ES Friday 6-27-14

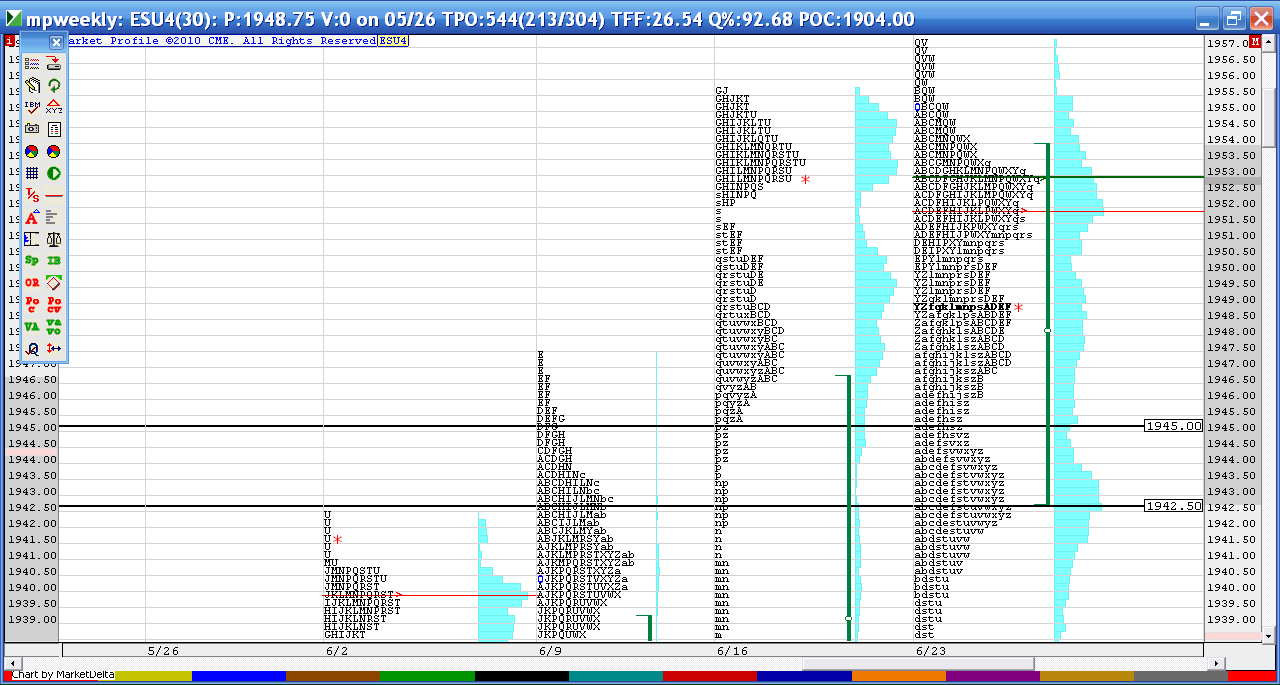

a video and the weekly chart..I snapped lines at the critical support point today that needs to hold if bullish seasonals are going to work..

