ES Wednesday 10-5-11

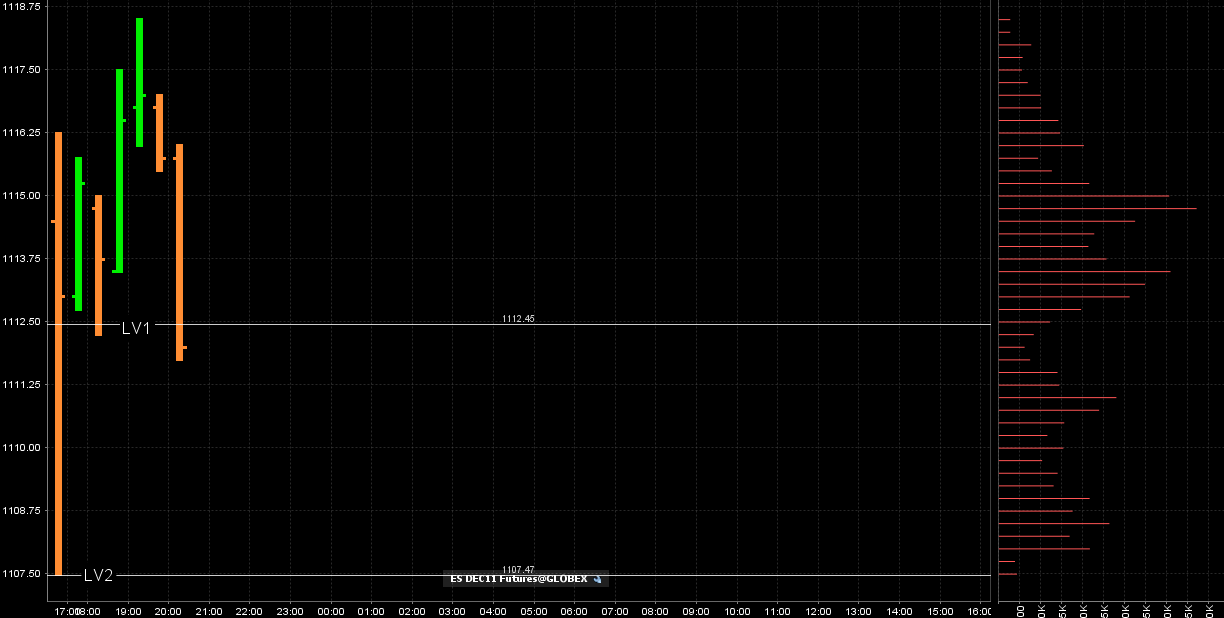

Very interesting finish today which hopefuly will helps us expand our knowledge of the bell curves. At the end of today we blew right through the high volume node of 1102.75 and then preceeded to blow through the low volume nodes ( LV1 and LV2 zones from yesterdays chart) that comprised the 1107.5- 1112.50 area. The market then stoped at our high volume area of 1120.

The rules as I have stated them say that we will come back to test LOW volume and that is why I choose to be more agressive in the low volume zones. They donot state that we will retest high volume and that is why I donot trade at those areas for retests once broken. Like all trading methods this has it's losses and trading at the end of the day is more prone to trend then in the morning. So if you were trading this afternoon it would have been most challenging but here is the interesting part. As soon as the Overnight opened the market dropped like a rock to come back down to test all the way down to our 1107.50 and retest the entire zone...like it should.

here is how the overnight looks as I type...the point of all this babble is that we can count on Low volume being tested but not so much the high volume nodes once broken.

The rules as I have stated them say that we will come back to test LOW volume and that is why I choose to be more agressive in the low volume zones. They donot state that we will retest high volume and that is why I donot trade at those areas for retests once broken. Like all trading methods this has it's losses and trading at the end of the day is more prone to trend then in the morning. So if you were trading this afternoon it would have been most challenging but here is the interesting part. As soon as the Overnight opened the market dropped like a rock to come back down to test all the way down to our 1107.50 and retest the entire zone...like it should.

here is how the overnight looks as I type...the point of all this babble is that we can count on Low volume being tested but not so much the high volume nodes once broken.

24 is ultimate target but taking something at 26

see that LV at 23.75

ES is trying to move above 1129.00 - 1129 is 50% from previous down swing in the daily chart. There's also a fibonacci extension from this mornings low, extending 2.618% at or to 1129.00.-- So, 1129.00 is a nice resistance cluster.

Moving above 1129 and finding support, will target 1143 with resistance at 1133/4. Above 1143, I will be looking for the next objective at 1163/4 resistance. Maybe late today or tomorrow AM.

Will see, in due time the market will show us the way.

ES now trading 1127.75 @ 11:58 E.T.

Moving above 1129 and finding support, will target 1143 with resistance at 1133/4. Above 1143, I will be looking for the next objective at 1163/4 resistance. Maybe late today or tomorrow AM.

Will see, in due time the market will show us the way.

ES now trading 1127.75 @ 11:58 E.T.

Plus 11/29 is my birthdate. :))) must mean something.

Bruce, why did you short 29? Was it LV?

1121.00 support (Notice that the price hit that twice this morning as support and bounced back up and to 1129.00 resistance. 1121.00 is also 1.618% from this mornings low and it's acting as support.

