ES Wednesday 11-5-14

my overall concern is that all that were short could cover and drive market up quicker than I like in the first few minutes.......2017 is my dividing line between the magnets of 2013 and 2021.25...my gut feel is that we will see the 21.25. Today I will once again be using the opening range as a filter as we are set to open outside of YD value area and range...watch 2011 - 2013 for possible support ...here is some video babble.......it only took me 3 tries to convey what I wanted to say without flubbing it up too much today...

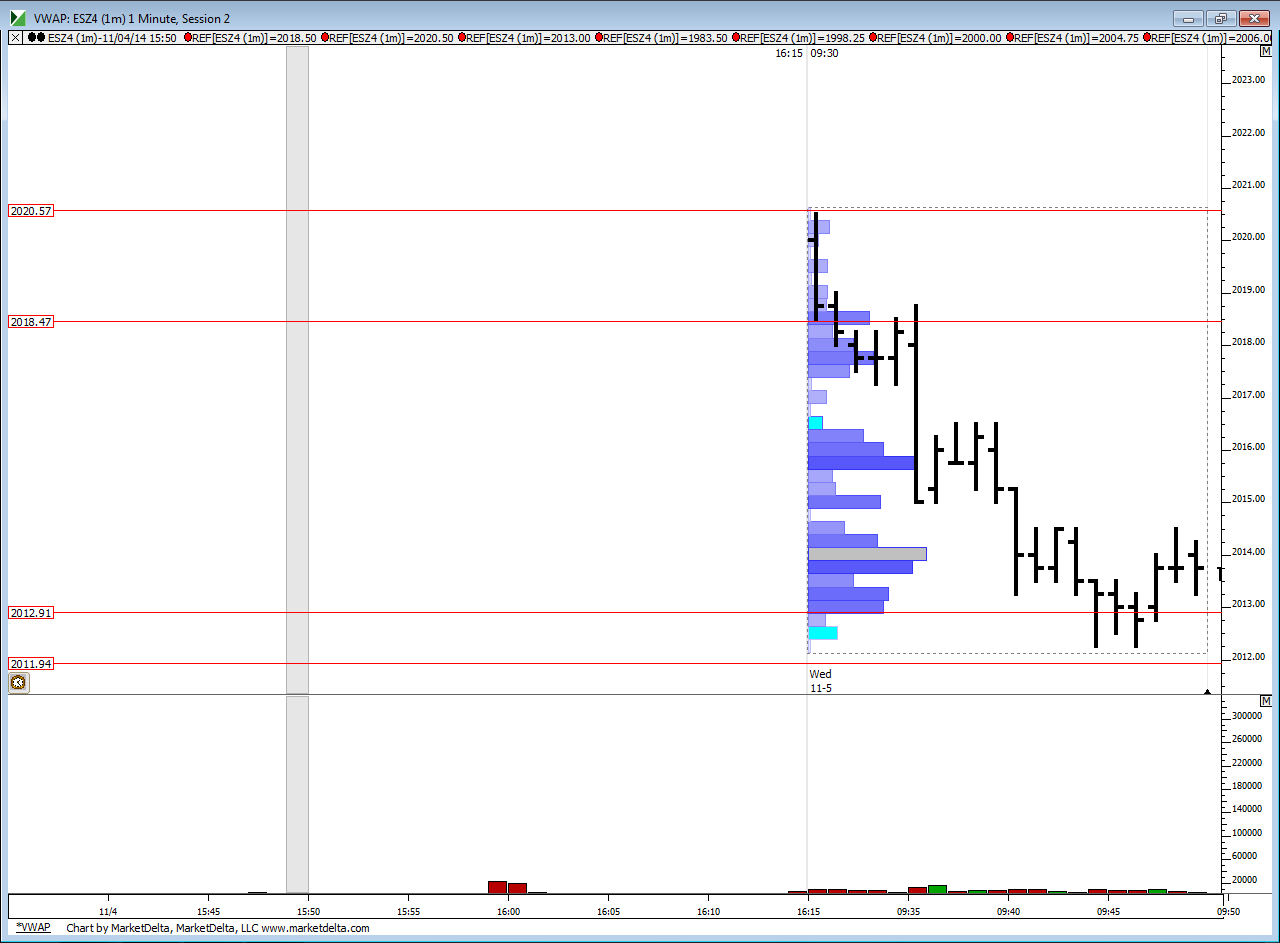

a quick follow up video and a picture of the one minute range breakdown that sent me short .... for that 2013 area magnet

who is on trader bites.....? You may have typed in the wrong window daddy wolf...perhaps you are looking for FT71...I don't think he is on our forum

Originally posted by daddywolf

when listening to traderbites, it sounded to me like u were looking to go long at 2013-2011 zone..??? do I listen wrong?