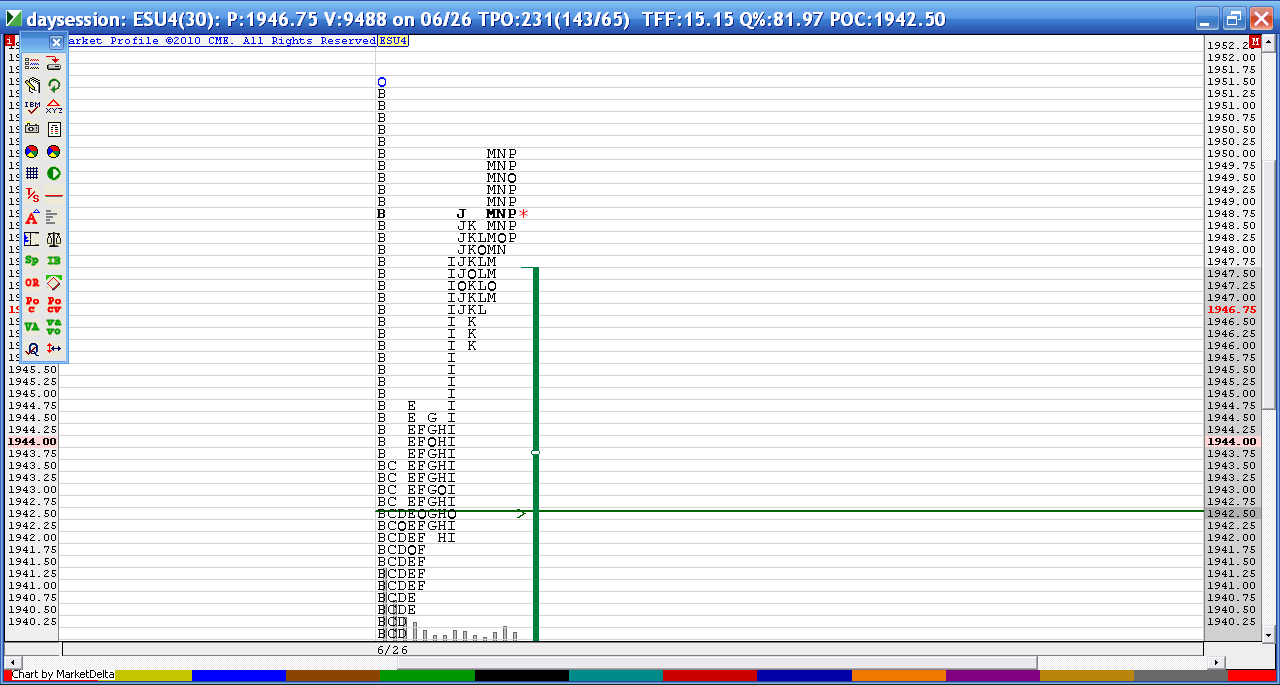

a quick look at YD session...the upper part...note the highs at "M,N and P " periods...that is a crappy way to put in a high even it is only a swing high ( assuming we will open lower) and not the actual high of the day...also note that the "K" period low matches today pivot point so if you get long I would scale out heavy in front of that just in case.....that is my plan

in a subtle way we have two mini distributions YD separated by LVN and low tpos at 44.75 - 45.75 so in terms of 30 minute closes that would be the area to watch for close clues and direction...bulls will want to see a 10 am close above there...bears will watch for a close below there...that time period is the FIRST 30 minute close of the day

starting small longs at 42.75 in O/N...most times we get a better chance in day session so I ALWAYS keep these small...44.50 is target....

below yest vpoc at 43 i have 38.5-40 and 36.25-37.25 (recent swing lows) with 33.5-34.5 below that...26.5-31 comes next and 26-27.5 would really be an extreme today

on the upside hodling above this 43-44.75 would bring the hvn of the bell curve above 47.47-50 (which includes onh and yest poor highs as Bruce mentioned). If that breaks then 52.5-53 wil likely be tested (it includes thurs o/n high and the vpoc of the balance area we formed from 6/19 to 6/24 roughly)

good luck

on the upside hodling above this 43-44.75 would bring the hvn of the bell curve above 47.47-50 (which includes onh and yest poor highs as Bruce mentioned). If that breaks then 52.5-53 wil likely be tested (it includes thurs o/n high and the vpoc of the balance area we formed from 6/19 to 6/24 roughly)

good luck

i menat 29.5-31 and not 26.5-31 btw

Originally posted by apk781

below yest vpoc at 43 i have 38.5-40 and 36.25-37.25 (recent swing lows) with 33.5-34.5 below that...26.5-31 comes next and 26-27.5 would really be an extreme today

on the upside hodling above this 43-44.75 would bring the hvn of the bell curve above 47.47-50 (which includes onh and yest poor highs as Bruce mentioned). If that breaks then 52.5-53 wil likely be tested (it includes thurs o/n high and the vpoc of the balance area we formed from 6/19 to 6/24 roughly)

good luck

runners coming out at 46.50...va high is 47.50 and I am not convinced we will open and drive with an open inside of YD's va...this may be only trade today and it was small as per O/N size