So what?, what does it mean? 1121.00 is an S/R place to buy from, if your charts and wiggling or none wiggling indicators say so.

So what?, what does it mean? 1121.00 is an S/R place to buy from, if your charts and wiggling or none wiggling indicators say so.

Price tested 1121 as support but failed. If the price is still bullish it will try to test the 1121 as resistance. If the resistance test fail and moves back up over 1121. I will buy.

Below 1121.00, next support is at 1117.00. If the price hits 1117 and test it as support and the test is a failure then I will look for the set up to sell. THe down side objective is at test of today's low 1109.50.

Will see. in due time the market will show us the way.

ES now trading 1120.50 @ 12:44 E.T.

[/quote]

1121.00 support (Notice that the price hit that twice this morning as support and bounced back up and to 1129.00 resistance. 1121.00 is also 1.618% from this mornings low and it's acting as support.

So what?, what does it mean? 1121.00 is an S/R place to buy from, if your charts and wiggling or none wiggling indicators say so.

[/quote]

Below 1121.00, next support is at 1117.00. If the price hits 1117 and test it as support and the test is a failure then I will look for the set up to sell. THe down side objective is at test of today's low 1109.50.

Will see. in due time the market will show us the way.

ES now trading 1120.50 @ 12:44 E.T.

[/quote]

1121.00 support (Notice that the price hit that twice this morning as support and bounced back up and to 1129.00 resistance. 1121.00 is also 1.618% from this mornings low and it's acting as support.

So what?, what does it mean? 1121.00 is an S/R place to buy from, if your charts and wiggling or none wiggling indicators say so.

[/quote]

Long at 1121.75. Stp at 1119.75

ES now trading 1121.00 12:52 E.T.

1121.00 support (Notice that the price hit that twice this morning as support and bounced back up and to 1129.00 resistance. 1121.00 is also 1.618% from this mornings low and it's acting as support.

So what?, what does it mean? 1121.00 is an S/R place to buy from, if your charts and wiggling or none wiggling indicators say so.

[/quote]

[/quote]

ES now trading 1121.00 12:52 E.T.

Originally posted by sandoxe

Price tested 1121 as support but failed. If the price is still bullish it will try to test the 1121 as resistance. If the resistance test fail and moves back up over 1121. I will buy.

Below 1121.00, next support is at 1117.00. If the price hits 1117 and test it as support and the test is a failure then I will look for the set up to sell. THe down side objective is at test of today's low 1109.50.

Will see. in due time the market will show us the way.

ES now trading 1120.50 @ 12:44 E.T.

1121.00 support (Notice that the price hit that twice this morning as support and bounced back up and to 1129.00 resistance. 1121.00 is also 1.618% from this mornings low and it's acting as support.

So what?, what does it mean? 1121.00 is an S/R place to buy from, if your charts and wiggling or none wiggling indicators say so.

[/quote]

[/quote]

Ooops, got stp out. hmmm will try again latter... - 2.00 pts

[/quote]

[/quote]

Originally posted by sandoxe

Long at 1121.75. Stp at 1119.75

ES now trading 1121.00 12:52 E.T.

Originally posted by sandoxe

Price tested 1121 as support but failed. If the price is still bullish it will try to test the 1121 as resistance. If the resistance test fail and moves back up over 1121. I will buy.

Below 1121.00, next support is at 1117.00. If the price hits 1117 and test it as support and the test is a failure then I will look for the set up to sell. THe down side objective is at test of today's low 1109.50.

Will see. in due time the market will show us the way.

ES now trading 1120.50 @ 12:44 E.T.

1121.00 support (Notice that the price hit that twice this morning as support and bounced back up and to 1129.00 resistance. 1121.00 is also 1.618% from this mornings low and it's acting as support.

So what?, what does it mean? 1121.00 is an S/R place to buy from, if your charts and wiggling or none wiggling indicators say so.

[/quote]

[/quote]

Play it one more time Sam!!!! long againg at 1122.25. stp 1119.50

[/quote]

[/quote]

Originally posted by sandoxe

Ooops, got stp out. hmmm will try again latter... - 2.00 pts

Originally posted by sandoxe

Long at 1121.75. Stp at 1119.75

ES now trading 1121.00 12:52 E.T.

Originally posted by sandoxe

Price tested 1121 as support but failed. If the price is still bullish it will try to test the 1121 as resistance. If the resistance test fail and moves back up over 1121. I will buy.

Below 1121.00, next support is at 1117.00. If the price hits 1117 and test it as support and the test is a failure then I will look for the set up to sell. THe down side objective is at test of today's low 1109.50.

Will see. in due time the market will show us the way.

ES now trading 1120.50 @ 12:44 E.T.

1121.00 support (Notice that the price hit that twice this morning as support and bounced back up and to 1129.00 resistance. 1121.00 is also 1.618% from this mornings low and it's acting as support.

So what?, what does it mean? 1121.00 is an S/R place to buy from, if your charts and wiggling or none wiggling indicators say so.

[/quote]

[/quote]

Thanks Sandoxe, I missed your reply & just found it when researching the posts, what formula would I use to calculate these previous 3 days S/R levels?

regards Brent.T

regards Brent.T

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.