Good trading again Bruce. Thanks for the videos as always.

glad you find them useful Newkid......There are some who can hold for bigger chunks but my personality needs to take some money off quickly ..I just can't handle the 2-3 point back and fill that the ES does...so it makes it hard to hold.....congrats to anyone who held for the O/N midpoint and the high or yesterday....nice hold...

Exit at 2014.75

That is it for me.

Thanks for the videos Bruce.

Have a nice day, everyone.

That is it for me.

Thanks for the videos Bruce.

Have a nice day, everyone.

nice trade Aladdin...and I too can hear Dalton saying "Value is higher and we can't get to unchanged from yesterday"....I love his stuff but one needs to find a away to make the ideas work for oneself....I think for me the most help was coming up with longer term brackets like monthly and weekly swings and the concept of single prints......but still we need to add other stuff too like daily and weekly pivots and high and low TPO and volume areas.... and then look for confluence......glad u did well.....I wish all day could end this fast....

I think one of many reasons we probably don't draw as many comments here anymore is the fact that we aren't watching the market all day like in the past..so we don't post that much ...there are still those ( and I am guilty too some days) that watch this market too long....I say to get your trade ideas on early and then make the trades....call it a wrap after 90 minutes and then wait till the next day.....try for one or two good trades and then go do something else...for me that new thing is options...which is freaking amazing and so challenging as I have so much to learn.

I think one of many reasons we probably don't draw as many comments here anymore is the fact that we aren't watching the market all day like in the past..so we don't post that much ...there are still those ( and I am guilty too some days) that watch this market too long....I say to get your trade ideas on early and then make the trades....call it a wrap after 90 minutes and then wait till the next day.....try for one or two good trades and then go do something else...for me that new thing is options...which is freaking amazing and so challenging as I have so much to learn.

Originally posted by Aladdin

Exit at 2014.75

That is it for me.

Thanks for the videos Bruce.

Have a nice day, everyone.

I just froze today and did not take any trades but good stuff all around as always. I am still learning every day so hope to get to your guys level sometime soon :)

i'm just pointing this out but notice how the break from the IB low stopped right at the VA high ( time va high ) of yesterday and then came back up to fill in the breakdown point..the bulls will really have to start getting this above yesterdays RTH highs to have a chance now...other wise they could just as easily roll it back down to the 05 - 06....it's all about ranges and value....in theory we could strip away all the volume profile work and just look at day session ranges and time value areas....

Can you shed some light on your SD bands study that you are doing with Paul? Is this the same as the 80% of the past 3 days?

here are two websites...the first gives an overview and the second goes on about Kevin haggerty calculated them.....they aren't perfect and need to be used in conjunction with other things....I'm trying to use them with some longer term option trade ideas but that will perhaps eventually be in a different thread

http://www.hamfon.com/daytrade/vband.htm

and here is haggerty stuff......the thing that messes with me is I don't know if it is better to use trading days or calander days.........if anyone has any thoughts please chime in here or in private...

http://www.traderslaboratory.com/forums/coding-forum/5190-volatility-bands.html

also if you want to see haggerty write up themn amazon has it here

http://www.amazon.com/Short-Term-Volatility-Trading-Bands-Haggerty/dp/B00005RF8T

ok..that's three websites

http://www.hamfon.com/daytrade/vband.htm

and here is haggerty stuff......the thing that messes with me is I don't know if it is better to use trading days or calander days.........if anyone has any thoughts please chime in here or in private...

http://www.traderslaboratory.com/forums/coding-forum/5190-volatility-bands.html

also if you want to see haggerty write up themn amazon has it here

http://www.amazon.com/Short-Term-Volatility-Trading-Bands-Haggerty/dp/B00005RF8T

ok..that's three websites

that's a keeper....thanks stockster

Originally posted by stocksster

p10 in the following article "Putting volatility to work" uses 252 days...

http://www.ivolatility.com/news/Putting_volatility_to_work.pdf

Originally posted by BruceM

yes this is what I am leaning towards also even though haggerty doesn'tOriginally posted by NewKid

I would imagine that using number of trading days makes more sense than using calendar days. So I would use 250 days instead of 365.

This gives us a multiplier of 0.063 instead of 0.052

Thoughts?

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.