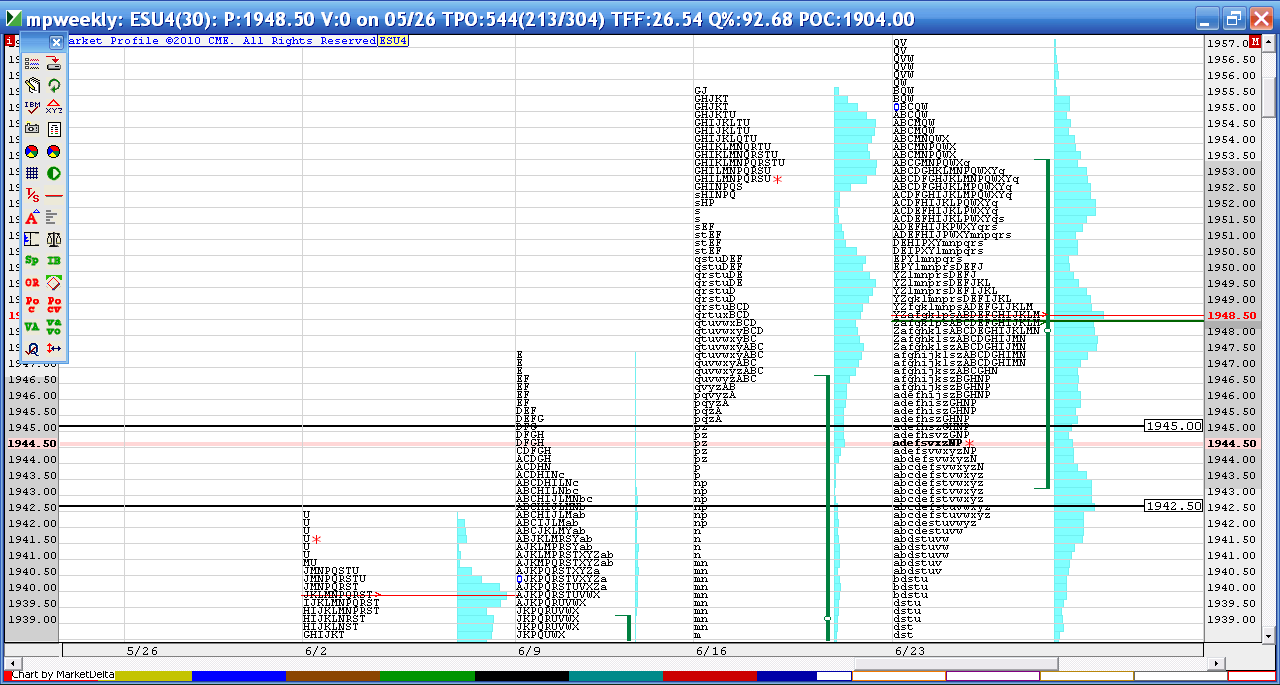

some close comments and some about that double distribution..

all the volume coming in at 47.75....seems suspicious to me with VA high so close by...seems sellers may win this up here for a bit

what the bulls don't want to see is a close back down near that LVN at 10:30 that would imply a reversal and a rejection from the center of the upper distribution from yesterday....also would put us closing back inside YD's VA high

if we keep selling then aggressive traders will sell opening range high targeting the 43 volume from YD afternoon

my last post today is this...u can compare the weekly posted this morning to this current one,,,,,note the poc/vpoc flip lower...so in theory traders agree on lower prices.....we are currently in the key support zone - the black lines at 42.50 - 45.....so do we ping pong between the support zone and the poc at 48.50..? red asterisk is current trade price....it will be fun to see how we end up today.......on Monday I will most likely following the concept of Friday strength or weakness spills over into monday....thanks for all who posted today and gave feedback...

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.