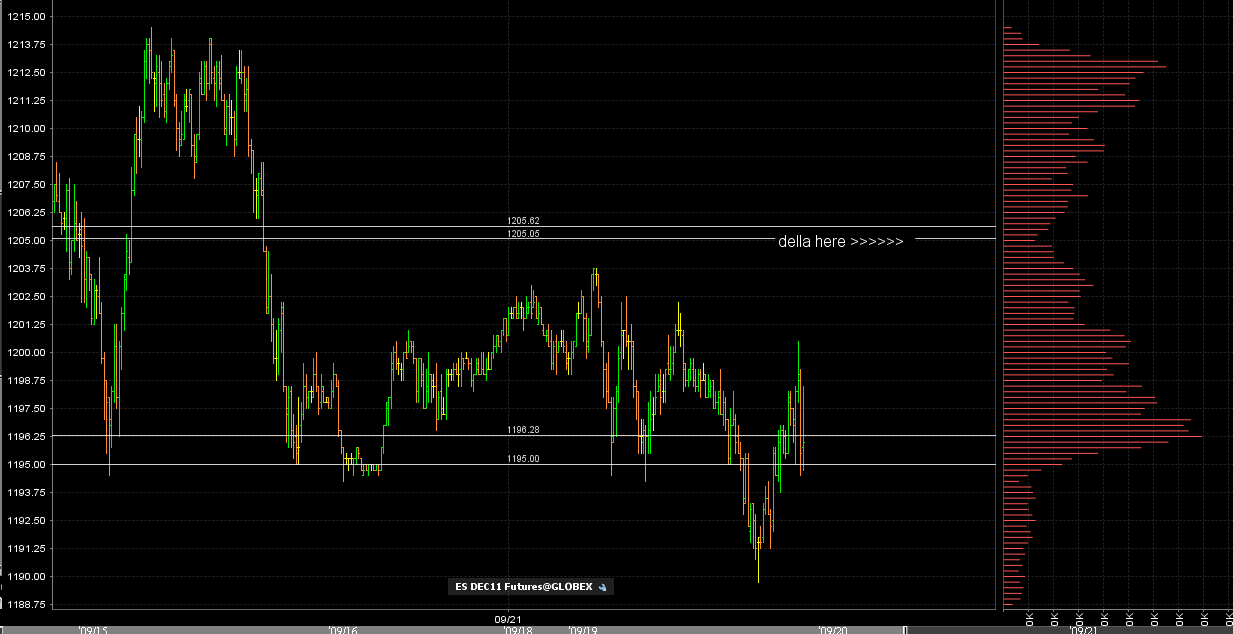

Della.....more later but we usually have low volume at highs and lows....this is NOT specifically what I am talking about but that Overnight high becomes a key spot becomes it is real close to the 05 low volume from yesterdays trade....explain layter sorry

della...here is a fast and crude chart....look at that low dip in the histogram on the right...

might have just missed another good buy 1193.25-1194...sigh

for those who follow the low volume concepts: I made a mistake yesterday afternoon and I lost of 2 out of 3 trades late in the day and here was the error.

Low Volume that is created on the same day DOES NOT always come back for those retests I expect once it gets broken. It is a much higher occurance when low volume is tested from a previouys session that has been COMPLETED. A subtle but important concept......

I know most do their own back testing but I thought I'd share that mistake with you......so if we go up and break above the 06 area today pre - fed announcement..then I would expect a retest back down as that low volume was created yesterday ( a previous completed day) ..hope that makes sense......and Dollars for you !!!

Low Volume that is created on the same day DOES NOT always come back for those retests I expect once it gets broken. It is a much higher occurance when low volume is tested from a previouys session that has been COMPLETED. A subtle but important concept......

I know most do their own back testing but I thought I'd share that mistake with you......so if we go up and break above the 06 area today pre - fed announcement..then I would expect a retest back down as that low volume was created yesterday ( a previous completed day) ..hope that makes sense......and Dollars for you !!!

I see it bruce big time thanks

all right Della ..! Way to go !!!! u r getting it......!!

yes i have market profile now and its in RTH so i see it but not in globex (Im getting it )

fliing blind before tradestion realy dosnt have much on market profile

fliing blind before tradestion realy dosnt have much on market profile

Originally posted by koolblue

might have just missed another good buy 1193.25-1194...sigh

Welcome back KB. I see what you mean. That last touch of 1200.5 had an initial move to 1196.5 giving an initial of 1194.0.

long here..per previous reasons...

took one off at 1195.75 for a two handle profit, stop on remaining es is now 2 handles (1193.75 for a risk free trade).

Appreciate the sentiment but it's not about that. It was an event trade(earnings,fed,etc...) He/She who hesitates is lost.

No news. No volume. Price is always the leading indicator. :)

1998 was resistance. Didn't make it?

Stopped at 1996.50 I think.

The 1182 target was missed by a tick. Took about 4 minutes top to bottom. That was the event.

Correction stopped below 1189. Other levels represented in corrections/ pauses and 1260 exceeded. Extension.

This was posted pre fed announcement. The objective is to be right, in the trade, even if 98 was hit.

No news. No volume. Price is always the leading indicator. :)

1998 was resistance. Didn't make it?

Stopped at 1996.50 I think.

The 1182 target was missed by a tick. Took about 4 minutes top to bottom. That was the event.

Correction stopped below 1189. Other levels represented in corrections/ pauses and 1260 exceeded. Extension.

This was posted pre fed announcement. The objective is to be right, in the trade, even if 98 was hit.

Originally posted by destiny

Originally posted by DavidS

Trade plan

1- shoots up to 1193.50 or higher to 1197, short as 1198 R level

2-drops below lod, go with it using 1189, 1187 as s/r line

1181-2 the 38%, target below that would be 1175,1171, or lower(1160)

above 1198 will reevaluate

between em all is 1193.50 key level imo and working good above and below so far today

1189 should have been a buy signal? there's a message there somewhere 1193.50 the key to me

maybe will muddle around in the area

Magic Beans!

You were right on the MONEY. CONGRATULATIONS.

using price as leading indicator

thinking overall down but subject to change my mind

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.