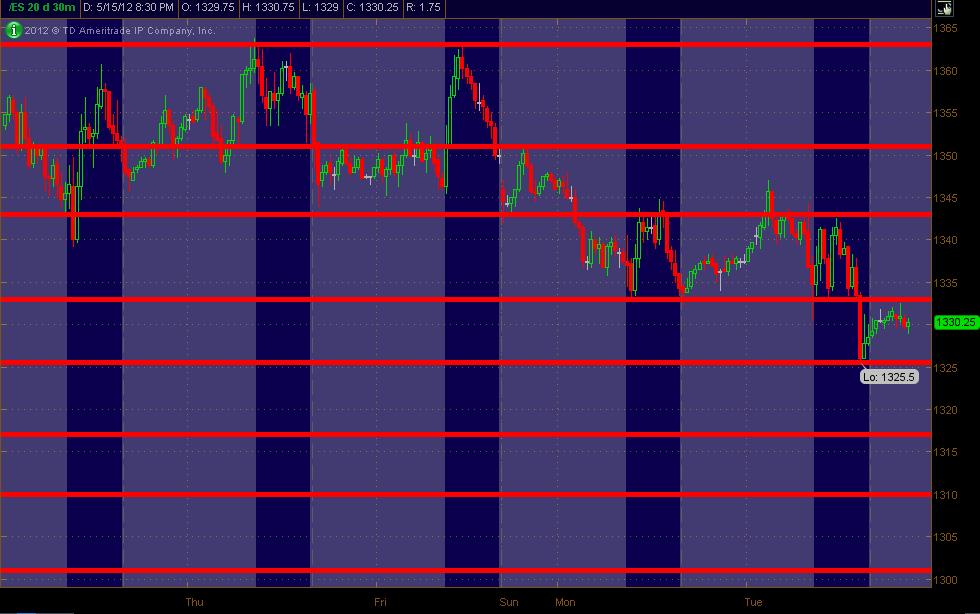

ES Wednesday 5-16-12

Here's what I've got as PASR Monkey Levels coming into Wednesday's ES trading as a MAP. Things are a bit erratic currently with news shocks etc. BSBSBS etc. Anyway, hope it's helpful to some.

MM

MM

Anyone/Everyone, post your analysis with charts here. Doesn't matter if it turns out right or not, it's about folks seeing multiple analyses from different traders, especially visually with comments.

All good!

All good!

I have been too busy on research projects to post.

But I wanted to take the time today to relate something about the current market that warrants watching.

I run pivots on the monthly

Years ago I spent hours looking back over weekly charts that had MOnthly pivots pasted across the chart face.

The R2 and the S2 of the monthly, when tested, usually reject price on the first test. (with any pivots, the longer the time frame, the more wiggle room you have to give it).

These (Monthly R2 and monthly S2) are especially difficult levels for price to just slice through. (it does happen occassionally)

MOnthly S2 created by the RTH only PA of APril = 1322.67

1321 handle is the daily piivot S1 for today.

Overnight lows printed in the 1322-1320 area and tested and tested and couldn't unlock more sellers.

Overnight H is roughly 1334 (as I write).

The mid point (50% of overnight range) is roughly 1327.

I don't know what will happen, but I will be looking for signs that buyers are coming in. I will be looking for bullish chart patterns

If Housing starts and permits numbers are bad (due at 8:30) and Price starts to fall but can't even fall through 50% of the overnight range, shorts are going to get nervous (if price ticks higher they will abandon short positions, forcing prices higher)

DBs are also buying patterns so if price drops to retest 1322 area in the RTH, watch the PA for signs the sellers are exhausted and it is the buyers' turn.

This is Option expiration week.

wild swings down (as we have seen) allow option market makers to suck the premium out of calls they have sold, buying them back at greatly reduced prices.

Bullish long side call owners have already been screwed.

Today might see bears (long puts) get screwed (prices rise to suck the premium out of the Puts). (they are already feeling the heat. a move back to 1342-44 area can easily unfold. (price traffic resistance starts in earnest at 1338 and higher.

This will probably be my only post.

But I wanted to take the time today to relate something about the current market that warrants watching.

I run pivots on the monthly

Years ago I spent hours looking back over weekly charts that had MOnthly pivots pasted across the chart face.

The R2 and the S2 of the monthly, when tested, usually reject price on the first test. (with any pivots, the longer the time frame, the more wiggle room you have to give it).

These (Monthly R2 and monthly S2) are especially difficult levels for price to just slice through. (it does happen occassionally)

MOnthly S2 created by the RTH only PA of APril = 1322.67

1321 handle is the daily piivot S1 for today.

Overnight lows printed in the 1322-1320 area and tested and tested and couldn't unlock more sellers.

Overnight H is roughly 1334 (as I write).

The mid point (50% of overnight range) is roughly 1327.

I don't know what will happen, but I will be looking for signs that buyers are coming in. I will be looking for bullish chart patterns

If Housing starts and permits numbers are bad (due at 8:30) and Price starts to fall but can't even fall through 50% of the overnight range, shorts are going to get nervous (if price ticks higher they will abandon short positions, forcing prices higher)

DBs are also buying patterns so if price drops to retest 1322 area in the RTH, watch the PA for signs the sellers are exhausted and it is the buyers' turn.

This is Option expiration week.

wild swings down (as we have seen) allow option market makers to suck the premium out of calls they have sold, buying them back at greatly reduced prices.

Bullish long side call owners have already been screwed.

Today might see bears (long puts) get screwed (prices rise to suck the premium out of the Puts). (they are already feeling the heat. a move back to 1342-44 area can easily unfold. (price traffic resistance starts in earnest at 1338 and higher.

This will probably be my only post.

Originally posted by PAUL9

I have been too busy on research projects to post.

But I wanted to take the time today to relate something about the current market that warrants watching.

I run pivots on the monthly

Years ago I spent hours looking back over weekly charts that had MOnthly pivots pasted across the chart face.

The R2 and the S2 of the monthly, when tested, usually reject price on the first test. (with any pivots, the longer the time frame, the more wiggle room you have to give it).

These (Monthly R2 and monthly S2) are especially difficult levels for price to just slice through. (it does happen occassionally)

MOnthly S2 created by the RTH only PA of APril = 1322.67

1321 handle is the daily piivot S1 for today.

Overnight lows printed in the 1322-1320 area and tested and tested and couldn't unlock more sellers.

Today might see bears (long puts) get screwed (prices rise to suck the premium out of the Puts). (they are already feeling the heat. a move back to 1342-44 area can easily unfold. (price traffic resistance starts in earnest at 1338 and higher.

This will probably be my only post.

Impressive forecast, Paul.

A MAJOR support area is near; 1290

Was support in July, became resistance in October, was retested as support in January. Support now...?

Was support in July, became resistance in October, was retested as support in January. Support now...?

I have a 78.6% @ 1293.60 that matches your 1290 area .. thanks

this seems to be the place to dump our thoughts so here are mine...I think we will see a minimum retest of 1305.50 in todays day session and more likely 1301.50 but here is the trick......if we break that On high up near 1310 and begin to consolidate then I think the 1317 area is coming and then 1321...

Bias is short until proven wrong...today is options expiration so I expect some selling early on since they poped it up in the overnight...my shorts are starting at 1307.50 in O/N...good luck today

monkey has posted cool stuff and links for opt. exp..

Bias is short until proven wrong...today is options expiration so I expect some selling early on since they poped it up in the overnight...my shorts are starting at 1307.50 in O/N...good luck today

monkey has posted cool stuff and links for opt. exp..

we need this opening range low to hold back the rallies in order for runners to eventually push to new lows into our 1301.50 target...no doubt a tuff hold...we can only assume if they start failing at the OR low then those longs with their eyes on the overnight high will win out!

$tick distribution is still skewed to the downside so that is keeping me short...not sure if it will stay like this but we'll see soon enough...hour range closing in..very few FULL $tick one minute bars above the zero line so far today

$ticks trying to make higher highs and higher lows now and we had our first plus 700 reading...if volume was increasing I'd be more inclined to think that the breakout is coming out of the IB high..without clues from the volume my observations are only marginally predictive ...even so I think anyone holding needs to realize that we are just gambling as we hold inside the IB range...in other words there is really no edge and I certainly wouldn't be holding anything unless you admit to yourself that you are gambling

in daltons world he would say that we are currently accepting value below yesterdays selling spike down...prblem is that sometimes too much time without further selling leads to all of us shorts bailing out and it fuels the pop higher

in daltons world he would say that we are currently accepting value below yesterdays selling spike down...prblem is that sometimes too much time without further selling leads to all of us shorts bailing out and it fuels the pop higher

nice stuff bruce. glad to see your posts. missed them

Originally posted by redsixspeed

Originally posted by redsixspeed

I had retrace area @ 1322 / 1329 ... 1322+1329 = 1325.50 es turned at 1326.50 .. lol .. maybe es will get a running start to move back up .. I just trade what I see .. above 1316 and I am bullish

========================================================================

as I type ES has moved up to that 1329 and stall .. market seems strong

r1 1330.75

=======================================================================

dang !!

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.